Global All-electric Trucks Market By Type (Light, By Application Medium-duty Truck , and Heavy-duty Truck)&(Logistics , and Municipal), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2019–2028

- Published date: Nov 2021

- Report ID: 20316

- Number of Pages: 208

- Format:

- keyboard_arrow_up

Electric Trucks Market Overview

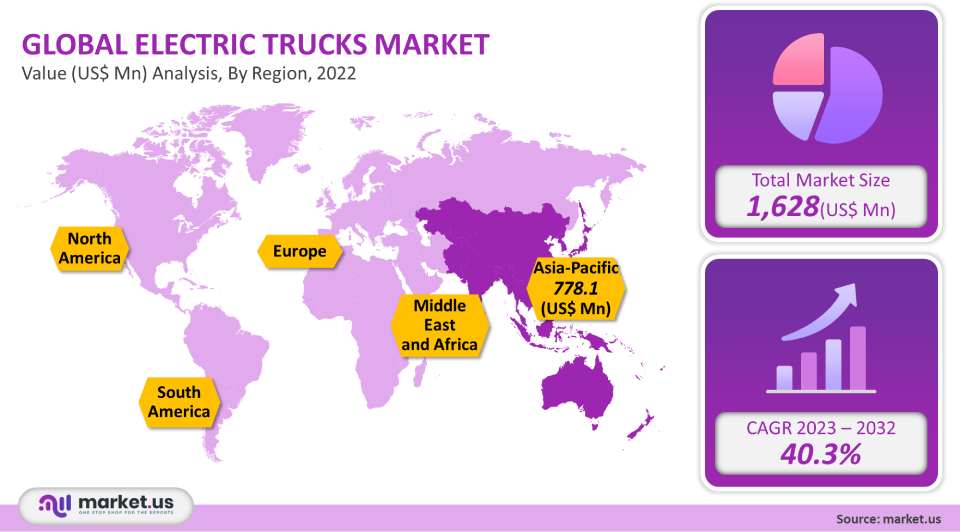

The global market for electric trucks was valued at US$ 1.628 billion in 2021. It is expected to grow at a CAGR of 40.3% between 2023 and 2032. This market’s growth is driven by increasing demand from the logistics industry, lower fuel and maintenance costs, as well as incentives to adopt zero-emission vehicles. Manufacturers will have to invest in electric truck manufacturing due to stringent emission standards for the commercial vehicle Industry. Manufacturers are expected to make significant investments to cater to this growth in demand, thus further contributing to market growth in the process. There are many uses for electric trucks, including in logistics, municipal, and other areas. A country’s GDP growth is largely dependent on the logistics sector. To expand the e-commerce industry, logistics providers should be able to deliver to remote areas. Supply chain and logistics companies are expected to actively participate in the replacement of internal combustion engine fleets with electric vehicles.

Global Electric Trucks Market Scope:

Vehicle Type Analysis

In 2021, the ‘Battery Electric Trucks’ sub-segment was responsible for over 85% of the total revenue generated and is slated to continue to retain its dominant position over the forecast period. This segment is expected to grow at the highest CAGR rate over the forecast period due to an increase in the average lifespan and energy density of batteries and a subsequent decrease in average battery price. The segment growth is also expected to be supported by a greater number of regulations imposed by respective governments that mandate the adoption and usage of zero-emission vehicles. For instance, the European Union (EU) has set a goal to reduce greenhouse gas emissions by almost 40% by 2032. The EU also has a goal to reduce emissions by 60% by 2040. In 2021, the ‘Hybrid Trucks sub-segment accounted for the lowest revenue share, and this is expected to continue to decrease over the forecast period. Due to a greater number of regulations concerning greenhouse gas emissions, the faster adoption of hybrid trucks is expected to decline. The market leaders in electric trucks are also focusing on fuel-cell electric trucks that can be used for long-distance travel. Hyundai Hydrogen Mobility leased ten fuel-cell SCIENT trucks to transportation and logistics companies on a per-user basis in July 2020.

Application Analysis

The electric truck market report can be divided on the basis of ‘Application’ into Logistics, Municipal, Construction, Mining, and Others. The largest market share was accounted for in the ‘Logistics’ sub-segment, and this segment will continue to do so for the remainder of the forecast timeline. Peterbilt and Dana just announced the Peterbilt Model 220EV’s debut. It will be capable of traveling up to 200 miles. The car was made available in 2020. Navistar, a global brand that offers a medium-duty electric car, has also entered the running. The production manager committed to a 250-mile range on a single charge and a 312 kWh battery. After Battery, while promising that the manufacturing process would be complete by 2021.

Key Market Segments

Vehicle Type

Hybrid Electric Trucks

Battery Electric Trucks

Application

Municipal

Logistics

Other Applications

Market Dynamics

Driver

CEVA Logistics, a U.K.-based logistics company, began trials with electric trucks in Central London in February 2020. Two electric trucks from Tevva will be operating daily between Dartford and St Thomas’ NHS Foundation Trust. The main obstacle to the growth of electric trucks is the lack of charging infrastructure. Charging stations may not be able to charge electric trucks due to high costs such as permits, building codes, and regulatory red tape. Due to a low level of investment, electric trucks are not as popular in emerging countries as they are in developed countries. The cost of EV batteries has decreased over the last decade due to technological advancements and mass production. This has resulted in a decline in the cost of electric trucks, as EV batteries are the most expensive component of an electric vehicle. An EV battery cost around US$ 1,100 per Kilowatt-hour in 2010. Bloomberg reports that the price has fallen to US$ 137 per kWh by 2020, while it is only US$ 100 per kWh in China. These batteries are cheaper to manufacture, have lower cathode material prices, and can be produced in larger quantities. According to Research Gate, EV battery prices will drop to US$40-60/kWh by 2031. This will significantly lower the cost of EV Trucks and make them comparable to conventional ICE trucks. This will result in a surge in electric truck adoption over the next decade due to the increasing demand for low-emission transportation solutions. Tesla, the world’s largest manufacturer of EVs, has already announced plans for a drastic reduction in prices over the next few years. “We have been working closely with top EV manufacturers to achieve this goal over the next 4-5 years.” Other major battery manufacturers include LG Chem., Panasonic, Samsung SDI, and SK Innovative. We have been working closely with top EV manufacturers to achieve this goal over the next 4-5 years.

Restraints

Manufacturing electric trucks require a higher initial investment than it does for CNG, petroleum, or diesel trucks. Production parts and machinery are also very expensive. The high cost of electric vehicles’ batteries is one reason for this. The price of electric trucks will drop as battery technology improves and prices decline. These trucks are less complex than other fuel trucks and, therefore, will affect the current market prices for EV batteries. These vehicles are still expensive to produce because they are currently manufactured on a small scale. Forbes by energy innovation reports that while the production cost of an electric vehicle is higher than diesel trucks or petrol trucks currently, it will still be half as expensive by 2032 compared with diesel and petrol versions due to falling battery prices.

Opportunity

The self-driving truck trend will have an impact on the market for electric trucks. Top OEMs include Tesla, Vera, Volvo, Daimler, etc. Self-driving electric vehicles have been developed for the market by startups like Embark, TuSimple, Ike, Einride, etc. Tesla plans to launch its self-driving electric truck in 2021. Waymo began testing its self-driving trucks in January 2020. TuSimple will operate autonomous vehicle technology developers’ routes between Phoenix and Tucson in Arizona, as well as certain areas in Texas. In May 2019, Einride began testing driverless trucks. Daimler announced in January 2019 that it had invested US$570 million to develop self-driving electric trucks. The many advantages of self-driving electric truck technology, such as ease of use and value-added features, will drive up the demand for electric trucks in the long run. This technology will mature in the next 5-6 years.

Challenge

The high manufacturing costs of electric trucks have been a concern to its widespread adoption. The popularity of electric trucks is expected to increase over the next decade. As a result, battery prices and R&D costs will decline. This should reduce the overall cost of buying these vehicles. Electric trucks are usually more expensive than their ICE counterparts. The high cost of rechargeable lithium-ion batteries that are used in electric trucks is the main reason. Due to the expensive development process, electric trucks are more expensive than ICE trucks. Higher-range electric trucks are costlier to develop due to the higher specifications of batteries and higher production technology. These trucks also require more expensive parts, making these trucks more expensive than conventional ICE trucks. These trucks are specially designed to deliver cargo to different locations as conventional trucks.

COVID-19 Impacts on the Electric Trucks Market

In the first months of the COVID-19 pandemic, the overall automotive market experienced a significant slump as the sales of automobiles fell drastically due to imposed lockdowns. Fortunately, sales figures recovered in the second half of 2020 and, in most cases, reduced losses from the previous months. Due to the increasing trend in vehicle electrification worldwide, electric vehicles saw an increase in sales between 2020 and 2021.

The influence of the pandemic was less severe in this sector. In the first half of 2020, electric trucks indexed a similar decline in demand which then increased again. These vehicles are a new segment in the EV market and have been in demand in recent months in countries such as China, the USA, Germany, France, the UK, etc.

Although top OEMs like Ford, Volkswagen, GM, AB Volvo, BYD, Daimler AG, Stellantis, etc., suffered varying amounts of losses, their electric truck divisions experienced steady growth during the pandemic.

Advantages of Electric Trucks

Electric trucks are becoming more and more popular due to their numerous advantages, which include:

1. Electric trucks are much quieter than traditional gas-powered trucks, which can be beneficial for early morning deliveries

2. Electric trucks have zero emissions, which is excellent for the environment

3. Electric trucks require less maintenance than gas-powered trucks since there are no oil changes or tune-ups needed

4. Electric trucks are much cheaper to operate than gas-powered trucks

5. Electric trucks are more reliable than gas-powered trucks since there are no spark plugs or pistons that can break down

6. Electric trucks have a much longer range than gas-powered trucks because they do not need to be refueled as often

7. Electric trucks are easier for drivers to use than gas-powered trucks since there are no manual gears or pedals to worry about

Disadvantages of Electric Trucks

Electric trucks are not without their disadvantages. One of the biggest disadvantages is range anxiety, which is the fear that a vehicle will run out of power before it reaches its destination. This is a particular concern with electric trucks, which tend to have larger batteries than passenger cars and thus can take longer to charge. Another disadvantage of electric trucks is their higher upfront cost. Electric trucks typically cost more than comparable gasoline-powered models, although this gap is expected to narrow as battery technology improves and production volumes increase. Electric trucks may be more expensive to maintain. For example, the need for regular charging can make it difficult to schedule maintenance work. The technology is still in its early stages, and the economics are challenging. Of particular concern is the weight of electric batteries, which can be a third as heavy-duty electric trucks as the truck itself. This makes it difficult for electric trucks to carry much cargo, especially on hilly terrain.

Regional Analysis

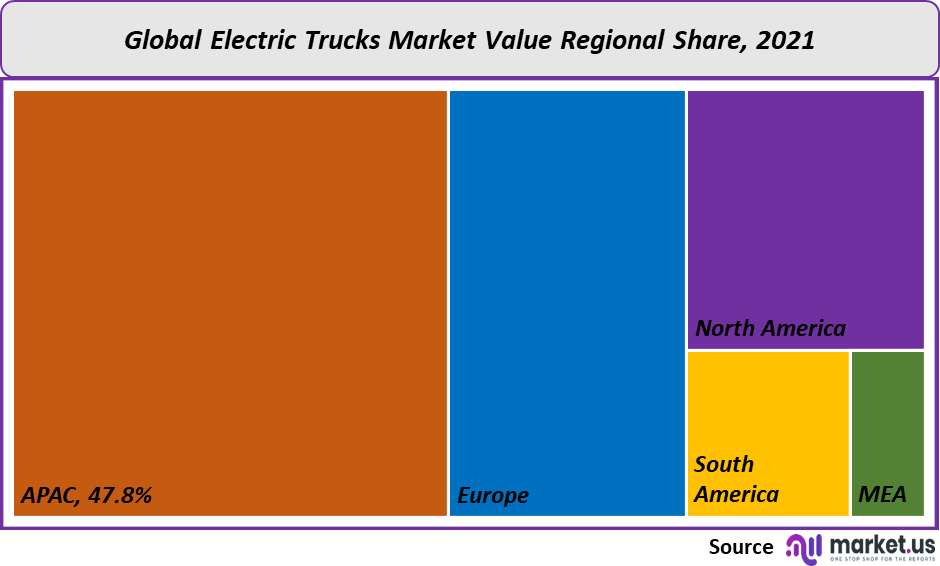

The APAC region accounted for the highest revenue share, exceeding 47.8% in 2021, and this region is expected to maintain its dominant market position over the forecast period, due to the presence of key companies like BYD Auto Co. Ltd., FAW Group Co. Ltd., Dongfeng Motor Corporation, and Daimler AG. The region is also the most likely to adopt electric trucks since the Chinese central government removed upper weight limits from subsidies for trucks and LCVs. China’s expanding model range and steady cost-saving improvements in batteries are expected to lead to an increase in electric truck volume sales. From 2023 to 2032, the market in the U.S. is slated to index the highest CAGR of 55.6%. This region will register an increase in demand from the logistics sector. In June 2020, California’s Air Resources Board set targets for electric truck sales, with the first being 2032.

Key Regions and Countries Covered in this Report:

North America

US

Canada

Mexico

Europe

Germany

UK

France

Italy

Russia

Spain

Rest of Europe

APAC

China

Japan

South Korea

India

Rest of Asia-Pacific

South America

Brazil

Argentina

Rest of South America

MEA

GCC

South Africa

Israel

Rest of MEA

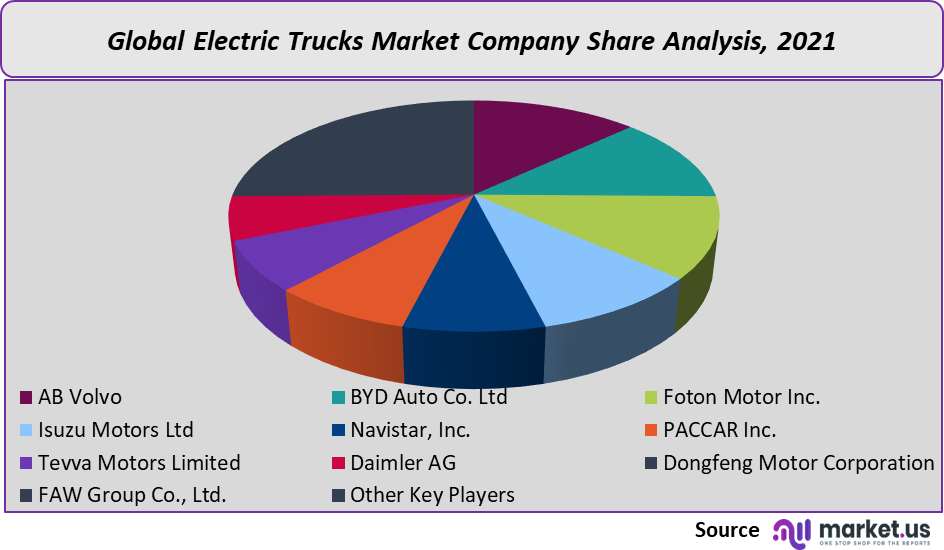

Market Share Analysis

This market is highly competitive and has both established as well as small-scale players. In 2021, the market was spearheaded by Dongfeng Motor Corporation and BYD Auto Company Ltd., Daimler AG, PACCAR Inc., and Scania. These companies offer an extensive range of electric trucks and can cater to the transportation and logistics sectors as well as municipal markets. These market players also focus on making fuel cell electric trucks that have a longer range and better performance. These players have continued to focus on new product launches and upgrading existing trucks. Daimler trucks, for instance, presented Freightliner eM2 106 in June 2018 at the Capital Market & Technology Day held at Portland International Raceway. Daimler Trucks introduced the Electric Freightliner Customer Experience Fleet in North America in March 2020. The fleet includes six Freightliner heavy-duty trucks Freightliner EM2 106’s and two Freightliner medium-duty EM2 106s.

Key Market Players

BYD Auto Co. Ltd

Foton Motor Inc.

Isuzu Motors Ltd

Navistar Inc.

PACCAR Inc.

Tevva Motors Limited

Daimler AG

Dongfeng Motor Corporation

FAW Group Co. Ltd.

Other Key Players

For the All-electric Trucks Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

1.628 Billion

Growth Rate

40.3%

Forecast Value in 2032

67.497 Billion

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the electric trucks market in 2021?The electric trucks market size was valued at US$ 1.628 Billion in 2021.

What is the projected CAGR at which the electric trucks market is expected to grow at?The electric trucks market is expected to grow at a CAGR of 40.3% (2023-2032).

List the segments encompassed in this report on the electric trucks market?Market.US has segmented the global electric trucks market by Region (North America, Europe, APAC, South America, and the Middle East and Africa). By Vehicle Type, this market has been segmented into Battery Electric Trucks and Hybrid Electric Trucks. By Application, this market has been further divided into Logistics, Municipal, and Other Applications.

List the key industry players in the electric trucks market?AB Volvo, BYD Auto Co. Ltd, Foton Motor Inc., Isuzu Motors Ltd, Navistar Inc., PACCAR Inc., Tevva Motors Limited, Daimler AG, Dongfeng Motor Corporation, FAW Group Co. Ltd., and Other Key Players.

Which region is more appealing for vendors employed in the electric trucks market?APAC accounted for the highest revenue share of 47.8%. Therefore, the electric trucks industry in APAC is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for electric trucks?China, India, The U.S., U.K., Germany, Brazil, and Canada are key areas of operation for the electric trucks market.

Which segment accounts for the highest market share in the electric trucks industry?With respect to the electric trucks industry, vendors can expect to leverage greater prospective business opportunities through the ‘battery electric trucks’ sub-segment, as this area of interest accounts for the majority market share.

![All-electric Trucks Market All-electric Trucks Market]()

- AB Volvo

- BYD Auto Co. Ltd

- Foton Motor Inc.

- Isuzu Motors Ltd. Company Profile

- Navistar Inc.

- PACCAR Inc. Company Profile

- Tevva Motors Limited

- Daimler AG

- Dongfeng Motor Corporation

- FAW Group Co. Ltd.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |