Global Grow Light Market By Type, By Application, By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 46765

- Number of Pages: 239

- Format:

- keyboard_arrow_up

Grow Light Market Overview:

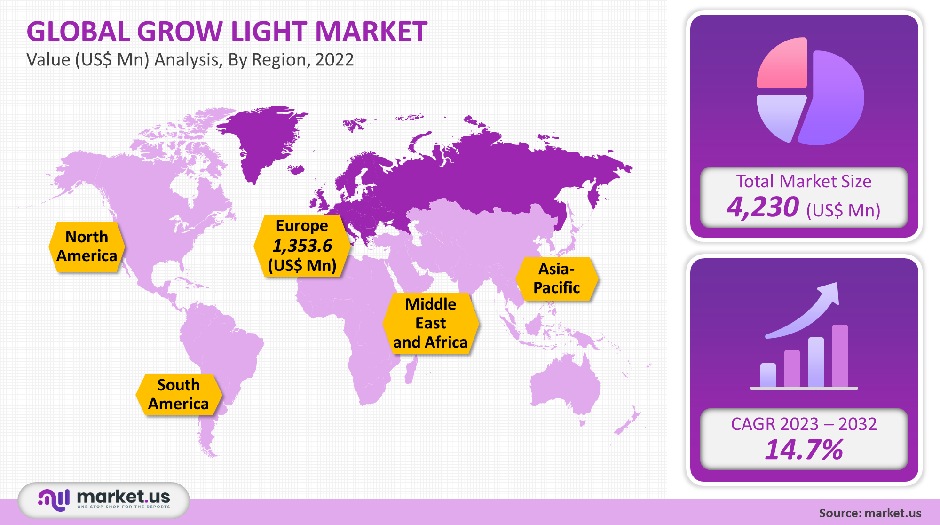

The Grow Light Market size is expected to be worth around USD 18.99 billion by 2032 from USD 4.2 billion in 2021, growing at a CAGR of 14.7% during the forecast period 2022 to 2032.

The market is growing due to the increasing use of vertical farming, urban cultivation, and the adoption of environmentally-friendly fruits and vegetables.

The urban agriculture sector has seen a surge in demand due to unprecedented global population growth. Vertical farming, which involves the production of food in vertically stacked layers such as a warehouse, skyscraper, or shipping container, is driving the market growth.

Global Grow Light Market Scope:

Covid-19 Impact Analysis

The market for grow lights has been negatively affected by the COVID-19 pandemic. Market conditions were adversely affected by the pandemic, the subsequent lockdowns in place by various governments, and severe travel restrictions. Supply chain disruptions had an impact on the availability of raw materials as well as the distribution of the final product.

There was also a marked drop in demand for grow lights compared to levels before COVID. The market began to recover once the restrictions were lifted. Students were more interested in gardening due to the long stay at the home of work-from-home professionals and students.

Many home gardeners have adopted vertical farming techniques and indoor farming, such as hydroponics. After lifting restrictions, the demand for grow lights began to pick up and it was soon stabilized. The supply of grow lights was also restored as normal supply chains began to be established and regular shipments were made.

Product Type Analysis

The industry can be divided into two groups based on its product: 300 Watt. With a market share greater than 64%, the 300 Watt segment was the most profitable in the industry in terms of revenue in 2021.

It is expected to continue its dominance over the forecast period. Technological advancements in energy efficiency and conservation are responsible for the industry’s growth.

The segment with a 300 Watt is expected to see the greatest CAGR over the forecast period. Low-power growth lights (300 Watt) are more efficient than high-power lights. Low power grow lights produce less heat and can last for longer periods of time without causing damage to plants.

Higher wattage can cause plants to wilt, brown, or die.This is why the segment of >300 Watts will likely hold a smaller market share than other segments. Some growers make use of it to increase their yields by adding more nutrients to counteract the high wattage. Grow lights are more expensive but offer a quicker way to grow indoor plants.

These lights are used primarily in the horticulture industry to produce a faster harvest. Commercial greenhouses also use high-wattage grow lights. To maintain temperature, grow lights with a power rating of >300 watts may need to be cooled. This adds to energy costs.

System Analysis

The hardware segment will continue to be dominant during the forecast period. The hardware segment covers various types of grow lights such as LEDs and plasma lights, high-intensity discharge (HID), lights, ballasts, and more. The fastest growth rate is expected for the software segment over the forecast period.

Software segment of the grow light market contains Controlled-Environment Agriculture (CEA) to control various environmental factors such as humidity, temperature, water, and light. Grow lights can be equipped with software solutions to enhance plant quality. Each plant has its own requirements in terms of optimal lighting duration and intensity.

This can optimize the indoor plant’s production output. The best way to maximize the use of grow lights is to design specialized software that meets the needs of each plant. There are many companies that offer software services, such as the repair and maintenance of grow lights.

Technology Analysis

The technology classifications of the industry are High Intensity (HID), LED, and Fluorescent. HID is primarily used in commercial farming, such as vertical farms and commercial greenhouses. The LED segment will dominate the market over the forecast period.

The LED segment will be driven by increasing urban cultivation and government initiatives to use energy-efficient LEDs.

The most efficient LED lamps can be found at a higher cost point. LEDs produce the exact wavelength of light desired. It can simultaneously produce both red and blue spectrums. All growth stages can use LEDs. While LEDs can be more costly in the initial stages, they become less expensive over time.

The highest expected CAGR for the plasma segment will be seen during the forecast period. Plasma lights emit full-spectrum light that is similar to sunlight. These lights are more durable and produce less heat. Plasma lights consume less energy than other types of lighting technology, even though they produce light with similar intensity to HID and LED.

Although plasma lights are expensive initially, they become less expensive over time. Both vegetative growth and flowering can be made easier by plasma lights.

Spectrum Analysis

A partial spectrum grows lights in a particular spectrum, such as yellow, green, or blue. These light spectrums can be used at different stages of plant growth.

They are designed to target specific stages of plant development and can significantly reduce growth time and increase yields. For the vegetative stage, blue and red wavelengths are most favorable. However, for flowering, far-red and far-red wavelengths encourage a better indoor plant growth rate.

The full spectrum segment will dominate the forecast period. It is expected to grow at an even higher CAGR than the partial spectrum. Full-spectrum light is light that reaches all wavelengths from 400 nm up to 700 nm. This is called Photosynthetic Active Radiation, (PAR).

Full-spectrum light can be used for dual purposes. It can also provide lighting for plants and space. This light can be used to help growers reduce or eliminate additional sources of light from their growing spaces.

Application Analysis

The industry can be divided into three types based on the applications: indoor farming, vertical agriculture, commercial greenhouse, and others. The commercial greenhouse segment was the most profitable in terms of revenue. This is due to technological advances and increased use of grow lights. The fastest-growing segment of vertical farming is expected to be during the forecast period.

Over the forecast period, factors such as technological advances in grow lights and increased penetration of indoor and vertical farming will drive the application segment. Vertical farming is well-accepted in countries such as Japan, China, and the Netherlands.

Vertical farming allows for the production of herbs, medicine, and food in vertically stacked layers that are then integrated into a warehouse, skyscraper, or shipping container. Vertical farms can also use grow lights and metal reflectors to improve the sunlight.

Due to space constraints, multiple vertical farms have been established in major cities across Japan and China. Vertical farming is a growing sector that big companies like Toshiba and Panasonic are investing heavily. This will be a major factor in the growth of the grow light market.

Кеу Маrkеt Ѕеgmеntѕ

By Product

- < 300 Watt

- 300 Watt

By System

- Hardware

- Software

By Technology

- High-Intensity Discharge (HID)

- LED

- Fluorescent

- Plasma

By Installation

- New Installation

- Retrofit

By Spectrum

- Partial Spectrum

- Full Spectrum

By Application

- Indoor Farming

- Vertical Farming

- Commercial Greenhouse

- Other applications

Grow Light Market Dynamics

The increase in daylight hours can help to improve the plant’s health, growth, and yield. Artificial lighting such as high-pressure sodium lighting, LED light, and plasma lighting can increase the availability of crops (throughout a given season).

Indoor farming is able to produce crops all year long, unlike traditional farming. This results in higher productivity.

Indoor farming is able to protect crops from severe weather conditions by using techniques like controlled environment agriculture technology. This involves artificial environmental control, control over light, and fertigation.

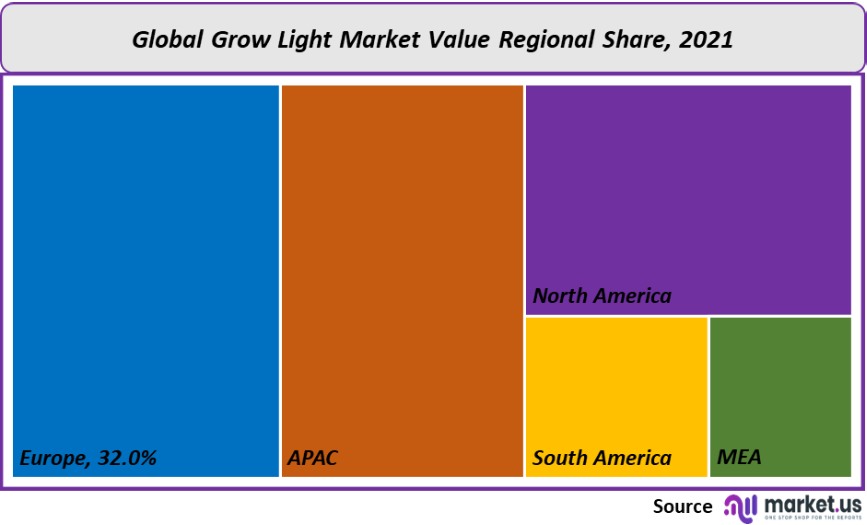

Grow Light Market Regional Analysis

The Europe region was the market leader in revenue in 2021, with a market share greater than 32%. It is expected to continue its dominance over the forecast period. The key factors expected to drive industry demand are growing awareness about the importance of alternative farming and the decreasing availability of fertile land.

The growing use of genetically modified crop technology is expected to drive significant growth in the Asia Pacific region market over the forecast period.

Many countries in the region are switching to energy-efficient LED lighting to lower their energy consumption. The replacement of traditional incandescent bulbs with LEDs could help reduce greenhouse gas emissions.

The African region’s demand is expected to grow due to growing urban populations and the commercialization of indoor agriculture.

The region’s growth will be impeded by limited financial resources and access to water and land. Vertically stacked wooden boxes and sack gardens are two examples of models that have been used in Africa to overcome these challenges.

Кеу Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

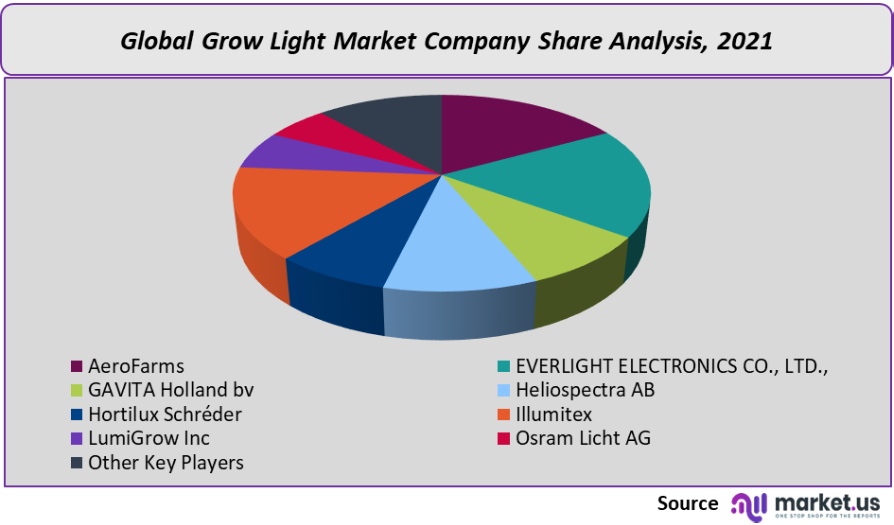

Key Companies & Market share Insights:

To increase their market share, the key market players use strategies like partnerships and new product development. To strengthen their market position, companies also acquire businesses of competitors.

Signify Holding B.V., for example, announced in December 2021 that it had reached an agreement to purchase Fluence, Osram’s agriculture lighting division, to increase its agricultural lighting business. This acquisition has also helped to strengthen the company’s position in North American horticulture lighting markets.

Кеу Маrkеt Рlауеrѕ іnсludеd іn thе rероrt:

- AeroFarms

- EVERLIGHT ELECTRONICS CO. LTD.,

- GAVITA Holland bv

- Heliospectra AB

- Hortilux Schréder

- OSRAM GmbH

- Savant Systems Inc.

- Illumitex

- LumiGrow Inc

- Osram Licht AG

- Other Key Players

For the Grow Light Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the Grow Light market size in year 2021?The Grow Light market size was $4,230 million in 2021.

What is the CAGR for the Grow Light market?The Grow Light market is expected to grow at a CAGR of 14.7% during 2023-2032.

What are the segments covered in the Grow Light market report?Market.US has segmented the Grow Light market by geography (North America, Europe, APAC, South America, and the Middle East and Africa). By Application, the market has been segmented into indoor farming, vertical farming, commercial greenhouse, and other applications. By product, the market has been further divided into < 300 Watt, and 300 Watt. By system, the market is further divided into hardware and software. By technology, the market is segmented into high-intensity discharge (hid), le, fluorescent, and plasma. By installation, the market is divided into new installation and retrofit. By Spectrum, the market is further divided into a partial spectrum and full spectrum.

Who are the key players in the Grow Light market?AeroFarms, everlight electronics co. LTD., Lumigrow, Inc., Illumitex Inc., Bridgelux, Inc., Gavita Holland bv, Heliospectra AB, Hortilux Schréder, Illumitex, LumiGrow Inc, Gavita International B.V., Bridgelux Inc., Black Dog Grow Technologies Inc., Samsung Electronics Co. Ltd., Royal Philips Electronics N.V., Epistar Corporation, Osram Licht AG, and Other Key Players

Which region is more attractive for vendors in the Grow Light market?Europe accounted for the largest revenue of 32% among the others. Therefore, the Europe Grow Light market is expected to garner significant business opportunities for the vendors during the forecast period.

What are the key markets for Grow Light?Key markets for Grow Light are the US, China, Japan, India, Brazil, Germany, the UK, France, Italy, Spain, etc.

Which segment has the largest share in the Grow Light market?In the Grow Light market, vendors should focus on grabbing business opportunities from the hardware system segment as it accounted for the largest market share in the base year.

![Grow Light Market Grow Light Market]()

- AeroFarms

- EVERLIGHT ELECTRONICS CO. LTD.,

- GAVITA Holland bv

- Heliospectra AB

- Hortilux Schréder

- OSRAM GmbH

- Savant Systems Inc.

- Illumitex

- LumiGrow Inc

- Osram Licht AG

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |