Global Folding Furniture Market By Product (Sofa, Table & Chair, and Bed), By Distribution Channel (Online and Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 18664

- Number of Pages: 231

- Format:

- keyboard_arrow_up

Folding Furniture Market Overview:

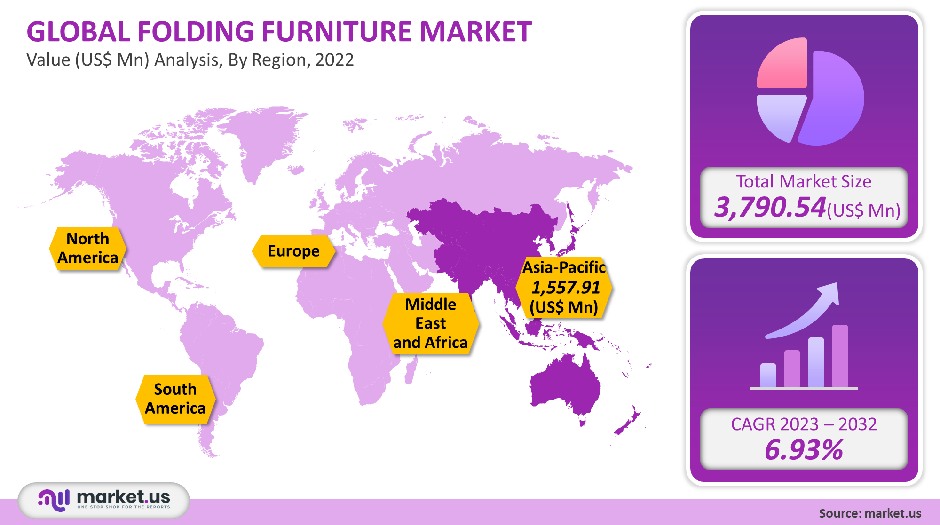

In 2021, the global folding furniture market was worth USD 3,790.54 million. It is expected to register a CAGR of 6.93% between 2023 to 2032.

The development of small-sized flats in many countries has led to a rise in demand for a multi-purpose and space-saving furniture. This has also contributed to the market’s growth. The trend towards compact and multifunctional furniture among millennials who rent their living spaces is expected to increase the market.

Global Folding Furniture Market Scope:

Product Analysis

The market for folding furniture was dominated by tables and chairs, which accounted for over 51% of global revenue in 2021. Because of their versatility and necessity, folding chairs are a dominant furniture category. Although they are mostly made from plastic, consumers prefer wooden furniture for its aesthetic value.

Flash Furniture, USA, offers bamboo-wood folding chairs that can be used both indoors and outdoors. From 2023 to 2032, folding sofas will grow at an 8% CAGR. Due to the importance of sofas in living rooms, increasing demand for smaller-sized furniture is expected to drive the demand for folding couches. The forecast period will see a shift in preference for foldable sofas that can be folded to become beds.

Distribution Channel Analysis

The market’s largest segment was offline, accounting for over 76.1% of global revenue in 2021. Due to a large number of home furnishing stores in the market, the offline distribution channels category was dominated by specialized retailers. Due to the dominance of retail stores, there has been intense competition in the market by major manufacturers such as Inter IKEA Systems B.V. and Pepper fry.

The store’s home environment allows customers to envision their own homes and furniture. These stores are driven by the availability of customizable features for home furniture according to the needs of customers and the space available in different houses. In addition, there is a growing demand for folding furniture stores in offline markets. This is due to the fact that furniture can be found in supermarkets and hypermarkets.

Online distribution is expected to grow at an 8.1% annual growth rate between 2023 to 2032. This segment has seen a surge in sales due to rising awareness and an increasing number of smartphone users. This channel is also expected to be popular due to the wide range of products available from international brands. The online buying segment for folding furniture products will be driven by the availability of flexible payment options and delivery to doorsteps. Online furniture giants like Durian Private Ltd. and Expand Furniture Inc. offer a wide range of folding furniture for consumers, along with post-purchase support.

Кеу Маrkеt Ѕеgmеntѕ

By Product

- Sofa

- Table & Chair

- Bed

- Other Products

By Distribution Channel

- Online

- Offline

Market Dynamics:

To replicate the traditional aesthetic appeal of furniture, companies are creating folding tables and chairs made from wood and metal. Companies have been able to offer more compact furniture, like racks, study tables, and storage boxes that can be folded. Inter IKEA Systems B.V. introduced space-saving shelving units that can double as desks and dining tables in 2019.

These modern products have been created because of rising prices for traditional wood furniture. This furniture is made from lightweight materials like plastic and mild steel. Because they are more durable and cost-effective, metal and plastic folding furniture is gaining popularity.

Lucid Mattress, for example, offers a metal folding bed frame with wire grid supports that allow you to adjust the mattress efficiently. Folding furniture is becoming more popular due to the growing trend towards smaller apartments and increasing urbanization. Tokyo Kantei reports that the Tokyo average apartment size was 680 square feet 2017. ft. with a floor area of 647 sq. For an existing apartment, it is ft. The average new apartment size in the U.S., however, is 941 square feet.

The average size of a new apartment in the United States is 941 sq. Accordingly, the demand for folding furniture has increased as apartments are becoming smaller.

A shift towards single-person and two-person households has also led to less furniture taking up space. In 2021, 35.6% of households were made up of one person living alone within the European Union-28. Only 27% of private households had two-person households. Manufacturers are also keen to introduce new products through mergers and acquisitions.

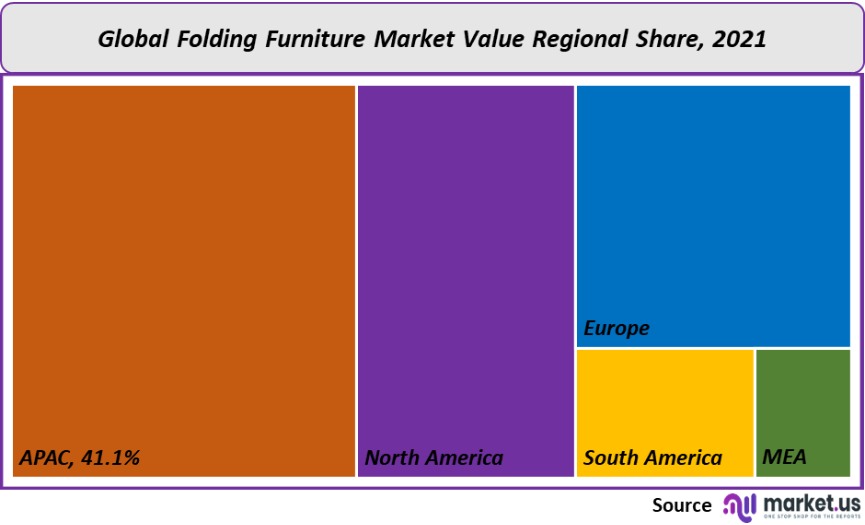

Regional Analysis

The Asia Pacific was the dominant region in global folding furniture sales, with a market share of around 41.1%. Consumers are increasingly looking for furniture that can be folded and stored in smaller apartments in countries like India, Japan, Tokyo, Shanghai, Shanghai, and Shanghai.

The market for folding furniture is also driven by the small living spaces of these countries. Hong Kong, for example, had the smallest flat in the world with a living area of 470 square feet in 2017. China had an average living area of 646 sq. ft. Market growth has been fueled by a concentration of manufacturers like Space Furniture Pte Ltd. and The PAN Emirates as well as Cost Plus World Market.

North America will experience the fastest growth rate of 8% between 2023 to 2032. Consumers are increasingly choosing to live in one- or two-person households in American states like the U.S., Canada, and Mexico. This has led to increased preference for such products due to their smaller usage and living spaces. Due to their flexibility and ease of moving, folding furniture has been more popular in Europe than in developed countries like the U.K. and Germany. These trends will drive demand for folding furniture both in Europe and North America over the forecast period.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

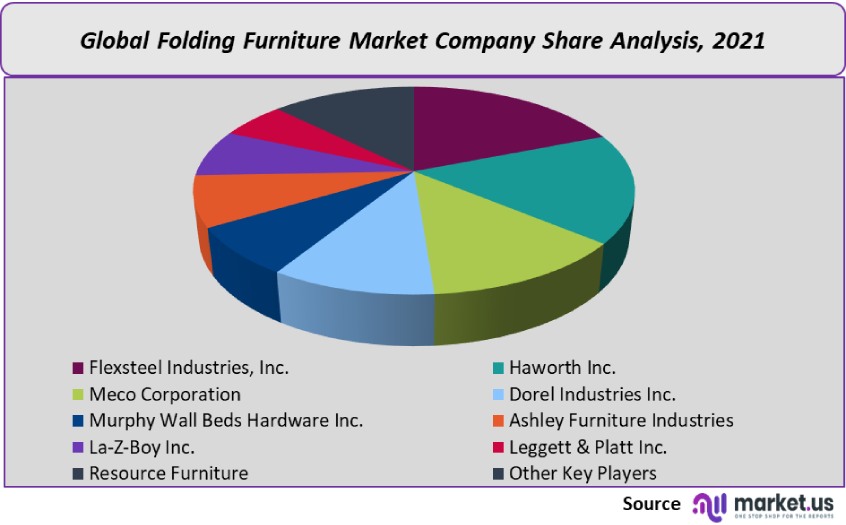

The global market is quite cutthroat. Murphy Wall Beds Hardware Inc., Flexsteel Industries Inc., Haworth Inc., Dorel Industries Inc., Meco Corporation, Ashley Furniture Industries, Sauder Woodworking Company, Leggett & Platt Inc., La-Z-Boy Inc., and Resource Furniture are the market leaders globally. Companies are boosting production and using new technologies to keep up with the rising demand for foldable furniture goods.

Just a few examples include Twin Cities Closet Company, The Bedder WayCo, and Murphy Wall Beds Hardware Inc. Folding wall beds and freestanding wall beds are the two different forms of wall beds. These are both functionally essential and space-saving.

Маrkеt Кеу Рlауеrѕ:

- Flexsteel Industries, Inc.

- Haworth Inc.

- Meco Corporation

- Dorel Industries Inc.

- Murphy Wall Beds Hardware Inc.

- Ashley Furniture Industries

- La-Z-Boy Inc.

- Leggett & Platt Inc.

- Resource Furniture

- Other Key Players

For the Folding Furniture Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Folding Furniture market in 2021?The Folding Furniture market size is US$ 3,790.54 million in 2021.

What is the projected CAGR at which the Folding Furniture market is expected to grow at?The Folding Furniture market is expected to grow at a CAGR of 6.93% (2023-2032).

List the segments encompassed in this report on the Folding Furniture market?Market.US has segmented the Folding Furniture market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Sofa, Table & Chair, and Bed. By Distribution Channel, the market has been further divided into Online and Offline.

List the key industry players of the Folding Furniture market?Flexsteel Industries, Inc., Haworth Inc., Meco Corporation, Dorel Industries Inc., Murphy Wall Beds Hardware Inc., Ashley Furniture Industries, La-Z-Boy Inc., Leggett & Platt Inc., Resource Furniture, and Other Key Players engaged in the Folding Furniture market.

Which region is more appealing for vendors employed in the Folding Furniture market?APAC accounted for the highest revenue share of 41.1%. Therefore, the Folding Furniture industry in APAC is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Folding Furniture?Japan, China, Brazil, The U.S., Germany, U.K., are key areas of operation for Folding Furniture Market.

Which segment accounts for the greatest market share in the Folding Furniture industry?With respect to the Folding Furniture industry, vendors can expect to leverage greater prospective business opportunities through the tables and chairs segment, as this area of interest accounts for the largest market share.

![Folding Furniture Market Folding Furniture Market]()

- Flexsteel Industries, Inc.

- Haworth Inc.

- Meco Corporation

- Dorel Industries Inc.

- Murphy Wall Beds Hardware Inc.

- Ashley Furniture Industries

- La-Z-Boy Inc.

- Leggett & Platt Inc.

- Resource Furniture

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |