Global Green Energy for Bitcoin Market By Type (Solar Power, Wind Power, Hydropower, Geothermal Energy, Other Types), By Application (Bitcoin Mining, Trading, Transaction) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Feb 2022

- Report ID: 84435

- Number of Pages: 202

- Format:

- keyboard_arrow_up

Green Energy for Bitcoin Market Overview:

Green energy is a form of energy generated from natural resources such as sunlight, water, and wind. The main benefit of green energy is its practically limitless accessibility factor.

Cryptocurrency has continued to thrive, requiring an immense amount of electricity, at times more than even some developed countries worldwide. With the cryptocurrency sector rapidly expanding, there are growing concerns about its negative influence on the environment. The first and most popular cryptocurrency, Bitcoin, was designed to be energy-intensive, as it is “mined” by millions of high-powered computers worldwide. Creating Bitcoin to trade consumes around 91 terawatt-hours of electricity annually, which is close to half a percent of all the electricity consumed worldwide.

Notwithstanding, a more significant part of cryptocurrencies are not sustainable and certainly not eco-friendly, considering how much energy is consumed.

According to the Economic Times, a single bitcoin is worth about US$45,000 and needs a dense network and plenty of computing power. If green energy is used to mine bitcoin, this will lead to more electricity being saved while reducing the overall carbon footprint.

Detailed Segmentation:

The global green energy for the bitcoin market is segmented based on its types, applications, and region.

Based on Type:

- Solar Power

- Wind Power

- Hydropower

- Geothermal Energy

- Other Types

Based on Application:

- Bitcoin Mining

- Trading

- Transaction

Based on Regions:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Market Dynamics:

All around the globe, Bitcoin miners compete with each other to be the ones to approve transactions and enter them into public records. They play a speculating game utilizing powerful PCs to attempt to prevail over others. That’s because they get luxuriously compensated with each newly-made Bitcoin. These bitcoin miners have distribution centers loaded with powerful computers, racing at maximum speed to figure out huge numbers and utilizing tremendous amounts of energy. This factor may create numerous opportunities among this market’s key players. However, the transition to renewable energy for bitcoin mining will not solve the e-waste issue. It has been estimated that bitcoin networks generate 11.5 kilotons of e-waste yearly. In addition, the COVID-19 pandemic has affected the global economy, with planned maintenance schedules becoming a significant issue for industry players, owing to a reduced labor force and the imposition of stringent social distancing norms. Furthermore, project delays and the cancellation of orders have also negatively affected key markets for blade production and wind turbine installations. This factor may affect the economic growth of this target market in the foreseeable future.

Large power plants like Greenridge consume around 139 million gallons of freshwater. It discharges around 30-50°F water, which is hotter than the lake’s average temperature. This factor may create lucrative opportunities for key players in this market. Climate changes can endanger wildlife and ecology, while large intake pipes can suck and kill fish, larvae, and other wildlife in the vicinity. This environmental issue can be solved with the adoption of green energy.

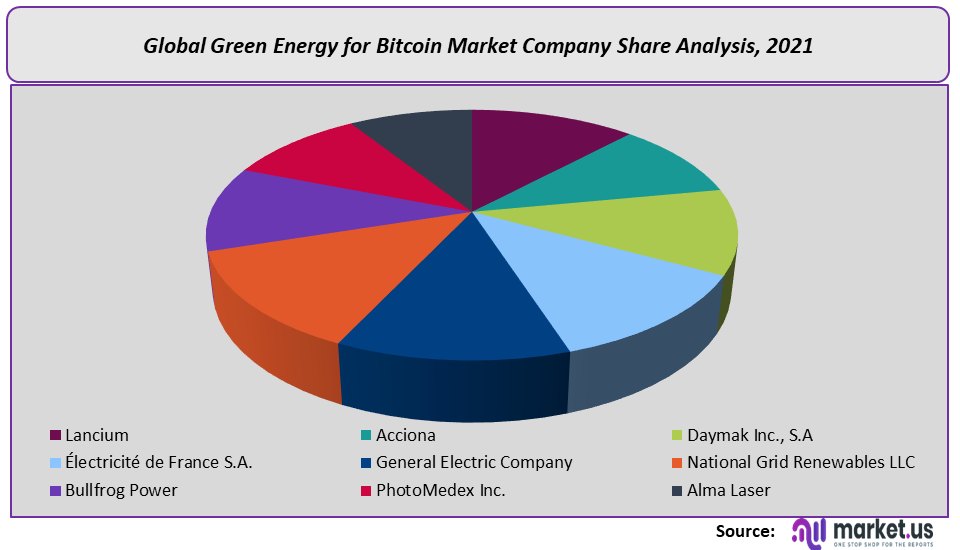

Competitive Landscape:

The global green energy for bitcoin market is relatively competitive, with the presence of a moderate number of local and international manufacturers such as

- Lancium

- Acciona

- Daymak Inc., S.A

- Électricité de France S.A.

- General Electric Company

- National Grid Renewables LLC

- Bullfrog Power, other key players.

Key Development:

- Houston-based tech company Lancium is spending US$150 million to build bitcoin mines across Texas that will run on renewable energy.

- Daymak to Launch CryptoSolarTree, the world’s first emission-free crypto mining solution, using the most versatile green-energy system

For the Green Energy for Bitcoin Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

![Green Energy for Bitcoin Market Green Energy for Bitcoin Market]() Green Energy for Bitcoin MarketPublished date: Feb 2022add_shopping_cartBuy Now get_appDownload Sample

Green Energy for Bitcoin MarketPublished date: Feb 2022add_shopping_cartBuy Now get_appDownload Sample - Lancium

- Acciona

- Daymak Inc., S.A

- Électricité de France S.A.

- General Electric Company

- National Grid Renewables LLC

- Bullfrog Power, other key players.

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |