Global Genotyping Market By Product (Instruments, Reagents & Kits, and Software & Services), By Technology (PCR, Capillary Electrophoresis, Microarray, Sequencing, Mass Spectrometry, and Other Technologies), By Application (Plastics, Inks, and Coatings), By Application (Pharmacogenomics, Diagnostics And Personalized Medicine, Agricultural Biotechnology, Animal Genetics, and Other Applications), By End-Use (Pharmaceutical And Biopharmaceutical Companies, Diagnostics And Research Laboratories, Academic Institutes, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Aug 2022

- Report ID: 41073

- Number of Pages: 351

- Format:

- keyboard_arrow_up

Genotyping Market Overview:

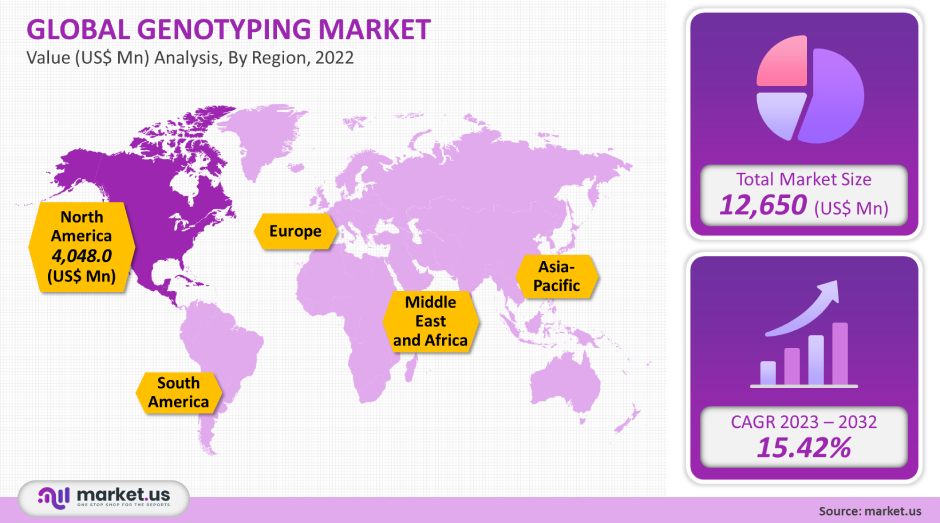

In 2021, the global genotyping market was valued at USD 12,650 million. The market is estimated to grow at a compound annual growth rate (CAGR) of 15.42% between 2022-2032.

This growth can be attributed primarily to technological advances, increasing prevalence of cancer and genetic disorders, as well as increased R&D funding for precision medicine research.

A positive impact was also seen by the COVID-19 Pandemic on the genotyping market. The increased demand for COVID-19-genotyping kits resulted in a higher level of sales. SNP genotyping is used to identify genetic variants of the Covid-19 virus.

Global Genotyping Market Analysis:

Product Analysis:

The largest share of 2021 was held by the reagents, kits, and chemicals segment. This is due in part to increasing demand for genetic tests, increasing investments in R&D, and increased genotyping test volumes.

Due to the increasing adoption of software-based services by academic institutions and research labs, the software & Services segment will also grow. Bioinformatics helps to improve the efficiency of sequencing methods and avoids mistakes that are common in traditional sequencing methods.

These services can be used in agrigenomics as well as for diagnosing and treating diseases of animals and microbes. The market is expected to grow due to all of the above factors.

Application Analysis:

Pharmacogenomics will be the fastest-growing technology in the forecast period. Genotyping is used to identify the most suitable patients for a specific drug by using their genetic makeup.

It helps to identify subsets of people that are responsive and non-responsive. It also helps to reduce trial attrition. In addition, key players are involved in providing solutions for pharmacogenomics.

Thermo Fisher Scientific offers RT-PCR solutions for pharmacogenomic testing. This includes QuantStudio instruments and TaqMan assays. It also includes a PharmacoScan solution, as well as a PharmacoScan Kit.

Due to the increasing adoption of genetic products for research and the growing demand for diagnosis and treatment of genetic diseases, the largest share of the genotyping market is in diagnostics and personalized medicines. The market will grow through strategic collaborations between players.Technology Analysis:

Major factors driving the market growth are the growing demand for advanced diagnostic methods, increasing numbers of CROs and forensic & laboratory laboratories, as well as rising prevalence of chronic diseases and genetic disorders.

The increased specificity of sequencing and its ability to detect the low expression and differentially expressed genes is expected to drive the industry forward. Genotyping through sequencing can also be used to perform comparative analyses across samples without the use of a reference gene.

End Use Analysis:

The fastest-growing segment in diagnostics and laboratory services is the research laboratories and research labs. This is due to the rising adoption of genotyping tools for research and the increasing demand for diagnosing genetic diseases and cancer.

Market growth is expected to be driven by the rising prevalence of cancer. Market growth will be driven by the increasing demand for pharmacogenomics in drug development and FDA recommendations to include genotyping and pharmacogenomics studies in drug discovery.

To develop new drugs, pharmacogenomics is actively used by companies. Pfizer has launched a genotyping-based trial to evaluate the effectiveness of Talazoparib for patients with metastatic BRCA mutant-resistant breast cancer.

The increasing number of clinical studies based on Pharmacogenomics will drive segment growth.

Key Market Segments:

By Product

- Instruments

- Reagents & Kits

- Software & Services

By Technology

- PCR

- Capillary Electrophoresis

- Microarray

- Sequencing

- Mass Spectrometry

- Other Technologies

By Application

- Pharmacogenomics

- Diagnostics And Personalized Medicine

- Agricultural Biotechnology

- Animal Genetics

- Other Applications

By End-Use

- Pharmaceutical And Biopharmaceutical Companies

- Diagnostics And Research Laboratories

- Academic Institutes

- Other End-Uses

Market Dynamics:

A rise in government funding is expected to propel the genotyping market, especially for genome research by both government bodies and pharma/biotechnology companies to speed up research.

Worldwide, the number of chronic diseases such as cancer and other genetic disorders is on the rise. This is expected to increase the demand for genotypic diagnostic testing.

About 20% of cancer deaths worldwide can be attributed to viruses that cause cancer, such as the Human Papilloma Virus(HPV) or Hepatitis B Virus/Hepatitis Virus.

Based on population growth, and aging, it is predicted that the number of cancer cases will rise by approximately 70% over the next 20 decades. The market’s main driver is likely to be the rising incidence of cancer.

However, the lack of skilled technicians in developing countries could slow down market growth. Because genotyping data analysis requires high levels of technical expertise, and management, and also requires high levels of technical knowledge. At the moment, there are very few experts and professionals in developing nations.

Local players can expect to take strategic steps to increase market growth. For example, VG Acquisition Corp. merged in February 2021 with 23andMe (a U.S.-based research and genetics company) that specializes in direct-to-consumer genotyping solutions. This merger would allow them to raise capital for their genetic consumer business.

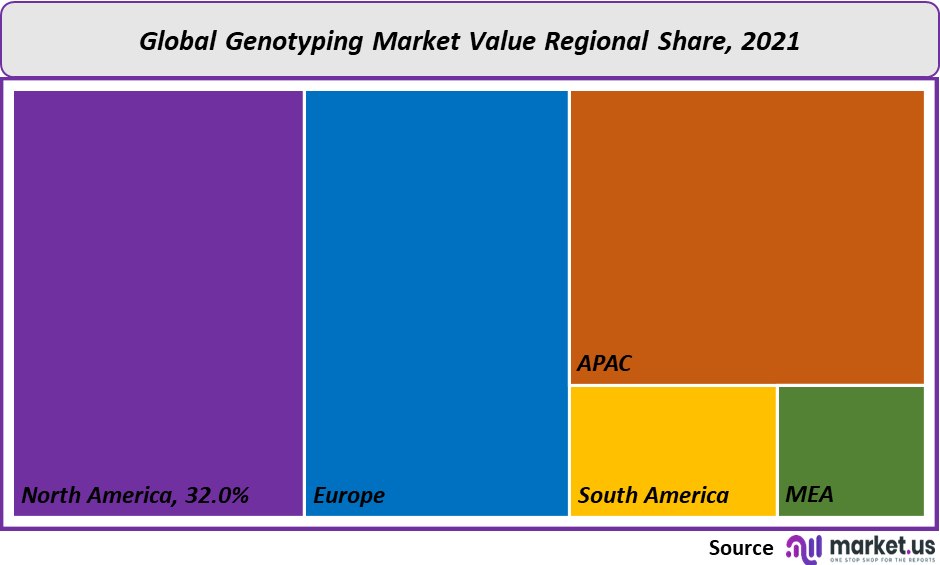

Regional Analysis:

North America had the largest market share of 2021. This is due to the growing adoption of advanced products, major pharmaceutical & biologic companies, proactive government initiatives, and advancements in healthcare infrastructure.

High market share can also be attributed to the presence of large players in this region. Europe is expected to experience a rapid CAGR over the forecast period.

Many factors are responsible for the enormous untapped potential of Europe, such as technological advancements in the region and the expanding pharma/biopharma sector.

The Asia Pacific is expected to have the best opportunities. Additionally, there are more clinical trials being performed in this region.

Кеу Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

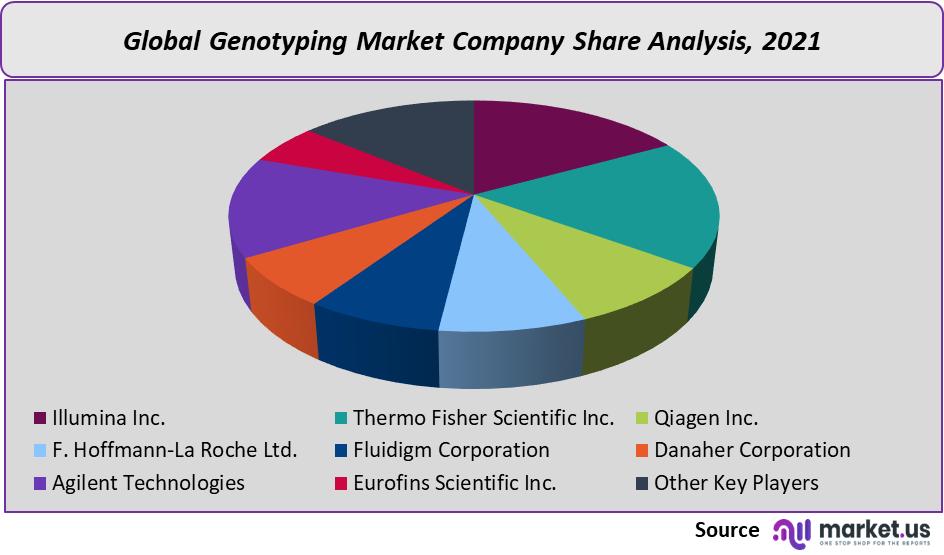

Key Companies & Market share Analysis:

To maintain market share, key players have adopted strategies like partnerships and product launches. Illumina and Roche, for instance, collaborated in January 2020 to increase access to oncology genomic tests. Illumina also invested in seven companies in genomics across different countries under its Illumina Accelerator Program in September 2021.

Key Market Players:

- Illumina Inc.

- Thermo Fisher Scientific Inc.

- Qiagen Inc.

- F. Hoffmann-La Roche Ltd.

- Fluidigm Corporation

- Danaher Corporation

- Agilent Technologies

- Eurofins Scientific Inc.

- Other Key Players

For the Genotyping Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Genotyping market size in year 2021?The Genotyping market size was $12,650 million in 2021.

Q: What is the CAGR for the Genotyping market?The Genotyping market is expected to grow at a CAGR of 15.42% during 2023-2032.

Q: What are the segments covered in the Genotyping market report?Market.US has segmented the Genotyping market by geography (North America, Europe, APAC, South America, and the Middle East and Africa). By Product, the market has been segmented into instruments, reagents & kits, and software & services. By Technology, the market has been further divided into pcr, capillary electrophoresis, microarray, sequencing, mass spectrometry, other technologies. By Application, the market has been further divided into pharmacogenomics, diagnostics and personalized medicine, agricultural biotechnology, animal genetics, and other applications. By End-Use, the market has been further divided into pharmaceutical and biopharmaceutical companies, diagnostics and research laboratories, academic institutes, other end-uses.

Q: Who are the key players in the Genotyping market?Illumina Inc., Thermo Fisher Scientific Inc., Qiagen Inc., F. Hoffmann-La Roche Ltd., Fluidigm Corporation, Danaher Corporation, Agilent Technologies, Eurofins Scientific Inc., and Other Key Players

Q: Which region is more attractive for vendors in the Genotyping market?North America accounted for the highest revenue share of 32% among the other regions. Therefore, North America Genotyping market is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Genotyping ?Key markets for Genotyping are US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc.

Q: Which segment has the largest share in the Genotyping market?In the Genotyping market, vendors should focus on grabbing business opportunities from the reagents & kits product segment as it accounted for the largest market share in the base year.

![Genotyping Market Genotyping Market]()

- Illumina Inc.

- Thermo Fisher Scientific Company Profile

- Qiagen Inc.

- F. Hoffmann-La Roche Ltd.

- Fluidigm Corporation

- Danaher Corporation Company Profile

- Agilent Technologies Inc. Company Profile

- Eurofins Scientific Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |