Global Genomics Market By Application & Technology (Functional Genomics, Biomarker Discovery, and Others), By Deliverable (Services and Products), By End-use (Hospitals and Clinics, Pharmaceutical and Biotechnology Companies, and Other End users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Aug 2022

- Report ID: 41074

- Number of Pages: 264

- Format:

- keyboard_arrow_up

Genomics Market Overview:

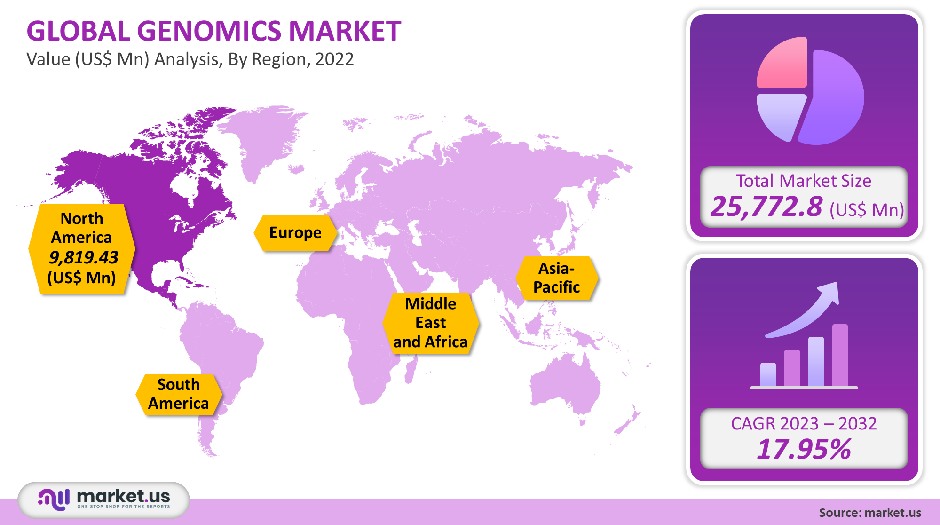

In 2021, the global genomics market was valued at USD 25,772.8 million. Between 2023 and 2032, this market size is projected to expand at a compound annual growth rate (CAGR) of 17.95 % during the forecast period.

In an effort to identify genetic SARS-CoV-2 susceptibility, researchers have integrated their work with existing genetic databases. Biological networks and common variations underpinning host/pathogen interactions have been found using multi-omic-based and genome-wide association studies (GWAS). Genomics is important in examining the molecular mechanisms and interaction of environmental major factors in diseases.

ABO blood classes, HLA haplotypes, and polygenic risk scores are only a few examples of data collected from genomes that may be used to assess COVID-19 susceptibility, complications, and resistance. Biobanks can be used to connect EHRs to genomic data in order to research the effects of genetic variables on patients with SARS-CoV 2. This market report gives an overview of the Genomics market report, growth factors, market size, and other key factors.

Global Genomics Market Scope:

Application & Technology Analysis

In 2021, functional genomics accounted for 33.35% of the total revenue. Functional genomics was the largest revenue share generator. Quantitative real-time PCR played an important role in the absolute quantifications of genetic sample elements within genomic DNA.

This technology was used to assess the potential use of tissue genome DNA as an external standard for the acceleration of quantification of any sequence in the genomes of different species. This technology can be used in conjunction with reverse transcription PCR to allow quantification of low abundance mRNA. Researchers are then able in order to measure relative gene expression at any given time.

This method can detect minute changes in gene expression more precisely than array technology. Its rate of acceptance is rising steadily. It needs additional input and can’t handle high-throughput research very well. The fastest CAGR for path analysis will be between 2023 to 2032.

The molecular network analysis of individual targets has provided insight into the function of biological processes at the cellular level. Pathway analysis is now an integral part of drug development research and life sciences research. Pathway analysis is used by the research community to increase fundamental understanding of molecular and cellular biology.

Deliverable Analysis

The products sector dominated the market growth in 2021 with a revenue share of 70.1 percent. Major producers continuously release kits or reagents for extracting nucleic acids, which drives the market. The launch of this new kit will assist in addressing the lack of RNA purification equipment needed for COVID-19 testing.

The RNA Extraction Kit for the PHASIFY VIRAL, which is utilized in coronavirus detection and prevention, will also be released globally in 2020, according to an announcement by PHASE Scientific. Viral transport media (VTM) samples from patients may include viral nucleic acids that may be concentrated and purified using this kit.

End-Use Analysis

The largest share, 62.3%, was held by biotechnology and pharmaceutical companies in 2021. Due to increasing numbers of genetic research studies, genomic technologies are in high demand by pharmaceutical & biotechnology firms. Many drug developers use genomic techniques to improve and simplify drug discovery and development.

Companies have been offering direct-to-consumer genome tests for the past few years. This has led to a shift in business models. Companies that specialize in personal genomics are now able to generate genomics data for pharmaceutical companies. Many new players have entered genomics services to meet growing demand. They offer a detailed analysis of data that is quick and easy, as well as cheaper data acquisition.

The largest market share is also seeing an increase in demand for gene-editing tools by biotechnology companies.To access this technology, biotechnology companies have entered into licensing agreements or strategic alliances. In 2020, Merck licensed CRISPR advanced technology from Takara Bio USA, Inc., and PanCELLA, Canada. These licenses aim to increase the development of new therapies and improve drug discovery. In 2020, New England Biolabs also signed an agreement to commercialize CRISPR gene editing reagents. This is why the market is seeing greater adoption of genomic technologies from biotechnology and pharmaceutical companies.

Кеу Маrkеt Ѕеgmеntѕ

The leading segment of the Genomics market is given below on the Basis of Application, Basis of Technology, Basis of Deliverables, End-use, etc.

By Application & Technology

- Functional Genomics

- Transfection

- Real-time PCR

- Mutational Analysis

- RNA Interference

- Epigenomics

- Other Functional Genomics

- Biomarker Discovery

- Microarray Analysis

- DNA Sequencing

- Mass Spectrometry

- Real-time PCR

- Other Biomarker Discoveries

- Pathway Analysis

- Bead-based Analysis

- Microarray Analysis

- Real-time PCR

- Proteomics Tools (2-D PAGE; yeast 2-hybrid studies)

- Epigenetics

- Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

- High-Resolution Melt (HRM)

- Bisulfite Sequencing

- Methylated DNA Immunoprecipitation (MeDIP)

- Other Applications & Technologies

By Deliverable

- Services

- Core Genomics Services

- NGS-based Services

- Computational Services

- Biomarker Translation Services

- Others

- Products

- Consumables & Reagents

- Instruments/Systems/Software

By End-use

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Clinical Research

- Academic and Government Institutes

- Other End Users

Genomics Market Dynamics:

Researchers from the Finnish Institute for Molecular Medicine launched the COVID-19 Host Genetics Initiative to encourage the human genetics community in order to share, analyze, and generate data to understand the determinants of COVID-19 impact outcomes and susceptibility. decode Genetics, a provider of genomics solutions in Iceland, used SARS-CoV-2 genome analysis to track the virus’ spread.

The company also partnered with Iceland’s Government to sequence the genomes of viral hosts. The COVID-19 GR initiative was Government funding of Greece to genotype 3,500 COVID-19 patients, perform WGS on the SARS-2 genomes obtained from these patients, as well as conduct immunogenomic analysis. You can retrieve the complete set of these data, along with detailed clinical information, from the Greek COVID-19 Registry.

Prenatal genetic screening programs will likely grow rapidly in the future. These programs are designed to help mothers find chromosomal abnormalities in their children. It is expected that every newborn’s genetic sequence will be stored in an electronic medical record within the next 10 years. To maintain their market leadership, major companies such as Natera and Counsyl have developed various genetic tests to assess the potential market for genomic analysis in newborn screening programs.

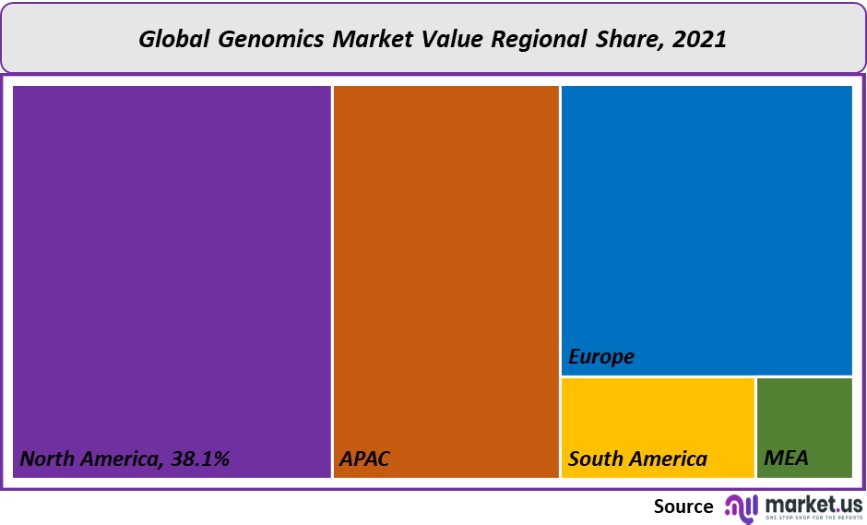

Genomics Market Regional Analysis

North America is in a leading position in this market in 2021 with a 38.1% largest share. This was due to an increase in research programs, a large number of strategic partnerships, and a rise in regulatory approvals by the U.S. FDA. The adoption of genetic tests is expected to increase as a result of changes in reimbursement and usage regulations. Color Genomics, Inc., along with NorthShore University Health System, successfully completed clinical genomics delivery in routine care under the U.S. program in 2020. North America plays a very important role in the genomics sector.

To improve clinical decision-making, the company also supports Sanford’s Imagenetics genomics program. The Asia Pacific is seeing an increase in the adoption of genomic sequencing technology due to the initiation of a variety of research programs. One such project is the Genome Asia 100K Program, which includes whole-genome sequencing (WGS), to allow genetic discoveries throughout Asia. The study was conducted in four countries across Asia.

Key Regions and Countries covered іn thе rероrt:

The Genomic market report contains key regions including North America, Europe, Asia- Pacific, South America, Middle East & Africa, and South Africa.

- North America (Latin America)

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia- Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

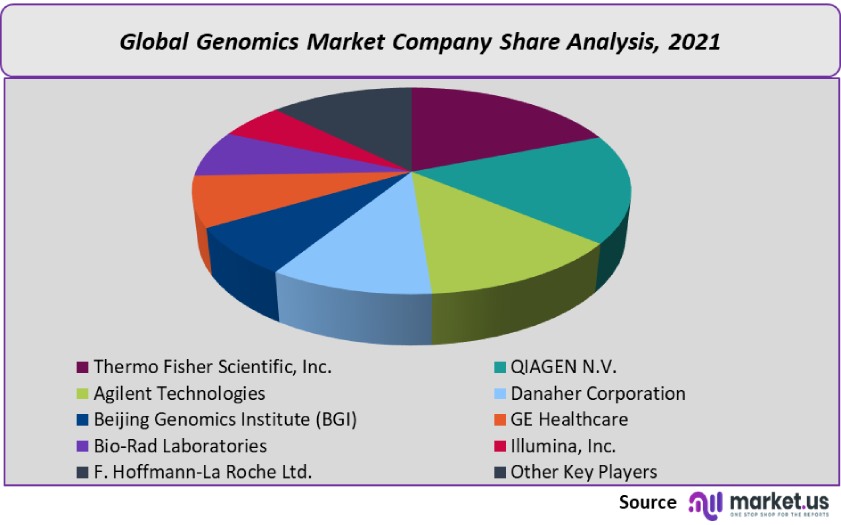

Companies are putting more and more emphasis on new product development and collaboration in order to increase their market share. AstraZeneca, the University of Nebraska Medical Center, and the Precision Medicine Science Center (PMSC) of Thermo Fisher worked together. This partnership began in September 2020. It promised to offer cutting-edge answers to problems in clinical biomarker research. The creation of standardized processes was one of the goals of this partnership.

Agilent Technologies’ GenetiSure Dx Postnatal test received approval from Japan’s Ministry of Health, Labor, and Welfare (MHLW) in December 2020. The microarray analysis was used in this test. This approval enabled the company to sell the product in Japan.

The genomics Market includes some of the prominent players such as F. HOFFMANN-LA ROCHE LTD, Bio-Rad Laboratories, Inc., Agilent Technologies, Thermo Fisher Scientific, Myriad Genetics Inc., Illumina, Inc., and other key companies.

Маrkеt Кеу Рlауеrѕ:

Here are some of the major players given from the Genomics Industry,

- Thermo Fisher Scientific Inc.

- QIAGEN N.V.

- Agilent Technologies Inc.

- Danaher Corporation

- Beijing Genomics Institute (BGI)

- GE Healthcare

- Oxford Nanopore Technologies

- BIO-RAD LABORATORIES INC.

- Illumina Inc.

- F. Hoffmann-La Roche Ltd.

- Eurofins Scientific

- Myriad Genetics, Inc.

- Eppendorf AG

- Foundation Medicine, Inc.

- R1 RCM Inc.

- Luminex Corporation

- McKesson Corporation

- Other Key Players

Frequently Asked Questions (FAQ)

Q: Whаt іѕ thе ѕіzе оf thе Gеnоmісѕ mаrkеt іn 2021?А: Тhе Gеnоmісѕ mаrkеt ѕіzе іѕ UЅ$ 25,772.8 mіllіоn іn 2021.

Q: Whаt іѕ thе рrојесtеd САGR аt whісh thе Gеnоmісѕ mаrkеt іѕ ехресtеd tо grоw аt?А: Тhе Gеnоmісѕ mаrkеt іѕ ехресtеd tо grоw аt а САGR оf 17.95% (2023-2032).

Q: Lіѕt thе ѕеgmеntѕ еnсоmраѕѕеd іn thіѕ rероrt оn thе Gеnоmісѕ mаrkеt?А: Маrkеt.us hаѕ ѕеgmеntеd thе Gеnоmісѕ mаrkеt bу gеоgrарhіс (North America, Еurоре, АРАС, Ѕоuth Аmеrіса, аnd Міddlе Еаѕt аnd Аfrіса). Ву Аррlісаtіоn & Тесhnоlоgу, mаrkеt hаѕ bееn ѕеgmеntеd іntо Funсtіоnаl Gеnоmісѕ, Віоmаrkеr Dіѕсоvеrу, Раthwау Аnаlуѕіѕ, аnd Еріgеnеtісѕ. Ву Dеlіvеrаblе, mаrkеt hаѕ bееn ѕеgmеntеd іntо Ѕеrvісеѕ аnd Рrоduсtѕ. Ву Еnd Uѕеr, thе mаrkеt hаѕ bееn furthеr dіvіdеd іntо Ноѕріtаlѕ аnd Сlіnісѕ, Рhаrmасеutісаl аnd Віоtесhnоlоgу Соmраnіеѕ, Сlіnісаl Rеѕеаrсh, аnd Асаdеmіс аnd Gоvеrnmеnt Іnѕtіtutеѕ.

Q: Lіѕt thе kеу іnduѕtrу рlауеrѕ оf thе Gеnоmісѕ mаrkеt?А: Тhеrmо Fіѕhеr Ѕсіеntіfіс, Іnс., QІАGЕN N.V., Аgіlеnt Тесhnоlоgіеѕ, Dаnаhеr Соrроrаtіоn, Веіјіng Gеnоmісѕ Іnѕtіtutе (ВGІ), GЕ Неаlthсаrе, Віо-Rаd Lаbоrаtоrіеѕ, Illumina, Inc., F. Ноffmаnn-Lа Rосhе Ltd., аnd Оthеr Кеу Рlауеrѕ еngаgеd іn thе Gеnоmісѕ mаrkеt.

Q: Whісh rеgіоn іѕ mоrе арреаlіng fоr vеndоrѕ еmрlоуеd іn thе Gеnоmісѕ mаrkеt?А: Nоrth Аmеrіса ассоuntеd fоr thе hіghеѕt rеvеnuе ѕhаrе оf 38.1%. Тhеrеfоrе, thе Gеnоmісѕ іnduѕtrу іn Nоrth Аmеrіса іѕ ехресtеd tо gаrnеr ѕіgnіfісаnt buѕіnеѕѕ орроrtunіtіеѕ оvеr thе fоrесаѕt реrіоd.

Q: Nаmе thе kеу аrеаѕ оf buѕіnеѕѕ fоr Gеnоmісѕ?А: Тhе UЅ, Сhіnа, Јараn, Іndіа, Вrаzіl, Gеrmаnу, UК, Frаnсе, Іtаlу, Ѕраіn, еtс., аrе kеу аrеаѕ оf ореrаtіоn fоr Gеnоmісѕ Маrkеt.

Q: Whісh ѕеgmеnt ассоuntѕ fоr thе grеаtеѕt mаrkеt ѕhаrе іn thе Gеnоmісѕ іnduѕtrу?А: Wіth rеѕресt tо thе Gеnоmісѕ іnduѕtrу, vеndоrѕ саn ехресt tо lеvеrаgе grеаtеr рrоѕресtіvе buѕіnеѕѕ орроrtunіtіеѕ thrоugh thе funсtіоnаl gеnоmісѕ ѕеgmеnt, аѕ thіѕ аrеа оf іntеrеѕt ассоuntѕ fоr thе lаrgеѕt mаrkеt ѕhаrе.

![Genomics Market Genomics Market]()

- Functional Genomics

- Thermo Fisher Scientific Company Profile

- QIAGEN N.V.

- Agilent Technologies Inc. Company Profile

- Danaher Corporation Company Profile

- Beijing Genomics Institute (BGI)

- GE Healthcare

- Oxford Nanopore Technologies

- BIO-RAD LABORATORIES INC.

- Illumina Inc.

- F. Hoffmann-La Roche Ltd.

- Eurofins Scientific

- Myriad Genetics, Inc.

- Eppendorf AG

- Foundation Medicine, Inc.

- R1 RCM Inc.

- Luminex Corporation

- McKesson Corporation

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |