Global High Performance Polyamides Market By Type (PA 6, PA 66, PA 11), By Application (Transportation, Electrical & Electronics), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2020-2029

- Published date: Jul 2022

- Report ID: 57575

- Number of Pages: 347

- Format:

- keyboard_arrow_up

High-Performance Polyamides Market Overview

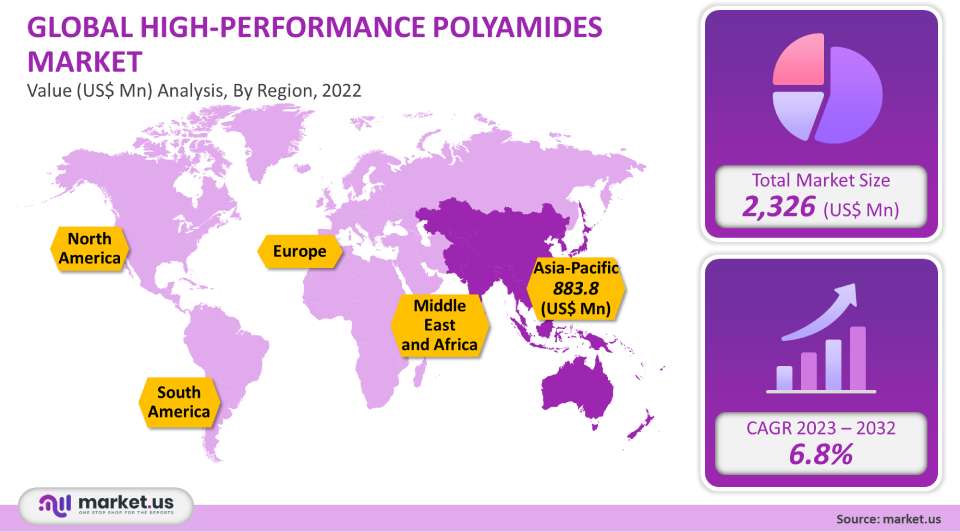

The global market for High-Performance Polyamides was valued at US$ 2.326 Billion in 2021. It is estimated to grow at a 6.8% CAGR, between 2023-2032. High-performance polyamide is a type of synthetic thermoplastic resin in the polyamide group. It is a synthetic polyamide in which the residuals of terephthalic acids contain at minimum 55% of the dicarboxylic acid molar percentage present in structural units within the polymer chains. The HPPA resin can be modified with polymers to suit specific purposes. Composites are made up of additives and polymers. Composites can include flame retardants and minerals as well as fiberglass and other chemicals.

Global High-Performance Polyamides Market Analysis

Type Analysis

The market’s leading segment, polyamide 12 types (PA 12), accounted for more than 24% of the global revenue for 2021. This is due to its excellent mechanical properties like tensile and rigidity strength, toughness, and surface heaviness. Polyamide 12 is used in the production of trailer brake lines, fuel lines, football shoe soles, water pipes, and air and spray-painting tubes. Demand for the material’s ability to protect from moisture is expected to rise over the forecast period.

The polyamide 6T segment (PA 6T type) is widely used for the production of tough blister packs that are puncture-resistant and puncture resistant. This is becoming increasingly important in the COVID-19 crisis. Pharmaceuticals and other healthcare products are in high demand due to rising corona positive rates and better access to COVID-19 healthcare. The forecast period will see a rise in demand for healthcare and medical products, including polyamide 6T (PA6T).

Polyamide 9T (PA9T), is estimated to grow at a 7.6% annual rate over the forecast period. Due to its strength and durability, the rising demand for polyester can also be attributed to the increased production of textiles and carpets. These products are used across many industries including building and construction, automotive, and consumer goods. The segment’s growth will be boosted by the increasing number of infrastructure and construction projects.

End-Use Industry Analysis

The automotive industry was the largest market segment and accounted significantly for the global revenue for 2021. This is due to the increasing demand for electric vehicles, and the growing awareness among consumers about light and efficient vehicles. The forecast period will see a rise in the use of high-performance polyamide in automotive parts to make robust components, in particular in Central & South America.

High-performance polyamides are being increasingly used in medical device manufacturing. They are more affordable, have better optical clarity and biocompatibility, as well as being increasingly popular for their economic benefits. Many polyamides, including polyamide 11, and polyamide 6T, can be blended together to produce desirable properties for medical devices.

High-performance polyamides can withstand chemicals and have excellent sterilization ability. They are also biocompatible. A limited number of polyamides can be applied in this sector as medical-grade. Multiple regulatory frameworks around the world determine which plastic is suitable for medical and healthcare applications. They have conducted research to assess the impact of these polyamides on body fluids.

The Asia Pacific will experience tremendous growth in the future due to the increasing medical and healthcare spending in these countries such as China, India, and Japan. A number of medical and healthcare equipment producers in the region, such as Shred-Tech Corp., and Admedus Ltd. will also drive industry expansion during the forecast period.

Key Market Segments

Polyacrylamide (PARA)

Polyamide 6T (PA 6T)

Polyamide 9T (PA 9T)

Polyamide 12 (PA 12)

Other Types

Automotive

Consumer Goods

Medical & Healthcare

Building & Construction

Other End-Uses

Market Dynamics

Market growth is expected to be supported by increasing consumption of polyamides in the production and insulation materials, and other end-use sectors. Due to the current global COVID-19 crisis, demand for medical and healthcare products has increased, including temperature guns and pharmaceutical packaging. This has led to a rise in high-performance polyamide demand in the healthcare and medical industries. However, the growth of electrical and electronic end-uses is expected to outpace those of medical and healthcare as well as building and construction.

Over the forecast period, the increase in North American and Asia Pacific construction markets such as Brazil and China, India, the U.S., and Mexico is expected to drive demand for high-performance polyamides over the forecast period. These countries have seen an increase in foreign investment, which is due to relaxed FDI regulations and the requirements for redevelopment.

Soaring demand for pharmaceutical packaging products to combat the COVID-19 epidemic is driving the demand for durable products. This will fuel the market growth in high-performance polyamides over the forecast period.

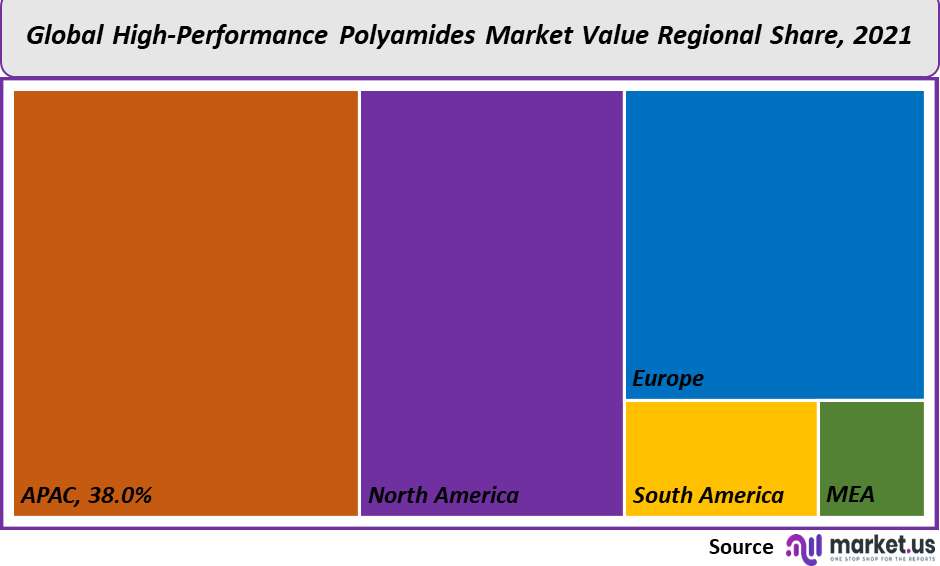

Regional Analysis

The Asia Pacific dominated this market and accounted for over 38% of global revenue for 2021. Due to the rising number of COVID-19-positive patients, Asia Pacific’s healthcare and medical industry will continue to grow. This is expected, in part, to drive the demand and supply for medical equipment, containers, and test kits. Due to the growing demand for non-residential projects like schools and hospitals, the construction industry is set to experience substantial growth. This will fuel the market growth by increasing demand for polyamide products like strip terminal blocks and corrugated pipes, window systems, pipe liners, and cable glands.

North America ranks second in terms of revenue, after the Asia Pacific, over the forecast period. The growth of major end-use sectors, such as consumer goods and electric vehicles, is driving the market. In the near future, market growth will be supported by the rising demand for consumer electronics and the growing construction industry in Canada, Mexico, and the U.S.

Europe will see a slower growth rate than North America and the Asia Pacific due to the COVID-19 pandemic. This market is driven primarily by the growing demand for polyamide 12 (PA12) and polyamide 16 (PA46) in the manufacture of packing material used in the food processing and sterilization industries, as well as bags for medical, healthcare, and pharmaceutical products.

Key Regions and Countries covered in the report:

North America

US

Canada

Mexico

Europe

Germany

UK

France

Italy

Russia

Spain

Rest of Europe

APAC

China

Japan

South Korea

India

Rest of Asia-Pacific

South America

Brazil

Argentina

Rest of South America

MEA

GCC

South Africa

Israel

Rest of MEA

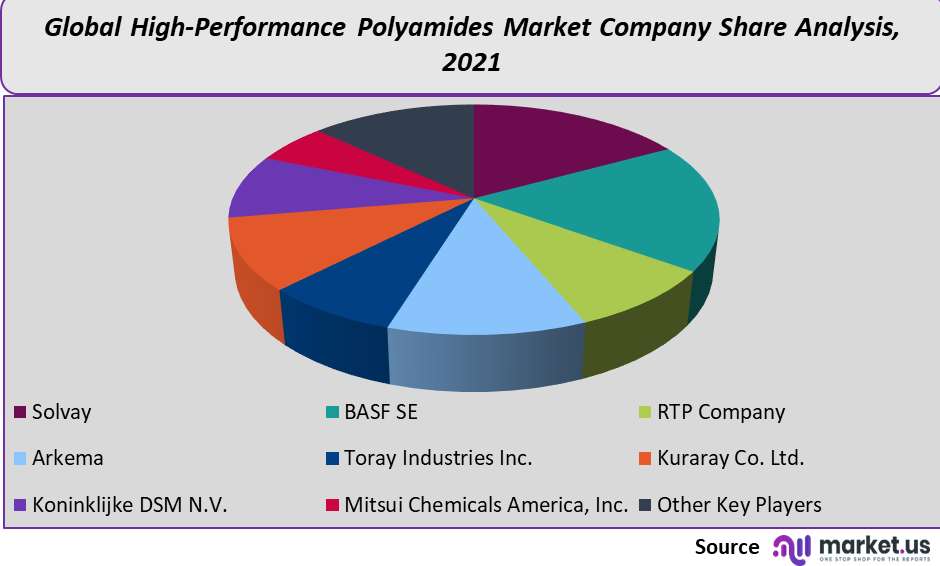

Market Share & Key Players Analysis:

Market players compete on the basis of product quality and technology used in high-performance polyester amide production. Major players invest in infrastructural and manufacturing development as well as in investing in research and development facilities. They also seek opportunities to integrate vertically across the value chain. These initiatives enable them to respond to increasing global demand and ensure their competitiveness. Because of the many manufacturers located around the world, the global market can be very fragmented.

Market Key Players:

BASF SE

RTP Company

Arkema

Toray Industries Inc.

Kuraray Co. Ltd.

Koninklijke DSM N.V.

Mitsui Chemicals America, Inc.

Other Key Players

For the High-Performance Polyamides Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

2.32 Billion

Growth Rate

6.8%

Forecast Value in 2032

4.79 Billion

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the High-Performance Polyamides Market in 2021?The High-Performance Polyamides Market size is US$ 2,326 million in 2021.

What is the projected CAGR at which the High-Performance Polyamides Market is expected to grow at?The High-Performance Polyamides Market is expected to grow at a CAGR of 6.8% (2023-2032).

List the segments encompassed in this report on the High-Performance Polyamides Market?Market.US has segmented the High-Performance Polyamides Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type, the market has been further divided into Polyarylamide (PARA), Polyamide 6T (PA 6T), Polyamide 9T (PA 9T), Polyamide 12 (PA 12), and Other Types. By End-Use, the market has been further divided into Automotive, Consumer Goods, Medical & Healthcare, Building & Construction, and Other End-Uses.

List the key industry players of the High-Performance Polyamides Market?Solvay, BASF SE, RTP Company, Arkema, Toray Industries Inc., Kuraray co. Ltd., Koninklijke DSM N.V., Mitsui Chemicals America, Inc., and Other Key Players are engaged in the High-Performance Polyamides market

Which region is more appealing for vendors employed in the High-Performance Polyamides Market?Asia Pacific is expected to account for the highest revenue share of 38%. Therefore, the High-Performance Polyamides industry in Asia Pacific is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for High-Performance Polyamides?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the High-Performance Polyamides Market.

Which segment accounts for the greatest market share in the High-Performance Polyamides industry?With respect to the High-Performance Polyamides industry, vendors can expect to leverage greater prospective business opportunities through the polyamide 12 type (PA 12) segment, as this area of interest accounts for the largest market share.

![High Performance Polyamides Market High Performance Polyamides Market]() High Performance Polyamides MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample

High Performance Polyamides MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample - Solvay

- BASF SE Company Profile

- RTP Company

- Arkema SA Company Profile

- Toray Industries Inc.

- Kuraray Co. Ltd.

- Koninklijke DSM N.V.

- Mitsui Chemicals America, Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |