Global Gluten-Free Products Market By Product (Bakery Products, Desserts & Ice Creams, and Other Products), By Distribution Channel (Convenience Stores, Specialty Stores, Online, and Other Distribution Channels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Mar 2022

- Report ID: 16550

- Number of Pages: 352

- Format:

- keyboard_arrow_up

Gluten-Free Products Market Overview:

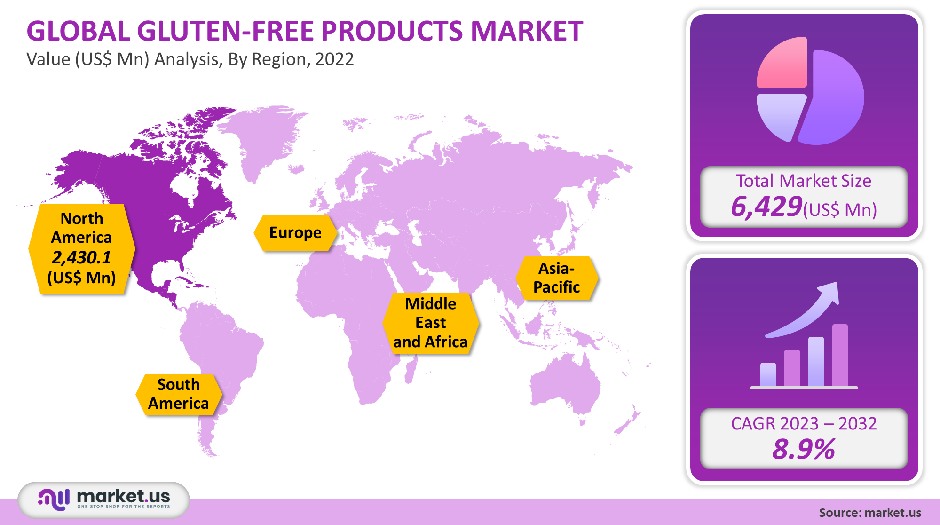

The global gluten-free products market was valued at USD 6,429 million in 2021. It is projected to grow at a compound annual growth rate of 8.9% between 2023 and 2032.

Gluten-free products will be in demand due to the rising incidence of celiac and other conditions resulting from unhealthy lifestyles. This market is expected to grow because of the increased consumption of healthy food products to prevent diseases such as diabetes, heart disease, obesity, chronic lung disease, metabolic syndrome, and other health conditions. Due to the rising health and wellness concerns of consumers, the use of gluten-free products has been impacted by the COVID-19 pandemic.

Global Gluten-Free Products Market Scope:

Product Analysis

In 2021, the bakery products category accounted for nearly 30.2% of the total revenue and will continue to dominate the market over the forecast period. The segment growth is expected to be driven by rising awareness about healthy eating, including organic, natural, and gluten-free. The future growth of the segment will be influenced by factors such as the existence of a broad product portfolio and continuous innovation.

The primary driver of the bakery product segment is the growing demand for gluten-free bread. Packaged bread manufacturers, including the U.K.’s major player Warburton’s, have developed free-from sub-brands for their flagship brands. These are becoming increasingly popular among consumers from all income levels.

A number of bakery startups are now offering gluten-free bread, like Coconut Wraps by NUCO in America. This is a product that is not only gluten-free but also meets all other health criteria such as raw, organic, vegan, and paleo. From 2032 to 2032, the bakery segment will experience the fastest CAGR at 11.7%.

It is expected that the availability of many products at reasonable prices, along with the convenience of ready-to-eat foods, will have a positive effect on the segment’s growth. Additionally, growing awareness about the health benefits of baking products and rapid urbanization will likely drive growth.

Distribution Channel Analysis

In 2021, the market was dominated by hypermarkets and supermarkets. They accounted for 29.6% of that total. It makes it easy to access a wide range of products under one roof. It makes it easy for consumers to select products from a variety of options.

Seasonally driven displays include gluten-free products. This promotes new products and expands the market. It is easier to deal with one large customer base than with many smaller customers. Because supermarkets and hypermarkets can access a large customer base, they have huge sales volumes. A national distribution network allows for greater brand recognition, which in turn leads to higher sales volumes.

The supplier also benefits from a contract with large supermarkets while they seek financial support for product development. These food manufacturers prefer to sell their products through hypermarkets and supermarkets. This leads to greater penetration.

From 2023 to 2032, the online segment will experience a 12.8% CAGR. The benefits of the online channel include shopping at home, delivery to your doorstep, free shipping, and discounts. This channel is attracting the millennial generation and younger generations. Online channels were also crucial for retailers during the COVID-19 pandemic.

Newer delivery methods are also making a difference in the retail sector. Customers and retailers alike prefer click-and-collect (also known as BOPIS or buying online and picking it up in-store) over the curbside pickup. Pickup may be more convenient than home delivery because it allows customers to pick up their items at any time they want, instead of waiting for delivery. These innovations in services will make online shopping more attractive over the forecast period.

Key Market Segments

By Product

- Bakery Products

- Desserts & Ice Creams

- Prepared Foods

- Pasta and Rice

- Other Products

By Distribution Channel

- Convenience Stores

- Specialty Stores

- Online

- Supermarkets & Hypermarkets

- Other Distribution Channels

Market Dynamics:

Irritable Bowel Syndrome (IBS), and celiac disease are on the rise. This will drive demand for gluten-free products in both developed and developing countries. The syndrome makes a person sensitive to gluten, and eating gluten can make the condition worse. These diseases are increasing in North America and Europe, including the U.S. and Canada. This will drive market demand. Many consumers are now embracing the gluten-free diet as a way to improve their health.

Market demand is increasing as more people explore new diets such as the keto or paleo diets. This includes those with existing medical conditions and those who want to live a gluten-free lifestyle. With technological advances, consumers can personalize their shopping experience to meet their nutritional needs.

Retailers have always made it easy for customers to access in-store nutritionists as well as color-coded shelf labels that indicate the nutritional properties of certain products (e.g., gluten-free and heart-healthy). These efforts rely heavily on advanced technology, which allows for more personalization and customization of the customer experience to meet individual nutritional needs. This technology has been a major factor in encouraging customers to eat gluten-free foods.

Gluten-free products are more appealing thanks to technological trends and product innovations. The manufacturing process is also changing with technological advances in order to lower product prices. Extrusion cooking and Annealing are two new manufacturing methods that increase firmness and decrease cooking loss.

The growing number of obese people is driving an increase in demand for gluten-free products. Pulses have replaced wheat in gluten-free products and are now a key ingredient. Manna, Tilda Swasth, and Dr. Gluten are just a few of the companies that offer pulses in gluten-free foods.

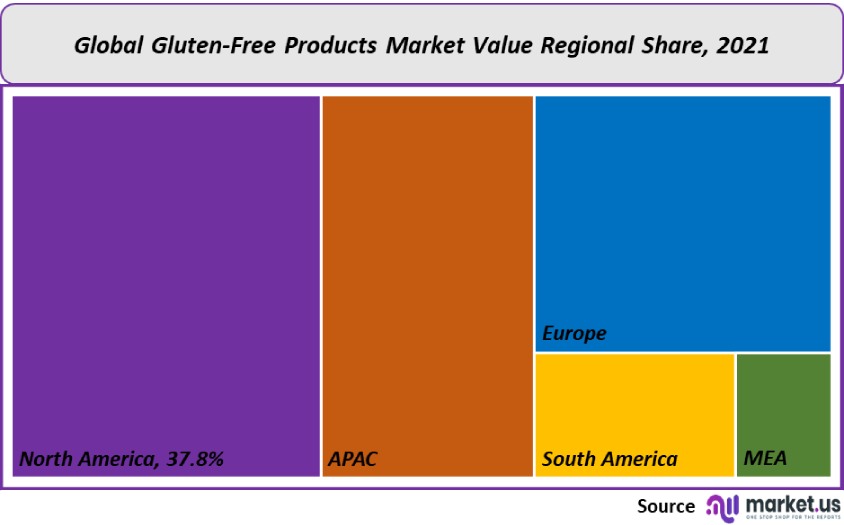

Regional Analysis

North America was the dominant market, accounting for 37.8% of the total revenue in 2021. Gluten-free foods are thought to be healthier for the digestive system, have less cholesterol, and are lower in fat. These factors will increase demand during the forecast period.

Consumption will also be aided by their availability in almost every grocery store, especially in the U.S. With the increasing awareness of the celiac disease, the U.S. market will likely grow. To avoid symptoms, celiac disease patients are now following a gluten-free diet. People who have not been diagnosed with the disease are also following a gluten-free diet to reduce their cardiovascular risk.

Asia Pacific is predicted to record the highest CAGR at 13% between 2023 and 2032. Due to factors like the growing internet penetration, booming online market, and favorable demographics, the regional market conditions look promising. The country’s consumers include those with celiac disease, and gluten intolerance/sensitivity, as well as those who are healthy and need these products for weight control. The region has a huge potential growth opportunity due to its growing consumption of healthy foods and unique marketing strategies used by key manufacturers to gain a significant market share.

A second trend that is emerging in the Asia Pacific is health and wellness tourism. This promotes healthier food choices. To improve their well-being, people are increasingly traveling more. The Global Wellness Institute’s latest research shows that the Asia Pacific is the fastest growing market for wellness tourism, as well as the largest number of spas.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

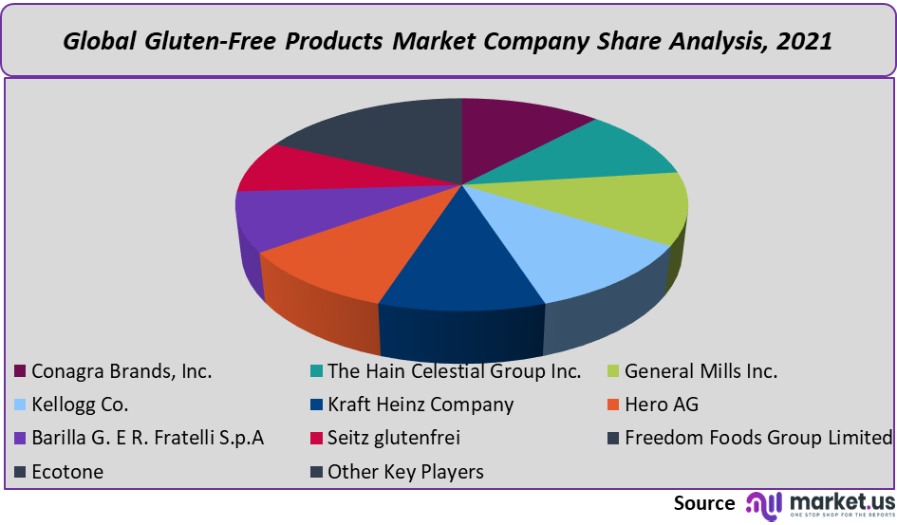

With the presence of many multinational companies from major economies, the market is highly competitive. Most of these companies are vertically integrated to produce gluten-free food. This allows them to have a better product portfolio and launch new brands. The following are some of the major initiatives that the companies have taken:

Маrkеt Кеу Рlауеrѕ:

- Conagra Brands, Inc.

- The Hain Celestial Group Inc.

- General Mills Inc.

- Kellogg Co.

- Kraft Heinz Company

- Hero AG

- Barilla G. E R. Fratelli S.p.A

- Seitz glutenfrei

- Freedom Foods Group Limited

- Ecotone

- Other Key Players

For the Gluten-Free Products Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the gluten-free products market in 2021?A: The Gluten-free products market size is US$ 6,429 million in 2021.

Q: What is the projected CAGR at which the Gluten-free products market is expected to grow at?A: The Gluten-free products market is expected to grow at a CAGR of 8.9% (2023-2032).

Q: List the segments encompassed in this report on the Gluten-free products market?A: Market.US has segmented the Gluten-free products market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, the market has been segmented into Bakery Products, Desserts & Ice Creams, Prepared Foods, Pasta and Rice, and Other Products. By Distribution Channel, the market has been further divided into Convenience Stores, Specialty Stores, Online, Supermarkets & Hypermarkets, Other Distribution Channels.

Q: List the key industry players of the Gluten-free products market?A: Conagra Brands, Inc., The Hain Celestial Group Inc., General Mills Inc., Kellogg Co., Kraft Heinz Company, Hero AG, Barilla G. E R. Fratelli S.p.A, Seitz glutenfrei, Freedom Foods Group Limited, Ecotone, and Other Key Players engaged in the Gluten-Free Products Market.

Q: Which region is more appealing for vendors employed in the Gluten-free products market?A: North America is expected to account for the highest revenue share of 37.8%. Therefore, the Gluten-free products industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Gluten-free products?A: The US, Canada, UK, India, China, Japan, & Germany are key areas of operation for the Gluten-free products Market.

Q: Which segment accounts for the greatest market share in the gluten-free products industry?A: With respect to the Gluten-free products industry, vendors can expect to leverage greater prospective business opportunities through the Bakery Products segment, as this area of interest accounts for the largest market share.

![Gluten-Free Products Market Gluten-Free Products Market]()

- Conagra Brands, Inc.

- The Hain Celestial Group Inc.

- General Mills Inc.

- Kellogg Co.

- Kraft Heinz Company

- Hero AG

- Barilla G. E R. Fratelli S.p.A

- Seitz glutenfrei

- Freedom Foods Group Limited

- Ecotone

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |