GCC Oilfield Chemicals Market By Type (Biocides, Demulsifiers, Surfactants, And Others), By Application (Drilling Fluids, Cementing, Completion & Stimulation And Production & Eor), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2019–2028

- Published date: Apr 2022

- Report ID: 45814

- Number of Pages: 268

- Format:

- keyboard_arrow_up

Market.us announces the publication of its most recently generated research report titled, “GCC Oilfield Chemicals Market by Type (Biocides, Corrosion and Scale Inhibitors, Demulsifiers, Surfactants, Polymers, Gallants & Viscosifiers and Others), By Application (Drilling Fluids, Cementing, Completion & Stimulation and Production & EOR (Enhanced Oil Recovery Chemicals)), and by Region – GCC Forecast to 2028.”, Which offers a holistic view of the GCC Oilfield Chemicals Market through systematic segmentation that covers every aspect of the target market.

The GCC Oilfield Chemicals Market was valued at US$ 3,344Mn in 2018 and is expected to reach US$ 5,245.9Mn by 2028 at a CAGR of 5.7%.

Oilfield chemicals are used in oil and gas extraction activity at every stage of drilling and exploration starting from borehole drilling, to production, and stimulation, in the end, is the closing of the borehole. These chemicals are also used for cementing applications.

The oilfield chemical includes transition metal compounds, common inorganic salts, common organic chemicals and solvents, surfactants, and water-soluble and oil-soluble polymers.

These chemicals play an important role in the prevention of penetration and loss of drilling fluid in various geographical conditions. In addition, these chemicals provide protection from corrosion in a chemically aggressive and hot environment and keep drilling fluid in pump-able / fluid form under continuously changing temperature conditions.

trending_up Total Revenue in 2018$ 3,013.9Mn

trending_up Market CAGR of the Next Ten Years5.7%

no_encryption Market Value (US$ Mn), Share (%) and Growth Rate (%) Comparison 2012-2028Purchase this report or a membership to unlock the market value (US$ Mn), share (%) and growth rate (%) comparison for this industry.- By Type

- By Region

- By Application

no_encryption Leading Companies Financial HighlightsPurchase this report or a membership to unlock the leading companies financial highlights for this industry.trending_up Market Revenue of the Next Ten Years$ 5,245.9Mn

Oil field chemicals are supplied by both – the chemical companies as well as by oil field service companies. However, oilfield companies preferable purchase these chemicals from chemical companies and then provide services in chemical transportation, chemical mixing, dilution, storage, and production of commodity chemicals.

In recent years, due to increasing environment-related concerns, the focus on the development of non-toxic and bio-degradable oilfield chemicals is increased. Many manufacturers are increasing R&D investment and activity for the development of naturally derived and marine-life-friendly oilfield chemicals.

GCC Oilfield Chemicals Market Revenue (US$ Mn), 2020–2028

Increasing crude oil production in GCC countries is expected to fuel the growth of the oilfield chemicals market. For instance, the Energy Minister of UAE has announced in October 2018 that UAE has begun to increase crude oil production to serve the increasing demand for crude oil from the market. In addition, UAE has increased the crude oil output capacity to around 3.5 million barrels a day in 2018, which is expected to boost the demand for oilfield chemicals in the GCC market.

Furthermore, the growing demand for highly effective oilfield chemicals due to increasing deep offshore deposits in GCC countries is expected to bolster the growth of the oilfield chemicals market over the forecast period.

However, increasingly stringent regulations regarding environmental safety and oil & gas exploration activity in GCC countries are expected to hamper the growth of the oilfield chemicals market to a certain extent. Nonetheless, advancements in the drilling and exploration technology, availability of a large number of market players, and increasing investment in the target market area offer lucrative opportunities for oilfield chemical manufacturers.

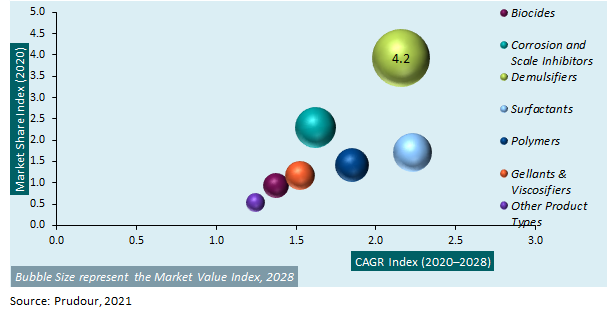

GCC Oilfield Chemicals Market is segmented based on type, end-user, and region. Based on type biocides, corrosion and scale inhibitors, demulsifiers, surfactants, polymers, gallants & viscosifiers, and others. The demulsifier segment accounts for the majority share in the GCC oilfield chemicals market, and also it is expected to register the highest growth rate over the forecast period. The basis of the application market is segmented into, drilling fluids, cementing, completion & stimulation, and production, and the EOR and drilling fluids segment accounts for a majority share in the GCC oilfield chemicals market.

GCC Oilfield Chemicals Market Attractiveness Analysis by Type, 2012–2018

On the basis of region, the market is segmented into Saudi Arabia, Qatar, UAE, and other GCC countries. Saudi Arabia accounts for the majority share in the GCC oilfield chemicals market followed by Qatar, owing to increasing demand for oilfield chemicals from enhanced oil recovery applications in the region, with Saudi Arabia registering the highest growth rate. UAE and other GCC countries are expected to register stable growth over the forecast period.

The research report on the GCC Oilfield Chemicals Market includes profiles of some of the major companies such as BASF SE, Croda International Plc, Halliburton Company, Schlumberger Limited, and DowDuPont Inc., Ecolab Inc., and others.

Key Market Segments

Type

- Biocides

- Corrosion And Scale Inhibitors

- Demulsifiers

- Surfactants

- Polymers

- Gallants & Viscosifiers And Others

End-User

- Drilling Fluids

- Cementing

- Completion & Stimulation

- Production & EOR(Enhanced Oil Recovery Chemicals)

By Country

- Saudi Arabia

- Qatar

- UAE

- Other GCC Countries

Key Market Players included in the report:

- BASF SE

- Croda International Plc

- Halliburton Company

- Schlumberger Limited

- DowDuPont Inc. (Dow Chemical Company)

- Ecolab Inc. (Nalco Champion LLC)

- Orkla ASA (Borregaard LignoTech AB)

- Chevron Corporation (Chevron Phillips Chemical Company LLC)

- Innospec Inc.

- Clariant AG

- Solvay SA

- Albemarle Corporation

- Flotek Industries Inc.

- Kemira Oyj

- Huntsman Corporation

- Lamberti S.p.A.

- Zirax Limited

- KMCO L.P.

- China National Petroleum Corporation

- Ashland GCC Holdings Inc.

- TETRA Technologies Inc.

- S.P.C.M. SA

- others.

For the GCC Oilfield Chemicals Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

![GCC Oilfield Chemicals Market GCC Oilfield Chemicals Market]() GCC Oilfield Chemicals MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample

GCC Oilfield Chemicals MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample - BASF SE Company Profile

- Croda International Plc

- Halliburton Company

- Schlumberger Limited

- DowDuPont Inc. (Dow Chemical Company)

- Ecolab Inc. (Nalco Champion LLC)

- Orkla ASA (Borregaard LignoTech AB)

- Chevron Corporation (Chevron Phillips Chemical Company LLC)

- Innospec Inc.

- Clariant AG Company Profile

- Solvay SA

- Albemarle Corporation Company Profile

- Flotek Industries Inc.

- Kemira Oyj

- Huntsman Corporation

- Lamberti S.p.A.

- Zirax Limited

- KMCO L.P.

- China National Petroleum Corporation

- Ashland GCC Holdings Inc.

- TETRA Technologies Inc.

- S.P.C.M. SA

- others.

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |