Global Electronic Lab Notebook Market By Product (Cross-disciplinary and Specific), By Delivery Mode (On-premise and Web-hosted/Cloud-based), By License (Proprietary and Open), By End-Use (Life Sciences, CROs, Chemical Industry, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 48988

- Number of Pages: 361

- Format:

- keyboard_arrow_up

Electronic Lab Notebook Market Overview:

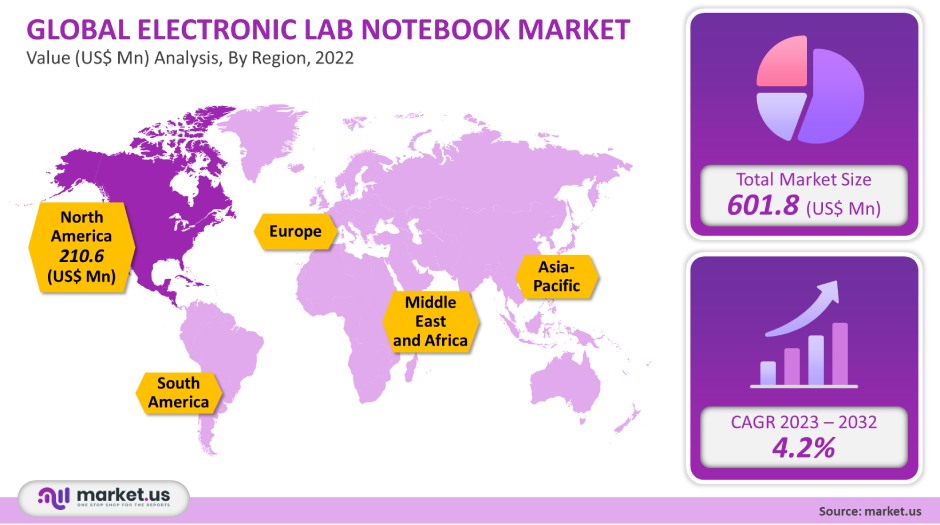

The global market for Electronic Lab Notebooks (ELN) was valued at USD 601.8 million in 2021. It is expected to grow at a CAGR of 4.2% during the forecast period.

The adoption of ELN is expected to be driven by the increased demand for automation in laboratories. Some of the key factors behind the growth include process optimization, better regulatory compliance, lower labor costs, improved data quality, and faster delivery.

Global Electronic Lab Notebook Market Scope:

Product Analysis

The market for electronic lab notebooks can be divided into specific and cross-disciplinary on the basis of their products. Due to its widespread use, the cross-disciplinary electronic laboratory notebook held the largest market share in 2021. It is versatile enough to be used in many disciplines, including management, IT, legal, and R&D. It also has other benefits such as lower IT overheads, shared data collection processes and standards throughout the organization, secure storage, and integrated workflow management.

It is easy to access and allows for greater exploitation of shared data. However, ELNs with specific characteristics held a significant market. Share. This data is only applicable to one discipline. Cross-disciplinary data is less secure. It increases the productivity of one research function, and data sharing is restricted to a particular team.

Delivery Mode Analysis

The market share for cloud-based/web-hosted electronic lab notebooks was at its highest as of 2021 accounting for a 60% share of the global revenue. Because of its advantages, cloud-based ELN software is being used increasingly frequently by CROs. These include lower labor costs, safe access to medical data, more storage, and a more streamlined ecosystem. All of these are anticipated to result in profitable growth possibilities for the industry

The on-premise ELN service includes the installation of services and solutions on computers within an enterprise. Due to the cost of purchasing gear, providing IT support, and general overhead, this kind of investment demands more money. When compared to conventional on-premise systems, SaaS-based cloud electronic lab notebooks have various benefits, including reduced downtime and automatic upgrades. Another cloud-based ELN that businesses employ is the private cloud. Managed and single-tenant services are included. Some of the most well-known cloud-based ELN apps are LabArchives and Lab-Ally. Examples include Benchling, Biosistemika, and LabArchives.

License Analysis

The proprietary sector maintained the highest revenue share in the ELN market in 2021. In the future, it is anticipated to keep taking the lead. More secure than open source, it. The software’s owner has access to the source code and has included some of the software’s most important features. On the other side, open-source software has a small feature set. The source code may be edited and distributed with restrictions. A good illustration of open-source is Indigo ELN. It was based on the CeN, a Pfizer proprietary electronic chemical lab notebook. Open source can be used by scientists to plan, prepare, analyze, and plan experiments as well as to access relevant data.

End-Use Analysis

As of 2021, the highest revenue share in the end-user segment was held by Life Sciences. This industry is seeing a rise in demand for electronic lab notebooks to improve product quality, create innovative products, and increase operational efficiency. These needs are being met by increasing demand for electronic and virtual laboratories. Cloud-based electronic lab notebooks allow for the efficient management of large amounts of data remotely and enable real-time analysis.

The increasing trend toward outsourcing is expected to lead to lucrative growth for the CROs segment. The lucrative growth of CROs and BPO segments is due to outsourcing companies’ increasing use of ELN to reduce healthcare costs. These have the added benefit of faster delivery, data entry, and reduced time. This technology is also used in the forensic and food and beverage industries, as well as other pharma labs. This segment is expected to grow due to rising operational costs and the advantages associated with electronic laboratory notebook usage.

Key Market Segments:

By Product

- Cross-disciplinary

- Specific

By Delivery Mode

- On-premise

- Web-hosted/Cloud-based

By License

- Proprietary

- Open

By End-Use

- Life Sciences

- CROs

- Chemical Industry

- Food and Beverage and Agriculture Industries

- Environmental Testing Laboratories

- Petrochemical Refineries & Oil and Gas Industry

- Other Industries (Forensics and Metal & Mining Laboratories)

Market Dynamics:

Healthcare procedures are now reproducible and repeatable because of the growing adoption of robotics and process automation. Now, the experimental setup, execution, and analysis may be completed more quickly. The increasing use of high throughput technology has made it possible to evaluate experimental results effectively, improving the effectiveness of lab operations overall. The ELN has an intuitive user interface with search features for data retrieval and simple inventory linking to the lab notes.

Manufacturing needs rigorous systems that promote collaboration due to its complicated iterative processes and approaches. These systems must be reliable, repeatable, resilient, stable, and downtime-free. The focus is on accelerating the delivery of services or goods and encouraging regulatory oversight.

Reengineering industrial processes is simple because most of them are process-driven. Virtual and electronic laboratories are necessary for life sciences organizations to develop novel products, enhance quality, and increase operational performance. Over the course of the forecast period, the aforementioned elements are anticipated to drive the market.

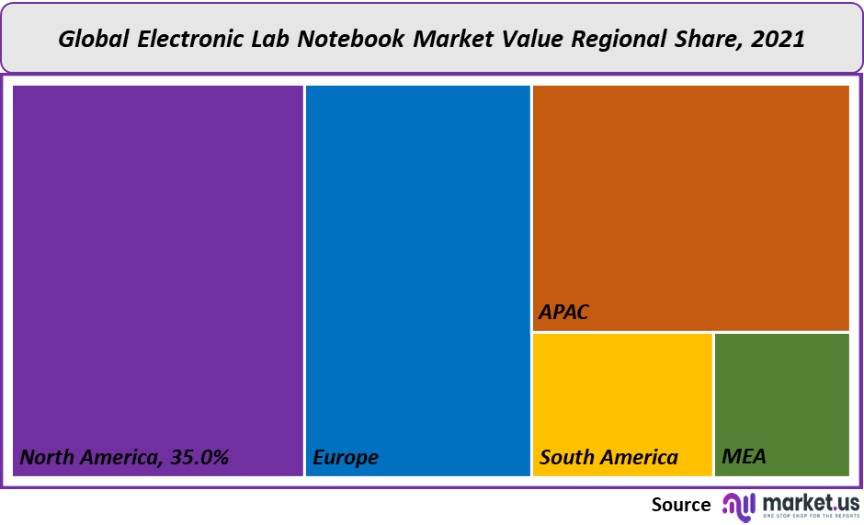

Regional Analysis

The technologically advanced infrastructure in North America was responsible for North America’s largest revenue share accounting for 35% share of the global revenue. The policies that support the deployment of ELN within the laboratories are another factor driving growth in this region.

The Asia Pacific will see lucrative growth due to the growing number of CROs. One of the main factors driving growth is the availability of skilled professionals at lower costs. Japan’s Ministry of Health Labor and Welfare has launched initiatives to improve existing healthcare infrastructure.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

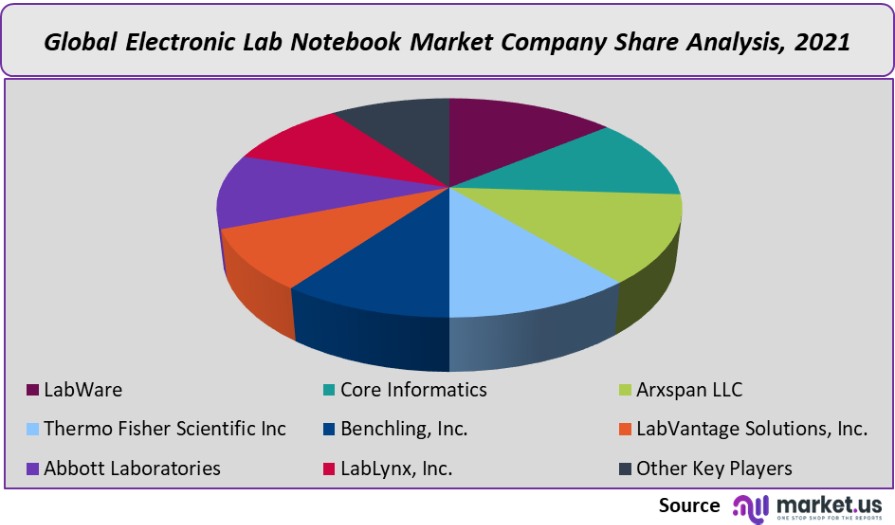

To increase their market share, the major players consistently take part in strategic efforts such as the introduction of new products, technical breakthroughs, and mergers and acquisitions. Companies created technologically sophisticated platforms, including cloud-based ELN with SaaS, and advanced products with better usability, to obtain an advantage over rivals.

Market Key Players:

- LabWare

- Core Informatics

- Arxspan LLC

- Thermo Fisher Scientific Inc

- Benchling, Inc.

- LabVantage Solutions, Inc.

- Abbott Laboratories

- LabLynx, Inc.

- Other Key Players

For the Electronic Lab Notebook Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Electronic Lab Notebook market in 2021?A: The Electronic Lab Notebook market size is US$ 601.8 million in 2021.

Q: What is the projected CAGR at which the Electronic Lab Notebook market is expected to grow at?A: The Electronic Lab Notebook market is expected to grow at a CAGR of 4.2% (2023-2032).

Q: List the segments encompassed in this report on the Electronic Lab Notebook market?A: Market.US has segmented the Electronic Lab Notebook Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By product, the market has been segmented into Cross-disciplinary and Specific; by Delivery Mode, the market has been segmented into On-premise and Web-hosted/Cloud-based, by License, the market has been segmented into Proprietary and Open and the end-use market has been segmented into Life Sciences, CROs, Chemical Industry, Food and Beverage and Agriculture Industries, Environmental Testing Laboratories, Petrochemical Refineries & Oil and Gas Industry, Other Industries (Forensics and Metal & Mining Laboratories).

Q: List the key industry players of the Electronic Lab Notebook market?A: LabWare, Core Informatics, Arxspan LLC, Thermo Fisher Scientific Inc, Benchling, Inc., LabVantage Solutions, Inc., Abbott Laboratories, LabLynx, Inc., Other Key Players are the key vendors in the Electronic Lab Notebook market.

Q: Which region is more appealing for vendors employed in the Electronic Lab Notebook market?A: North America accounted for the highest revenue share of 35%. Therefore, the Electronic Lab Notebook industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for the Electronic Lab Notebook Market.A: The US, Canada, China, Japan, Germany, France, UK, etc., are leading key areas of operation for Electronic Lab Notebook Market.

Q: Which segment accounts for the greatest market share in the Electronic Lab Notebook industry?A: With respect to the Electronic Lab Notebook industry, vendors can expect to leverage greater prospective business opportunities through the cross-disciplinary segment, as this area of interest accounts for the largest market share.

![Electronic Lab Notebook Market Electronic Lab Notebook Market]() Electronic Lab Notebook MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample

Electronic Lab Notebook MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample - LabWare

- Core Informatics

- Arxspan LLC

- Thermo Fisher Scientific Company Profile

- Benchling, Inc.

- LabVantage Solutions, Inc.

- Abbott Laboratories

- LabLynx, Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |