Global Eye Health Supplements Market By Ingredient Type (Lutein and Zeaxanthin, Antioxidants, Omega-3 Fatty acids, Other Ingredients), By Indication (Age-related Macular Degeneration (AMD), Cataract, and Other Indications), By Formulation (Tablets, Capsules, Powder, Softgels, and Liquid), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 48306

- Number of Pages: 270

- Format:

- keyboard_arrow_up

Eye Health Supplements Market Overview:

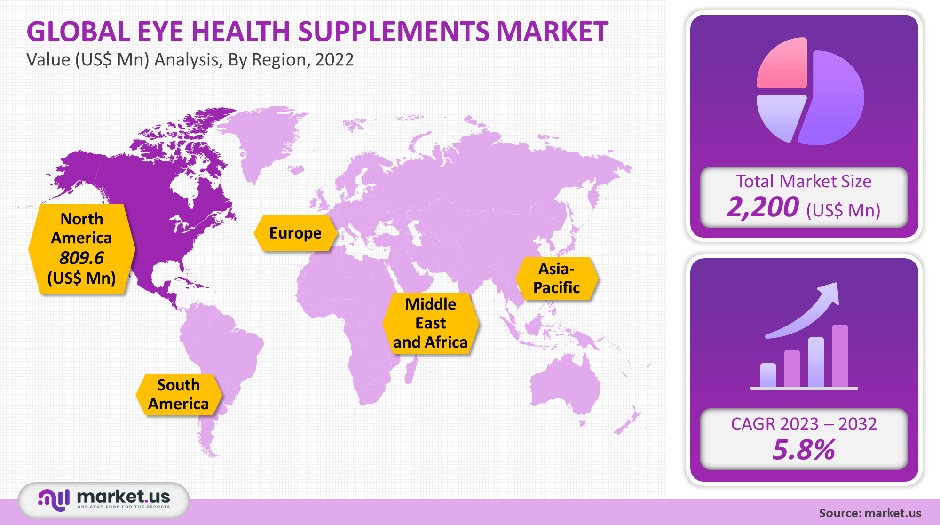

The global market for eye supplements was valued in 2021 at USD 2,200 million. It is expected that the market will grow at a 5.8% compound annual growth rate (CAGR), from 2023 to 2032.

The market’s key drivers are the growing prevalence of vision impairment and the rise in myopia during the COVID-19 crisis. High myopia can lead to a higher risk of developing progressive eye conditions like cataracts, glaucoma, and age-related maculopathy.

Global Eye Health Supplements Market Scope:

Ingredient type analysis

Lutein ingredients for eye-health supplements and Zeaxanthin accounted for 31.4% of revenue share in 2021. This is due to growing awareness about the potential benefits of Zeaxanthin and Lutein in the treatment and prevention of eye diseases, such as AMD, diabetes, uveitis, and other conditions. The significant growth of this segment can also be attributed to the growing incidence of eye conditions, especially AMD.

The Eye Disease Case-Control Study revealed that people who have the highest intakes of Zeaxanthin and Lutein supplements had a 42.8% decreased risk of developing AMD compared to those with lower intakes.

Eye doctors recommend that an average daily intake of Lutein or Zeaxanthin be between 6-20 mg per person. This is according to the National Institutes of Health Office of Dietary Supplements. In order to meet the daily requirement, it is recommended to include supplements in your diet. This further drives the market growth.

Flavonoids are expected to grow at 7.0% in the future due to increased demand for bilberry extracts among consumers. Bilberry extract is one of the most important eyes health supplements. It has been extensively used to treat nearsightedness, eye diseases, and other eye disorders such as cataracts, glaucoma, nearsightedness, and eye fatigue.

Flavonoids have been gaining acceptance as eye supplements because they are affordable and easy to obtain.

Formulation Analysis

The largest share of revenue in 2021 was 41.8% for the tablets segment. This market was dominated by the tablets segment. The segment growth is being driven by a growing preference for tablets as eye health products. They are easily available in many forms such as chewable tablets or sustained-release tablets.

Market growth is driven by factors such as tablets being relatively cheaper than other supplement forms and their acceptance among patients from all age groups. Tablets have a much longer shelf life than liquid and powder forms.

However, the softness will see significant growth over the forecast. Softgels can be used as a delivery method for liquid and oil-based vitamins. Research suggests that supplements delivered in their natural form are more efficient than those given modified forms.

Softgels can be used to encapsulate nutrients like fish oil or Krill Oil in order to prevent adverse effects that could alter the flavor and aroma of oils. Further, soft gel eye health dietary products such as Vision Shield, Nature’s Bounty, or Viteyes are readily available at low prices.

Indication Analysis

Age-related Macular Degeneration was responsible for the largest revenue share at 32.3% in 2021. The segment growth is due to the increasing prevalence of AMD around the world. According to the International Agency for the Prevention of Blindness, IAPB AMD was ranked third in blindness.

In addition, AMD is the leading cause of sight loss among countries with large aging populations. Bright Focus Foundation has estimated that 11 million Americans suffer from AMD. By 2050, this number will increase to around 22.0million.

Globally, almost 196.0 million individuals will suffer from the macular disease by 2020. The number is expected to rise to a 288.0million by 2040. However, the segment for dry eye syndrome will experience a significant increase rate of 6.6% in the forecast period. There is a growing recommendation that Asian ophthalmologists recommend dietary supplements to dry eye patients. This is one of the main factors driving the demand for eye supplements to treat dry conditions.

Additionally, around 60% of dry eye patients are taking Omega-3 fatty acid supplements. Omega-3 has been proven to be an effective treatment for dry eye and ocular skin disease.

Кеу Маrkеt Ѕеgmеntѕ

By Ingredient Type

- Antioxidants

- Omega-3 Fatty acids

- Coenzyme Q10

- Alpha-Lipoic Acid

- Lutein and Zeaxanthin

- Flavonoids

- Astaxanthin

- Other Ingredients

By Indication

- Age-related Macular Degeneration (AMD)

- Inflammation

- Dry Eye Syndrome

- Cataract

- Other Indications

By Formulation

- Tablets

- Liquid

- Capsules

- Softgels

- Powder

Market Dynamics:

Market growth is being driven by the growing demand for eye health products among both older individuals and millennials, who are more likely to suffer from digital eye fatigue and myopia. Further driving the market is the rise in various eye conditions, including dry eye syndrome, AMD, and cataracts. The glowing recommendation by ophthalmologists to use eye health supplements in the prevention and treatment of these eye disorders is another factor.

The WHO reported that nearly 2.2 billion people in the world have vision impairments or blindness. South Asia, western and eastern sub-Saharan Africa, and South Asia have eight-time higher rates of blindness than the high-income country. Eye disorders like AMD and cataracts are more common in lower-income countries than in those in middle income.

In developed countries like the U.S., Canada, and Australia, consumers spend a lot on healthcare products. This contributes to market growth. The market is driven by an increasing demand and easy access to bilberry extract and Lutein and Zeaxanthin products for eye health.

In addition, strong growth is projected due to the increasing number of eye health supplement launches to satisfy the demand from 1.0 million people suffering from vision impairment. This will drive future sales of eye health products. Bausch + Lomb launched Presser Vision® AREDS2 Formula mini gel eye vitamin in the U.S., for example, in October 2019. Presser Vision AREDS 2 Formula is an alternative to its PreserVision AREDS 2 Formula softgels. The mini gel is designed for advanced AMD.

The market growth can also be attributed to the strong distribution and sales channels for these supplements. NutraIngredients has published a study that shows that the COVID-19 situation has led to an increase in online sales of eye-health supplements to around 48.3% in just a few months.

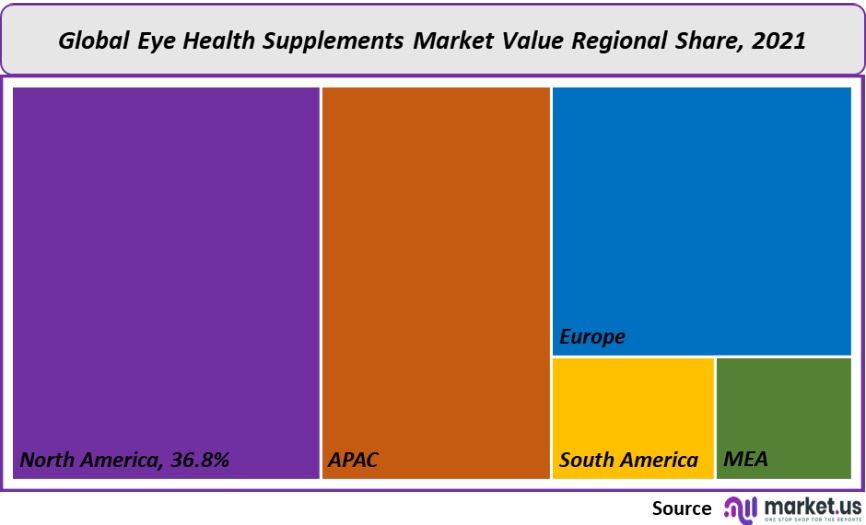

Regional Analysis

North America held the largest revenue share, at 36.8%, in the market in 2021. North America holds the largest revenue share. This is due to the growing prevalence of AMD, dry eyes syndrome, diabetic retinopathy, glaucoma, and other eye conditions. A key factor driving market growth in North America is also the rise in product launches of eye health supplements. Bausch + Lomb has launched Ocuvite Eye Performance vitamins supplements in the U.S. to meet increasing consumer demand.

However, the Asia Pacific region is expected to show a substantial growth rate over the forecast period. The market is being driven by a large number of local players that provide affordable and innovative eye-health supplements. There are also emerging contract manufacturing hubs like China, India, and the Philippines.

Additionally, the market’s growth has been positively impacted due to increasing eye health awareness. Also, market growth will be driven by Asia’s increasing incidence of eye-related conditions in Asian countries. International Finance Corporation has published a study showing that China is seeing a 6.0% increase each year in blindness. The country houses almost one-fifths of the world’s visually impaired population.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

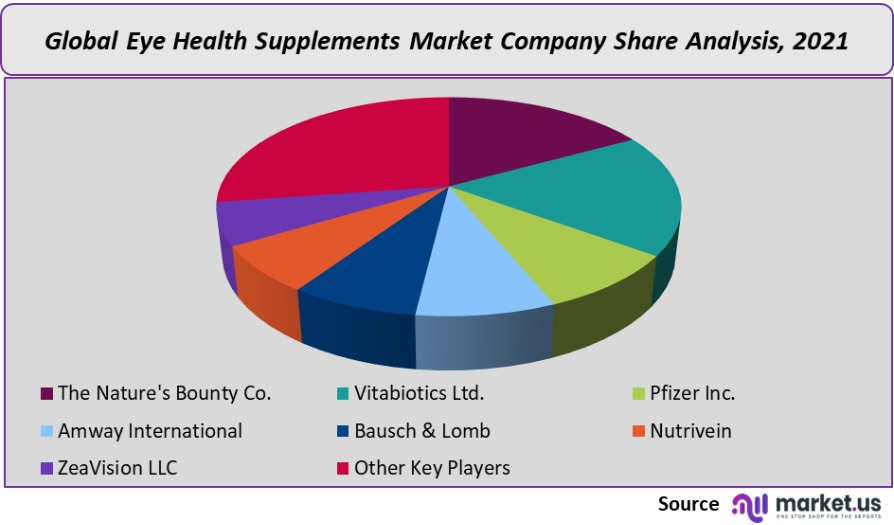

Market Share & Key Players Analysis:

For their market share to be maintained, key companies have adopted a range of business strategies that include mergers, collaborations, and product launches. Nippon Flour Mills, Japan, was the first to enter the healthcare industry with the launch in August 2019 of its eye and brain flavonoid supplements. These include lutein and Ginkgo Biloba, Terpene Lactone, and Zeaxanthin. There are several prominent players in this market for eye supplements:

Маrkеt Kеу Рlауеrѕ:

- The Nature’s Bounty Co.

- Vitabiotics Ltd.

- Pfizer Inc.

- Amway International

- Bausch & Lomb

- Nutrivein

- ZeaVision LLC

- Kemin Industries, Inc.

- Other Key Players

For the Eye Health Supplements Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Eye Health Supplements Market in 2021?A: The Eye Health Supplements Market size is estimated to be US$ 2,200 million in 2021.

Q: What is the projected CAGR at which the Eye Health Supplements Market is expected to grow at?A: The Eye Health Supplements Market is expected to grow at a CAGR of 5.8% (2023-2032).

Q: List the segments encompassed in this report on the Eye Health Supplements market?A: Market.US has segmented the Eye Health Supplements Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Ingredient Type, market has been segmented into Lutein and Zeaxanthin, Antioxidants, Omega-3 Fatty acids, Coenzyme Q10, Flavonoids, Alpha-Lipoic Acid, Astaxanthin, Other Ingredients. By Indication, the market has been further divided into Age-related Macular Degeneration (AMD), Cataract, Dry Eye Syndrome, Inflammation, Other Indications. By Formulation, market has been segmented into Tablets, Capsules, Powder, Softgels, Liquid.

Q: List the key industry players of the Eye Health Supplements market?A: The Nature's Bounty Co., Vitabiotics Ltd., Pfizer Inc., Amway International, Bausch & Lomb, Nutrivein, ZeaVision LLC, Kemin Industries, Inc., and Other Key Players engaged in the Eye Health Supplements market.

Q: Which region is more appealing for vendors employed in the Eye Health Supplements market?A: North America is expected to account for the highest revenue share of 36.8%. Therefore, the Eye Health Supplements Technology industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Eye Health Supplements?A: U.S., Canada, U.K., Germany, France, Spain, Russia, Brazil, South Korea, are key areas of operation for Eye Health Supplements market.

Q: Which segment accounts for the greatest market share in the Eye Health Supplements industry?A: With respect to the Eye Health Supplements industry, vendors can expect to leverage greater prospective business opportunities through the Tablet segment, as this area of interest accounts for the largest market share.

![Eye Health Supplements Market Eye Health Supplements Market]() Eye Health Supplements MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample

Eye Health Supplements MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample - The Nature's Bounty Co.

- Vitabiotics Ltd.

- Pfizer Inc Company Profile

- Amway International

- Bausch & Lomb

- Nutrivein

- ZeaVision LLC

- Kemin Industries, Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |