Global Healthcare Analytical Testing Services Market By Service Type (Physical Characterization Services, Method Development And Others), By End User, By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2020-2027

- Published date: Sep 2021

- Report ID: 42962

- Number of Pages: 315

- Format:

- keyboard_arrow_up

Healthcare Analytical Testing Services Market Overview

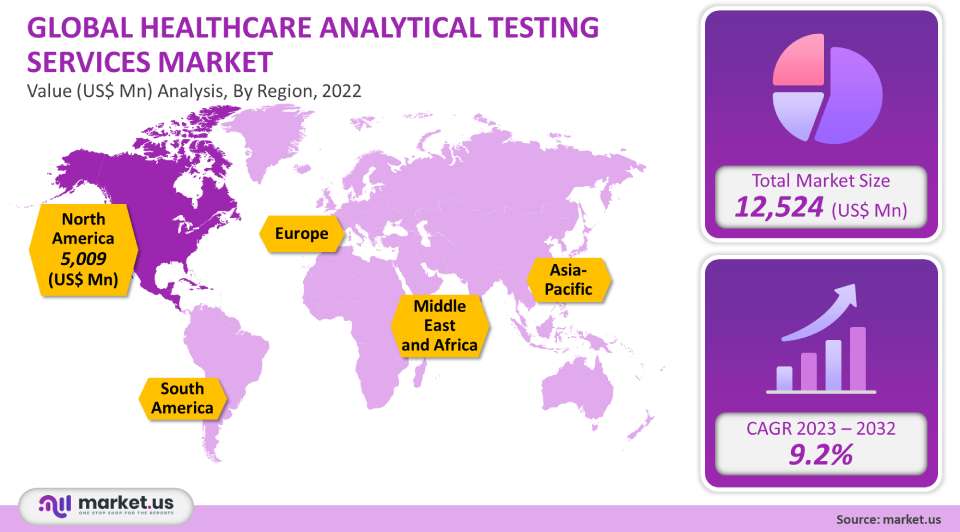

The healthcare global market for Analytical Testing Services was valued at US$ 12.524 Billion in 2021. This market is expected to grow at 9.2% CAGR during the forecast period. Global market growth is expected to be driven by the following key factors: an increase in analytical testing services outsourcing by biotech and pharmaceutical firms, an increase in the number of clinical trials, and a focus on biosimilar. Biosimilar offers a lower-cost treatment option than biologicals. Therefore, pharmaceutical companies have increased their investment in developing and approving biosimilars.

Global Healthcare Analytical Testing Services Market Analysis

Product Type Analysis

The market was led by the pharmaceutical product type, which held the largest share of revenue at 60% for 2021. According to product type, there are two main segments in the market: medical devices and pharmaceutical analytical testing services. Pharma companies outsource most of their analytical testing services because it involves skilled staff and specialized equipment. Emergent Bio Solutions entered into an agreement with AstraZeneca to develop a COVID-19 vaccine candidate. It was expected to provide AstraZeneca analytical testing services. Because of the increasing regulatory pressure for medical devices to be chemically analyzed, the segment of medical device products is expected to grow at a faster rate of 10% over the forecast period. Analytical testing labs will be able to reap the benefits of the combination of digital technology and biochemical testing.

End-User Analysis

According to the end user, the healthcare analytical testing services market can be divided into medical device companies, pharmaceutical and biopharmaceutical companies, and contract research organizations (CROs). These companies are increasingly outsourcing analytical testing services to improve profit margins and reduce capital expenditure. They also want to focus on their core competencies.

Key Market Segments

- By Product Type

- Medical Device

- Material Characterization

Extractable & Leachable

Sterility

Physical

- Other Tests

- Pharmaceutical

- Stability

Method Development & Validation

Bioanalytical

Other Services

- By End-User

Contract Research Organizations

Pharmaceutical & Biopharmaceutical Companies

Medical Device Companies

Market Dynamics

Pfizer is the dominant biosimilar player in the United States, which supports market growth. Due to rising cases of chronic diseases, biosimilar demand is expected to rise. Analytical testing is used in biosimilar development to determine the physicochemical characteristics to determine the sameness of the biosimilar to its reference molecule. Healthcare analytical testing services will also be in demand over the forecast period. The complexity of medical and pharmaceutical devices has increased. The demand for analytical testing of medical devices, and combination drugs, is increasing. These products are complex and require sophisticated instrumentation. These companies outsource such services to pharmaceutical and medical device manufacturers.

Due to the availability of high-quality data and low costs, many pharmaceutical companies are turning to service providers from emerging countries like India. Veeda Medical Research is an Indian CRO that offers bioanalytical services to international pharma firms. In February 2021, the company entered into a partnership agreement with Somru BioScience Inc. which opened a bioanalytical lab in Ahmedabad.

In addition, there has been a rapid increase in international pharma companies developing therapeutic drugs & vaccines to treat COVID-19. These companies are increasingly outsourcing their analytical testing. SGS and AstraZeneca signed an analytical testing service agreement. This was to support AZD1222, a COVID-19-based vaccine candidate. SGS will carry out analytical testing for vaccine production in its Belgium-based lab under the terms of this agreement.

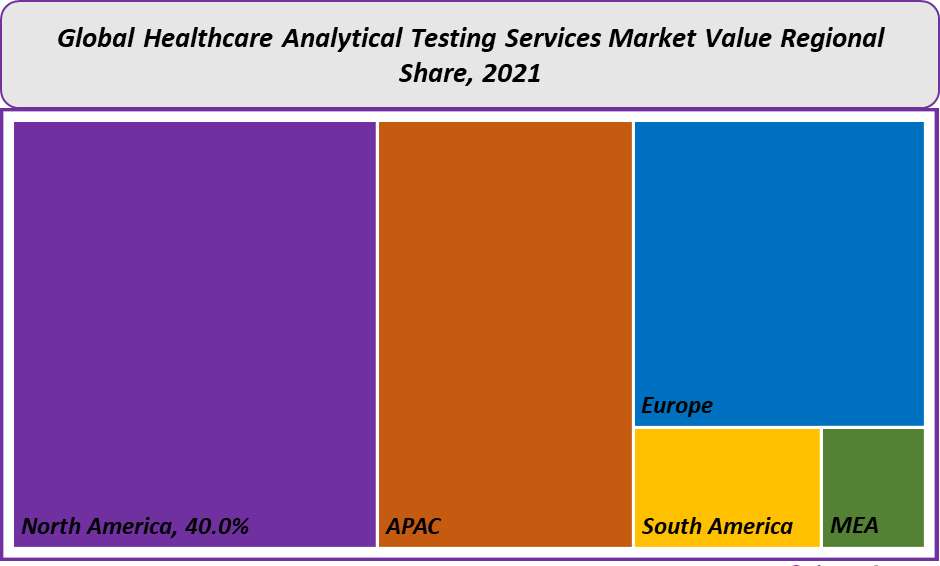

Regional Analysis

North America had a 40% revenue share in 2021. This is due to the U.S. being the home of the world’s largest market for clinical trial products. ClinicalTrials.gov data shows that more than 28% of all registry studies are in the U.S. Due to the high number of registered clinical trials, the demand for analytical testing is expected to rise. Major pharmaceutical companies are located in the country, and they do extensive R&D with a focus on biosimilar. Pfizer Inc. occupies a top position at the global level as a biosimilar firm. The company actively participates in the development and approval of biosimilars. These require analytic testing.

The Asia Pacific is expected to experience the fastest growth rate between 2023 and 2032, due to the rapid expansion of the Indian biosimilar market. Over 95 biosimilars have been approved in this country. There is also a strong biosimilar pipeline, with 40 biosimilars still in clinical development. Indian officials are expected to increase market growth by offering subsidies to biosimilar manufacturers.

Key Regions and Countries covered in thе rероrt:

North America

US

Canada

Mexico

Europe

Germany

UK

France

Italy

Russia

Spain

Rest of Europe

APAC

China

Japan

South Korea

India

Rest of Asia-Pacific

South America

Brazil

Argentina

Rest of South America

MEA

GCC

South Africa

Israel

Rest of MEA

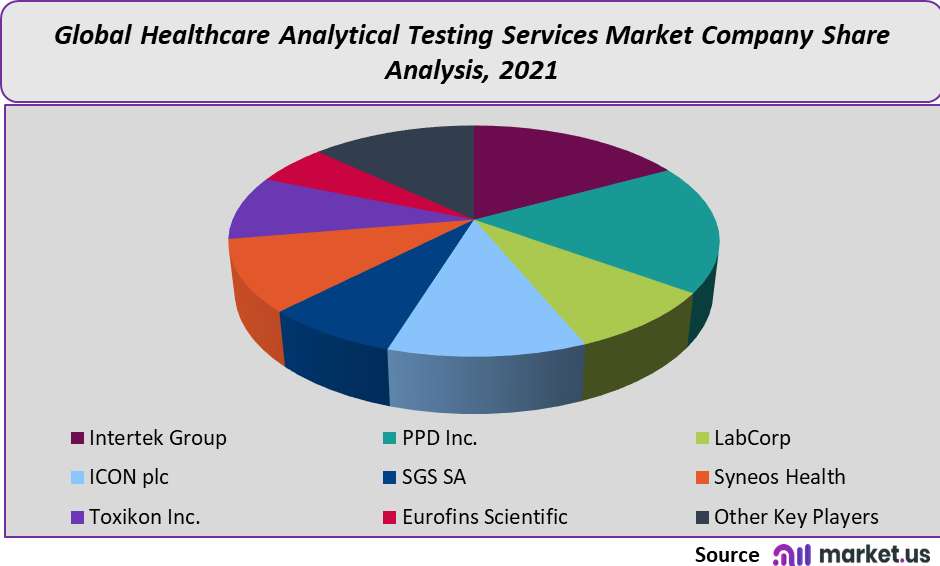

Market Share & Key Players Analysis:

The major market players have a number of strategic priorities. These include collaborations, expansions to their service portfolio, and mergers & Acquisitions. In order to improve their market position, many companies provide various services such as laboratory validations and other solutions. LabCorp’s drug-development business, Covance, launched preclinical to clinical and post-approval gene and cell therapy development solutions.

Pfizer Inc. and PPD Inc. entered into a three-year agreement to provide services to advance Pfizer’s drug portfolio. Pfizer expects PPD to support its drug development efforts in multiple therapeutic areas by providing clinical development and laboratory support.

Маrkеt Кеу Рlауеrѕ:

- Intertek Group

PPD Inc.

LabCorp

ICON plc

SGS SA

Syneos Health

Toxikon Inc.

Eurofins Scientific

Other Key Players

For the Healthcare Analytical Testing Services Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

12.524 Billion

Growth Rate

9.2%

Forecast Value in 2032

36.009 Billion

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Healthcare Analytical Testing Services Market in 2021?The Healthcare Analytical Testing Services Market size is US$ 12,524 million in 2021.

What is the projected CAGR at which the Healthcare Analytical Testing Services Market is expected to grow at?The Healthcare Analytical Testing Services Market is expected to grow at a CAGR of 9.2% (2023-2032).

List the segments encompassed in this report on the Healthcare Analytical Testing Services Market?Market.US has segmented the Healthcare Analytical Testing Services Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, the market has been further divided into Medical Devices and Pharmaceutical. By End-User, the market has been further divided into Contract Research Organizations, Pharmaceutical & Biopharmaceutical Companies, and Medical Device Companies.

List the key industry players of the Healthcare Analytical Testing Services Market?Intertek Group, PPD Inc., LabCorp, ICON plc, SGS SA, Syneos Health, Toxikon Inc., Eurofins Scientific, and Other Key Players are engaged in the Healthcare Analytical Testing Services market

Which region is more appealing for vendors employed in the Healthcare Analytical Testing Services Market?North America is expected to account for the highest revenue share of 40%. Therefore, the Healthcare Analytical Testing Services industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Healthcare Analytical Testing Services?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Healthcare Analytical Testing Services Market.

Which segment accounts for the greatest market share in the Healthcare Analytical Testing Services industry?With respect to the Healthcare Analytical Testing Services industry, vendors can expect to leverage greater prospective business opportunities through the pharmaceutical segment, as this area of interest accounts for the largest market share.

![Healthcare Analytical Testing Services Market Healthcare Analytical Testing Services Market]() Healthcare Analytical Testing Services MarketPublished date: Sep 2021add_shopping_cartBuy Now get_appDownload Sample

Healthcare Analytical Testing Services MarketPublished date: Sep 2021add_shopping_cartBuy Now get_appDownload Sample - Intertek Group

- PPD Inc.

- LabCorp

- ICON plc

- SGS SA

- Syneos Health

- Toxikon Inc.

- Eurofins Scientific

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |