Global Fiberglass Pipe Market By Product Type (GRE Pipes, GRP Pipes, and Other Product Types), By Fiber Type (E-glass, T/ S/ R Glass, and Other Fiber Types), By End-Use (Oil & Gas, Chemicals, Sewage, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2021

- Report ID: 66521

- Number of Pages: 266

- Format:

- keyboard_arrow_up

Fiberglass Pipe Market Overview:

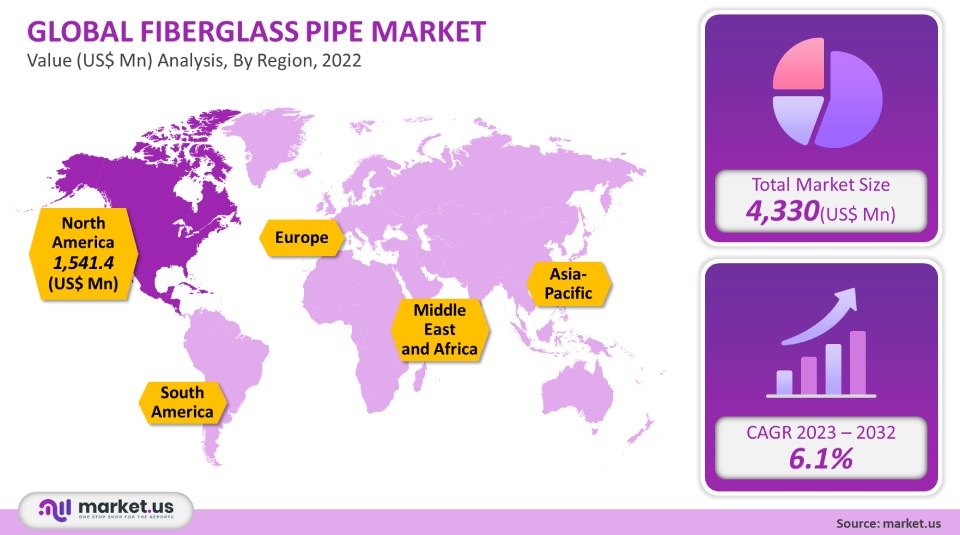

In 2021, the global fiberglass pipe market was valued at USD 4,330 million. The market is expected to grow significantly over the forecast period with a 6.1% CAGR from 2023 to 2032 due to the increasing demand for lightweight, fire retardant, and high-stiffness pipes.

Fiberglass pipes can be described as composite materials that combine the properties of several materials, such as resins and glass fibers. They are used in many end-use industries like chemicals and irrigation. Oil & Gas, Chemicals, chemicals, sewage, and others are the key industries. GRE is the main product segment driving the industry. It is used in many offshore and onshore oil and gas exploration and production activities.

Global Fiberglass Pipe Market Scope:

Product Type Analysis

GRE segment was the largest revenue segment. It was responsible for a 49.9% global revenue share in 2021. It is projected to grow at a CAGR of 6.3% during the forecast period.

Fiberglass pipes reinforced with epoxy resins can be used in high-pressure and high-temperature environments with high corrosion resistance, such as offshore oil and gas applications. The International Marine Organization (IMO) has approved these products for use in level 3-fire endurance marine applications, which has increased demand.

Fiber Type Analysis

Many composites can benefit from the use of e-glass fiber. As a strengthening agent, this product improves the resin’s strength. The market for E-glass fiber has been partially consolidated by Saint-Gobain Vertex, PPG Industries, and Nippon Electric Glass Co. Ltd. E-glass is used for cooling and drainage in the marine environment. In 2021, e-glass fiber was the most profitable segment, accounting for 47.9% of global revenue.

End-Use Analysis

In 2021, the oil and gas industry was the most powerful end-use sector, accounting for 40.2 percent of global revenue. Chemicals and irrigation came in second and third, respectively, in terms of revenue. Emerging countries’ oil and gas industries, such as those in South and Central America, Asia Pacific, and the Middle East and Africa, significantly impact the market. This is due to these areas’ rapid growth, which has prompted energy and infrastructure reforms to improve their infrastructure and meet their energy needs.

Chemical industries are also one of Europe’s and North America’s fastest-growing and most established markets. Lower natural gas prices aid fiberglass pipe growth in Europe and North America. Natural Gas is used in many chemical processing industries. Due to the rapid infrastructural development of the region, particularly in China, India, and Saudi Arabia, construction is a diverse sector that will experience strong growth.

Кеу Маrkеt Ѕеgmеntѕ:

By Product Type

- GRP Pipes

- GRE Pipes

- Other Product Types

By Fiber Type

- T/ S/ R Glass

- E-glass

- Other Fiber Types

By End-Use

- Oil & Gas

- Chemicals

- Sewage

- Other End-Uses

Market Dynamics:

Global demand is driven by the increasing need for products with advantages like ease of installation, low maintenance costs, and flexibility in creating complex shapes. The changing needs of consumers are driving the demand for new products, such as concrete, steel, and polyvinyl chloride.

Markets are becoming more popular as viable alternatives to traditional ones due to longer-lasting durability, higher corrosion resistance, and easier handling due to the lower weight. As a result, the market is seeing a rise in acceptance of its use in various applications. Fiberglass pipes offer many advantages, including the ability to manufacture the product in various sizes and shapes to meet customer requirements in a wide range of applications. Because there is less friction between the product’s surfaces, excellent hydraulic features can be maintained.

Regional Analysis:

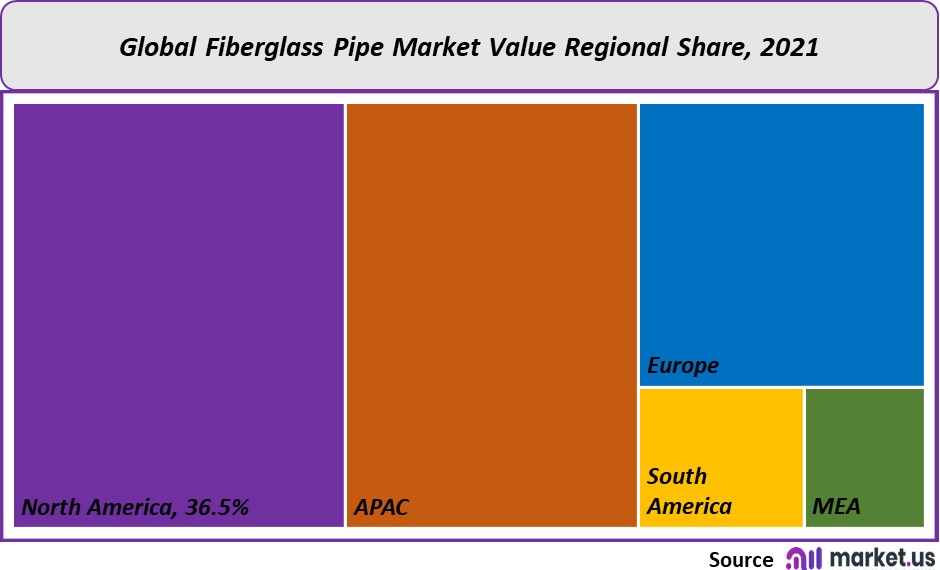

North America is the largest market for fiberglass pipes in terms of revenue, and this trend will continue in the future. It accounted for 36.5% of the total revenue share in 2021 and is expected to grow at a 7.1% CAGR between 2017-2025.

Natural Gas is becoming a more popular choice in emerging economies like China, India, and Japan, where there is high energy demand. Although natural gas imports come at a high cost, transportation via pipeline is more economical than large LNG vessels. Developing infrastructure requires huge investments. These factors will allow the market to grow as a replacement for concrete and steel pipes.

The Asia Pacific was second in revenue, followed by Europe. It is expected that the Asia Pacific will grow at a CAGR of 6.6% during the forecast period. The demand for end-use applications will be driven by the economic recovery in Europe and the growing dependence on Russia for natural gas imports. The European region is seeing an increase in desalination plants across many countries due to increasing urbanization and drought conditions. GRP and GRE piping equipment will be used in desalination plants, as well as in the manufacture of chemicals and effluent treatment systems. This is expected to drive the demand.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

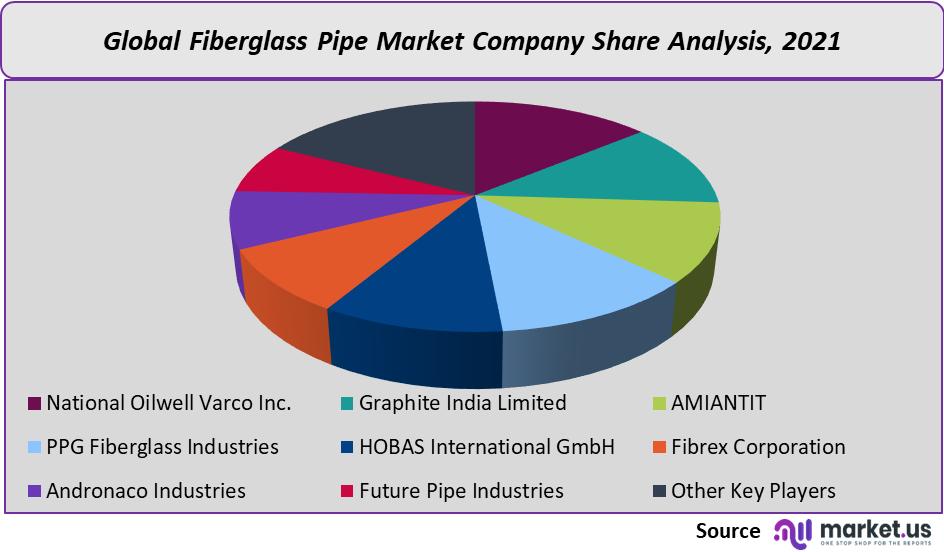

National Oilwell Varco Inc., Graphite India Limited, and Saudi Arabian AMIANTIT Company are the key players in this global market. PPG Fiberglass Industries, HOBAS International GmbH, Fibrex Corporation, and Domestic companies place great emphasis on quality products at affordable prices that meet international standards. Key players in the global market include National Oilwell Varco, Inc., Graphite India Limited, and Saudi Arabian AMIANTIT Company.

Маrkеt Кеу Рlауеrѕ:

- National Oilwell Varco Inc.

- Graphite India Limited

- AMIANTIT

- PPG Fiberglass Industries

- HOBAS International GmbH

- Fibrex Corporation

- Andronaco Industries

- Future Pipe Industries

- Sarplast SA

- FCX Performance

- Other Key Players

For the Fiberglass Pipe Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Fiberglass pipe market in 2021?The Fiberglass pipe market size is estimated to be US$ 4,330 million in 2021.

Q: What is the projected CAGR at which the Fiberglass pipe market is expected to grow at?The Fiberglass pipe market is expected to grow at a CAGR of 6.1% (2023-2032).

Q: List the segments encompassed in this report on the Fiberglass pipe market?Market.US has segmented the Fiberglass pipe market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, the market has been segmented into GRE Pipes, GRP Pipes, and Other Product Types. By Fiber Type, the market has been further divided into E-glass, T/ S/ R Glass, and Other Fiber Types. By End-Use, the market has been further divided into Oil & Gas, Chemicals, Sewage, and Other End-Uses.

Q: List the key industry players of the Fiberglass pipe market?National Oilwell Varco Inc., Graphite India Limited, AMIANTIT, PPG Fiberglass Industries, HOBAS International GmbH, Fibrex Corporation, Andronaco Industries, Future Pipe Industries, and Other Key Players are the key vendors in the Fiberglass Pipe market

Q: Which region is more appealing for vendors employed in the Fiberglass pipe market?North America is expected to account for the highest revenue share of 36.5%. Therefore, the fiberglass pipe market in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Fiberglass pipe?The US, Canada, UK, Japan, Mexico, India, China & Germany are key areas of operation for the Fiberglass Pipe Market.

Q: Which segment accounts for the greatest market share in the Fiberglass pipe industry?With respect to the Fiberglass pipe industry, vendors can expect to leverage greater prospective business opportunities through the GRE segment, as this area of interest accounts for the largest market share.

![Fiberglass Pipe Market Fiberglass Pipe Market]()

- National Oilwell Varco Inc.

- Graphite India Limited

- AMIANTIT

- PPG Fiberglass Industries

- HOBAS International GmbH

- Fibrex Corporation

- Andronaco Industries

- Future Pipe Industries

- Sarplast SA

- FCX Performance

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |