Global Downstream Processing Market By Product Type (Filters, Chromatography Systems, Centrifuges, Evaporators, and Dryers), By Application (Hormone Production, Antibiotic Production, Antibodies Production, and Enzyme Production), By Technique (Solid-liquid separation, Cell Disruption, and Formulation), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 61043

- Number of Pages: 242

- Format:

- keyboard_arrow_up

Downstream Processing Market Overview:

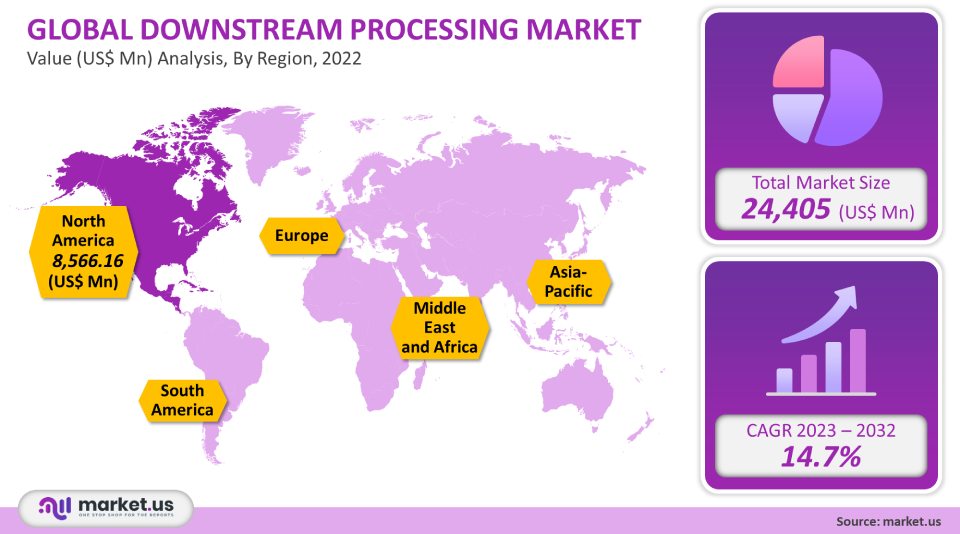

The global downstream processing market accounted for USD 24,405 million in 2021. It is estimated to grow at a CAGR of 14.7% between 2023 to 2032.

The market is being driven by a rise in downstream processing techniques used for the development of COVID-19 vaccinations. Rentschler Biopharma, Vetter, and Vetter launched Xpert Alliance in March 2022. This collaborative representation of their strategic partnership was released. This visualization is meant to “bring back to life” their ongoing collaboration and highlight the company’s success in providing effective solutions for customers’ changing and growing needs in biopharmaceuticals.

Global Downstream Processing Market Scope:

Product type analysis

The market was dominated by the chromatography system segment, which accounted for 42% of the total revenue in 2021. The segment growth is expected to be driven by continuous R&D to improve efficiency and speed. Thermo Fisher Scientific’s HyPeak chromatography systems were launched in 2021. It is Thermo Fisher Scientific’s only single-use system for bioprocessing. It has significant functions for therapeutic protein and vaccine development. The segment growth is also supported by a rise in chromatography system deals and developments. In 2021 Sartorius Stedim Biotech, for example, announced that it had acquired Novasep’s chromatography equipment business.

Sartorius will be able to use this information to help develop new chromatography systems that will solve efficiency problems and eliminate bottlenecks in downstream processes. From 2023 to 2032, the filters segment will experience the highest CAGR. The market for downstream processing is driven by a rise in viral inactivation filters’ utility. A team of researchers from Pennsylvania State University examined the effectiveness of BioEX hollow fiber and Planova 20N virus filter for the removal of viral-size particles. These studies will likely increase the use of filters for downstream processing biologics.

Application analysis

The global market can be further divided into three categories based on the applications: antibiotic production, hormone production, and vaccine production. In 2021, the antibiotic production segment was the dominant market and held more than 33.1%. The wide range of antibiotics that can be used to treat multiple disorders is responsible for this high growth. Annually, more than 700,000 people are affected by antibiotic-resistant bacteria. This results in a high demand for antibiotics which drives the market growth.

The rise in demand for monoclonal antibodies drove the fastest growth in antibody production. The segment growth is also driven by the launch of new products that allow for efficient purification. Cytiva, for example, launched HiScreen Fibro Prisma in 2021 to enable the development and purification of monoclonal antibody (mAb) processes. This product is a fiber-based Protein A platform that allows for a 20-fold increase in productivity.Technique analysis

Purification by chromatography dominated the global market, accounting for more than 42.13% of the total revenue in 2021. Companies are pursuing business development strategies such as acquisitions, mergers, and agreements to expand their chromatography portfolio. Single-use chromatography is and will always be the best in downstream bioprocessing. Repligen, a New Jersey-based company, purchased Newton, New Jersey-based BioFlex solutions in 2021. Repligen’s single-use fluid management product line is enhanced and simplified by the purchase. BioFlex Solutions is integrated into Repligen’s system, further strengthening its offering through the integration of components and assemblies.

Aldevron was acquired by Danaher Corp. in 2021. Aldevron will be an operational business within Danaher’s Life Sciences section. The segment of solid-liquid separation is expected to see the greatest CAGR over the forecast period. Solid-liquid separation has many advantages, including its simplicity, cost-effectiveness, and suitability for continuous-mode production. This technique can be hindered by the high shear forces. For high cell density processes, new developments such as depth filters, multistage depth filters, alternating tangential microfiltration, and tangential flow filtration are being used.

Кеу Маrkеt Ѕеgmеntѕ:

By Product Type

- Filters

- Chromatography Systems

- Centrifuges

- Evaporators

- Dryers

- Other Product Types

By Application

- Hormone Production

- Antibiotic Production

- Antibodies Production

- Vaccine Production

- Enzyme Production

By Technique

- Solid-liquid separation

- Cell Disruption

- Purification by Chromatography

- Concentration

- Formulation

Market Dynamics:

Bayer announced in 2022 that Ginkgo Bioworks is looking to purchase Bayer’s West Sacramento Biologics R&D site as well as its internal discovery platform and lead optimization platform. Bayer will be able to strengthen its leadership in biologics and gain access to key supporting technologies in synthesized biology. The deal will also allow Bayer to maintain its position as the preferred partner in biologics research, commercial development, and partnership.

This company uses its CDMO capabilities, as well as its equipment and bioprocess consumables offerings for these projects. The company has also partnered up with Singapore and the U.S. government in order to increase its vaccine development and therapy development capabilities. EMD Millipore and Cytiva have made similar efforts to make use of their bioprocess offerings in COVID-19 therapeutics research. The adoption of continuous downstream processing systems has led to an increase in R&D activities in advanced bioprocess technology. These systems can be used for multicomponent separations and perfusion chromatography systems.

This has resulted in a rise in the demand for bioprocessing technology improvements to address the purification bottleneck. CMOs are increasingly being used for downstream processing. This is because outsourcing allows pharmaceutical companies to reduce their initial capital investment and costs. CMOs assist drug manufacturers in optimizing downstream processing, as well as other processes such as cell culture preparation, chromatography mixing, concentration, monitoring, and disposable technologies.

Regional Analysis:

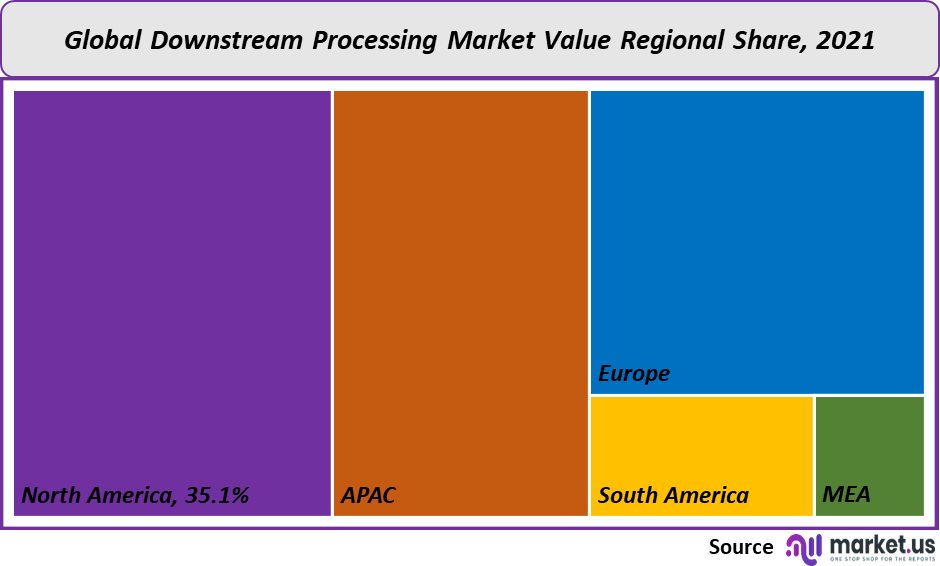

North America was the dominant market. It accounted for more than 35.1% of the total revenue in 2021. This is due to the government’s support for bioprocess technologies, growing medical expenditure and the development of healthcare infrastructure. The region has seen significant collaborations with major healthcare companies that invest heavily in R&D for biopharmaceuticals. Key players in the market are also expanding their presence in the region. Thermo Fisher Scientific Inc. announced recently a USD 97 million investment to expand its Richmond, Virginia clinical research facilities.

These facilities, which include laboratory operations acquired from PPD, Inc. in 2021, will address the increasing demand for more consistent, higher-quality laboratory services in biopharma. This will help to accelerate drug development. The fastest-growing market in the Asia Pacific is predicted to be 2023-2032, thanks to increased investments by both developers and consumers within the biotechnology sector. A large population base drives the demand for advanced medical facilities. Players are keen to implement rapid analytical methods that support in-process design and bioprocessing.

China was the dominant market in the Asia Pacific region due to its growing biopharmaceutical sector and high demand for vaccines & medicines. China’s biopharmaceutical sector is one of the most dynamic economic sectors. It is characterized by constant innovation with new biopharmaceutical equipment.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

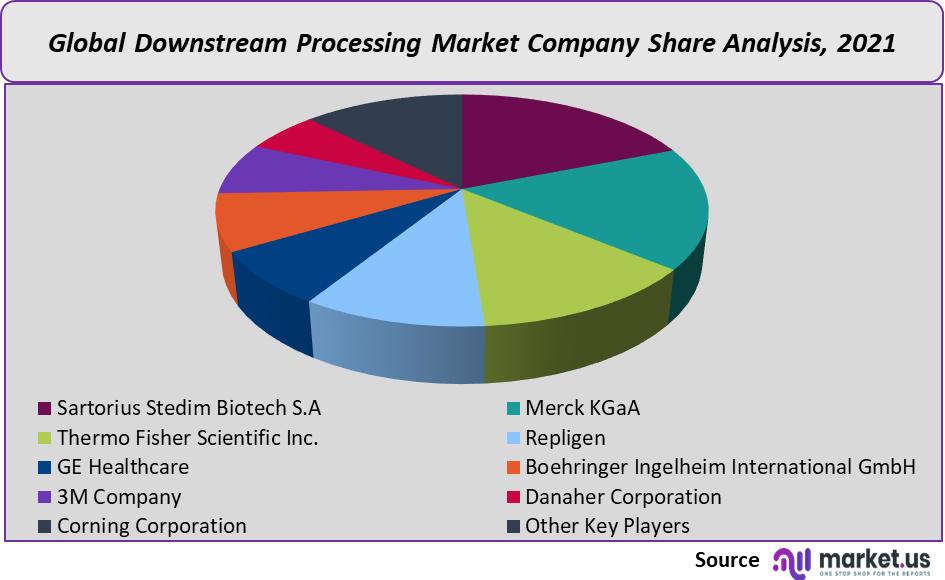

Market Share & Key Players Analysis:

Companies are increasingly focused on developing new products for downstream processing. Merck, for example, entered into a partnership in 2022 with the Wuxi National High-Tech Industrial Development Zone administrative management Board. Merck’s Mobius a Single Use production center in China was created to significantly expand its premier Mobius. Sartorius purchased Novasep’s Chromatography Section in 2022. The portfolio includes systems for chromatography that are primarily used for small biomolecules such as peptides and oligonucleotides. It also includes new technologies for biologics’ continuous production.

Маrkеt Кеу Рlауеrѕ:

- Sartorius Stedim Biotech S.A

- Merck KGaA

- Thermo Fisher Scientific Inc.

- Repligen

- GE Healthcare

- Boehringer Ingelheim International GmbH

- 3M Company

- Danaher Corporation

- Corning Corporation

- Other Key Players

For the Downstream Processing Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Downstream Processing market in 2021?The Downstream Processing market size is US$ 24,405 million in 2021.

Q: What is the projected CAGR at which the Downstream Processing market is expected to grow at?The Downstream Processing market is expected to grow at a CAGR of 14.7% (2023-2032).

Q: List the segments encompassed in this report on the Downstream Processing market?Market.US has segmented the Downstream Processing market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, market has been segmented into Filters, Chromatography Systems, Centrifuges, Evaporators, and Dryers. By Application, market has been segmented into Hormone Production, Antibiotic Production, Antibodies Production, Vaccine Production, and Enzyme Production. By Technique, the market has been further divided into Solid-liquid separation, Cell Disruption, Purification by Chromatography, Concentration, and Formulation.

Q: List the key industry players of the Downstream Processing market?Sartorius Stedim Biotech S.A, Merck KGaA, Thermo Fisher Scientific Inc., Repligen, GE Healthcare, Boehringer Ingelheim International GmbH, 3M Company, Danaher Corporation, Corning Corporation, and Other Key Players engaged in the Downstream Processing market.

Q: Which region is more appealing for vendors employed in the Downstream Processing market?North America accounted for the highest revenue share of 35.1%. Therefore, the Downstream Processing industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Downstream Processing?The US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc., are key areas of operation for Downstream Processing Market.

Q: Which segment accounts for the greatest market share in the Downstream Processing industry?With respect to the Downstream Processing industry, vendors can expect to leverage greater prospective business opportunities through the chromatography systems segment, as this area of interest accounts for the largest market share.

![Downstream Processing Market Downstream Processing Market]() Downstream Processing MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample

Downstream Processing MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample - Sartorius Stedim Biotech S.A

- Merck KGaA Company Profile

- Thermo Fisher Scientific Company Profile

- Repligen

- GE Healthcare

- Boehringer Ingelheim International GmbH

- 3M Company Company Profile

- Danaher Corporation Company Profile

- Corning Corporation

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |