Global Histology and Cytology Market By Type of Examination (Cytology and Histology), By Product (Reagents and Consumable and Instruments and Analysis Software System), By Application (Clinical Diagnostics, Designing & Drug Discovery, and Research), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 58874

- Number of Pages: 266

- Format:

- keyboard_arrow_up

Histology and Cytology Market Overview:

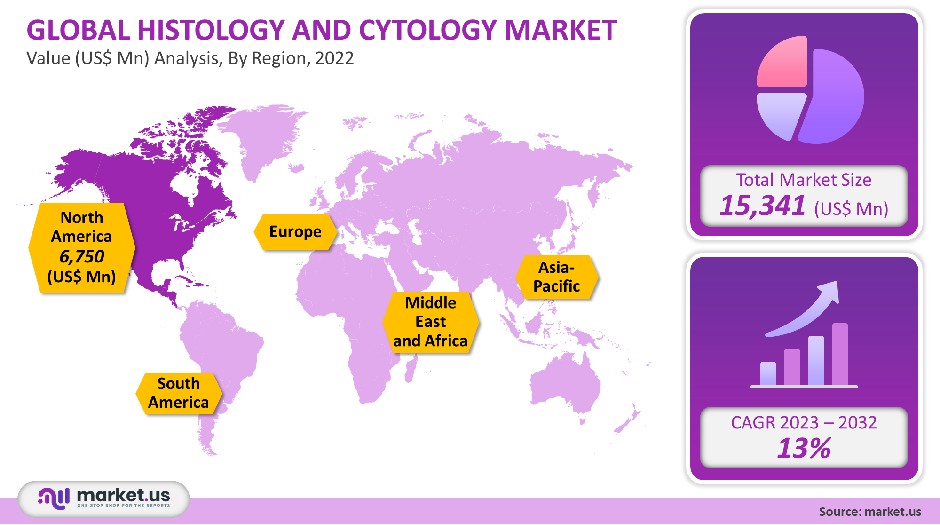

The global market for Histology and Cytology was valued at USD 15,341 million in 2021. This is expected to increase at a CAGR of 13% between 2023-2032.

Cytology and histology are critical areas of medical study that diagnose diseases in tissues, organs, and bodily fluids. The integral part of pathology is histology and cytology.

With the advancements in technology and research & development, the adoption of histology & cytology will likely rise in the next decade. The digital pathology market will see significant growth in the coming year thanks to data collection and diagnostic care advancements.

Global Histology and Cytology Market Analysis

Types of Examination Analysis

The market leader was cytology, with a 67% revenue share in 2021, which is expected to continue throughout the forecast period. The segment’s growth is due to the use of AI for developing advanced systems. Hologic Inc., for example, partnered with Google Cloud to integrate machine-learning technologies into its Genius Digital Diagnostics System in February 2021. This agreement aims at improving cervical cancer screening using machine learning, and Artificial Intelligence.

Early screening and detection are the keys to improving your chances of catching breast cancer. Fine Needle Aspiration Cytology, also known as FNAC, is the best way to detect breast carcinoma. FNAC is vital for the preoperative pathological evaluation and management of breast cancer.

Fine needle aspiration cytology, which is operator-dependent, is more difficult than histological analysis. Due to the relatively high incidence of breast cancer, countries with low and middle incomes are a good place for new industry participants looking to establish a market presence. It is therefore essential to reduce the mortality rate by using effective screening methods.

Papanicolaou (Pap smear), is recommended by WHO for cervical screening. This method detects cervical cancerous precursors at low cost and high rates. The market will grow if there is an increase in innovative cytology solutions for cervical cancer screening.

Modern histology technology has facilitated workflow and increased diagnostic capabilities for clinical laboratories. In addition, many companies are now focusing their efforts on integrating AI platforms into histology. Cernostics in partnership with Deciphex evaluated AI technology-based imaging tools in order to facilitate the early detection of Barrett’s esophageal cancer.

Product Analysis

Consumables and reagents were the dominant segments of the market in 2021. It is expected that the segment will continue growth from 2023 to 2032. There are many consumables that are used in the histology or cytology process, including tissue sample containers and kits, fixatives, medium reagents, stain solutions, and others. The routine adoption of histology or cytology consumables is responsible for segment growth. Additionally, companies are creating cost-effective reagents and kits that will further drive the market in cytology/histology.

Biocare Medical LLC released the TIGIT [BLR047F] rabbit monoclonal antibody in collaboration with Bethyl Laboratories. It allows qualitative identification of TIGIT proteins by Immunohistochemistry. The antibody will provide a cost-effective immunohistochemistry option for institutions involved in biotech and pharmaceutical research.

Due to the increased use of technologically advanced instruments like multimodal nonlinear microscopes, photoacoustic microscopic microscopy, and stimulated Raman spectroscopy for histopathology, the instruments, and analysis system segment will see a significant increase in growth between 2023-2032. However, the large-scale adoption of digital transformational solutions in pathology has been hindered by high infrastructure costs as well as technical and practical limitations. Therefore, digitization costs will decrease in pathology.

Application Analysis

With a high revenue share, the segment of drug discovery and design dominated this market in 2021. It is expected that the segment will maintain its leadership position during the forecast period. The large use of IHC staining in drug development companies and pharmaceutical companies can explain the segment’s growth. Image analysis is used across many steps of drug discovery, development, and validation such as target validation, drug efficacy, safety studies, drug repositioning, and patient stratification.

The growing use of histopathology for the diagnosis of various types of cancer is expected to drive a 13.5% CAGR in the clinical diagnostics segment. To identify abnormalities and malignancy, the cells and tissues of suspicious lump sites are removed. They are widely used in the screening of different types of cancer, including cervical, breast, and bowel cancer.

Key Market Segments

By Type of Examination

- Cytology

- Histology

By Product

- Reagents and Consumable

- Instruments and Analysis Software System

By Application

- Clinical Diagnostics

- Designing & Drug Discovery

- Research

Market Dynamics

Major factors that will drive the market over the forecast period include an increase in demand for the detection of cell and tissue characteristics and a global rise in the incidence of cell-based diseases like cancer. Integration of digital solutions in cytological diagnosis gives the advantage of the quick interpretation of primary diagnostic data.

Additionally, digital cytology systems are being developed by companies to aid in rapid evaluations of cytology samples. Antech Diagnostics, for example, introduced the North American Digital Cytology Scanner, in June 2021. This scanner delivers whole-slide interpretations in less than 2 hours. It also allows you to assess large quantities of samples at POC settings and reduces the time it takes to examine them.

This market is growing due to immunohistochemistry’s increasing popularity for visualizing cells to diagnose a variety of diseases including cancers. Innovative immunohistochemistry instruments are being developed by a number of companies.

Diagnostic laboratories can maximize their sample processing time and throughput with the In-Vitro Diagnostic labeled systems. The COVID-19 pandemic has been a positive catalyst for the growth of the market. Collaboration is seen between the companies for developing antibodies specific for validation with immunohistochemistry. GeneTex Inc., for example, formed a partnership with HistoWiz Inc. to develop validated antibodies for immunohistochemistry using COVID-19-infected human tissues.

Both companies will collaborate on the development of an automated immunohistochemistry kit with GeneTex to detect SARS-CoV-2 infection in different tissues. They stressed that IHC is more effective than RTPCR, which only amplifies fragments of virus RNA in the sample specimen.

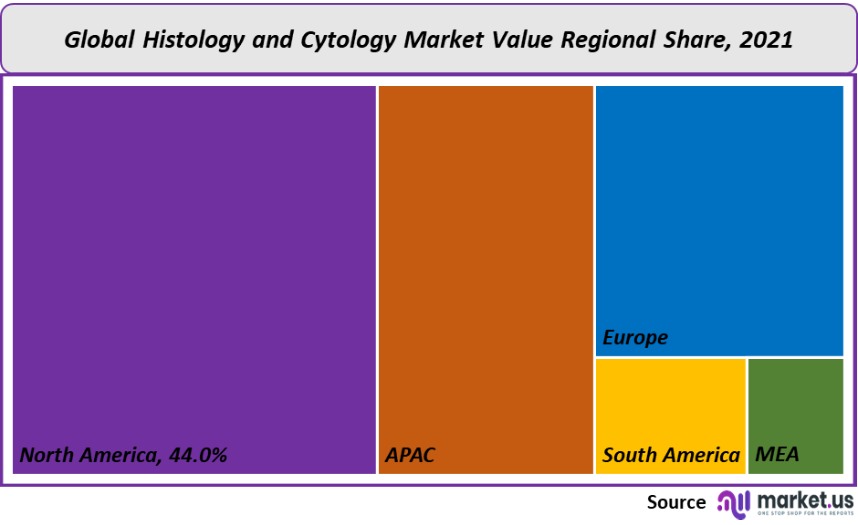

Regional Analysis

North America held the largest market share with over 44% in 2021. There are many factors that contributed to the region’s growth, such as high cancer incidence, extensive R&D, key players, and a well-established research infrastructure for pathology. Additionally, the market is thriving due to the high rate at which products are approved and commercialized in the region.

The Asia Pacific is expected to see the fastest growth in the market for cytology and histology between 2023-2032. There are many factors that have contributed to the rapid growth of this market, such as rising cancer awareness, large target populations, and improved healthcare infrastructure. Research is also accelerating the growth of this market by evaluating new forms of cytology.

In Japan, researchers evaluated the efficacy and safety of liquid-based Cytology in cervical cancer screening in February 2021. The study revealed that liquid-based, practical cytology was superior to conventional cytology.

Key Regions and Countries covered in thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

Different solutions for cancer screening have had rapid introductions and approvals in recent years. Hologic Inc. was granted premarket approval in May 2021 by the U.S. FDA to market its Thin Prep Genesis Processor. The Thin Prep genesis processor combines sample processing and cytology with improved workflow.

Barcode scanning, automatic tube, and slide labeling are some of the features. These features reduce hands-on work and allow for repetitive motions. The company offers a large selection of products and automated testing platforms to detect cervical cancer.

Маrkеt Кеу Рlауеrѕ:

- Thermo Fisher Scientific Inc.

- Hologic Inc.

- Danaher Corporation

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd.

- Becton, Dickinson, and Company

- Merck KGaA

- Sysmex Corporation

- Other Key Players

For the Histology and Cytology Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Histology and Cytology Market in 2021?The Histology and Cytology Market size is US$ 15,341 million in 2021.

What is the projected CAGR at which the Histology and Cytology Market is expected to grow at?The Histology and Cytology Market is expected to grow at a CAGR of 13% (2023-2032).

List the segments encompassed in this report on the Histology and Cytology Market?Market.US has segmented the Histology and Cytology Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type of Examination, the market has been further divided into Cytology and Histology. By Product, the market has been further divided into Reagents and Consumable, and Instruments and Analysis Software System. By Application, the market has been further divided into Clinical Diagnostics, Designing & Drug Discovery, and Research.

List the key industry players of the Histology and Cytology Market?Thermo Fisher Scientific Inc., Hologic Inc., Danaher Corporation, Abbott Laboratories, F. Hoffmann-La Roche Ltd., Becton, Dickinson and Company, Merck KGaA, Sysmex Corporation, and Other Key Players are engaged in the Histology and Cytology market

Which region is more appealing for vendors employed in the Histology and Cytology Market?North America is expected to account for the highest revenue share of 44%. Therefore, the Histology and Cytology industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Histology and Cytology?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Histology and Cytology Market.

Which segment accounts for the greatest market share in the Histology and Cytology industry?With respect to the Histology and Cytology industry, vendors can expect to leverage greater prospective business opportunities through the cytology segment, as this area of interest accounts for the largest market share.

![Histology and Cytology Market Histology and Cytology Market]() Histology and Cytology MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample

Histology and Cytology MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample - Thermo Fisher Scientific Company Profile

- Hologic Inc.

- Danaher Corporation Company Profile

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd.

- Becton, Dickinson and Company

- Merck KGaA Company Profile

- Sysmex Corporation

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |