Global Flexitanks Market By Product (Single-trip and Multi-trip), By Application (Foodstuffs, Wine & Spirits, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Apr 2022

- Report ID: 28452

- Number of Pages: 245

- Format:

- keyboard_arrow_up

Flexitanks Market Overview

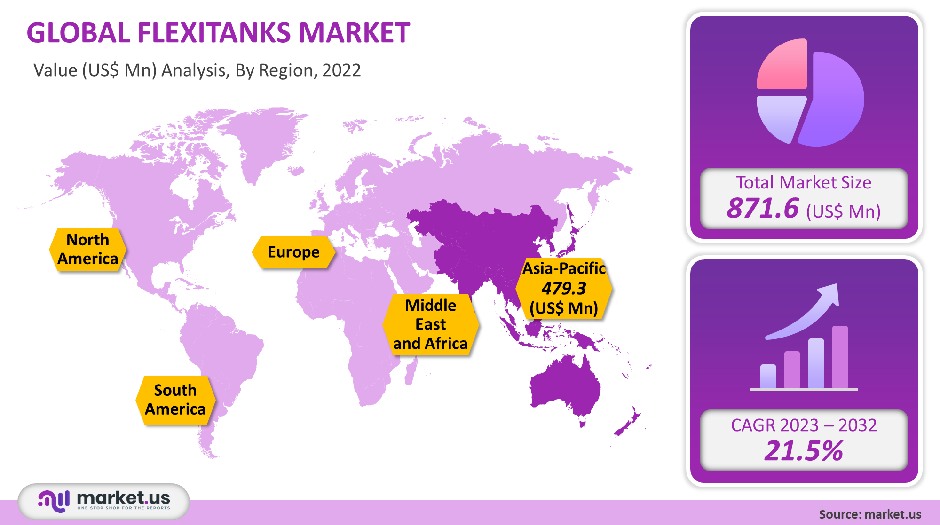

The global market for flexitanks was worth USD 871.6 million in 2021. It is projected to grow at a CAGR of 21.5% between 2023 and 2032.

The industry is expected to grow due to increased global trade and the advantages of flexitanks over traditional alternatives such as drums, barrels, ISO containers, and IBCs. There are capacities that range from twelve thousand to twenty-six thousand liters for flexitanks. These can be used to ship a wide range of liquid products including wine, juices, concentrated foods, oils, and tallow.

Global Flexitanks Market Scope:

Product Analysis

Single-trip products dominated the market, accounting for a revenue share in 2021 of 90%. Because of the availability and low cost of single-trip products, the segment will likely maintain its leadership position for the duration. Their demand will increase in the future years due to the low risk of product contamination with single-trip Flexitanks. These products often contain 1mm thick PE as an inner material to improve the package’s barrier properties.

Single-trip products can be used to transport polymers, lubricating oils, and transformer oils as well as surfactants, liquid malt and cement, edible oils, and special chemicals. This segment will lose market share to multi-trip products due to increased demand for multi-trip flexitanks. These products offer high sustainability. The multi-trip segment is expected to grow at a significant CAGR during the forecast period in terms of volume. Flexitanks are a great option for sustainability as they can be reused multiple times and eliminate the need to dispose of one user. These bulk packages are therefore comparatively more efficient in the logistics circuit.

Application Analysis

Foodstuffs applications dominated the market, accounting for 36% of global revenue in 2021. This is due to high demand from end-use products such as bakery and confectionery, fruit juices and sauces, concentrates, and edible oils. This segment will see a rapid increase in retail chains and a rising number of food needs due to the increasing population in emerging countries. When wine products are packaged in ordinary shipping boxes, they can easily spoil. Wine producers around the world are increasingly using polyethylene-based flexible tanks to combat this problem. They can replace insulated shipping containers or pouches.

The most popular packaging material for wine is PE, which can be double- or multi-layered. Flexitanks are being adopted by more chemical companies than traditional corrugated packaging because they are cost-effective and last a long time. Additionally, flexitanks can be made from recycled plastic resins which means that they are less expensive than 100% virgin polymers. This reduces production costs and promotes sustainability. Flexitanks are used in the oil sector to transport base oils, lubricants, and transformer oils. This has resulted in a rise in demand for industrial oils such as greases and metalworking fluids. These are essential for the smooth operation of machinery. The oil segment is expected to see a rise in demand due to steady growth in global manufacturing.

Key Market Segments:

By Product

- Single-trip

- Multi-trip

By Application

- Foodstuffs

- Wine & Spirits

- Chemicals

- Oils

- Industrial Products

- Pharmaceutical Goods

Market Dynamics:

Market growth is expected to be supported by the growing demand to reduce bulk packaging’s weight to improve freight cost-effectiveness. The market will be supported by flexitanks’ low labor and logistic cost, zero cleaning costs due to one-time use, as well as eco-friendliness. Flexitanks cost less than ISO containers or drums. They can carry around 15% more payload than IBCs, and 44% more than drums. This makes them an economically attractive bulk packaging solution. They are also primarily used for single-use, which decreases the risk of contamination. Leakage or breaking of flexitanks can result in a total loss to the shipper. This could reduce product use for transportation of hazardous liquids and limit growth. Manufacturers will face challenges due to fluctuating plastic resin prices, which are the raw material used to make flexitanks.

COVID-19 caused severe disruption to the supply chain and retail distribution of many products around the globe. The COVID-19 epidemic was concentrated in China during the first quarter of 2020. To contain its spread, many countries, including the U.S., restricted their imports from China. This temporary suspension of imports from China, a major exporting country, resulted in a decrease in the demand for flexitanks in 2020.

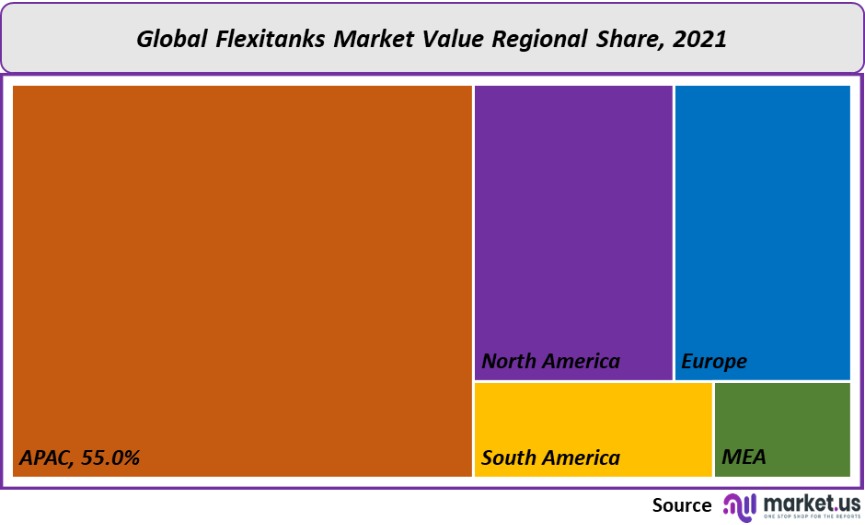

Regional Analysis

The Asia Pacific was the largest market, accounting for 55% of global revenue in 2021. This is due to the presence of India and China, which are the two biggest agricultural producing and consuming nations. The region’s growth was also helped by the high export and production of palm oils from Indonesia, Malaysia, and other Asian countries.

Due to lower production costs, many companies from North America and Europe have outsourced production to India and China. The potential growth in the pharmaceutical and food industries will increase demand for flexible tanks in the Asia Pacific region during the forecast period. The market in Europe is anticipated to expand at a remarkable rate over the forecast period. This is due to the rise in the manufacturing and export of medications that are temperature-sensitive, especially in Germany, Switzerland, Belgium, France, and the Netherlands. North America is anticipated to expand at a notable CAGR over the course of the projection period as a result of the consistent rise in the U.S. manufacturing sector.

Due to the existence of NAFTA and other advantageous trade agreements that permit free trade between the United States, Canada, and Mexico, the market is anticipated to expand.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

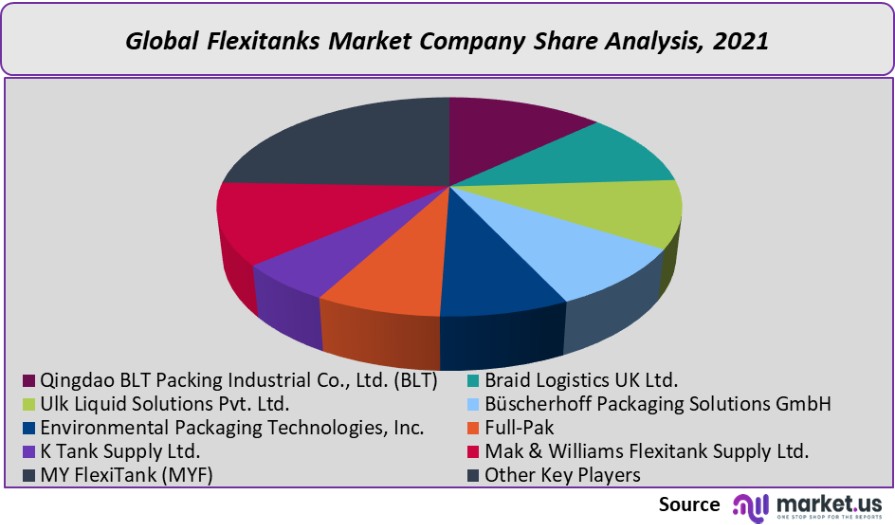

Globally, the market is fragmented due to the presence of many companies. To gain a competitive edge, market players follow developments in technology and competitive prices. Small-scale producers that can serve both regional and international markets will increase the industry’s competitive edge. To increase their market share, major companies employ a variety of organic and inorganic growth strategies. These companies also use new product launches and regional expansions to increase their product range and meet rising demand.

Market Key Players:

- Qingdao BLT Packing Industrial Co., Ltd. (BLT)

- Braid Logistics UK Ltd.

- ulk Liquid Solutions Pvt. Ltd.

- Büscherhoff Packaging Solutions GmbH

- Environmental Packaging Technologies, Inc.

- Full-Pak

- K Tank Supply Ltd.

- Mak & Williams Flexitank Supply Ltd.

- MY FlexiTank (MYF)

- Other Key Players

For the Flexitanks Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

871.6 Million

Growth Rate

21.5%

Forecast Value in 2032

7424.31 Million

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Flexitanks market in 2021?The Flexitanks market size is US$ 871.6 million in 2021.

What is the projected CAGR at which the Flexitanks market is expected to grow at?The Flexitanks market is expected to grow at a CAGR of 21.5% (2023-2032).

List the segments encompassed in this report on the Flexitanks market?Market.US has segmented the Flexitanks Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By product, the market has been segmented into Single-trip and Multi-trip; by application, the market has been segmented into Foodstuffs, Wine & Spirits, Chemicals, Oils, Industrial Products, Pharmaceutical Goods.

List the key industry players of the Flexitanks market?Qingdao BLT Packing Industrial Co., Ltd. (BLT), Braid Logistics UK Ltd., ulk Liquid Solutions Pvt. Ltd., Büscherhoff Packaging Solutions GmbH, Environmental Packaging Technologies, Inc., Full-Pak, K Tank Supply Ltd., Mak & Williams Flexitank Supply Ltd., MY FlexiTank (MYF), Other Key Players are the key vendors in the Flexitanks market.

Which region is more appealing for vendors employed in the Flexitanks market?APAC accounted for the highest revenue share of 55%. Therefore, the Flexitanks industry in APAC is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for the Flexitanks Market.The US, Germany, France, UK, China, Japan, etc., are leading key areas of operation for Flexitanks Market.

Which segment accounts for the greatest market share in the Flexitanks industry?With respect to the Flexitanks industry, vendors can expect to leverage greater prospective business opportunities through the Single-trip segment, as this area of interest accounts for the largest market share.

![Flexitanks Market Flexitanks Market]()

- Qingdao BLT Packing Industrial Co., Ltd. (BLT)

- Braid Logistics UK Ltd.

- ulk Liquid Solutions Pvt. Ltd.

- Büscherhoff Packaging Solutions GmbH

- Environmental Packaging Technologies, Inc.

- Full-Pak

- K Tank Supply Ltd.

- Mak & Williams Flexitank Supply Ltd.

- MY FlexiTank (MYF)

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |