Global Filler Masterbatch Market By Carrier Polymer (Polyethylene and Polypropylene), By End-Use (Building & Construction, Packaging, Automotive & Transportation, Consumer Goods, and Other End-Uses), By Application (Films & Sheets, Injection & Blow Molding, Tapes, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Aug 2022

- Report ID: 37883

- Number of Pages: 202

- Format:

- keyboard_arrow_up

Filler Masterbatch Market Overview:

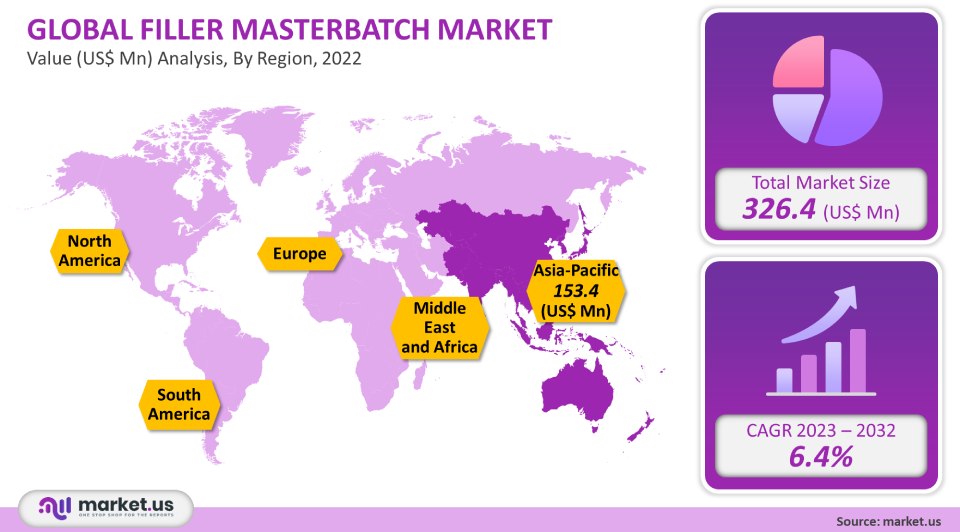

The global masterbatch filler market was worth USD 326.4 million in 2021. It is expected to grow at a 6.4% CAGR, between 2023-2032.

The market’s growth depends on how it is used in different end-use sectors like agriculture, packaging, and consumer goods. According to the scope of this research study, the global market for filler masterbatch includes the consumption of polyethylene-based filler masterbatch as granules. Because of their excellent flow properties, they are easy to process, making them ideal for many industries including packaging, automotive, and consumer goods. They are used for improving plastic product processing and property modification at lower costs.

Global Filler Masterbatch Market Analysis:

Carrier Polymer Analysis

In 2021, polyethylene accounted for more than 52% of the filler masterbatch market. The polyethylene segment has been used extensively as a carrier plastic in the automotive, packaging, building, construction, and many other end-use industries. Furthermore, polyethylene has enjoyed a rising market share as a carrier material in many industries, including packaging, building, and construction. Different color shades of the masterbatch polyethylene masterbatch make it useful in product differentiation. Because it enhances the appearance of components, this is expected to increase its usage in the automotive sector.

Polypropylene has high resistance to heat and strong chemicals. Because of its increased flexibility and mechanical strength, polypropylene is used as a carrier polymer for rigid and flexible packaging applications. Polypropylene can quickly be set up in a mold during injection molding. This allows polypropylene to use the injection molding area to create molded components. Polypropylene has excellent dimensional stability, excellent chemical resistance, and good abrasion resistance. It is well-suited for film or fibers that require optical properties, moisture barrier properties, and superior strength.

End-Use Analysis

The market for filler masterbatch was dominated by the packaging industry segment in 2021. The growing eCommerce market in developed and emerging economies was further accelerated by the coronavirus outbreak, which drove the demand to purchase packaging applications. Food courts and restaurants were closed, which increased the demand for grocery and packaged food. These conditions are likely to be one factor driving the increase in packaging demand.

Filler masterbatch, widely used for automotive parts compounding, has been in high demand because of strong demand from the automobile industry, especially from developing nations. The automotive industry is experiencing a shift from metal to plastic parts, driving demand for filler masterbatch. This allows automakers and consumers to make cars lighter and more economical. In the future, this product is likely to be more in demand because of the increased innovation in masterbatch products for other applications.

Urbanization and a growing global population are expected to drive growth in the building and construction sector. It is expected that the construction and building sector will grow in demand for filler masterbatch to manufacture pipes, tool handle grips, safety gear for transportation containers, and other exterior and interior construction materials for roofing, plumbing, and electrical fittings.

Application Analysis

The market was dominated by injection and blow holding accounting for a significant revenue share in 2021. Injection molding uses filler masterbatch materials to create molds in different shapes and sizes that can be used across various industries. Injection molding products are consistently produced with consistent quality thanks to the automation of operations on injection mold machines.

The blown film technique uses filler masterbatch to make films and sheets. To avoid food contamination, increased safety measures have been implemented in food packaging. Masterbatch has attractive color options, modifies other properties, and attracts consumers to help increase sales conversion. Masterbatch products are expected to be more in demand because of the increasing importance of packaging solutions across various industries.Masterbatch has a great anti-fibrillation ability that allows for high stretch in the production process of tapes. The fine calcium particles are not only cost-effective but also add whiteness to the finished product. The market for raffia taps will grow due to the development of the construction and agricultural sectors.

Key Market Segments:

By Carrier Polymer

- Polyethylene

- Polypropylene

By End-Use

- Building & Construction

- Packaging

- Automotive & Transportation

- Consumer Goods

- Other End-Uses

By Application

- Films & Sheets

- Injection & Blow Molding

- Tapes

- Other Applications

Market Dynamics:

Numerous prominent automotive companies use plastics to reduce vehicle weight. This improves fuel efficiency. This is driving demand for plastics with different blends of filler masterbatch to alter their functional properties. Asia Pacific’s emerging economies, including India, China, and Japan, have seen an increase in automobile production. These activities are expected to continue over the forecast period, further boosting the plastic component market. The market for automotive filler masterbatch will grow due to the increased use of plastic parts in automobiles.

The Asia Pacific held a significant share of the global market’s revenue in 2021. This is due to the growth of plastic processing industries, automotive, packaging, and the construction industry. The COVID-19 pandemic affected all manufacturing industries around the world, which adversely affected the growth of filler masterbatch because of order cancellations.

The rise in electric vehicles has been made possible by stringent regulations and growing concerns about environmental pollution from gasoline-powered vehicles. The growing investments in electronic vehicle manufacturing, and the shifting of major automobile manufacturers towards vehicle electrification, are expected to lead to a filler masterbatch in the manufacturing of various automotive components. Because of the lucrative opportunities available in the African region’s construction, packaging, and consumer goods industries, filler masterbatch companies are expanding their reach. In Africa, Merit Polymers, an India-based filler masterbatch producer, opened offices at the Ugandan and Nigerian offices in August 2019 & January 2020, respectively, to expand its reach in the market for filler masterbatch.

Region Analysis:

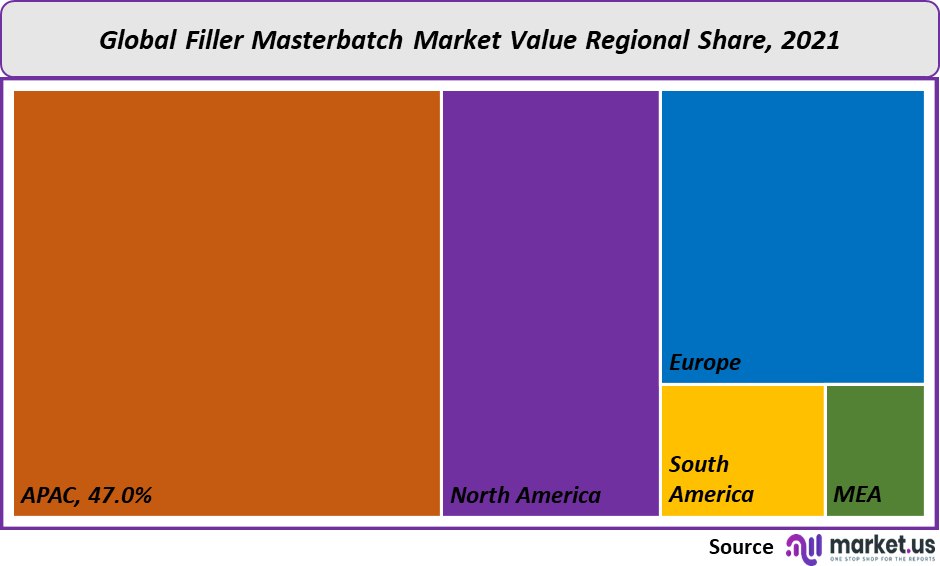

The Asia Pacific dominated filler masterbatch markets in the region segment, accounting for 47% of the total revenue share in 2021. Filler masterbatch is in high demand in the Asia Pacific due to its increased use in various end-use industries such as packaging, building, and construction. China’s leading position in plastic-processing capacity is critical for the growth and demand for filler masterbatch during the forecast period. China, India, South Korea, and Japan have grown the automotive industry. Plastic components are used in the vehicle’s interior and exterior components. The Asia Pacific’s growing automotive industry is expected to increase the demand for filler masterbatch during the forecasted time.

The consumer goods sector strongly influences North America’s filler masterbatch demand. Growing urbanization has also driven the demand to buy consumer goods like washing and cleaning machines, kitchen appliances, refrigeration appliances, and other appliances. This will increase North America’s demand for filler Masterbatch. U.S. consumers are increasingly using barrier packaging to extend the shelf life of food products. This protects them from light, oxygen, and moisture. Due to their lightweight and low cost, barrier materials such as polypropylene (or polyethylene) are preferable. These factors are expected to drive growth in the market over the forecast.The lucrative infrastructure development sector has emerged in the Middle East as an investment opportunity. Because of the large refugee population and government support, Africa’s number of new houses is increasing. The market is expected to grow over the forecast period due to increased demand for architectural fittings.

Key Regions and Countries covered in thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

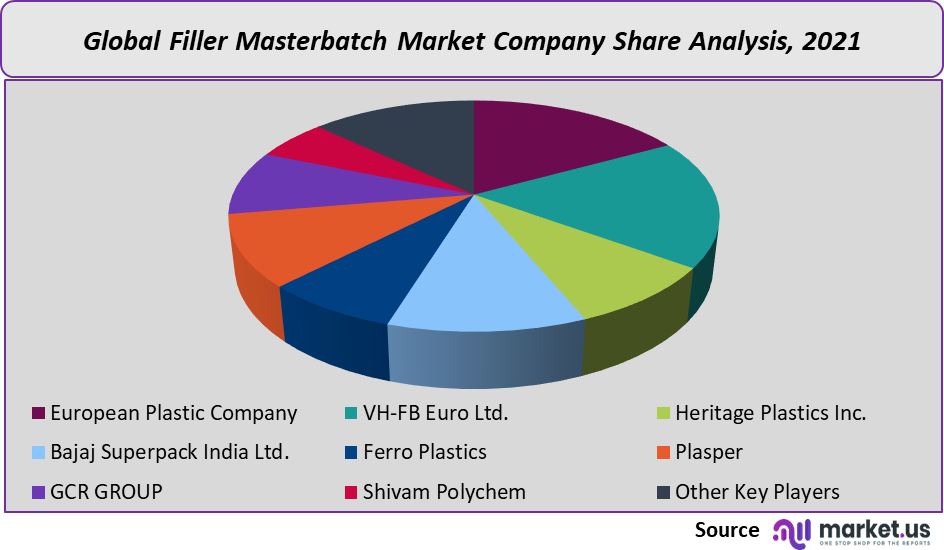

Silvergate Plastics is one of the established players in the market. They are working with end-users to develop filler masterbatches in different colors. For instance, Bambusa Ltd. collaborated with Silvergate Plastics in the U.K. to produce ultra-blue filler masterbatch colors for Rehook Plus. This cycling multitool includes spoke keys and wrenches as well as tire levers and wrenches. Rehook PLUS can be marketed in the U.K. and across Europe via distribution channels.

Маrkеt Кеу Рlауеrѕ:

- European Plastic Company

- VH-FB Euro Ltd.

- Heritage Plastics Inc.

- Bajaj Superpack India Ltd.

- Ferro Plastics

- Plasper

- GCR GROUP

- Shivam Polychem

- Other Key Players

For the Filler Masterbatch Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Filler Masterbatch Market in 2021?The Filler Masterbatch Market size is US$ 326.4 million in 2021.

What is the projected CAGR at which the Filler Masterbatch Market is expected to grow at?The Filler Masterbatch Market is expected to grow at a CAGR of 6.4% (2023-2032).

List the segments encompassed in this report on the Filler Masterbatch Market?Market.US has segmented the Filler Masterbatch Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Carrier Polymer, the market has been further divided into Polypropylene and Polyethylene. By End-Use, the market has been further divided into Building & Construction, Packaging, Automotive & Transportation, Consumer Goods, and Other End-Uses. By Application, the market has been further divided into Films & Sheets, Injection & Blow Molding, Tapes, and Other Applications

List the key industry players of the Filler Masterbatch Market?European Plastic Company, VH-FB Euro Ltd., Heritage Plastics Inc., Bajaj Superpack India Ltd., Ferro Plastics, Plasper, GCR GROUP, Shivam Polychem, and Other Key Players are engaged in the Filler Masterbatch market

Which region is more appealing for vendors employed in the Filler Masterbatch Market?APAC is expected to account for the highest revenue share of 47%. Therefore, the Filler Masterbatch industry in APAC is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Filler Masterbatch?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Filler Masterbatch Market.

Which segment accounts for the greatest market share in the Filler Masterbatch industry?With respect to the Filler Masterbatch industry, vendors can expect to leverage greater prospective business opportunities through the polyethylene segment, as this area of interest accounts for the largest market share.

![Filler Masterbatch Market Filler Masterbatch Market]()

- European Plastic Company

- VH-FB Euro Ltd.

- Heritage Plastics Inc.

- Bajaj Superpack India Ltd.

- Ferro Plastics

- Plasper

- GCR GROUP

- Shivam Polychem

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |