Global Electric Vehicle Infotainment Market By System Type (Multimedia, Communication Unit, and Others), By Connectivity Type (Cellular, Bluetooth, Wireless, and Wired Connectivity), By End-User (HEV, and BEV), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2021

- Report ID: 67507

- Number of Pages: 338

- Format:

- keyboard_arrow_up

Electric Vehicle (EV) Infotainment Market Overview:

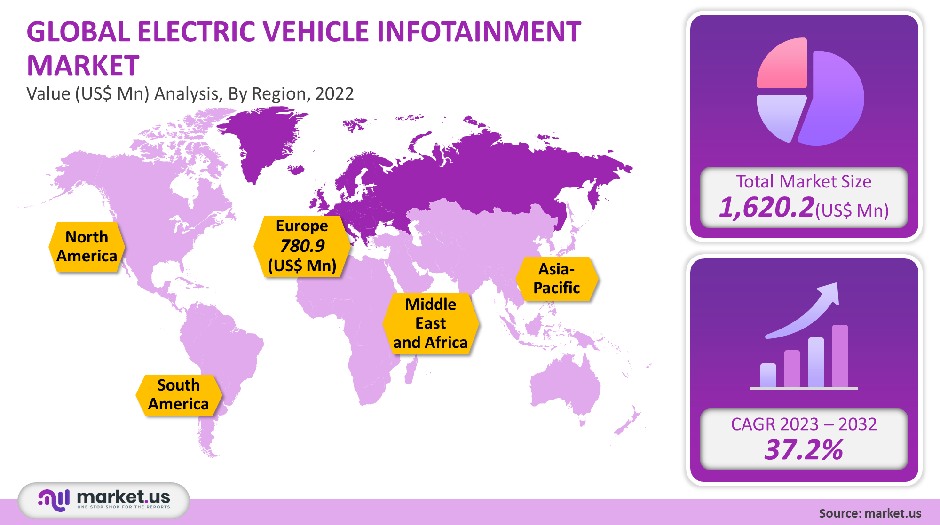

The global electric vehicle infotainment market was valued at USD 1,620.2 million in 2021. It is expected to grow at a CAGR of 37.2% between 2023 and 2032.

Consumers are increasingly adopting electric vehicles (EVs) for their commutes and work. This is driving demand for the infotainment market. Market growth is also being driven by the rising demand for GPS-enabled infotainment systems. It allows for traffic monitoring and mapping functions, which has increased the system’s functionality.

Market growth is also driven by the increasing use of wireless connectivity, which can be done at a very low cost. Manufacturers are also incorporating integrated center stacks into their EVs to improve control and engagement.

Global Electric Vehicle Infotainment Market Scope:

System Type Analysis

The EV infotainment market can be divided into heads-up systems and navigation systems. This allows for driver safety, driver communication, system entertainment, and multimedia systems. The market share for multimedia infotainment systems is expected to grow significantly over the forecast period. It will account for 55.69% of the total market in 2021. Multimedia infotainment allows the driver to access features like navigation, calling, music, and more. Multimedia infotainment has a wide range of functions, and it is compatible with low- to high-end cars.

In the forecast period, the heads-up display system will register a 44.3% CAGR. The windshield’s information is displayed at the driver’s eye level on the heads-up display. Projections and mirrors are used to display information such as road speed, warning messages, call information, and navigation. Heads-up displays allow the driver to operate their machine without fatigue, increasing the driver’s awareness of the outside world. These are the main growth drivers for heads-up displays.

Connectivity Analysis

Based on the type of connectivity, EV vehicle infotainment systems can be classified into Bluetooth, cellular and wireless connectivity. Wireless connectivity has the largest market share at 42.7% in 2021, and the highest CAGR of 37.5% between 2023 and 2032. With smartphones becoming more popular, the network connectivity to support the increasing connectivity capabilities of smartphones is improving. Smartphones have enabled wireless and cell phone infotainment connectivity.

High-speed internet connections and fast data transfer speeds are driving wireless and cellular connectivity to EV infotainment systems. Cloud data transfer is possible with advanced infotainment systems thanks to internet connection-based wireless technology.

Wireless connectivity is expanding worldwide, allowing EV infotainment systems for seamless driving experiences and market growth. Bluetooth connectivity is the most popular option in infotainment systems because of its low price.

End-User Analysis

The market for electric vehicle infotainment is split into two types: hybrid electric vehicles and battery electric vehicles. With 67.3% of all market share in 2021, the battery electric vehicle will be the dominant end-use product. Battery electric vehicles were born out of rising carbon emissions and increased demand for alternative fuels. Subsidies and other government programs are helping to increase the adoption of electric cars.

Digital infotainment systems are becoming more popular due to the integration of cloud, AI, and IoT technologies in electric vehicles. The market is also being driven by the increasing popularity of rear-seat entertainment systems for battery electric vehicles.

Over the forecast period, HEVs are expected to grow at a CAGR exceeding 38.9 %. Commercial vehicles use infotainment systems for communication, navigation, and tracking. Advanced infotainment systems in commercial vehicles will allow drivers to navigate routes with greater efficiency using real-time traffic information and maps. These factors will increase the market share for commercial vehicles with EV infotainment systems.

Кеу Маrkеt Ѕеgmеntѕ

By System Type

- Multimedia

- Communication Unit

- Heads-up Display

- Navigation Unit

- Rear Seat Entertainment

By Connectivity Type

- Cellular

- Bluetooth

- Wireless

- Wired Connectivity

By End-User

- HEV

- BEV

Market Dynamics:

A center stack allows for touch capabilities and vertical integration. A curved center stack display improves the user experience and saves money. Another reason for market growth is the availability of different infotainment system options, including rear-seat and heads-up displays. The market is also growing due to the integration of operating systems such as Windows, Android, and Linux into EV infotainment systems. Operating systems support software updates, software downloads, convenience functions, connectivity, and other features.

New avenues have opened up for market growth thanks to the implementation of cloud technologies, Artificial Intelligence, and the Internet of Things.

Industries around the world were severely affected by the COVID-19 pandemic, which forced authorities to enforce containment measures like lockdowns and quarantine. The governments’ subsequent containment measures have crippled many industries. Production of infotainment systems directly depends on automobile production, which negatively impacts EV infotainment producers. The rapid spread of the pandemic resulted in a drop in automobile demand, which affected the demand for infotainment systems.

The lockdown was lifted due to vaccination efforts in 2021 and automobile demand experienced a surge. The demand surge was met by a disruption in the supply chain for semiconductor chips. The infotainment system is dependent on the type of vehicle. Production delays were caused by the absence of semiconductor chips. The COVID-19 pandemic, repeated supply chain disruptions, and production delays hampered the growth of the EV infotainment industry.

In recent years, electric vehicles have seen a steady increase in use due to fuel efficiency and other development efforts such as bodyweight reduction and better efficiency of automotive electronic circuits. Increasing the screen size and the use of elements such as Universal Serial Bus (USB), Bluetooth and operating systems has led to an increase in the power channel and current consumption in high-end vehicles. High power consumption directly affects EVs’ battery efficiency.

High power consumption in EVs is a major problem for infotainment systems. Infotainment features include vehicle diagnostics and live traffic visualization. Satellite-view maps and music streaming are also available through premium infotainment service subscriptions. These services are offered by automobile manufacturers like Tesla. The cost of such a subscription, along with the associated paid software upgrade cost, is another barrier to the growth of the EV infotainment industry.

Regional Analysis

The European region holds the largest market share at 48.2%, according to the regional segment. This will be the case in 2021. The European region’s EV infotainment market is growing due to major automotive manufacturers, technological innovation, and the availability of skilled manpower. Market growth is also influenced by the increasing demand for EVs within the region and strict emission norms set forth by authorities.

The remaining market regions around the globe are forecast to grow at a rate of 51.9% during the forecast period. The market is driven by the increase in disposable income, availability, and use of EV infrastructure, and increased ownership and integration of infotainment systems with ADAS and cloud. Due to the growing demand for electric vehicle infotainment, the Latin American market is also growing. This market is driven by the availability of 4G/5G networks in the region and a decreased data tariff rate.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

Due to the strong support for electric vehicles around the world, there is a competitive market for Electric Vehicle Infotainment. These key players are well-known in the market, which encourages healthy competition. These companies invest a lot of resources in research and development. The major players resort to acquisitions, mergers, and strategic partnerships in order to expand their market share.

The following are some of the most prominent players in the global electric car infotainment industry:

Маrkеt Кеу Рlауеrѕ:

- Alpine Electronics

- Continental AG

- Harman International Industries Inc.

- Panasonic Corporation

- DENSO Corporation

- DELPHI Automotive Plc

- Pioneer Corporation

- JVC Kenwood

- Garmin Ltd.

- Audi AG

- General Motors Corp.

- Other Key Players

For the Electric Vehicle (EV) Infotainment Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the electric vehicle infotainment market in 2021?The Electric vehicle infotainment market size is US$ 1,620.2 million in 2021.

What is the projected CAGR at which the Electric vehicle infotainment market is expected to grow at?The Electric vehicle infotainment market is expected to grow at a CAGR of 37.2% (2023-2032).

List the segments encompassed in this report on the Electric vehicle infotainment market?Market.US has segmented the Electric vehicle infotainment market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By System Type, the market has been segmented into Multimedia, Communication Unit, Heads-up Display, Navigation Unit, and Rear Seat Entertainment. By Connectivity Type, the market has been further divided into Cellular, Bluetooth, Wireless, and Wired Connectivity. By End-User, the market has been further divided into HEV and BEV.

List the key industry players of the Electric vehicle infotainment market?Alpine Electronics, Continental AG, Harman International Industries Inc., Panasonic Corporation, DENSO Corporation, DELPHI Automotive Plc, Pioneer Corporation, JVC Kenwood, Garmin Ltd., Audi AG, and Other Key Players engaged in the Electric Vehicle Infotainment Market.

Which region is more appealing for vendors employed in the Electric vehicle infotainment market?Europe is expected to account for the highest revenue share of 48.2%. Therefore, the Electric vehicle infotainment industry in Europe is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Electric vehicle infotainment?UK, Germany, The US, India, China, Canada, & Japan are key areas of operation for the Electric vehicle infotainment Market.

Which segment accounts for the greatest market share in the electric vehicle infotainment industry?With respect to the Electric vehicle infotainment industry, vendors can expect to leverage greater prospective business opportunities through the multimedia infotainment systems segment, as this area of interest accounts for the largest market share.

![Electric Vehicle (EV) Infotainment Market Electric Vehicle (EV) Infotainment Market]() Electric Vehicle (EV) Infotainment MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample

Electric Vehicle (EV) Infotainment MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample - Alpine Electronics

- Continental AG

- Harman International Industries Inc.

- Panasonic Corporation Company Profile

- DENSO Corporation

- DELPHI Automotive Plc

- Pioneer Corporation

- JVC Kenwood

- Garmin Ltd.

- Audi AG

- General Motors Corp.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |