Global Control Valves Market By Value Size Type (Less than 1”, Between 1” to 6”, Between 6” to 25”, Between 25” to 50”, and More than 50”), By Product Type (Linear, and Rotary), By End-Use (Oil & Gas, Chemical, Energy & Power, Water & Waste Water, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Aug 2022

- Report ID: 35290

- Number of Pages: 236

- Format:

- keyboard_arrow_up

Control Valves Market Overview:

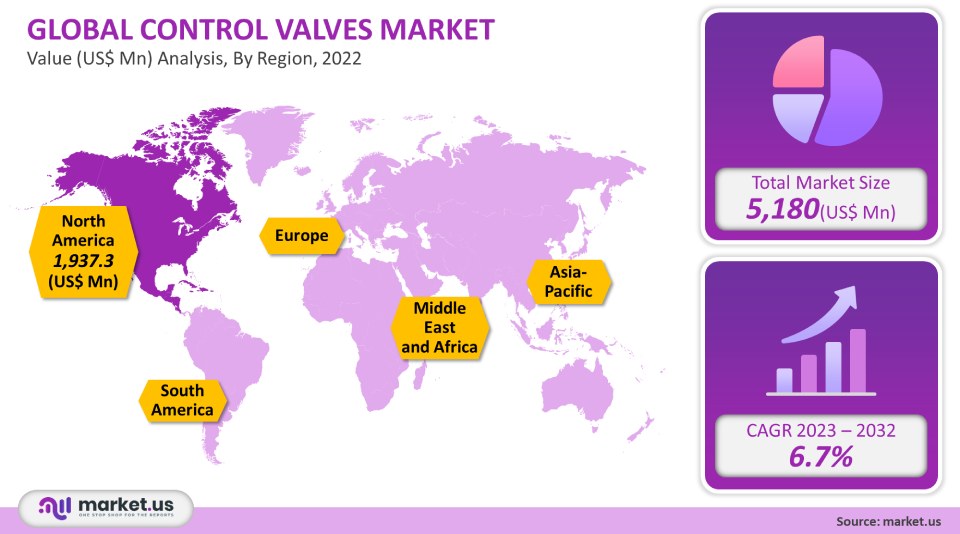

In 2021, the global control valve market was valued at USD 5,180 million. The market is expected to grow at a 6.7% CAGR over the forecast period.

This market is driven by growing demand from the end-use industries, such as water and wastewater treatment, oil and gas, and the energy & power sector. The market is expected to grow due to the increasing use of industrial automation.

Global Control Valves Market Scope:

Valve Size Analysis

There are many sizes of valves that are available. They range from 1″ to 6, 1″ to 6, 1″ to 25, 6″ to 25, 6″ to 25, 6″ to 25, and 25″ to 50, but not more than 50. Due to their widespread use in the chemical, pharmaceutical, and food & drink industries, valves ranging in size from 1″-6″ dominated the market in 2021.

This segment is expected to continue its dominance in the market through 2025. The CAGR for the segment less than 1″ is expected to be the highest during this same time.

Product Analysis

The market can be divided into two types based on product: linear and rotary. Linear control valves can be further divided into a gate, diaphragm, and other, while rotary types can be further segmented into plug, ball, butterfly, and plug. Due to the high demand for linear control valves in end-use industries like oil & gas chemicals, and energy & power in emerging economies, the market is dominant. This segment will see a 6.12% CAGR over the forecast period.

End-Use Analysis

Due to the wide use of control valves in crude oil extraction, natural gas generation, and refining, the oil & gas sector accounted for the largest share. A lot of the installed valves are being replaced annually due to increasing safety standards.

The water and wastewater industry also includes applications processes such as water supply for manufacturing purposes or treatment of wastewater generated from industries

Кеу Маrkеt Ѕеgmеntѕ:

By Value Size Type

- Less than 1”

- Between 1” to 6”

- Between 6” to 25”

- Between 25” to 50”

- More than 50”

By Product Type

- Linear

- Gate

- Diaphragm

- Others

- Rotary

- Ball

- Butterfly

- Plug

By End-Use

- Oil & Gas

- Chemical

- Energy & Power

- Water & Waste Water

- Other End-Uses

Market Dynamics:

Control valves are in high demand because of the growth of power generation plants around the globe and the increasing need for power and energy from developing countries. These valves can also be used in nuclear power plants, especially in chemical treatment, cooling water, or steam turbine control systems.

Control valves are also in high demand because of the harsh conditions encountered by production and refineries platforms. These platforms are used primarily in offshore and onshore oil and gas activities. These valves are essential in many of the mechanisms used in the oil and gas industry.

Control valves are used extensively in many industries, including food & beverage, oil &gas, water & waste, power, energy & energy, and pharmaceutical. Control valves play an important role in increasing profitability, safety, efficiency, and productivity for multiple production processes. Due to their temperature and pressure control benefits throughout the downstream, midstream, as well as upstream activities, control valves are increasingly being adopted in industries.

Many control valve companies have invested in state-of-the-art control instrumentation to meet rising demand from new end-use industries. This will increase the economic, competitive, and environmental pressures on control valve companies to provide high-rated products at a lower return on investment. These control valves, which are technologically advanced and integrate digital intelligence, are an integral part of a plant asset management strategy.

Additionally, control valves are in high demand due to the increasing trend towards digitalization and automation of conventional plants. Control valve manufacturers are always engaged in R&D to develop and design their products to meet the needs of end-use industries.

Regional Analysis:

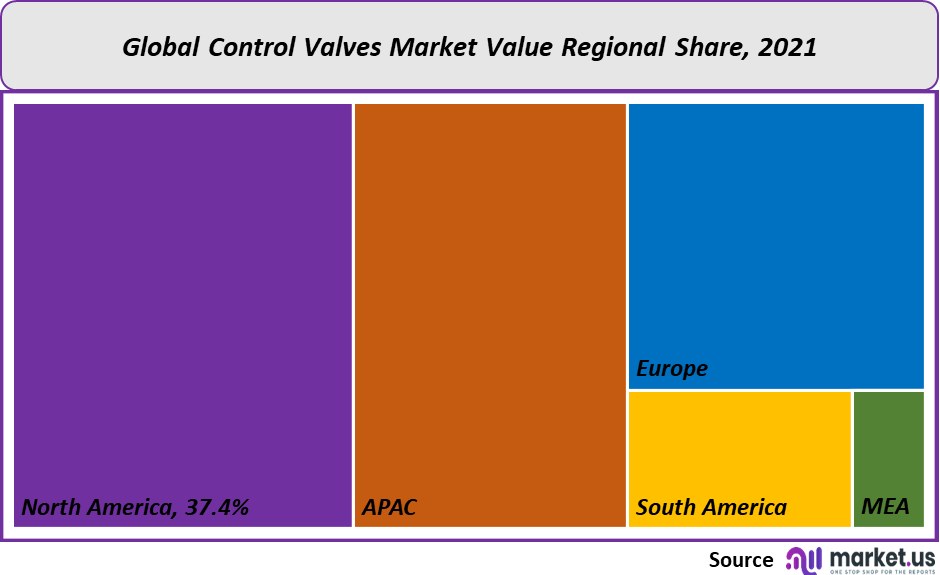

North America’s market dominated the global market by over 37.4%. Due to the high demand in the United States for valve replacement and a large number of projects currently underway in the country.

Due to the presence of emerging economies like India and China, Asia Pacific will dominate the second-largest market in 2021. In order to make smart valves, companies are investing in actuator and valve manufacturing. This is because of the increasing demand for automated valve operations in many industries, including water & and wastewater, food & drink, energy & electricity, pharmaceutical, and medical.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

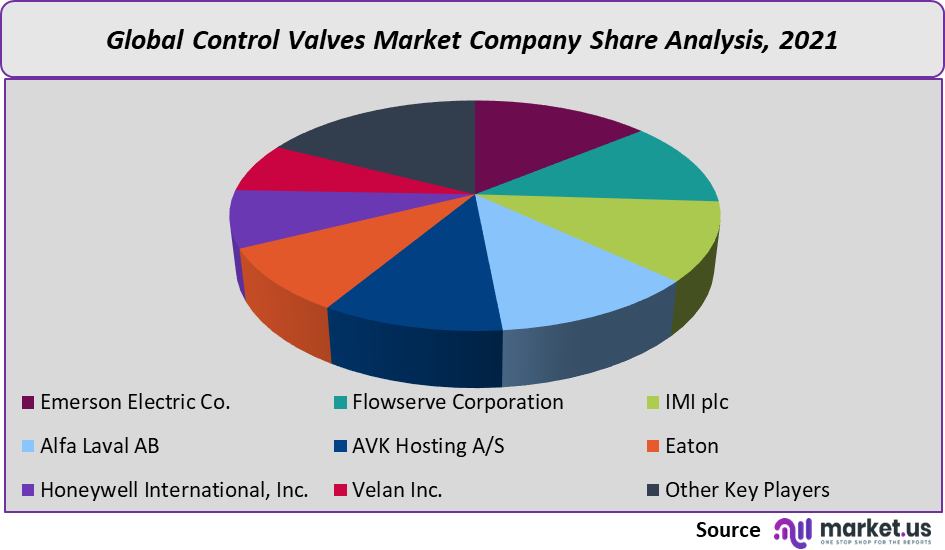

Market key players also invest heavily in R&D to create innovative solutions and give them a competitive advantage.

Due to the large number of small and medium-sized manufacturers that offer control valve products tailored to end-use industries, the market is fragmented. Companies are constantly taking strategic initiatives to maintain their market share in a highly competitive market. These include mergers and acquisitions as well as joint ventures, product launches, and partnerships. These initiatives are designed to expand their reach globally and regionally, as well as offer a wider product range to their customers:

Маrkеt Кеу Рlауеrѕ:

- Emerson Electric Co.

- Flowserve Corporation

- IMI plc

- Alfa Laval AB

- AVK Hosting A/S

- Eaton

- Honeywell International, Inc.

- Velan Inc.

- Burkert Fluid Control System

- Valvitalia SpA

- Other Key Players

For the Control Valves Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the control valves market in 2021?The Control valves market size is estimated to be US$ 5,180 million in 2021.

Q: What is the projected CAGR at which the control valves market is expected to grow at?The Control valves market is expected to grow at a CAGR of 6.7% (2023-2032).

Q: List the segments encompassed in this report on the Control valves market?Market.US has segmented the Control valves market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Value Size Type, the market has been segmented into Less than 1”, Between 1” to 6”, Between 6” to 25”, Between 25” to 50”, and More than 50”. By Product type, the market has been further divided into Linear and Rotary. By End-Use, the market has been segmented into Oil & Gas, Chemical, Energy & Power, Water & Waste Water, and Other End-Uses.

Q: List the key industry players of the Control valves market?Emerson Electric Co., Flowserve Corporation, IMI plc, Alfa Laval AB, AVK Hosting A/S, Eaton, Honeywell International, Inc., Velan Inc., and Other Key Players engaged in the Control Valves market

Q: Which region is more appealing for vendors employed in the Control valves market?North America is expected to account for the highest revenue share of 37.4%. Therefore, the Control Valves Technology industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Control valves?The US, Canada, UK, Japan, Mexico, India, China & Germany are key areas of operation for the Control Valves Market.

Q: Which segment accounts for the greatest market share in the Control valves industry?With respect to the Control valves industry, vendors can expect to leverage greater prospective business opportunities through the 1” to 6“valve size segment, as this area of interest accounts for the largest market share.

![Control Valves Market Control Valves Market]()

- Emerson Electric Co. Company Profile

- Flowserve Corporation

- IMI plc

- Alfa Laval AB

- AVK Hosting A/S

- Eaton

- Honeywell International, Inc. Company Profile

- Velan Inc.

- Burkert Fluid Control System

- Valvitalia SpA

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |