Global Enterprise Data Management Market By Component (Services and Software), By Service (Professional Services and Managed Services), By Deployment (On-premise and Cloud), By Enterprise Size (Large Enterprise and Small & Medium Enterprise (SME)), By End-use (BFSI, IT & Telecom, Healthcare, and Manufacturing), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2021

- Report ID: 63894

- Number of Pages: 299

- Format:

- keyboard_arrow_up

Enterprise Data Management Market Overview:

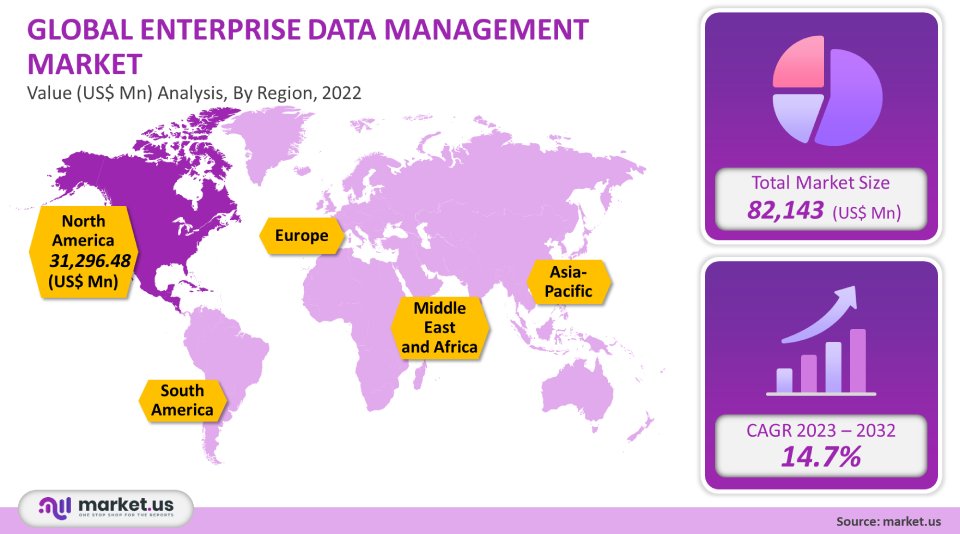

The global enterprise data management market was valued at USD 82,143 million in 2021. It is projected to grow at a CAGR of 14.7% between 2022 to 2032.

This market is driven by the increasing adoption of the Internet of Things (IoT), the growing demand for timely data delivery, and the growing importance of data management for businesses as a vital need for business continuity. The global market has seen positive effects from the COVID-19 epidemic.

Global Enterprise Data Management Market Scope:

Components Analysis

Software accounted for over 78.2% of the total revenue in 2021. Over the forecast period, the software segment is expected to grow due to the increasing use of enterprise data management solutions for small and medium businesses.

Many organizations are adopting EDM solutions that meet regulatory compliance. This includes financial services reporting and data privacy. The growth is expected to be further driven by the potential benefits, including a reduction in duplication and inaccurate data, and an improvement in organizational productivity.

Over the forecast period, the highest CAGR for the service segment will be 16%. Enterprise data management services allow businesses to reduce operating expenses, improve operational efficiency, and concentrate on their core competencies. It helps to gain quick, contextual, and empowered insight and then address complex business problems.

Many companies have begun to use enterprise data management to manage their businesses and ensure smooth operations. These factors will attract large client bases and propel the enterprise segment’s growth over the forecast period.

Services analysis

In 2021, the market share for the professional services segment was 69.2%. This segment growth can be attributed largely to big data and analytics, and the increasing demand rate for service consultants who are more mobile. These services can optimize staffing, improve collaboration, automate time and expense management, and help optimize staffing. The forecast assessment period will see the professional services management market size growth rate due to the increasing need to improve operational efficiency.

In 2021, the managed services segment held a greater market share than 31%. These services could help companies simplify their data and improve their business operations. These services provide efficient functionalities at low costs and without compromising quality. Managed services provide support for and ensure consistency in services provided to various business processes. They are able to integrate and manage both cloud-based and traditional IT infrastructures. This is a boon for growth because organization size is increasingly dependent on IT assets to increase productivity.

Deployment analysis

In 2021, the on-premise segment had a revenue share exceeding 43.2%. Many organizations are moving from manual systems to automate various operations. This has led to a rise in demand for software on-premise. Due to the increased security features, many organizations have turned to on-premise deployment. Some enterprise data management solutions don’t require an internet connection and can be customized to meet business needs. The on-premise market is expected to grow steadily over the forecast period.

The forecast period will see a 17% CAGR in the cloud segment. Cloud-based solutions enable businesses to access data from any device at any time. This increases the possibility for customization and allows the implementation of analytics tools across multiple channels. Cloud-based solutions are increasingly being adopted by organizations. This is because cloud-based deployment does away with the need to periodically upgrade and users can access their data from any location.

Enterprise Size Analysis

Large enterprises held the largest market share at 68.1% in 2021. This is due to the growing demand for robust monitoring and automation capabilities that can be used for resource allocation and strategic decision-making across large organizations. Large enterprises require sophisticated tools to manage their operations and processes. These tools include advanced analytical engines, process blueprints, and real-time data collection tools. This is essential for the adoption of business solutions. Large companies are keen to adopt effective data approaches to predict and classify possible threats and use this data to make better business decisions. These factors will drive demand for EDM solutions.

The Small & Medium Enterprises segment (SME), is expected to grow at a substantial CAGR of 13.9% during the forecast period. This segment growth is due to the increasing preference for cloud-based solutions, as well as the emphasis on cybersecurity strategies, preventing outside threats, and streamlining business operations. Enterprise data management is a tool that helps SMEs to reduce costs, eliminate repetitive tasks, prioritize work, lower business risks, improve collaboration between teams, and increase productivity. These will increase the segment’s growth over the forecast period.

End-use Analysis

The BFSI market is expected to grow at a substantial CAGR of 16% over the forecast period. Enterprise data management solutions are a great way to help BFSI industry incumbents manage enterprise-wide risk, improve sales and marketing operations and track and monitor finance and accounting procedures. They can also efficiently manage various compliances. Banks worldwide have adopted advanced agile methods to protect their data and ensure data quality. These technological advances are driving the adoption of enterprise data management solutions in the BFSI sector.

Over the forecast period, the healthcare segment will see a 12.4% CAGR. Healthcare professionals have instant access to patient data via secure portals. They also have the ability to store large amounts of data and manage them effectively. Enterprise data management allows them to use their data to improve patient care. EDM solutions can be used by healthcare industry experts to encourage remote collaboration and data sharing. These solutions can support data automation, simplify incoming data, facilitate the discharge process, and eliminate the need to go offline.

Key Маrkеt Segments:

By Component

- Services

- Software

By Service

- Professional Services

- Managed Services

By Deployment

- Cloud

- On-premise

By Enterprise Size

- Small & Medium Enterprise (SME)

- Large Enterprise

By End-use

- BFSI

- Healthcare

- IT & Telecom

- Manufacturing

- Retail & Consumer Goods

- Other End Uses

Market Dynamics:

Organizations all around the world have re-evaluated enterprise data management (EDM) suppliers for a variety of services and solutions. This trend will continue to grow in the future. Businesses and enterprises can benefit from unified integration with their consuming apps, control over their data, enhanced transparency, and support for continuing regulations and compliances.

The market’s growth has been driven by the growing demand for visual analytics and data integration. Artificial Intelligence (AI), which is used in cognitive media solutions (whiteboard video and whiteboard animations), allows for the real-time synthesis of data to support effective decision-making.

Vendors are also offering AI-powered products to improve their analytics capabilities. Many businesses are integrating business analytics software into their businesses to enable dynamic representations of data. These factors will continue to fuel market growth over the forecast period.Many organizations have opened offices around the world as a result of globalization. Data procurement is complicated by the fact that data can change depending on where they are located. Enterprise data management solutions are able to assist clients at this point in single-source reporting. They also allow multi-user capability and provide data management services that can be used by all business locations.

EDM solutions are able to help incumbents in various industries, such as manufacturing and BFSI, gain valuable insights from historical and current data and forecast market changes that could potentially impact clients’ needs. EDM solutions can help such companies by providing accurate information and managing risk.As this model allows for the creation of a process that delivers relevant insights from unstructured and duplicated data, there will be a growing demand for enterprise data management. It allows for the sharing of data among departments within an organization. EDM solutions will continue to be in high demand as companies place greater importance on accurate and timely information.

It is an excellent tool for companies and businesses as it allows seamless integration with the consuming apps, increased transparency, improved data control, greater transparency, and support for rules and compliance. These factors will drive the growth of the global enterprise data management market growth over the forecast period.EDM helps organizations resolve data management problems that can lead to data mishandling. EDM implements a structured data delivery process from the data producer to data users. It includes software, network infrastructure, and business judgment.

Organizations must follow certain aspects and collaborate with inter-teams such as IT, finance, and operations to implement enterprise data management.Regional Analysis:

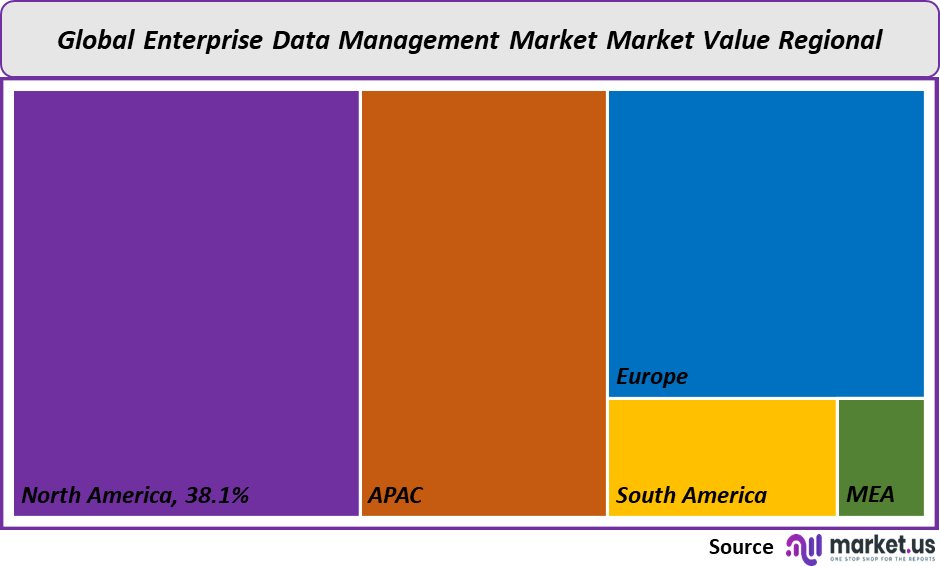

In 2021, North America was the largest regional market with a 38.1% revenue share. This growth is due to increasing demand for risk management solutions and an increased need for authentic information. Many companies, including IBM, Oracle, Amazon Web Service, and Oracle, place a strong emphasis on digital transformation. They are often considered early adopters and advocates of new technologies such as IoT and big data analytics, AI, and machine learning. This is a positive sign for the growth of the region’s market.

Due to increasing industry verticals in the Asia Pacific and the adoption of large data within the region, the market for the Asia Pacific is expected to experience a 17.3% CAGR over the forecast period. The rising popularity of cloud computing, as well as the need to increase operational efficiency in large businesses and SMEs, will drive demand for enterprise data management. Many governments in the region encourage software companies to develop open-source software that allows remote access to large amounts of data. This will likely increase the demand for EDM solutions.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

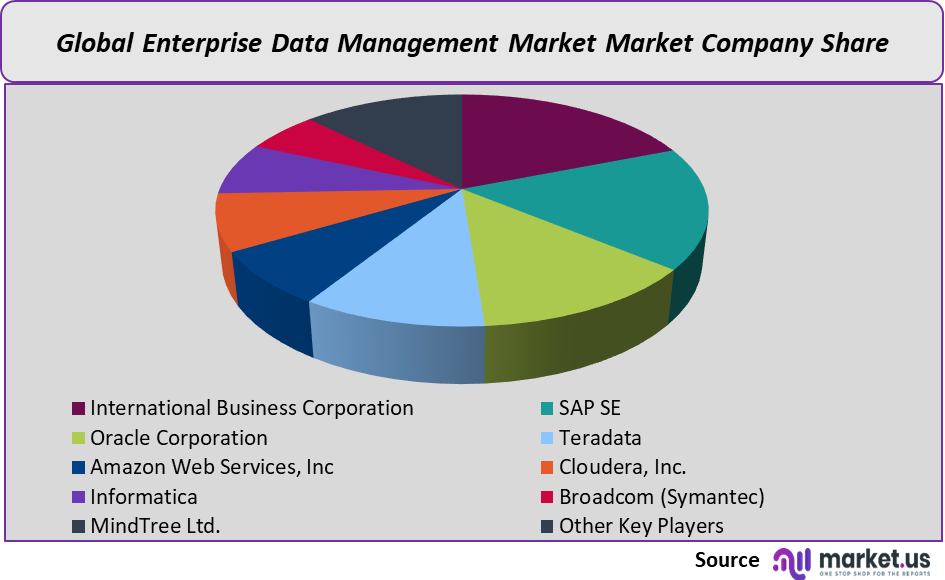

International Business Corporation, Oracle Corporation, and SAP SE are the dominant players in this market. Cloudera, Inc., Amazon Web Services (AWS), and Broadcom (Symantec) are some of the major players in this market. To support growth and improve their internal operations, market players have invested significant resources in R&D.

Companies can be seen forming partnerships and mergers & acquisitions to improve their products and increase their market share. They are actively working on product development and enhancements to existing products in order to gain new customers and increase market share. IBM Corporation, for example, launched a storage system to manage data across hybrid clouds in April 2021. This storage system will improve data management in hybrid cloud environments and increase data availability and flexibility.

Маrkеt Key Industry Players:

- International Business Corporation (IBM Corporation)

- SAP SE

- SAS Institute Inc.

- Oracle Corporation

- Teradata

- Amazon Web Services, Inc

- Cloudera, Inc.

- Informatica

- Broadcom (Symantec)

- MindTree Ltd.

- NortonLifeLock Inc.

- Solix Technologies Inc.

- Other Key Players

For the Enterprise Data Management Market research study, the following years have been considered to estimate the current market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Enterprise Data Management market in 2021?The Enterprise Data Management market size is US$ 82,143 million in 2021.

Q: What is the projected CAGR at which the Enterprise Data Management market is expected to grow at?The Enterprise Data Management market is expected to grow at a CAGR of 14.7% (2023-2032).

Q: List the segments encompassed in this report on the Enterprise Data Management market?Market.US has segmented the Enterprise Data Management market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Component, market has been segmented into Services and Software. By Service, the market has been further divided into Professional Services and Managed Services. By Deployment, the market has been further divided into On-premise and Cloud. By Enterprise Size, the market has been further divided into Large Enterprise and Small & Medium Enterprise (SME). By End-use, the market has been further divided into BFSI, IT & Telecom, Healthcare, Retail & Consumer Goods, and Manufacturing.

Q: List the key industry players of the Enterprise Data Management market?International Business Corporation, SAP SE, Oracle Corporation, Teradata, Amazon Web Services, Inc., Cloudera, Inc., Informatica, Broadcom (Symantec), MindTree Ltd., and Other Key Players engaged in the Enterprise Data Management market.

Q: Which region is more appealing for vendors employed in the Enterprise Data Management market?North America accounted for the highest revenue share of 38.1%. Therefore, the Enterprise Data Management industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Enterprise Data Management?The U.S., Canada, U.K., Germany, China, India, Japan, Brazil, are key areas of operation for Enterprise Data Management Market.

Q: Which segment accounts for the greatest market share in the Enterprise Data Management industry?With respect to the Enterprise Data Management industry, vendors can expect to leverage greater prospective business opportunities through the software segment, as this area of interest accounts for the largest market share.

![Enterprise Data Management Market Enterprise Data Management Market]() Enterprise Data Management MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample

Enterprise Data Management MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample - International Business Corporation (IBM Corporation)

- SAP SE Company Profile

- SAS Institute Inc.

- Oracle Corporation

- Teradata

- Amazon Web Services, Inc

- Cloudera, Inc.

- Informatica

- Broadcom (Symantec)

- MindTree Ltd.

- NortonLifeLock Inc.

- Solix Technologies Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |