Global Flat Steel Market By Type (Low Carbon Steel (C 0.25%), Medium Carbon Steel (C 0.25-0.60%), and High Carbon Steel (C 0.60%)), By Application (Machinery Manufacturing, and Architecture), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Apr 2022

- Report ID: 28446

- Number of Pages: 278

- Format:

- keyboard_arrow_up

Flat Steel Market Overview

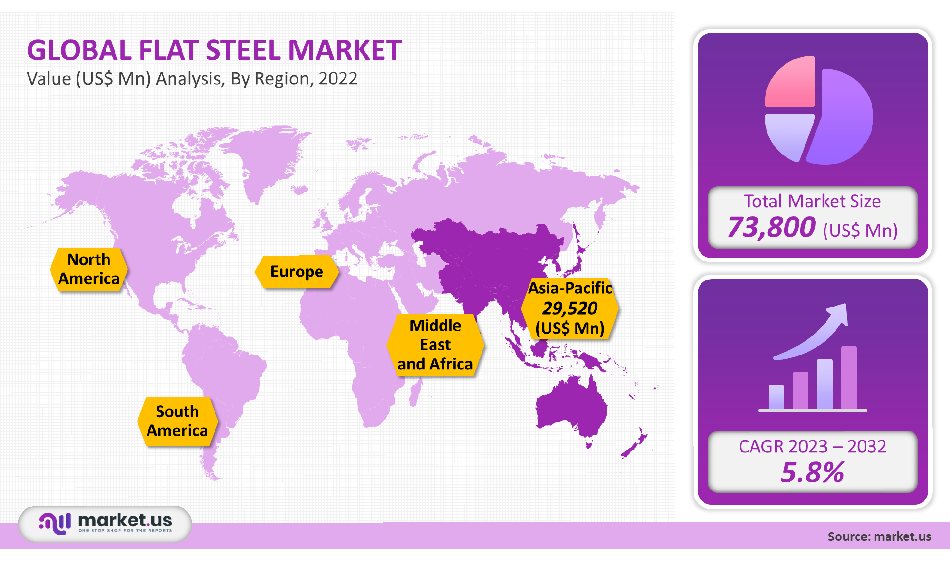

The global flat steel market was worth US$ 73,800 million in 2021. It is expected to grow at a compound annual rate (CAGR of 5.8%) between 2023 and 2032.

The market is expected to see a significant increase in demand due to its extensive use in construction, automobile, and mechanical equipment. The iron and steel industry influences the country’s economic performance and development. It is the most widely used and easily recyclable material on Earth. The industrialization of a region is a critical factor in determining GDP growth. A rapid industrialization process in developing countries is likely to lead to an increase in consumer demand.

Global Flat Steel Market Scope:

Product Analysis:

The largest market share was 63.2% for sheets & strips in 2021. You can make it from various materials, including carbon, alloy, and stainless. It also comes in a variety of tools depending on your application. They are widely used in architecture, industry, and transport because of their advantages, such as corrosion-resistant and adhesive solid and welding properties.

There are two types of sheets: hot-rolled and cold-rolled. Because of their excellent workability, cold-rolled sheets can be used for automobiles and electrical appliances. Carbon sheets can be used in many machine structure applications, including chain parts, automotive AT, automotive clutch parts, and seat belts. Steel plates can be more than 3/16 inches thick. They are made on either a coiled or discrete plate mill. Unique dishes are available that are low-alloy and heat-treated for specific applications, such as mining and logging equipment.

In 2021, plates accounted for 36.8% of the global market in volume. In 2021, containers accounted for 36.8% of the market volume. They are used in bridges, shipbuilding, offshore structures, storage tanks, boilers & pressure vessels, and machinery with high tensile strength and resistance to atmospheric corrosion, seawater resistance, and abrasion-resistant.

Material Type Analysis:

Over the forecast period, carbon will experience a 3.4% CAGR in revenue. Carbon is a popular building material worldwide. Its cost efficiency, recyclability, and durability will drive demand in the forecast period.

Due to the advantages of flat carbon products over other materials, such as cost efficiency, safety, resistance to corrosion, environmental friendliness, and cost-effectiveness, demand for them is expected to increase. The utilization of carbon steel will be driven by the growth of major end-use industries like construction and automotive. Stainless Steel has many advantages over other materials, including higher cryogenic toughness and hot strength, excellent corrosion resistance, flexibility, attractive appearance, and higher strength and hardness. These properties will open up new possibilities for the material’s use in vehicle structural components.

Application Analysis

In terms of revenue, the automobile segment accounted for 48.3% of total revenue in 2021. Flat products have allowed automobile manufacturers to attain the expected standards of strength, protection, and durability for their vehicles at relatively low costs compared to other materials. The market growth for automotive applications is expected to be limited by the increasing focus on fuel efficiency and weight loss.

Flat steel products are expected to see the fastest volume growth of 3.8% between 2017 and 2025. This is due to their high mechanical strength, toughness, weldability, and high mechanical strength. The carbon steel-based hot rolled, cold rolled, and galvanized flat products’ excellent features make them suitable for the construction of light and heavy components.

About 70.0% of the automobile’s weight is made up of iron & steel. The World Steel Association estimates that the automotive industry accounts for nearly 12.0% of the world’s steel consumption. ArcelorMittal is a crucial producer of automotive steel. ArcelorMittal was responsible for 16.7% of the global automotive sheet market. The replacement of lightweight materials with lighter products to increase fuel efficiency has led to flat product penetration in the automotive and other transport applications segments.

Маrkеt Ѕеgmеntѕ:

By Product

- Sheet and Strips

- Plates

By Material Type

- Carbon Steel

- Alloy Steel

- Stainless Steel

- Tool Steel

By Application

- Building & infrastructure

- Automotive and other Transport

- Mechanical equipment

- Other Applications

Market Dynamics:

The industry’s significant drivers are projected to be rapid urbanization, increasing industrialization, and rising disposable income of a middle-class families in emerging economies. Since 2012, India has invested more than 25% in infrastructure. This trend is expected to grow, positively impacting the sector. Iron ore prices are very volatile because of replacing an annual benchmark pricing system with a quarterly pricing system. This pricing system allows raw material producers to take full advantage of the higher spot price of their raw materials and not be restricted by annual contracts that are expected to slow down market growth.

The prices of raw materials are generally determined by the market leaders in flat steel, which will likely impact the production process over the following years. Flat products can be supplied via direct supply agreements and third-party supply arrangements. Forward integration is a popular method for manufacturers to sell their products directly. Essar and Tata Steel Limited have their distribution channels.

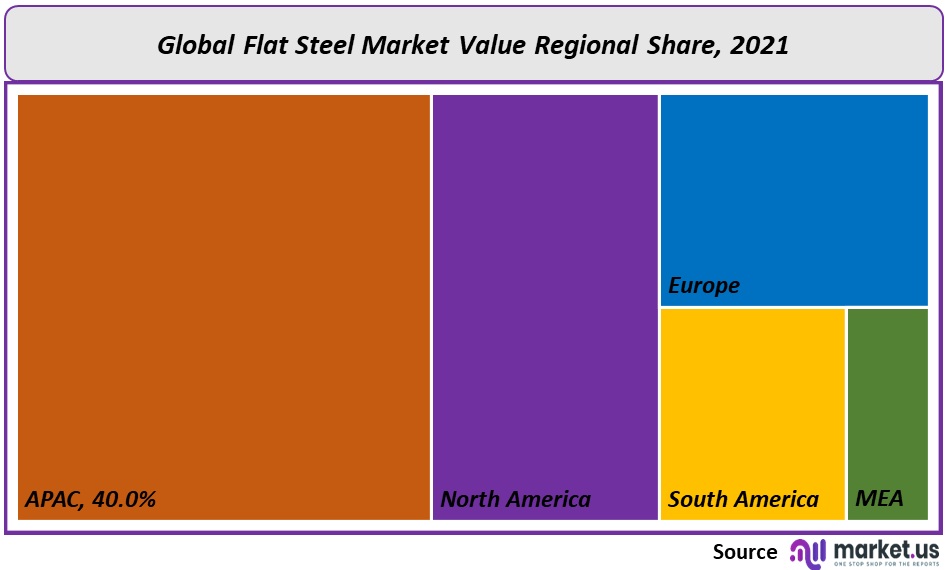

Regional Analysis

The Asia Pacific is the fastest-growing market for flat products. Due to the rising demand from large populations, countries such as Japan, India, and China are likely to experience high growth rates. China was the largest steel exporter worldwide in 2021, with flat products accounting for 40% of the total exports.

The massive investment opportunities in North America and Canada are expected to grow North America’s construction industry. Europe was third in revenue share, with 18.6% in 2021. The market is expected to see a rise in flat product demand due to the growth of industries like construction, transport, and machinery, as well as the growing demand from the UK and Germany. Germany’s flat product export volume in 2021 was 13.1

Million metric tons. This was more than 50% of its total steel exports.

Кеу Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

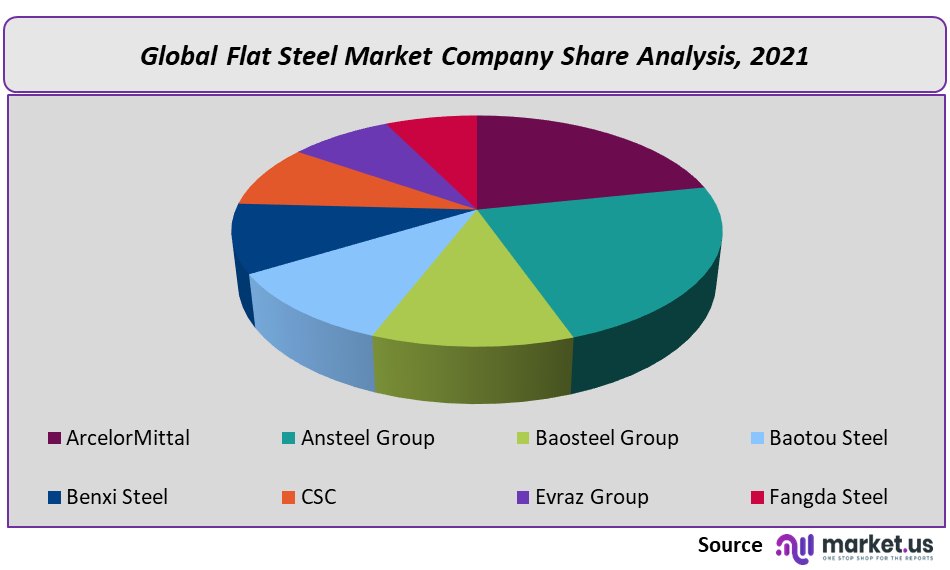

Market Share & Key Players Analysis:

With the large number of multinational companies operating high production volumes, this industry is highly competitive. Global market companies are highly integrated, from flat steel production to sales and distribution to different locations. High production capacity is the basis of companies such as Tata Steel Limited and ArcelorMittal. The market has seen a lot of cross-border trade as distribution channels can meet local and global demand.

Маrkеt Кеу Рlауеrѕ:

- АrсеlоrМіttаl

- Аnѕtееl Grоuр

- Ваоѕtееl Grоuр

- Ваоtоu Ѕtееl

- Веnхі Ѕtееl

- СЅС

- Еvrаz Grоuр

- Fаngdа Ѕtееl

- Gеrdаu

- Аnуаng Ѕtееl

For the Flat Steel Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Flat Steel market size in 2021?The Flat Steel market size is $ 73,800 million in 2021.

Q: What is the CAGR for the Flat Steel market?The Flat Steel market is expected to grow at a CAGR of 5.8 % during 2023-2032.

Q: What are the segments covered in the Flat Steel market report?Market.US has segmented the Global Flat Steel Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, market has been further divided into Sheet and strips , Plates. By Material Type, market has been segmented into Carbon steel, alloy steel, Tool steel, and Stainless steel.

Q: Who are the key players in the Flat Steel market?The ArcelorMittal, Ansteel Group, Baosteel Group, Baotou Steel, Benxi Steel, CSC, Evraz Group, Fangda Steel, Gerdau, Anyang Steel, and Other Key Players are the key vendors in the Flat Steel market

Q: Which region is more attractive for vendors in the Flat Steel market?APAC will register the highest revenue share of 40% among the other regions. Therefore, the Flat Steel market in APAC is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Flat Steel?Key markets for Flat Steel are Japan, India and China

Q: Which segment has the largest share in the Flat Steel market?In the Flat Steel market, vendors should focus on grabbing business opportunities from the Sheets and strips product type segment as it accounted for the largest market share in the base year.

![Flat Steel Market Flat Steel Market]()

- ArcelorMittal SA Company Profile

- Ansteel Group

- Baosteel Group

- Baotou Steel

- Benxi Steel

- CSC

- Evraz Group

- Fangda Steel

- Gerdau

- Anyang Steel

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |