Global Gas Sensor Market By Product Type (Oxygen/Lambda Sensor, Carbon Dioxide Sensor, Carbon Monoxide Sensor, NOx Sensor, Methyl Mercaptan Sensor, Others), By End - Use (Medical, Building Automation & Domestic Appliances, Environmental, Petrochemical, Automotive, Industrial, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 55472

- Number of Pages: 386

- Format:

- keyboard_arrow_up

Gas Sensor Market Overview

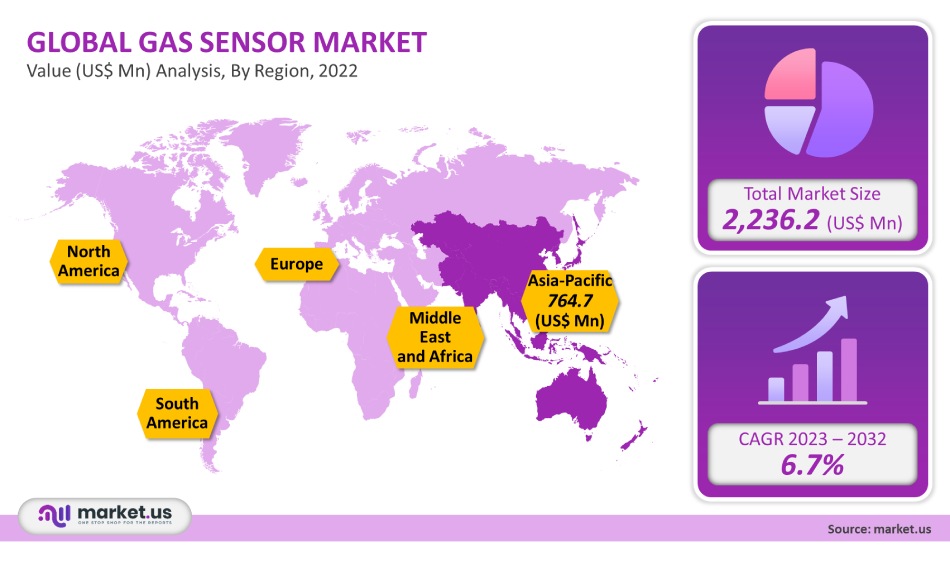

The global gas sensor market was worth USD 2,236.2 million in 2021. It is projected to grow at a 6.7% compound annual growth rate, from 2023 to 2032.

The development of wireless and miniaturized gas sensors, along with improved communication technologies, is the main driver for the global market. This allows them to be integrated into other devices and machines that detect toxic gases safely.

Global Gas Sensor Market Scope:

Product Type analysis

In 2021, the carbon dioxide gas sensor market dominated and accounted for more than 32.5% of the global revenue share. The main purpose of carbon dioxide sensors is to monitor indoor air quality in buildings, homes, offices, automobiles, healthcare facilities, and other applications. Many companies are working to develop MEMS-based carbon dioxide sensors for various applications. TDK Corporation, for example, introduced the TCE-11101 MEMS gas sensor platform in January 2021. It is a small, lightweight, low-power, miniaturized device that measures carbon dioxide in homes, hospitals, automobiles, IoT, and other settings. These initiatives are positive for the segment’s growth. In the coming years, significant growth is expected in the carbon monoxide sensor market. Carbon monoxide sensors are needed to prevent fatalities from carbon monoxide poisoning. The carbon monoxide sensor market is growing due to government regulations that ensure workplace safety. In the U.S., for example, carbon monoxide poisoning has led the government to install carbon monoxide detection devices in various states.

End-Use analysis

The industrial sector dominated the market in 2021 and accounted for more than 23% of worldwide sales. Hazardous gases and vapors can be detected and monitored using industrial gas sensors, which can also set off visual and audio warnings. Now, a lot of gas sensor producers are concentrating on making tiny industrial gas sensors. In October 2020, sensor company DD-Scientific unveiled its newest line of high-performance industrial gases sensors. It provides the same durability and dependability as a bigger sensor in a more compact form.

The petrochemicals industry will experience significant expansion during the forecast period. Gas sensors are being rapidly deployed by the LPG and LNG sector verticals since these verticals need to monitor the storage, production, and transportation of gas at every stage. As natural gas output increases, the processing facilities’ emphasis on safety and security has increased. As natural gas goods continue to rise in popularity, this market is anticipated to grow further.

Key Market Segments:

By Product Type

- Oxygen/Lambda Sensor

- Carbon Dioxide Sensor

- Carbon Monoxide Sensor

- NOx Sensor

- Methyl Mercaptan Sensor

- Others (Hydrogen, Ammonia, Hydrogen Sulfide)

By End-Use

- Medical

- Building Automation & Domestic Appliances

- Environmental

- Petrochemical

- Automotive

- Industrial

- Agriculture

- Others

Market Dynamics:

Gas sensors can be used to continuously monitor and control gas emissions from various industrial processes. The market’s growth is also supported by the growing demand for control of harmful emissions from crucial industries. Smart gas sensors are possible thanks to technological advances and innovation. To improve safety and security for pipeline operators around the world, a variety of companies have developed drone-based gas leak detection systems.

For instance, ABB announced the introduction of HoverGuard, a drone-based gas detection system, in April 2021. Up to 100m away from facilities for the distribution and storage of natural gas, HoverGuard can identify, locate, and measure leaks. Gathering lines, transmission pipes, and other potential source areas. It accomplishes this rapidly and effectively. These technological developments are beneficial for the market’s expansion and development.

The forecast period will see a rise in demand due to strict government regulations to lower car emissions. Governments around the globe have established rules and regulations regarding the emission of gasoline from cars. The National Highway Traffic Safety Administration (EPA) and the EPA amended the Corporate Average Fuel Economy standards and greenhouse gas emission standards applicable to passenger cars in April 2020. The imposed limit on vehicle gas emissions creates demand to install gas sensors. This reduces atmospheric pollution and improves fuel efficiency.

Regional Analysis

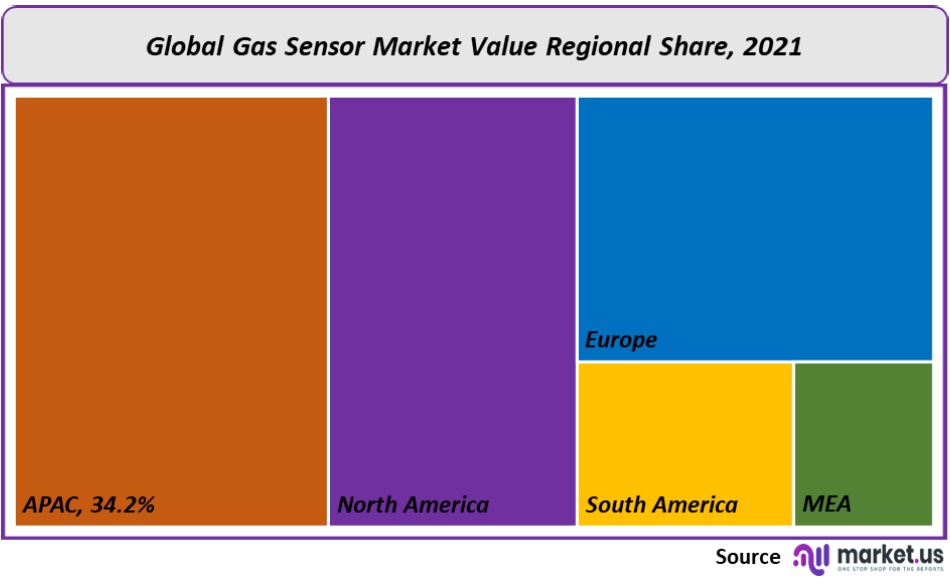

The market was dominated by the Asia Pacific in 2021, accounting for more than 34.2% of global revenue. Gas sensors are being used to monitor air quality and increase awareness of the health effects of air pollutants. The region’s continued urbanization is contributing to the increasing demand for gas sensors. Smart sensor devices are also in high demand as the governments of the Asia Pacific region invest heavily in smart city projects. These factors are positive for regional market growth.

Europe is forecast to experience steady growth over the forecast period. The regional market will grow due to strict emission norms and the need to monitor them. All European vehicle OEMs must include gas sensor technology in their offerings due to safety regulations. The popularity of gas sensors to reduce pollution in the automotive industry is expected to grow as stricter pollution regulations are implemented.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

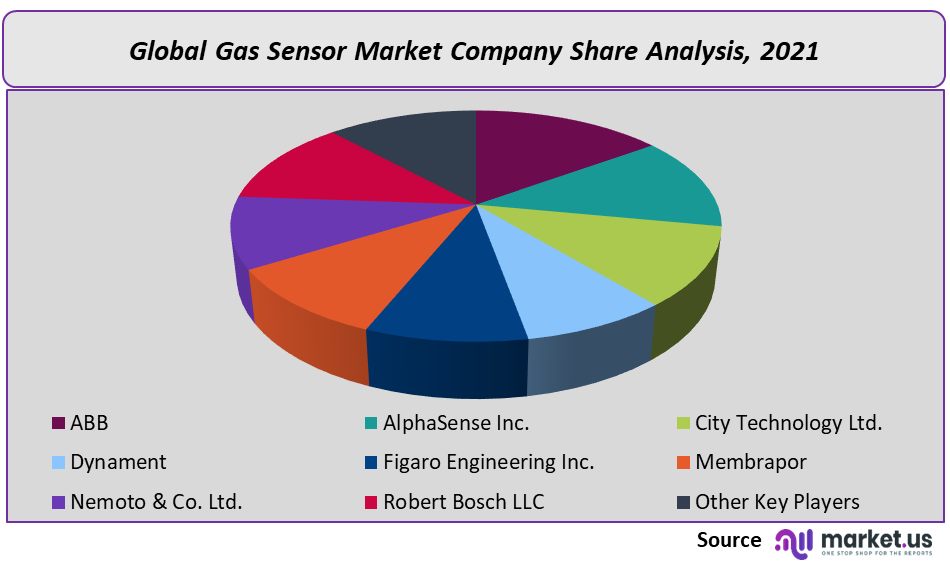

Markets are fragmented. To expand their market presence, market players pursue various strategies, including acquisitions & mergers, and new product launches. Market players also invest heavily in R&D to improve their product offerings. Market players are increasingly focusing on wireless gas sensors because of the many benefits associated with wireless devices.

Expanding their selection of products is another area of emphasis for vendors. For instance, Bosch Sensortec, a Robert Bosch GmbH company, announced the release of the BME688 sensor in March 2021. This sensor combines artificial intelligence with the ability to sense humidity, gas, temperature, and barometric pressure (AI). The BME688 can detect the presence of numerous gases in the part per billion (ppb) range, including VOCs, hydrogen, and carbon monoxide.

Маrkеt Кеу Рlауеrѕ:

- ABB

- AlphaSense Inc.

- City Technology Ltd.

- Dynament

- Figaro Engineering Inc.

- Membrapor

- Nemoto & Co. Ltd.

- Robert Bosch LLC

- Other Key Players

For the Gas Sensor Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Gas Sensor market in 2021?The Gas Sensor market size is US$ 2,236.2 million in 2021.

Q: What is the projected CAGR at which the Gas Sensor market is expected to grow at?The Gas Sensor market is expected to grow at a CAGR of 6.7% (2023-2032).

Q: List the segments encompassed in this report on the Gas Sensor market?Market.US has segmented the Gas Sensor market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, market has been segmented into Oxygen/Lambda Sensor, Carbon Dioxide Sensor, Carbon Monoxide Sensor, NOx Sensor, Methyl Mercaptan Sensor, Others. By End Use, the market has been further divided into Medical, Building Automation & Domestic Appliances, Environmental, Petrochemical, Automotive, Industrial, Agriculture, Others.

Q: List the key industry players of the Gas Sensor market?ABB, AlphaSense Inc., City Technology Ltd., Dynament, Figaro Engineering Inc., Membrapor, Nemoto & Co. Ltd., Robert Bosch LLC, Other Key Players engaged in the Gas Sensor market.

Q: Which region is more appealing for vendors employed in the Gas Sensor market?APAC accounted for the highest revenue share of 34.2%. Therefore, the Gas Sensor industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Pigment Dispersion?China, India, Japan & The US, are key areas of operation for Gas Sensor Market.

Q: Which segment accounts for the greatest market share in the Gas Sensor industry?With respect to the Gas Sensor industry, vendors can expect to leverage greater prospective business opportunities through the carbon dioxide gas sensor segment, as this area of interest accounts for the largest market share.

![Gas Sensor Market Gas Sensor Market]()

- ABB Ltd Company Profile

- AlphaSense Inc.

- City Technology Ltd.

- Dynament

- Figaro Engineering Inc.

- Membrapor

- Nemoto & Co. Ltd.

- Robert Bosch LLC

- Other Key Players

- Nestlé S.A Company Profile

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |