Global High Volume Dispensing Systems Market By Type (Systems/Cabinets, and Software Solutions), By Application (Retail Pharmacies, and Hospital Pharmacies), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 48795

- Number of Pages: 320

- Format:

- keyboard_arrow_up

High Volume Dispensing Systems Market Overview:

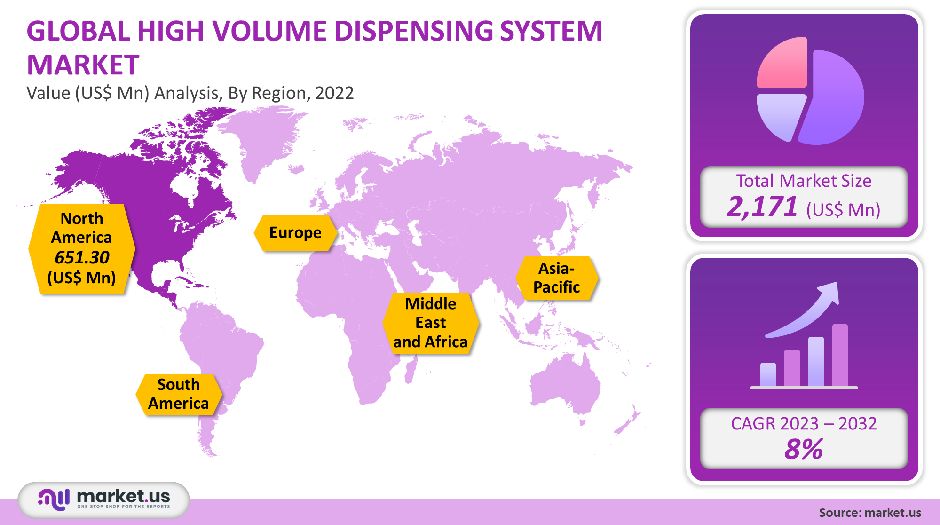

In 2021, the global high-volume dispensing system market was worth USD 2,171 million. The market is expected to grow at 8% during the forecast period.

Cabinets for dispensing large quantities of medication inventory can be described as high-volume dispensing systems.

Global High Volume Dispensing System Market Analysis

Product Analysis

The cabinets segment was the most profitable in terms of revenue in 2021, accounting for 39% of the total market. The rising demand for efficient pharmacy workflows and growing concerns about safe medication dispensing are expected to be positive for high-volume cabinet sales.

The growing number of prescriptions has led to a large medication inventory. This will in turn contribute to the segment’s growth.

The high-volume dispensing system market is gaining momentum thanks to technological advancements in cabinet design. Modern developments in cabinet design include the incorporation of RFID and barcode technologies.

The Omnicell XT Series Automated dispensing system is an example of a system that promotes patient safety and maximizes workflow efficiency.

The key factor expected to drive the segment’s growth is the increasing demand for pharmacy software solutions to improve workflow.

The overall market is also being stimulated by the increasing adoption of large-volume dispensing software systems and solutions in various medical applications, particularly in the case of controlled substances.

End-Use Analysis

The retail pharmacy segment in 2021 held a significant market share, due to the increasing number of prescriptions and retail pharmacies. This, in turn, has led to significant medication inventory.

This is in addition to the growing demand for specialty medications, which means cabinets and software are needed that can safely and efficiently dispense medication.

Cabinets have been proven to be effective in reducing labor costs and preventing overstocking or understocking of medication.The market is also growing due to favorable government and private initiatives to implement these systems at pharmacies.

The demand for high-volume dispensing systems is increasing due to rising costs and the risk of medication errors. These systems are in high demand because of increasing medication errors, inventory discrepancies, and a growing emphasis on reducing workload.

Key Market Segments

By Product

- Systems/Cabinets

- Software Solutions

By End-use

- Retail Pharmacies

- Hospital Pharmacies

Market Dynamics

Technological advances, rising incidence of medication errors and growing adoption of pharmacy automation systems for high-volume dispensing are some of the key trends driving the market growth.

The market is poised for a boost with an increasing number of prescriptions and rising cases of non-communicable diseases.

According to the Centers for Disease Control and Prevention (CDC), approximately 117 million people had one or more chronic conditions in 2021. The market will be further pushed by the rising demand for accurate and faster prescription processing.

The recent technological advances in the design of automated cabinets that can process large volumes of prescriptions faster are expected to increase demand for these systems in retail pharmacy chains. Innovation Associates, a key market participant, began offering high-volume dispensing solutions.

Their quick start system allows for the processing of approximately 500-6,000 Rxs per eight-hour shift. This system is suitable for independent, mail-order, federal healthcare pharmacies, retail chains, hospitals, and other institutions.

The demand for software and systems that can efficiently handle large quantities of medication inventory is increasing with the increase in mail-order and retail pharmacies. This leads to a rise in demand for high-volume dispensing systems. These cabinets and software are also in high demand due to rising pressures on the healthcare sector to reduce medication prices.

The market is expected to gain significant traction by increasing government funding for the installation of these cabinets in hospitals. The market’s primary growth stimulant is also the rising demand to reduce inventory discrepancies at hospitals and pharmacies.

Regional Analysis

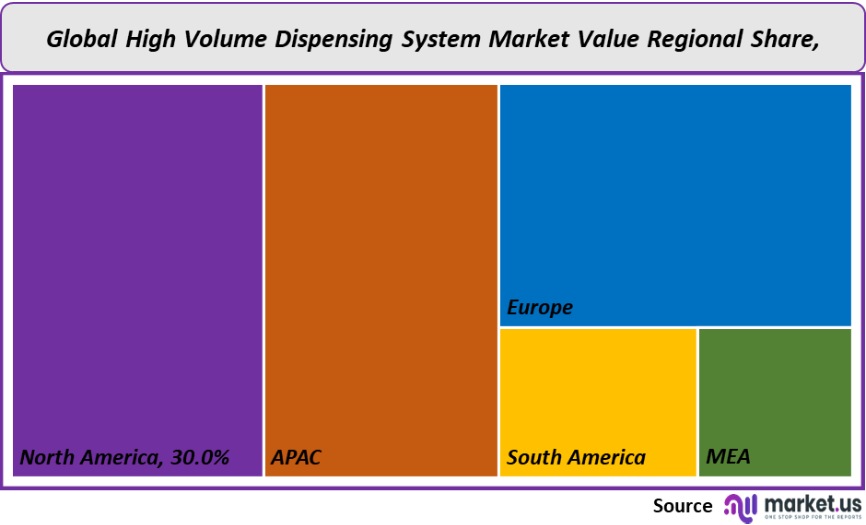

North America was the largest revenue contributor to the market in 2021 with a revenue share of 30%, due to the large number of market participants that increase the availability of these systems.

This market is thriving due to rapid technological advances and early adoption of these cabinets and software by hospitals as well as pharmacies. The region will also benefit from increased investments by both public and private entities in the sector of pharmacy automation.

The demand for cabinets and software is increasing due to growing concerns about inadequate inventory management. The region’s rising incidence of chronic diseases is driving the demand for medication refills. This is expected to boost the market.

Asia Pacific will see the highest CAGR over the forecast period. The key factors driving the growth of the market are the rising number of prescriptions and the shortage of qualified pharmacists.

The rising healthcare costs, increasing incidence of dispensing mistakes, and growing disease burden have all contributed to an increase in medication inventories. This is driving the need for high-volume dispensing systems in the forecast period.

Кеу Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Companies & Market share Analysis:

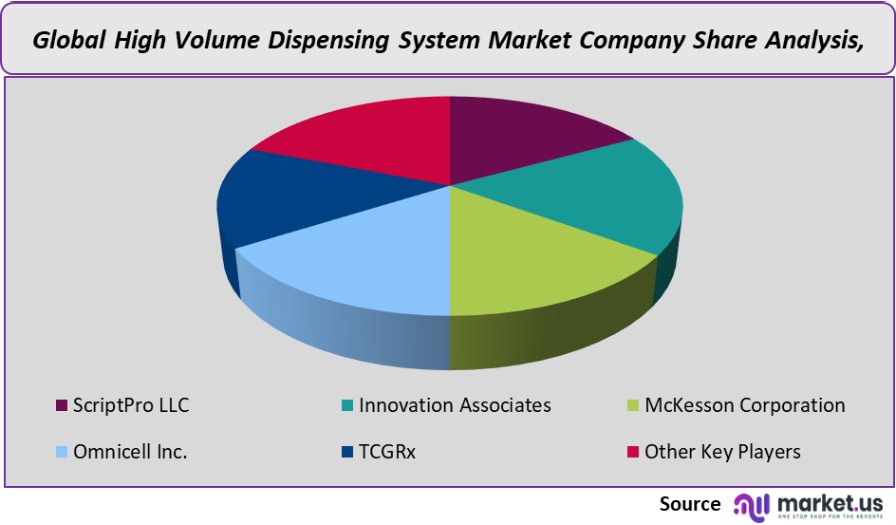

The market is also seeing a rise in partnerships and agreements to acquire new technologies. While the market is currently dominated by multinationals and large companies, smaller players are investing more in these systems. These systems are not widely available in developing countries due to their high cost of installation and maintenance.

Key Market Players:

- ScriptPro LLC

- Innovation Associates

- McKesson Corporation

- Omnicell Inc.

- TCGRx

- Other Key Players

For the High Volume Dispensing Systems Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the High Volume Dispensing System market size in year 2021?A: The High Volume Dispensing System market size was $2,171 million in 2021.

Q: What is the CAGR for the High Volume Dispensing System market?A: The High Volume Dispensing System market is expected to grow at a CAGR of 8% during 2023-2032.

Q: What are the segments covered in the High Volume Dispensing System market report?A: Market.US has segmented the High Volume Dispensing System market by geography (North America, Europe, APAC, South America, and the Middle East and Africa). By Product, the market has been segmented into systems/cabinets, and software solutions. By End-use, the market has been further divided into retail pharmacies, and hospital pharmacies.

Q: Who are the key players in the High Volume Dispensing System market?A: ScriptPro LLC, Innovation Associates, McKesson Corporation, Omnicell Inc., TCGRx, and Other Key Players.

Q: Which region is more attractive for vendors in the High Volume Dispensing System market?A: North America accounted for the highest revenue share of 30% among the other regions. Therefore, North America High Volume Dispensing System market is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for High Volume Dispensing System ?A: Key markets for High Volume Dispensing System are US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc.

Q: Which segment has the largest share in the High Volume Dispensing System market?A: In the High Volume Dispensing System market, vendors should focus on grabbing business opportunities from the systems/cabinet products segment as it accounted for the largest market share in the base year.

![High Volume Dispensing Systems Market High Volume Dispensing Systems Market]() High Volume Dispensing Systems MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample

High Volume Dispensing Systems MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample - ScriptPro LLC

- Innovation Associates

- McKesson Corporation

- Omnicell Inc.

- TCGRx

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |