Global Fraud Detection and Prevention (FDP) Market By Type (Fraud Analytics, Authentication), By Application (Insurance claims, Money laundering, Electronic payment, Mobile payment), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2020-2029

- Published date: Dec 2021

- Report ID: 67821

- Number of Pages: 315

- Format:

- keyboard_arrow_up

Fraud Prevention and Detection Market Overview

The global fraud prevention and detection market was worth US$ 24.486 billion in 2021. This number is expected to increase at a CAGR of 18.5% between 2023-2032. Despite technological advancements that allow for easy payment options and data access, growing concerns over digital fraud call for the deployment of fraud detection solutions. The rise of financial crime, digital fraud, and cyberattacks is threatening the growth of many businesses around the world. Due to the popularity of e-Banking, digital payment apps, and cross-border transactions, fraud cases involving identity thefts and data breaches are also on the rise. All of these factors create market opportunities.

Global Fraud Prevention and Detection Market Analysis

Component Analysis

In 2021, solutions accounted for the highest revenue share at 62%. Companies have been forced to use advanced tools and methods to detect fraud patterns at an early stage due to rising incidences of Account takeovers (ATO), and phishing email attacks. These solutions reduce the detection time by processing large data sets in real-time. These solutions are also useful for compliance. According to forecasts, the services sector will experience the fastest CAGR. Organizations in emerging economies are increasing their investment in fraud prevention strategies. Integration, training, and support services provided by fraud prevention service providers are required to create a solid framework. The segment growth is expected to be driven by the need for third-party services and professional consulting to detect fraud in real time.

Solutions Analysis

In 2021, the market was dominated by the authentication solutions segment. It accounted for over high revenue share. Over the years, companies have relied upon authentication solutions to protect customer credentials. However, fraud attempts to compromise customer-facing apps have become more sophisticated over the years. Organizations are now looking for advanced authentication solutions that include voice biometrics, single-factor, and multi-factor authentication, and voice biometrics. It is essential to protect critical information in enterprises using cloud technology across every industry vertical. This will help avoid data breaches. This will increase segment growth in the future by ensuring that credentials are secured and that only authorized users have access to sensitive information.

It is expected that the fraud analytics solutions segment will experience the fastest growth over the forecast period. Digital technologies are on the rise. Data assimilation through these technologies transforms businesses and creates new opportunities for growth. Analytical solutions can be used to identify fraud and other anomalies in large amounts of data that organizations store. Such predictive and preventive analytics tools are useful for companies to take necessary remediation actions. These potential benefits are expected to drive segment growth over the forecast time.

Services Analysis

A high revenue share was held by the professional services sector in 2021. It is expected to continue its lead position during the forecast period. These services include support, consulting, and training & development services. The vendors that offer these services have a dedicated team of specialists to help companies deploy technology and train staff. As part of professional services, there is also training and support. It helps professionals to reduce security gaps and implement fraud detection processes.

However, managed services are expected to grow at the fastest rate of CAGR during the forecast period. Companies that are committed to taking proactive measures to prevent fraud in real-time should consider managed services. Managed services providers monitor business transactions and analyze unusual user behavior in real-time across large data sources across all touchpoints. It is possible to detect fraud by reviewing and mining these data in real time. Additionally, managed service vendors can outsource such risk-based security mechanisms to businesses so they can focus on other activities. These factors are expected to drive up demand for managed service across all industry verticals during the forecast period.

Application Analysis

Payment fraud applications had a significant revenue share in 2021. They are expected to continue to grow with a steady CAGR for the forecast period. Fraudsters are now able to exploit the increasing demand for e-wallets and cashless payment options. Loopholes or vulnerabilities in these applications could give easy access to banking and financial reserves. The segment’s growth is due to its ability to detect and fix any flaws within applications in real-time.

The fastest CAGR is expected in the identity theft segment over the forecast period. Criminals are adapting to the foiling authentication process, which is causing identity theft to increase significantly. The Federal Trade Commission’s investigative tool called “The Consumer Sentinel Network”, analyzed 4.8 million identity theft and fraud reports. This represents a rapid growth rate compared to the previous year. Segment growth will be driven by the need for identity theft prevention.

Organizational Analysis

In 2021, significant revenue share came from large enterprises. Large enterprises are susceptible to fraud, such as money laundering and phishing. This could have a negative impact on business profits. It is important that large companies adopt preventive services and solutions. For organizational data security, it is crucial to make investments in preventive measures. However, the segment of SMEs is expected to see the fastest CAGR during the forecast period.

This segment’s growth can be attributed to increasing fraud cases within these organizations. Cyber-attacks result from the growing dependence on digital solutions as well as the absence of effective security frameworks for SMEs. In terms of data protection compliance standards, SMEs are challenged by a limited awareness regarding fraud and its effect on business profits. In addition, frauds are increasing due to cross-border trade. Accordingly, the future growth of the segment will be driven by the need for solutions to assess, detect, mitigate, and report frauds among SMEs.

Key Market Segments

Services

Solutions

Fraud Analytics

Governance, Risk, and Compliance

Authentication

Managed Services

Professional Services

Payment Fraud

Money Laundering

Identity Theft

Other Applications

SMEs

Large Enterprises

Market Dynamics

Cybercrimes have increased in number due to technological advances. Hackers continue to improve and are now skilled at finding loopholes and vulnerabilities within systems. The result is a higher risk of corporate data breaches, and consequently, a greater economic loss for businesses. Companies have become more aware of the importance of preventing data breaches and are now looking for proactive fraud prevention strategies. This trend is likely to continue for the forecast period.

BFSI, healthcare, and e-commerce executives are aware of the need to upgrade outdated tools and implement new strategies to fight digital fraud. Some companies still use traditional methods of fraud investigation, which can be time-consuming and complicated. Advanced Persistent Threats and Fraudsters are skilled in sophisticated techniques, and they continue to modify their intrusion methods so that traditional methods cannot be used to detect them. With the help of authentication and analytical tools, fraud detection is now easy. It is expected that this will lead to the adoption and promotion of fraud detection (FDP).

In this context, proactive measures are a priority for all industries. Security strategies for businesses have included customer-centric fraud prevention. This bridges the gap between enhanced payment experience and security by implementing such measures and techniques. Financial institutions, for example, use voice recognition technologies in their contact centers to reduce identity fraud attempts. The application of fraud authentication technology, such as device fingerprinting or geolocation, increases customer verification and adds an additional layer of security against identity theft.

There are more online scams and frauds due to the growing popularity of web applications and digital money applications. To steal personal data, cyber-threat agents target vulnerable applications. These fraudulent activities increased during the COVID-19 pandemic in 2020.

The market is growing due to increasing fraud activities and the increase in online transactions. One of the main reasons for fraudulent activity is the increasing use of next-generation digital channels to transact, interact, and market products and/or services. A large number of people use digital channels that include social, messaging, and eCommerce applications. This makes it difficult to identify patterns and prevent fraud. Market growth will be boosted by technological advances in detecting and tracking anomalous behavior across applications as well as the internet.

The rise in popularity of e-commerce B2C, B2B, and C2C transactions has increased the risk of fraud online. These transactions often involve a mutual exchange of identity information and personal data between individuals and businesses. The risks of fraud are also increasing due to mobile gaming’s popularity and the increased use of social networks. Fraudsters are becoming more sophisticated, but the loss from these attacks is also growing.

The most vulnerable sector to online fraud remains financial services. This includes account takeovers. These accounts are carried out using a combination of manual and automated methods. BFSI is seeing an increase in fraud detection and prevention solutions due to increased frauds like phishing, identity thefts, card fraud, and insurance fraud. Banks and financial institutes have recognized the need for advanced analytics-based data mining solutions to prevent fraud as well as the growing sophistication of fraud attacks, both digitally, and physically. Fraud detection and prevention solutions have gained significant popularity in both the retail and eCommerce sectors. The increased use of advanced technologies, such as POS systems, digital transactions, and eCommerce payment transactions, has resulted in an increase in fraud attempts. This has led to excessive chargeback fees and loss of merchandise.

Fraud detection and prevention depend in large part on being able to identify and then develop appropriate solutions to protect businesses from recurring attacks. Business intelligence (BI) tools are used to summarize large volumes of data that are generated each quarter in a particular business. However, these traditional analytics methods cannot provide enough detail to accurately predict what the outcomes might be. Predictive analytics, data mining, and big data analytics are all becoming increasingly popular for analyzing large quantities of data and extracting patterns across different industries on a regional and global level. These tools employ a mathematical approach to data interpretation and machine learning techniques to identify patterns, create correlations, and group data sets. An organization of historical data in a predictable pattern allows enterprises to respond to foreseeable threats.

Regional Analysis

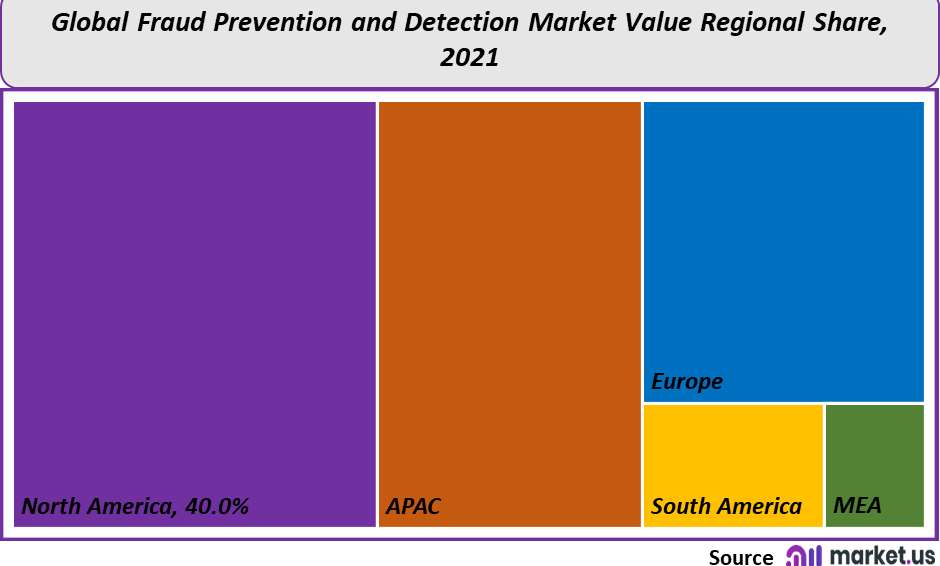

North America was the largest regional market in 2021. It accounted for over 40% revenue share in the same year. The regional market grew due to an increase in money laundering, identity theft, and payment fraud cases in both the U.S. and Canada. Due to increased investments made by various organizations to improve security IT infrastructure and protect against data breaches, the market will grow further. Additionally, the region will see an increase in demand due to stricter data security compliance standards. North America’s fraud prevention and detection market are expected to grow with the emergence of e-commerce and e-banking as well as the increased use of IP services. TransUnion data showed that the number of digital frauds against the financial industry increased by 109% during this same period. Therefore, financial companies have been investing in upgrading and deploying their security infrastructure in order to protect crucial data. This has prompted the adoption of fraud prevention and detection solutions in North America.

The Asia Pacific is expected to be the fastest-growing regional market in the future. This region has seen digital acceleration, which has led governments and businesses to invest in their security infrastructure. As part of their security infrastructure, many awareness programs are being promoted in Asian countries to prevent and detect fraud. As fraud continues to rise, businesses will likely adopt advanced security measures, which will in turn favor regional market growth during the forecast period.

The pandemic caused a rise in the adoption of digital services. This trend is expected not to change after the next pandemic. Many APAC organizations shifted to digital platforms for customer engagement, increasing fraud risk. Experian conducted a May 2021 survey and found that about one-third of Asia Pacific businesses were more concerned with generating revenue than ensuring security and fraud prevention. To reduce fraud risk, many businesses in the region resort to old-fashioned methods like passwords and security questions. However, this is changing with many consumers feeling more secure thanks to biometrics as well as one-time passwords for their mobile devices. As such, the Asia Pacific will see the adoption of digital services rise and consumers’ behavior change.

Key Regions and Countries covered in thе rероrt:

North America

US

Canada

Mexico

Europe

Germany

UK

France

Italy

Russia

Spain

Rest of Europe

APAC

China

Japan

South Korea

India

Rest of Asia-Pacific

South America

Brazil

Argentina

Rest of South America

MEA

GCC

South Africa

Israel

Rest of MEA

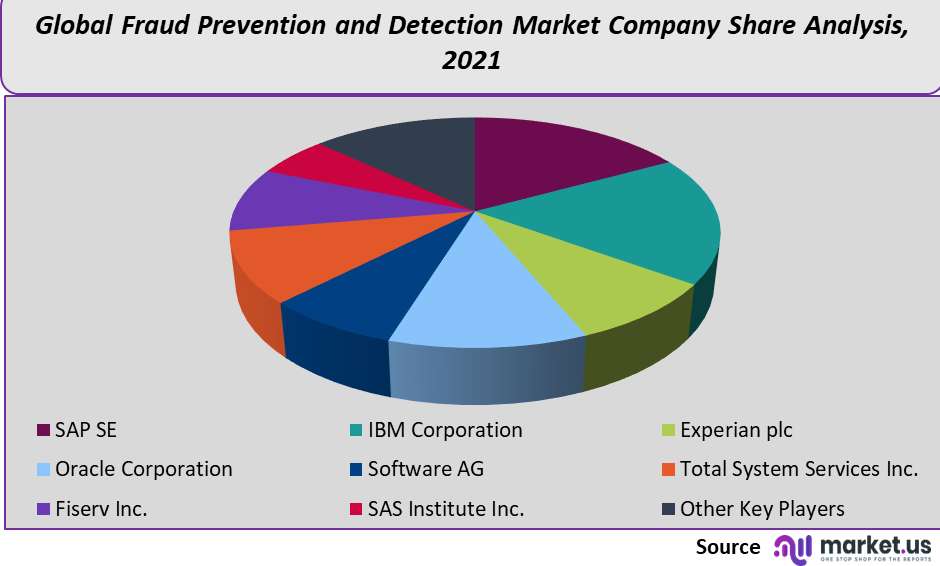

Market Share & Key Players Analysis:

It is highly fragmented with many companies offering different products. The market is highly competitive due to factors like fraud detection technology advancements and strategic partnerships and collaborations. In order to grow their businesses, major players are involved in product development and collaboration strategies. Oracle Financial Services AML Express Edition, a product for small and mid-sized banks, was announced by Oracle. This solution allows banks to be compliant and reactive to threats. The solution effectively makes business decisions, detects suspicious activities, and monitors customer behavior in real-time to prevent fraud.

Market Key Players:

IBM Corporation

Experian plc

Oracle Corporation

Software AG

Total System Services Inc.

Fiserv Inc.

SAS Institute Inc.

Other Key Players

For Fraud Detection and Prevention Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

24.486 Billion

Growth Rate

18.5%

Forecast Value in 2032

158.42 Billion

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Fraud Prevention and Detection Market in 2021?The Fraud Prevention and Detection Market size is US$ 24,486 million in 2021.

What is the projected CAGR at which the Fraud Prevention and Detection Market is expected to grow at?The Fraud Prevention and Detection Market is expected to grow at a CAGR of 18.5% (2023-2032).

List the segments encompassed in this report on the Fraud Prevention and Detection Market?Market.US has segmented the Fraud Prevention and Detection Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Component, the market has been further divided into Services and Solutions. By Solution, the market has been further divided into Fraud Analytics, Governance, Risk, Compliance, and Authentication. By Services, the market has been further divided into Managed Services and Professional Services. By Application, the market has been further divided into Payment Fraud, Money Laundering, Identity Theft, and Other Applications. By Organization Size, the market has been further divided into SMEs and Large Enterprises.

List the key industry players of the Fraud Prevention and Detection Market?SAP SE, IBM Corporation, Experian plc, Oracle Corporation, Software AG, Total System Services Inc., Fiserv Inc., SAS Institute Inc., and Other Key Players are engaged in the Fraud Prevention and Detection market

Which region is more appealing for vendors employed in the Fraud Prevention and Detection Market?North America is expected to account for the highest revenue share of 40%. Therefore, the Fraud Prevention and Detection industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Fraud Prevention and Detection?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Fraud Prevention and Detection Market.

Which segment accounts for the greatest market share in the Fraud Prevention and Detection industry?With respect to the Fraud Prevention and Detection industry, vendors can expect to leverage greater prospective business opportunities through the solution segment, as this area of interest accounts for the largest market share.

![Fraud Detection and Prevention (FDP) Market Fraud Detection and Prevention (FDP) Market]() Fraud Detection and Prevention (FDP) MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample

Fraud Detection and Prevention (FDP) MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample - SAP SE Company Profile

- IBM Corporation

- Experian plc

- Oracle Corporation

- Software AG

- Total System Services Inc.

- Fiserv Inc.

- SAS Institute Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |