Global Fitness App Market By Type (Exercise & Weight Loss, Diet & Nutrition, and Activity Tracking), By Platform (Android and iOS), By Device (Smartphones, Tablets, and Wearable Devices), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2021

- Report ID: 64267

- Number of Pages: 289

- Format:

- keyboard_arrow_up

Fitness App Market Overview

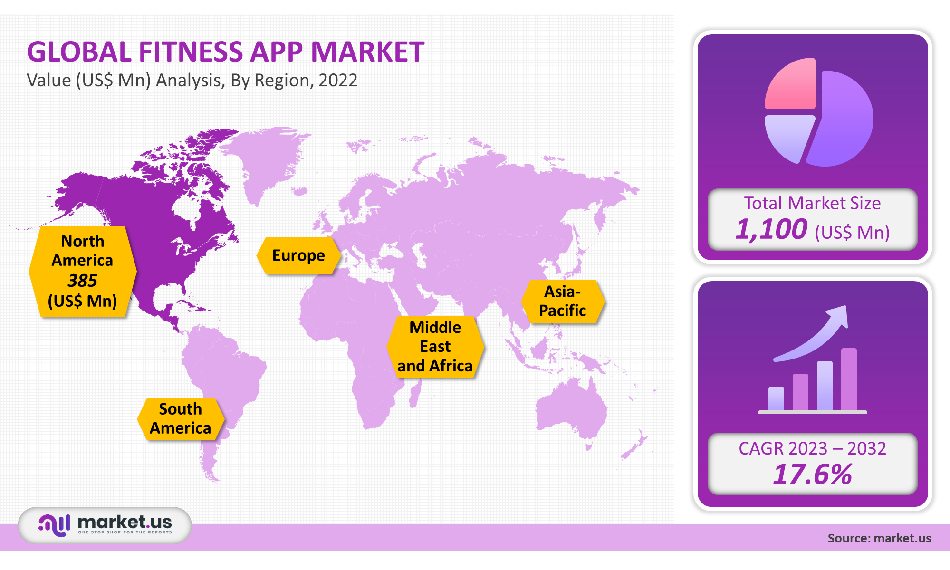

The global fitness app market was worth US$ 1,100 million in 2021. It is projected to grow at a CAGR rate of 17.6% between 2023 and 2032.

Due to the widespread COVID-19 pandemic, there were nationwide lockdowns that were followed by social distancing norms. This allowed for the transition from traditional gyms and studios toward virtual fitness. This led to an increase in downloads and subscriptions for fitness apps. According to an American College of Sports Medicine report, fitness apps were ranked number 13 according to 2019 fitness trends.

Global Fitness App Market

Type Analysis

In 2021, the exercise & weight loss segment accounted for more than 50% of all revenue. Regular notifications can be used to encourage users to exercise & weight loss apps. These apps often include video demonstrations, fitness tracking tools, and audio cues that can assist in maintaining a routine. Some examples of apps are Daily Workouts Fit Trainer, Nike Training Club, Aaptiv, and 7 Min Workout.

This segment is growing because of the increasing acceptance of weight loss and exercise apps by a large consumer base. Additionally, weight loss and exercise apps make it easier to track/monitor daily calorie intake and provide personalized lifestyle plans based on the data of users. These apps are in high demand because of their user-friendliness and ease of use.

Over the forecast period, activity tracking is expected to grow at a substantial CAGR. Fitbit, Nike, and, Jawbone are the leaders in fitness activity monitoring. Samsung, Pebble, and other companies that include features of activity tracking into their wearable devices are following these activity monitoring apps. According to an IDC report, smartwatches are anticipated to outstrip fitness tracker consumer interest. According to Fitbit, the demand for fitness trackers has been high over the past few years. They are expected to see the greatest growth rate in the projection period. The segment is driven by features e.g. the ability to compare an individual’s performance against other application users, sharing highlights from daily activity via stories on Instagram, and competition in the exercise regime to motivate an active lifestyle.

Platform Analysis

In 2021, iOS accounted for over 50% of the total revenue. Over the past few decades, the segment has seen a high level of adoption across all iOS devices. Apple, Inc. reports that the number of users of Apple devices has increased from 1,400 million in the first quarter of 2019 to 1,500 million in the second quarter of 2020. Fitness apps for iOS devices can offer fitness coaching, streaming workout classes, activity monitoring, inspiration videos, and motivational videos. 7-minute Workouts, Centr, Sworkit, MyFitnessPal, Strava, Freeletics, JEFIT, and Keelo.

The fastest growth rate for the segment of Android is 18.6% over the projection period. Smartphones of Android have made it easy to track your health and fitness. Android phones can download fitness apps that can perform various functions, including setting goals for exercise, tracking calories, and tracking other activities. This market is expected to grow quickly due to global smartphone adoption and rapid growth. The platform Android offers a variety of fitness apps, including Runstastic, Sworkit, and MyFitnessPal (Google Fit).

Device Analysis

Smartphones had a 65% revenue share in 2021. A key contributing factor to the segment’s growth is an increase in smartphone penetration. Global smartphone adoption was at 65% in 2019, which is projected to rise to 75% in 2022. Most individuals choose to exercise at home with their smartphones, rather than going to the gym or joining a fitness club due to the constantly changing technology within the industry. The ability to access fitness platforms via smartphones can help them save on training fees of personal as well as expensive gym/gym memberships, which will support the segment’s growth.

Over the forecast period, wearable devices will rise at a substantial rate. Pew Research Center reports that 21% of U.S. citizens use a watchable device. Like most technologies of digital in use today, wearable device adoption varies by socio-economic factors, such as education, occupation, and income. A study by the University of California found that 31% use wearable fitness gadgets annually among those with household incomes of US$ 75,000 or more. This number drops to 12% for those with household incomes of US$ 30,000 and less. Over the forecast period, the U.S. market will see a high adoption rate for wearable devices.

Key Segment Analysis

Type

- Exercise & Weight Loss

- Diet & Nutrition

- Activity Tracking

Platform

- Android

- iOS

Device

- Smartphones

- Tablets

- Wearable Devices

Market Dynamics

Physical fitness centers have faced fierce competition from app-based fitness. The fitness industry has seen a shift in the way it works thanks to the use of information technology. For instance, in September 2020, downloads of health apps and fitness apps rose by 46% globally owing to the rising popularity of online personal training. This is propelling the market growth worldwide. This market is also driven by growing awareness about mental health and fitness.

These apps use machine learning, AI, etc., to provide customized workout plans for their customers. These apps offer customized no-equipment workout routines, diet charts, tracking footsteps, monitoring diet, as well as customized fitness coaches. These offerings and the advantages they offer over physical fitness buildings will increase the market’s growth potential. MyFitnessPal, for instance, offers customized diet tracking to its customers, which generated a revenue of US$ 6.7 million in June 2021. Wearable technology is the most popular fitness trend in 2019. With 96.0% of users only using one app, fitness and health apps have a high rate of retention of all categories.

The increasing use of smartphones around the world is another factor that has contributed to market growth. According to the Mobile Economy Survey 2018, smartphone penetration has increased from 57% in 2017 to 77% by 2021. According to the survey, 5,900 million unique mobile subscribers will be reached by 2025. The market will also be supported by the increasing adoption of wearable devices like the Apple Watch, Fitbit watch, etc.

To meet growing consumer demand, key players are creating advanced fitness apps. This is expected to propel the market worldwide. To enhance the user experience, advanced functions and new functions are added. HealthifyMe, a mobile app for nutrition and health, introduced HealthifyMe Studio in June 2020. This allows users to live stream interactive workouts. The gap between demand and supply of functionality made it relatively easy to enter new markets five years ago. The popularity of running apps has also increased significantly. The market is seeing a lot of mergers and acquisitions in 2015-2016, including Runkeeper and Runtastic, which were purchased by sporting apparel companies.

Many capital ventures and investment firms are making investments in the fitness app sector. Increasing investments have been made in the sector of fitness apps due to their effectiveness and popularity. Future Fitness, an American venture capital company, announced that it had received US$ 8.5 million in ‘Series A funding from Kleiner Perkins. Khosla Ventures and Caffeinated Capital are also investors. Founders Fund is Mike Krieger, co-founder of Instagram. Fitter also raised US$ 2 million in April 2020. It is expected that it will positively impact market growth.

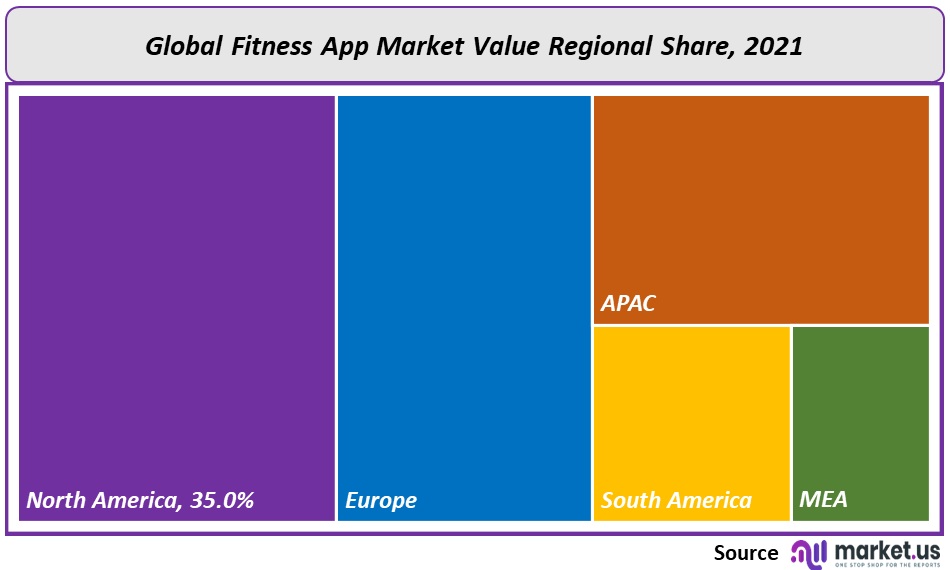

Regional Analysis

North America was the country with the highest revenue share, at 35.0%, in 2021. The adoption of fitness apps in North America is driven by a variety of factors, such as an increase in chronic diseases, rapid growth of smartphone uses, and growth of coverage networks. There has also been a surge in the number of geriatrics, COVID-19, increased prevalence, and growing popularity of smartphones. The USA is the most popular market for these apps in the world. The higher adoption rate in NA of mHealth is one major factor that has contributed to the market’s expansion. According to Freeletics’ survey, 74% of citizens of America have been seen using at minimum one fitness app in the COVID-19 lockdown. Moreover, 60% of individuals are planning to cancel their membership in the gym.

APAC is predicted to be the largest regional market in the projection period, due to the growing penetration of smartwatches, smartphones, and increasing adoption of mHealth service. According to GSMA’s 2017 report, the number of connections of smartphones in APAC has reached 47% as of 2016. This figure is expected to rise to 62% by 2021. A rise in affordability is driving the acceptance of smartphones for accessing various apps for fitness. A rising healthcare cost, an increasing number of obese people, and an increase in the number of athletes all motivate private and government organizations to come up with new models for fitness. According to World Economic Forum, India saw a 157% increase in fitness and health app downloads, which equals 58 Mn new app users.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

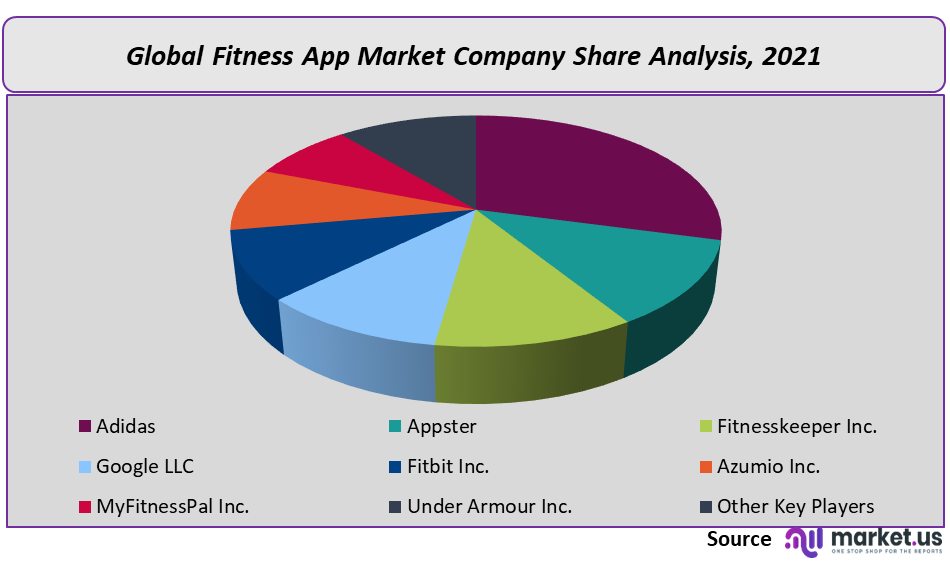

Market share Analysis

To meet growing consumer demand, key players are creating fitness apps. This market is expected to grow globally. To enhance customer experience, additional features and functions are also added. HealthifyMe Studio, an app for nutrition and health, was launched in June 2020 to offer interactive and live workouts. Due to the fragmentation of this industry, there is a lot of competition in the market. This leads to a long market and innovation is used to influence consumer behavior. The market for virtual fitness apps is growing rapidly due to the high aggregated growth. Product differentiation is therefore likely to be the primary goal in this market. Developers of fitness apps are attempting to increase market share through the development of innovative platforms for health and fitness, and digital medical devices.

Key Market Players:

The following are the top players in the global fitness app market:

- Fitnesskeeper Inc.

- Adidas

- Google LLC

- Fitbit Inc.

- Appster

- Azumio Inc.

- MyFitnessPal Inc.

- Under Armour Inc.

- Other Key Players

For the Fitness App Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the fitness app market size in 2021?The fitness app market size is US$ 1,100 million for 2021.

Q: What is the CAGR for the fitness app market?The fitness app market is expected to grow at a CAGR of 17.6% during 2023-2032.

Q: What are the segments covered in the fitness app market report?Market.US has segmented the Global Fitness App Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By type, market has been segmented into exercise & weight loss, diet & nutrition, and activity tracking. By platform, market has been divided into android and iOS. By device, market has been further classified into smartphones, tablets, and wearable devices.

Q: Who are the key players in the fitness app market?Adidas, Appster, Fitnesskeeper Inc., Google LLC, Fitbit Inc., Azumio Inc., MyFitnessPal Inc., and Under Armour Inc. among others.

Q: Which region is more attractive for vendors in the fitness app market?North America is accounted for the largest revenue share of 35% among the other regions in 2021. Therefore, the fitness app in North America is expected to garner significant business opportunities during the forecast period.

Q: What are the key markets for fitness app market?Key markets for fitness app market are the US, Mexico, and Canada.

Q: Which segment has the largest share in the fitness app market?In the fitness app market, exercise & weight loss segment is dominating the market as it is accounted for more than 50% of all revenue.

![Fitness App Market Fitness App Market]()

- Fitnesskeeper Inc.

- Adidas

- Google LLC

- Fitbit Inc.

- Appster

- Azumio Inc.

- MyFitnessPal Inc.

- Under Armour Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |