Global In Vitro Diagnostic Products Market By Type (Roche Diagnostics, Danaher Corporation, Abbott Laboratories, Sysmex Corporation, Thermo Fisher Scientific, Becton, Dickinson and Company, Biomerieux, Bio-Rad Laboratories, Johnson & Johnson, Agilent Technologies, Qiagen, and Illumina), By Application (Diabetes, Oncology, Cardiology, and Nephrology), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2020-2029

- Published date: Jul 2022

- Report ID: 57454

- Number of Pages: 310

- Format:

- keyboard_arrow_up

In Vitro Diagnostics (IVD) Market Overview:

The In Vitro Diagnostic Products Market size is expected to be worth around USD 133.4 Bn by 2031 from USD 98.3 million in 2021, growing at a CAGR of 3.1% during the forecast period 2021 to 2031

In-vitro diagnosis (IVD) refers to reagents, tools, and software used to examine specimens such as blood, stool, urine, and tissues. This is done to diagnose and treat diseases, conditions, or infections. You can also find various In Vitro Diagnostic devices that employ different methods, such as immunodiagnostics, tissue diagnostics, or hematological or molecular diagnosis. Specialist medical facilities have the necessary technical skills to apply and manage the IVD markets.

This market report overviews the In Vitro Diagnostics market growth, value, growth, size, and other key factors.

Global In-Vitro Diagnostics Market Analysis:

Product Analysis

The market leader in the global reagents product segment was 2021. It accounted for more than 66% of the total revenue. Major market players are investing in extensive R&D to develop novel reagents. This region is expected to maintain its dominant position. Companies can now focus their efforts on niche areas that are more profitable in IVD by launching kits that speed up cancer detection. Invitae, for example, launched FusionPlex Dx and LiquidPlex Dx, cancer testing kits to help patients with cancer. This is due to the growing demand for consumables, novel reagents, and precision medicine. The increasing demand for genetic testing is prompting major players to align their instrument launches. Thermo Fisher Scientific introduced Ion Torrent Genexus Dx Integrated Sequencer to the market driver. It is used for both diagnostic and research purposes. Further, the company announced that it had developed a line for genomic profiling and hemato-oncology using its system. This will increase adoption.

Technology Analysis

In 2021, the molecular diagnostics market segment held a significant share. This was due to the launch and continued evolution of technology. PCR requires complex equipment. Research efforts in this area have resulted in innovations about the size of a postal stamp. According to ACS Nano Journal, in May 2021, plasmofluidic chips can perform a PCR test within 8 minutes. They are therefore expected to speed up diagnosis in current and future pandemics. Multiple launches took place in 2021 for the immunoassay section.

This could be explained by the ongoing impact of COVID-19 on the market as well as the increased need of consumers. It was difficult to distinguish flu from COVID-19 because they have the same symptoms. New products were developed to detect Flu and SARS-CoV-2. Roche and other pharmaceutical companies have made SARS-CoV-2 and Flu Rapid Antigen Test available to meet this demand. The microbiology section includes assays and tests for the identification of infectious microorganisms. The diagnosis is made by plating patient samples and then choosing pure cultures from those biological samples. Antibiotic susceptibility testing has been a fast-growing application in microbiology testing. Microbiology is expected to expand as pathogenic diseases become more common.

Application Analysis

Infectious disease applications held a significant market share in 2021. IVDs are used to detect microorganisms that can cause infectious diseases. HIV/AIDS and tuberculosis are the most dangerous infections. Market leaders are collaborating with healthcare providers and other key players to improve patient access to high-quality, innovative laboratory service. Quest Diagnostics partnered with Memorial Hermann Health System to provide cost-efficient, innovative, and high-quality diagnostic services for 21 Huston hospital labs. These market-leading players’ initiatives to expand their presence will likely drive the market.

COVID-19 spread quickly, leading to an increase in the IVD market share. Diabetes is the leading cause of death in the world. According to the International Diabetes Federation, 550 million people worldwide were diagnosed with diabetes in 2021. Chronic diseases like cancer are one of the most common causes of death. To increase screening rates for cancer, the U.S. government initiated Cancer Moonshot in February 2022. This was to identify those cases not yet identified by the COVID-19 epidemic. In the next 30 years, the government will reduce the death rate due to cancer by 55% through treatment, early diagnosis, and promotion of IVD testing.

End Use Analysis

The highest revenue shares among End-Use were held by the laboratory segment in the global market. A rise in awareness about personalized medicines, increased demand for affordable services, and technological advances are all key factors that will boost the segment’s growth. Because of the volume of testing performed in laboratories, this is one of the largest revenue-generating segments of the market. Additionally, laboratory-based tests have higher accuracy than home and PoC tests. This gives them an advantage over the rest. A rise in the number of hospitalizations that are dependent on faster diagnostics has resulted in hospitals holding a large market share. Also, the continuous development of healthcare infrastructure will enhance existing hospital facilities. Therefore, hospital-based IVD tests are becoming more in demand. Hospitals purchase most IVD medical devices and use them in large numbers.

Key Market Segments:

By Product

- Instruments

- Services

- Reagents

By Technology

- Molecular Diagnostics

- Immunoassay

- Clinical Chemistry

- Hematology

- Other Technologies

By Application

- Infectious Disease

- Oncology

- Cardiology

- Diabetes

- Other Applications

By End-Use

- Hospitals

- Home Care

- Laboratories

- Other End-Uses

Market Dynamics:

Due to the increase in testing related to the pandemic, IVD has seen a rise in adoption. Market growth will be stimulated by the introduction of automated IVD systems that allow hospitals and laboratories to deliver accurate, reliable, and error-free diagnoses. Key players are also launching more IVD (In-Vitro diagnosis) products to boost the market.

The University of California created an ultrasensitive molecular test in May 2021. This test relies on a chip technology to detect SARS-CoV-2 or influenza A antigen. Further research is underway to convert the test into a Point of Care (POC). With more major companies focusing on home-based testing, there has been a shift within the industry. The FDA has also given priority to home-based molecular diagnostic tests in 2021. BATM Ltd. announced in March 2021 the launch of its molecular diagnosis self-test kit for COVID-19 detection. These tests can detect diseases early and offer a low risk of replacements. The high costs of these tests may encourage patients to switch to external replacements. The rate of internal substitution for newer infections like SARS-CoV-2 is high. This increases competition. It is rare for established players to sell IVD products in APAC. The region is dominated heavily by local players selling lower-cost instruments. The market’s primary drivers are expected to be technological advances in terms of portability and accuracy and cost-effectiveness.

As the majority of chronic diseases and deaths from infections occur in older people, the popularity of early testing and the increase in geriatric populations has increased the frequency of check-ups. According to the Office for Budget Responsibility, the U.K.’s healthcare costs have grown exponentially. This can put economic pressure on rapidly aging nations. But, this is expected to positively impact the IVD industry and drive the market’s fastest growth.

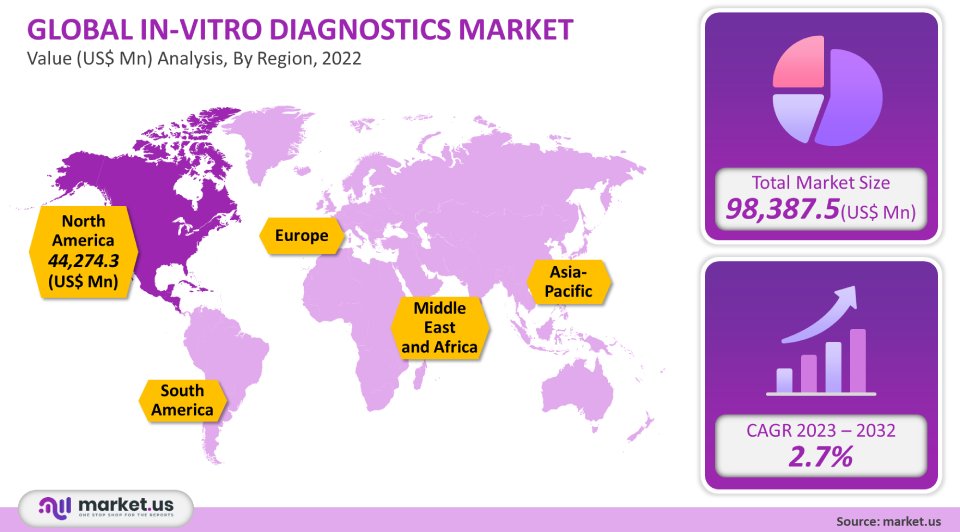

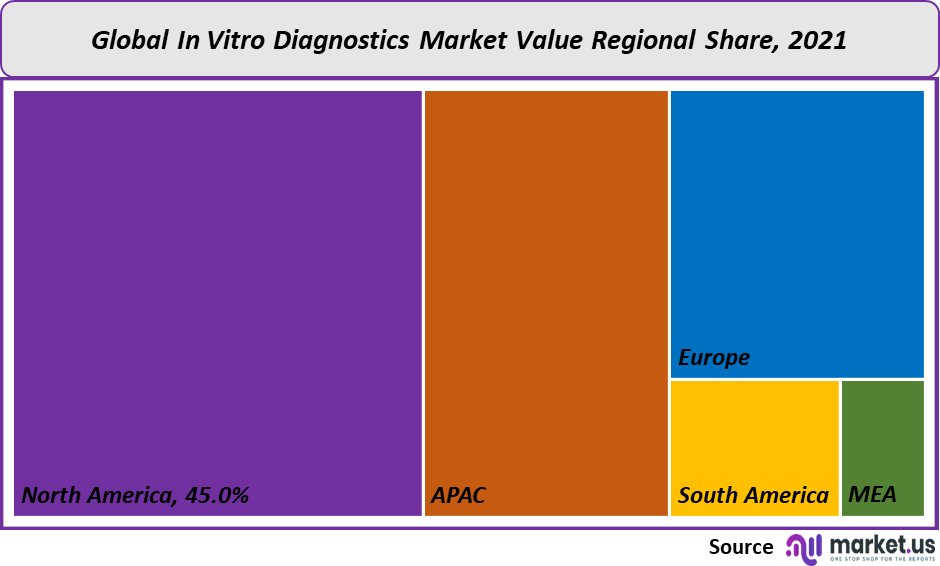

Regional Analysis:

The largest market share, 45%, was held by North America in 2021. This region will likely maintain its market leadership position for the forecast period. This region’s market is driven by several major factors, including the increasing incidence of chronic disease, the rapidly growing geriatric population, high healthcare expenditure, and supportive government funding.

North America’s market growth is expected to be driven by an increasing need for genetic testing to personalize health care (e.g., for cancer and diabetes). The Asia Pacific was also responsible for a significant share of the revenue in 2021 and will be the fastest growing regional market over the forecast period. The diagnosis of diseases and medical conditions such as cardiovascular disorders, cancer, and infectious diseases can be done using In-Vitro diagnostics. Many factors will drive the Asia Pacific region’s market. These include stabilizing economies and a rapidly growing middle-class population. They also support government policies and rapid urbanization.

A detailed analysis of key regions is given below, including North America, Europe, Asia- Pacific, South America, and Middle East & Africa.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

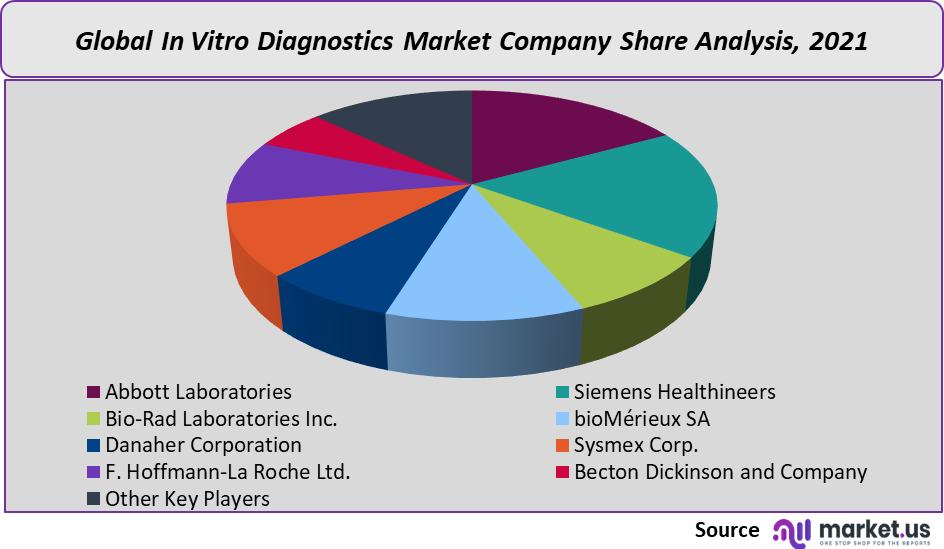

Market Share & Key Players Analysis:

Market players adopt this strategy to increase their product offerings and offer customers a wide range of innovative product portfolios. Abbott was granted FDA approval in January 2021 for its handheld Traumatic Brain Injury blood test. This is the first-of-its-kind test that can assess mild TBIs and concussions in patients. Abbott also introduced the RealTime SARS CoV-2 test. This PCR-based test can diagnose COVID-19. BioMedomics has a point-of-care COVID-19 test that can detect antibodies within 15 minutes.

Key Market Players:

- Abbott Laboratories

- Siemens Healthineers

- Bio-Rad Laboratories Inc.

- bioMérieux SA

- Danaher Corporation

- Sysmex Corp.

- F. Hoffmann-La Roche Ltd.

- Becton Dickinson and Company

- Roche Diagnostics

- Other Key Players

For the In Vitro Diagnostic Products Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the In-Vitro Diagnostics Market in 2021?The In-Vitro Diagnostics Market size is US$ 98,387.5 million in 2021.

Q: What is the projected CAGR at which the In-Vitro Diagnostics Market is expected to grow?The In-Vitro Diagnostics Market is expected to grow at a CAGR of 2.7% (2023-2032).

Q: List the segments encompassed in this report on the In-Vitro Diagnostics Market?Market.US has segmented the In-Vitro Diagnostics Market position by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, the market has been further divided into Instruments, Services, and Reagents. By Technology, the market has been further divided into Molecular Diagnostics, Immunoassay, Clinical Chemistry, Hematology, and Other Advanced Technologies. By Application, the market has been further divided into Infectious Disease, Oncology, Cardiology, Diabetes, and Other Applications. By End-Use, the market has been further divided into Hospitals, Home Care, Laboratories, and Other End-Uses.

Q: List the key industry players of the In-Vitro Diagnostics Market?Abbott Laboratories, Siemens Healthineers, Bio-Rad Laboratories Inc., bioMérieux SA, Danaher Corporation, Sysmex Corp., F. Hoffmann-La Roche Ltd., Becton Dickinson and Company, and Other Key Players are engaged in the In-Vitro Diagnostics market

Q: Which region is more appealing for vendors employed in the In-Vitro Diagnostics Market?North America is expected to account for the highest revenue share of 45%. Therefore, the In-Vitro Diagnostics industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for In-Vitro Diagnostics?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the In-Vitro Diagnostics Market.

Q: Which segment accounts for the greatest market share in the In-Vitro Diagnostics industry?With respect to the In-Vitro Diagnostics industry, vendors can expect to leverage greater prospective business opportunities through the reagents segment, as this area of interest accounts for the largest market share.

![In Vitro Diagnostic Products Market In Vitro Diagnostic Products Market]() In Vitro Diagnostic Products MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample

In Vitro Diagnostic Products MarketPublished date: Jul 2022add_shopping_cartBuy Now get_appDownload Sample - Roche Diagnostics

- Danaher Corporation Company Profile

- Abbott Laboratories

- Sysmex Corporation

- Thermo Fisher Scientific Company Profile

- Becton, Dickinson and Company

- Biomerieux

- Bio-Rad Laboratories, Inc. Company Profile

- Johnson & Johnson

- Agilent Technologies Inc. Company Profile

- QIAGEN NV Company Profile

- Illumina

- Diasorin

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |