Global Halal Food and Beverage Market By Product (Milk & Milk Products, Meat & Alternatives, Grain Products, Fruits & Vegetables, and Other Products), By Distribution channel (Hypermarket & Supermarket, Online, Departmental Store, and Other Distribution Channel), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Dec 2021

- Report ID: 67855

- Number of Pages: 229

- Format:

- keyboard_arrow_up

Halal Foods and Beverages Market Overview:

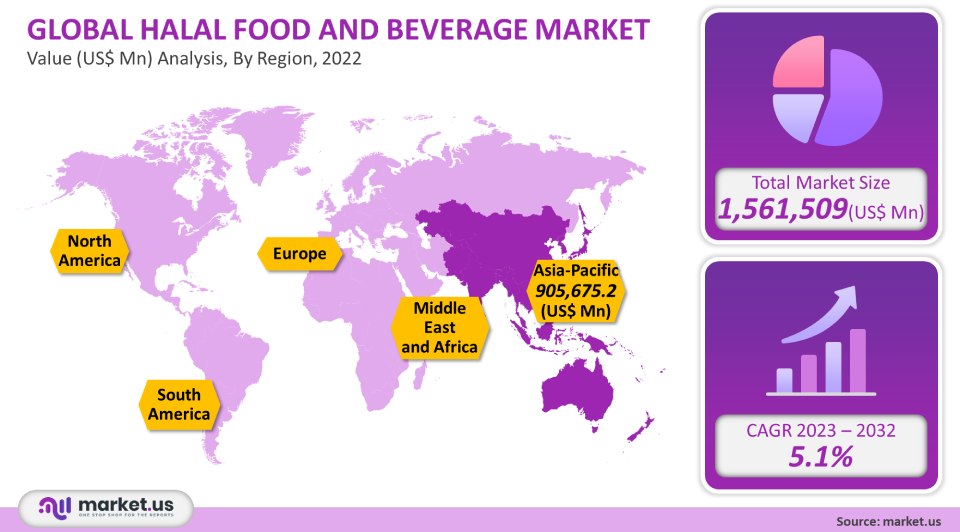

Global Halal Food and Beverage markets were valued at USD 1,561,509 million in 2021. They are expected to experience a CAGR of 5.1% between 2023 and 2032.

Market growth will be driven by an increasing Muslim population and increased concern over food safety, reliability, hygiene, and quality. According to Pew Research April 2019 article, there are approximately 1,800 million Muslims in the world. Due to increasing demand, manufacturers have increased their product offerings by adding halal food items such as pasta, vegetable, and milk. The market’s key players will produce halal-certified food products to increase consumer visibility.

Halal Food and Beverage Market Analysis:

Product Analysis

The largest market share was held by meat & alternatives at 53% in 2021. This position is expected to remain strong during the forecast period. Due to safety, hygiene, and health concerns, there will be a growing demand for products that are bacteria-free. The National Library of Medicine reports that 51% of people eat meat only once a week. 47% eat meat every day, 4% once per month, and 0.2% eat meat just occasionally. The growth of this market is also influenced by respect for animals and acculturation.

Grain products are expected to grow at the fastest rate during the forecast period, with a 7.3% CAGR from 2023 to 2032. Due to their nutritional advantages, cereals or grain products have been gaining popularity. These products include cereals such as wheat, rice, and pasta. A Multidisciplinary Digital Publishing Institute article (MDPI), states that in February 2021, 20% of halal-certified grains were consumed by buyers around the globe. Many market leaders are adopting halal as a marketing concept. Kellogg’s cereals include the halal symbol on their packages to attract more customers who prefer health benefits products, particularly in the Muslim community.

Distribution Channel Analysis

The hypermarket & supermarket segment held a significant revenue share in 2021. This has led to a significant increase in the supply of halal food at these stores in different regions. Taylor & Francis Online reported that 20% of Norwegian consumers come from large, educated families. 15% are from small, educated families. 7% of Norway’s young residents would prefer to shop at the national supermarkets. These stores also offer the convenience of verifying that halal-certified products are in stock.

With a CAGR between 2023 and 2032 of 7.5%, the online distribution channel will experience faster growth. The segment’s growth will be boosted by the rapid digital transformation caused by non-Muslim and Muslim consumers who are looking for tasty, convenient, healthy, and affordable meals that can all be delivered to their homes. Kitopi, a Dubai cloud kitchen, has raised US$ 65 million in Series B funding in February 2021. It also raised US$ 430 million in Series C funding for July 2021. These funds will allow Kitopi to expand its operations in the Middle East and reach the Southeast Asian markets. The growing trend in this market will be supported by a further increase in home deliveries during COVID-19.Key Market Segments:

By Product

- Milk & Milk Products

- Meat & Alternatives

- Grain Products

- Fruits & Vegetables

- Other Products

By Distribution channel

- Hypermarket & Supermarket

- Online

- Departmental Store

- Other Distribution Channel

Market Dynamics:

The rapid spread and disruption of COVID-19 in the food and drink industry, including the Halal food industry, caused disruptions to the food supply chain. Leading global manufacturers saw a reduction in labor and disruption in the import and export of Halal Food. This significantly affected their sales and consumption. In addition, the pandemic caused a slowdown in the demand for meat products. Bloomberg published an article in July 2021 stating that sales of meat in grocery stores decreased by more than 10% when compared with the year prior to the pandemic. However, the market will be boosted by the growing demand for healthy and safe foods over the forecast period.

The market is expected to grow from 2023 to 2032 due to rising demand for vegan food & beverages and product introductions by Halal manufacturers to these conscious consumers. The changing perceptions of suffering and animal slaughter are driving key market players to launch vegan products. AI Islami Foods launched a plant-based burger in January 2021. The product is made using a mixture of fava beans, sunflower proteins, and peas from an organic. The market is growing and the demand for vegan food has prompted the initiative.

Asia Pacific’s fastest-growing religion is Islam. This will impact the demand in the region for halal products. China Highlights reported that China has almost 27 million Muslims. These Muslims are spread in small groups and are concentrated in China, where Islam is the main community. This market is expected to grow due to the increasing awareness of Muslims regarding the need to eat non-haram food because of their religious convictions. Market leaders are adopting a range of marketing strategies to increase their market share, including product innovation, product line expansion, and acquisition. Kimly, a coffee businessman, purchased a 77% stake at Tenderfresh, a food company for US$ 56 million in May 2021. This strategy was changed to increase the sector in Singapore and neighboring countries. It will be available in restaurants, food stalls, and kiosks throughout the country.

In recent years, Halal cuisine has gained popularity among Muslim and non-Muslim customers. It has gone from being a religious identity to a guarantee of hygiene, food safety, and reliability. According to a report in the United States Department of Agriculture (US$A), Indonesia’s April 2021 legislation required halal labeling. These laws have led to more people choosing these foods. To meet increased demand, manufacturers have expanded their product lines by creating value-added products.

Regional Analysis:

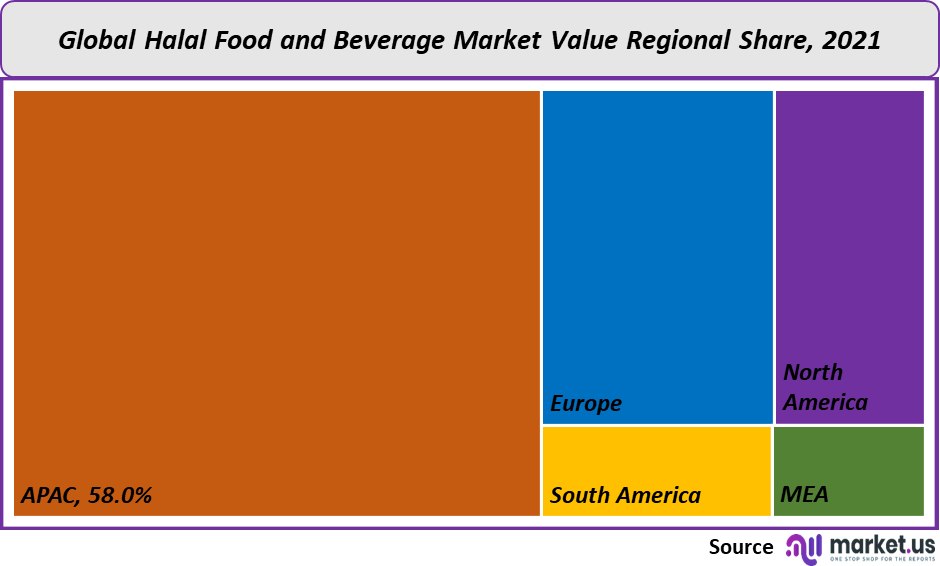

The Asia Pacific contributed 58% to the global marketplace in 2021. One of the key factors behind the significant rise in the Muslim population in Asia-Pacific is the migration from Muslim-dominated regions to other areas. As Muslims have become more numerous, so has the demand for these kinds of foods. This trend will likely continue in the forecast period, driving the market here. The market will be driven by two main factors: the rapidly expanding Muslim population and their psychological growth.

Europe is the second-fastest-growing market and is expected to witness a CAGR of 7.4% from 2023 to 2032. The region’s growing demand for certified products is helping to boost the market. O’Tacos is a fast food chain in France that announced the launch of halal-certified French-style beef and vegetable wraps. Italy has approximately 550 small-to large-sized manufacturers that are certified halal. This trend and the introduction of newly certified products are expected to lead to an increase in market growth.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

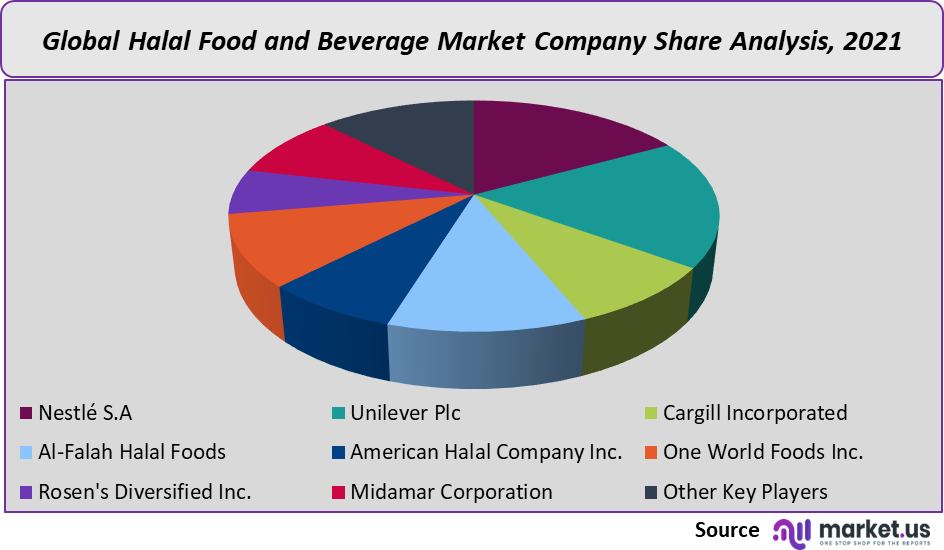

Due to the presence of numerous regional and local players in the halal food & beverages market, it is very fragmented. To remain competitive, companies have employed various expansion strategies like partnerships and product launches. Crescent Foods, a pioneer in American premium hand-cut chicken and halal meats, launched an all-inclusive foodservice program for colleges and universities in August 2021. The company will offer a wide variety of products such as hand-cut beef and lamb, turkey, and chicken products for campus dining, including restaurants.

Маrkеt Кеу Рlауеrѕ:

- Nestlé S.A

- Unilever Plc

- Cargill Incorporated

- Al-Falah Halal Foods

- American Halal Company Inc.

- One World Foods Inc.

- Rosen’s Diversified Inc.

- Midamar Corporation

- Other Key Players

For the Halal Foods and Beverages Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Halal Food and Beverage market in 2021?The Halal Food and Beverage market size is US$ 1,561,509 million in 2021.

What is the projected CAGR at which the Halal Food and Beverage market is expected to grow at?The Halal Food and Beverage market is expected to grow at a CAGR of 5.1% (2023-2032).

List the segments encompassed in this report on the Halal Food and Beverage market?Market.US has segmented the Halal Food and Beverage market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, the market has been segmented into Milk & Milk Products, Meat & Alternatives, Grain Products, Fruits & Vegetables, and Other Products. By Distribution Channel, the market has been further divided into Hypermarket & Supermarket, Online, Departmental Store, and Other Distribution Channel.

List the key industry players of the Halal Food and Beverage market?Nestlé S.A, Unilever Plc, Cargill Incorporated, Al-Falah Halal Foods, American Halal Company Inc., One World Foods Inc., Rosen's Diversified Inc., Midamar Corporation, and Other Key Players are engaged in the Halal Food and Beverage market

Which region is more appealing for vendors employed in the Halal Food and Beverage market?APAC is expected to account for the highest revenue share of 58%. Therefore, the Halal Food and Beverage industry in APAC is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Halal Food and Beverage?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Halal Food and Beverage Market.

Which segment accounts for the greatest market share in the Halal Food and Beverage industry?With respect to the Halal Food and Beverage industry, vendors can expect to leverage greater prospective business opportunities through the Meat & Alternatives segment, as this area of interest accounts for the largest market share.

![Halal Foods and Beverages Market Halal Foods and Beverages Market]() Halal Foods and Beverages MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample

Halal Foods and Beverages MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample - Nestlé S.A Company Profile

- Unilever Plc Company Profile

- Cargill Incorporated

- Al-Falah Halal Foods

- American Halal Company Inc.

- One World Foods Inc.

- Rosen's Diversified Inc.

- Midamar Corporation

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |