Global Gas Detection Equipment Market By Product Type (Fixed Gas Detectors and Portable Gas Detectors), By Application (Infrared Gas Detection and Semiconductor), By End-Use (Petrochemical, Industrial, Medical, Environmental, Other End-Use), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Apr 2022

- Report ID: 28496

- Number of Pages: 235

- Format:

- keyboard_arrow_up

Gas Detection Equipment Market Overview:

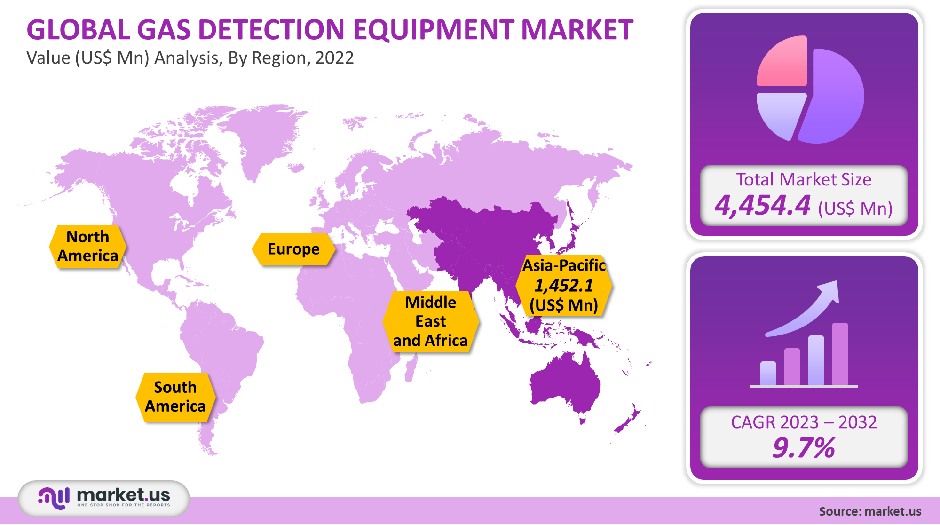

The global market for Gas Detection Equipment was worth USD 4,454.4 million in 2021. It is projected to grow at a CAGR of 9.7%, between 2023 and 2032.

Market growth is driven by the increasing demand for gas detection equipment in the oil and gas sectors for applications like emergency response, fracking, and leak detection.

Global Gas Detection Equipment Market Scope:

Product Type analysis

The fixed gas segment dominated the market, accounting for over 66.3% of global revenue in 2021. Fixed gas protection systems are designed to protect personnel and plants. These sensors can monitor multiple or single hazardous gases in safe locations. This segment is in high demand due to its growing use in the oil and gas, food and beverage, and pharmaceutical sectors.

The segment of portable gas detectors is expected to grow the fastest over the forecast period. Because portable gas detectors are able to remotely monitor commercial and industrial units, they are more in demand than traditional fixed gas detectors. The segment is growing simultaneously because of the ease of use, cost-effectiveness, security, and easy connections that portable gas detectors offer. Environment agencies are increasingly using these detectors to inspect the gas emissions from public vehicles.

Technology analysis

The market’s largest segment, the infrared gas detection technology segment, accounted for over 27.2% of global revenue in 2021. These detectors are able to operate in both oxygen-poor and oxygen-rich environments. For the detection of hydrocarbon gas using infrared light, equipment based on infrared gas detector technology is used. An optical filter and a source of infrared lighting are used to determine the correct wavelength. These detectors are used to control air pollutants in air cleaners and purifiers.

Over the projected period, the semiconductor segment is predicted to expand the quickest. Semiconductor gas sensors have several uses, including industrial control, safety, environmental monitoring, and medical diagnostics. Metal oxide semiconductors are commonly employed as gas sensing materials nowadays due to benefits such as ease of manufacture, low cost, and ease of usage. However, the segment’s expansion is hampered by the sensing material’s poor selectivity.

End-Use analysis

In 2021, the industrial sector led the market, accounting for more than 22.3% of worldwide sales. Industrial gas detection equipment ensures safety in all working conditions. These detectors are used in the mines to detect oxygen and carbon dioxide. The growing usage of gas detection equipment in sectors such as pharmaceuticals and food and beverage is also propelling the market forward.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Fixed Gas Detectors

- Portable Gas Detectors

By Technology

- Infrared Gas Detection

- Semiconductor

By End-Use

- Petrochemical

- Industrial

- Medical

- Environmental

- Automotive

- Other End-Use

Market Dynamics:

There is a growing demand for gas detection equipment as governments around the world make efforts to reduce oil and gas methane emissions. Methane detection is made possible by infrared gas detectors. These sensors are essential for safety and efficiency monitoring. The gas detection equipment is crucial in reducing methane-related damages during transport, natural gas extraction, power generation, and other activities.

HART is a communications system for instrumentation that delivers reliable and uniform transmission without interfering with 4-20mA analog signals. It provides several benefits to corporate teams in terms of delivering the relevant data to huge corporate networks and specific plants. Gas detectors that support the HART 7 protocol may report sensor status to a plant’s maintenance system through HART.

Bluetooth-enabled gas detection equipment has lately gained popularity. This wireless technology allows users to exchange real-time air quality measures with their colleagues. Several businesses are attempting to create Bluetooth-based gas detection technology.

Regional Analysis

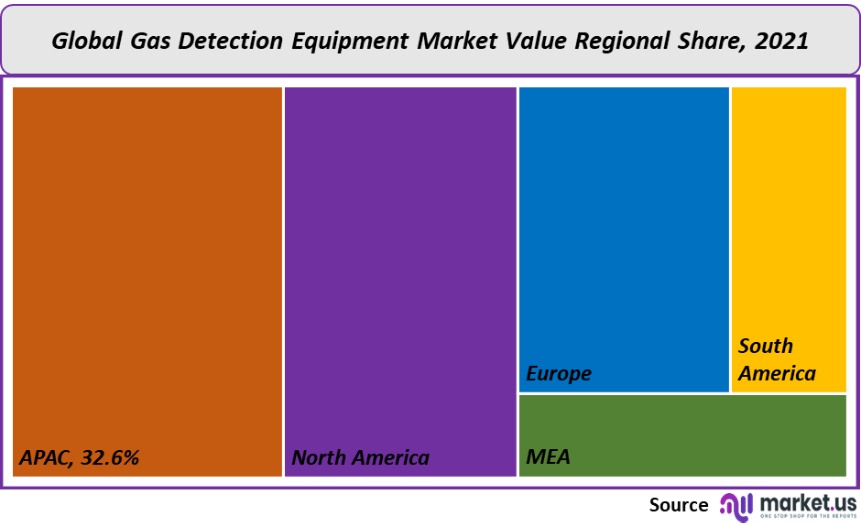

The Asia Pacific was the dominant market, accounting for over 32.6% of global revenue in 2021. This is due to the abundance of raw materials and low-cost labor. It has attracted many manufacturers from different industries to establish production plants in the Asia Pacific region in order to reap greater benefits. The coatings application segment in South Korea is expected to have the largest share of the overall Gas Detection Equipment industry growth over the forecast period.

During the projection period, China held the lion’s share of the Asia Pacific market. The Chinese government’s expanding number of Greenfield projects is propelling the country’s market expansion. Simultaneously, the growth of activities by many oil corporations like the Oil & Natural Gas Corporation of India and the National Offshore Oil Corporation of China is increasing demand for the region’s market.

North America is predicted to increase significantly throughout the projection period. The presence of a significant oil and gas pipeline network as well as oil and gas refineries in nations such as the United States and Canada bodes well for market expansion. Furthermore, the growing requirement for the safety and security of employees who are regularly exposed to harmful gases is boosting regional market expansion. One of the primary aspects driving market expansion is the increased requirement to minimize accidents caused by gas leaks.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

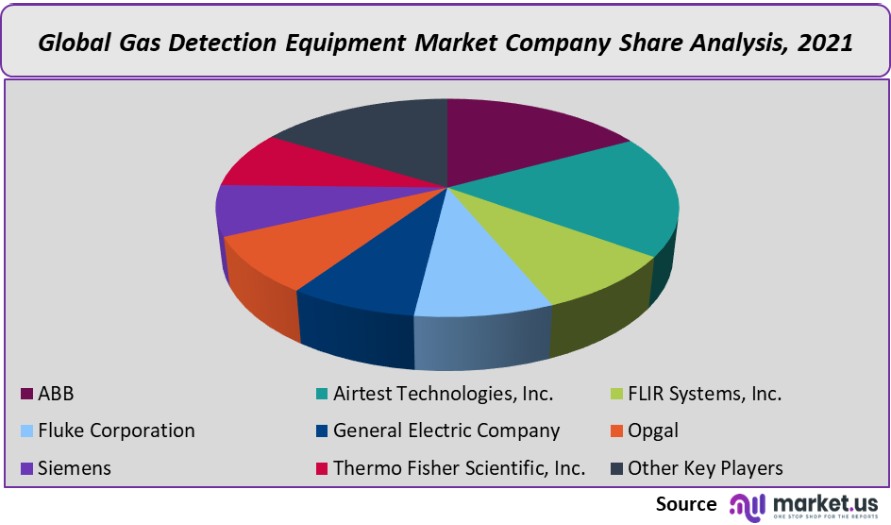

The competitive landscape is distributed in nature. Market players are focused on geographical expansion, partnerships, and product innovation to strengthen their market positions.

Маrkеt Кеу Рlауеrѕ:

- ABB

- Airtest Technologies, Inc.

- FLIR Systems, Inc.

- Fluke Corporation

- General Electric Company

- Opgal

- Siemens

- Thermo Fisher Scientific, Inc.

- Other Key Players

For the Gas Detection Equipment Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Gas Detection Equipment market in 2021?A: The Gas Detection Equipment market size is US$ 4,454.4 million in 2021.

Q: What is the projected CAGR at which the Gas Detection Equipment market is expected to grow at?A: The Gas Detection Equipment market is expected to grow at a CAGR of 9.7% (2023-2032).

Q: List the segments encompassed in this report on the Gas Detection Equipment market?A: Market.US has segmented the Gas Detection Equipment market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, market has been segmented into Fixed Gas Detectors and Portable Gas Detectors. By Application, the market has been further divided into Infrared Gas Detection and Semiconductor. By End-Use, the market has been further divided into Petrochemical, Industrial, Medical, Environmental, Automotive, Other End-Use.

Q: List the key industry players of the Gas Detection Equipment market?A: ABB, Airtest Technologies, Inc., FLIR Systems, Inc., Fluke Corporation, General Electric Company, Opgal, Siemens, Thermo Fisher Scientific, Inc., Other Key Players are the key vendors in the Gas Detection Equipment market engaged in the Gas Detection Equipment market.

Q: Which region is more appealing for vendors employed in the Gas Detection Equipment market?A: APAC accounted for the highest revenue share of 39.8%. Therefore, the Gas Detection Equipment industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Gas Detection Equipment?A: China, Japan, South Korea, Canada, & The US, are key areas of operation for Gas Detection Equipment Market.

Q: Which segment accounts for the greatest market share in the Gas Detection Equipment industry?A: With respect to the Gas Detection Equipment industry, vendors can expect to leverage greater prospective business opportunities through the fixed gas segment, as this area of interest accounts for the largest market share.

![Gas Detection Equipment Market Gas Detection Equipment Market]() Gas Detection Equipment MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample

Gas Detection Equipment MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample - ABB Ltd Company Profile

- Airtest Technologies, Inc.

- FLIR Systems, Inc.

- Fluke Corporation

- General Electric Company

- Opgal

- Siemens Aktiengesellschaft Company Profile

- Thermo Fisher Scientific, Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |