Global Industrial Dust Collectors Market By Product (Cartridge Dust Collector, Inertial Separators, and Other Products), By End-Use Industry (Food & Beverage, Energy & Power, Steel, Cement, and Other End-Use Industries), By Mechanism (Wet and Dry) By Mobility (Portable and Fixed), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: May 2022

- Report ID: 13798

- Number of Pages: 237

- Format:

- keyboard_arrow_up

Industrial Dust Collectors Market Overview:

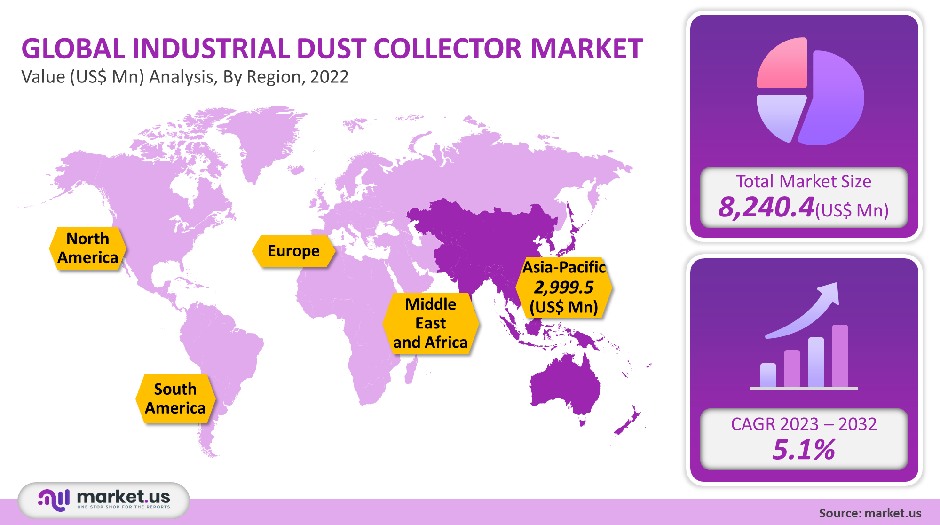

Global Market for industrial dust collectors was valued at USD 8,240.4 million in 2021. It is projected to grow at a CAGR of 5.1% between 2023 and 2032.

Market growth will be driven by strict government regulations and higher hygiene standards in the food industry. Over the forecast period, the market will be driven by the expanding use of these devices in construction, increasing industrial manufacturing and global economic activities, rapid infrastructure developments, and the increase in coal-fired power plants.

Global Industrial Dust Collector Market Analysis

Type Analysis

Baghouses accounted for 24.8% of global revenue share in 2021. The baghouse dust collector is efficient in collecting particulate matter such as dust, smoke, bio-contaminants, or other toxic particles. They are also very cost-effective when compared to other products, such as cartridge dust collectors and electrostatic precipitators.

There are three types of inertial separators: settling chambers and baffle chambers. These devices use a combination force to remove or collect dust particles. This includes inertial force and centrifugal force. These products are great for industries with flue gas temperatures between 40 and 200 degrees F.

The fastest growth rate for the cartridge segment will be 6.8% during the forecast period. These products are extremely efficient because they trap dust particles smaller than 0.3 microns. They also have a faster filtration rate than other types. This segment of wet scrubbers is growing at a rapid pace.

Wet scrubbers are able to withstand high temperatures, making them suitable for use in nearly every industry. High-humidity gases can be filtered with wet scrubbers. These devices can remove many pollutants, including sulfur and other acidic gas that contribute to acid precipitation.

Mechanism Analysis

The market was dominated by the dry segment, which accounted for 68.7% of the global revenue share in 2021. The market can be divided into two sub-segments, dry and wet, based on the mechanism. The National Fire Protection Association (NFPA) states that dry dust collectors include cyclone separates, baghouse collectors, and cartridge dust collectors.

These tools are made from dry filter media and are used for collecting fine particulate dust that is generated in the processing industry. These tools are great for large dust-loading systems, heavy dust-loading applications, and other situations that require high dust removal efficiency. They are preferred over wet dust collection because only one dry dust collector can handle large dust loads and airflows. Wet equipment needs multiple collectors. The fastest CAGR for the wet mechanism segment will be more than 5.5% between 2023 and 2032.

Mobility Analysis

The fixed segment dominated the market, accounting for 66.3% of the global revenue share in 2021. They are also called stationary dust collectors. They are effective for many applications such as woodworking and chemical fumes. Fixed dust collectors can be more expensive than portable ones. The majority of dust collectors in industries are fixed dust collectors. Industries require large dust collection units that are stationary.

Industries such as Steel, chemical, and food require large electrostatic precipitators or bag filters. They are fixed in an area where dusty air or flue gas passes and programmed to collect dust at a specific interval.

The fastest growing segment in the forecast is the portable. It will grow at a CAGR of 6%. Because of their convenience and cost-effectiveness, portable tools are in high demand. These low-maintenance filters don’t require installation which is another reason for their high demand.

End-Use Industry Analysis

Cement accounted for 25.2% of the global revenue share in 2021. The market can be divided into food & beverages, power, steel, cement, and Others. Cement facilities produce a lot of dust. To reduce this dust, they need different types of dust collectors. Concrete batching involves many processes such as measuring, storage, transport, and transport. All of these require dust collectors.

One of the most polluting industries is energy & power. Flue gas from power and energy industries contains harmful particles that must be removed before they are released into the environment. Dust collectors are used to collect and removing such flue gas contents.

Key Market Segments

By Product

- Cartridge Dust Collector

- Inertial Separators

- Baghouse Dust Collector

- Woven

- Non-woven

- Other Products

By End-Use Industry

- Food & Beverage

- Energy & Power

- Steel

- Cement

- Other End-Uses

By Mechanism

- Wet

- Dry

- By Mobility

- Portable

- Fixed

Market Dynamics

OSHA regulates worker exposure to hexavalent chromium (metal found within the weld fumes). Inhaled particulates of hexavalent chromium can cause serious health problems. These regulations are driving the market growth.

However, global market growth for industrial dust collectors was impacted by the Covid-19 pandemic in 2020. Market growth has been negatively affected by factors such as the closing of manufacturing plants in several end-use sectors, a decrease in production due to a lack of raw materials, and supply chain disruptions. Market growth can also be impeded by high maintenance costs and stiff competition from other air filter technologies like membrane filtration.

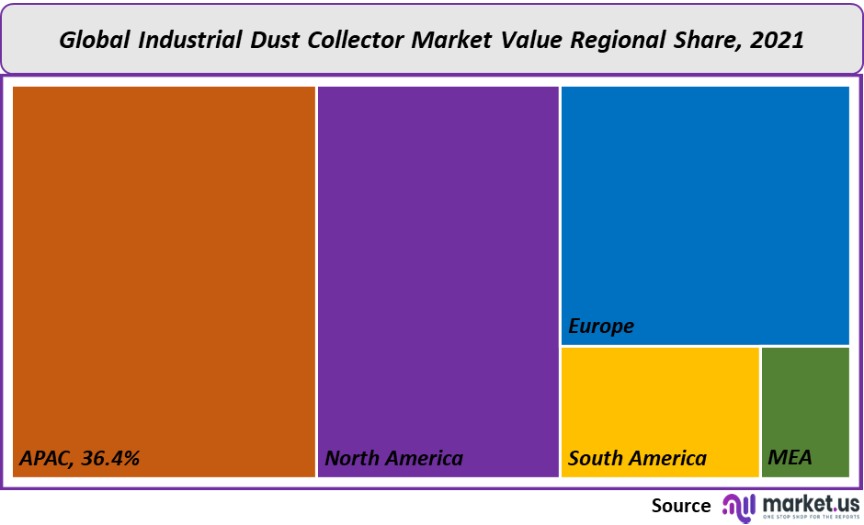

Regional Analysis

The Asia Pacific accounted for 36.4% of the global market’s revenue share in 2021. Due to rapid industrialization and the increasing number of infrastructure projects in APAC, the regional market will continue to grow at a steady CAGR between 2023-2032.

The market will be influenced by the increasing investment in infrastructure sectors by different governments, especially in developing countries. The World Steel Association AISBL states that China is the largest producer of steel and India is the 3 largest crude steel producer in the world. Europe is a major regional market due to its presence in the end-use industry. Europe’s industries directly employ more than 35 million people. It is home to the largest global food and beverage sector.

Key Regions and Countries covered in thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

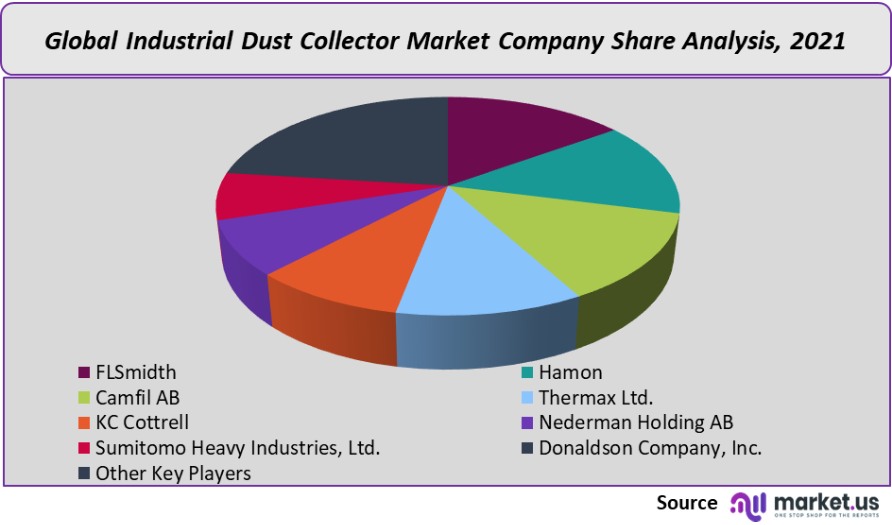

Market Share & Key Players Analysis:

Due to the presence of many global, regional and local manufacturers, the global market is highly competitive. The market offers a variety of products, with an efficiency range between 90% and 99.9%. Industrial collectors can be sold by manufacturers through a variety of channels including distributors, retailers, and company-operated websites.

Product quality, performance, corporate reputation, and technical competence are all factors that determine the competitiveness of players. To increase their market, share and strengthen their market position, companies use a variety of strategies to gain market share. These include new product launches, technological innovations, and joint ventures. The following are some of the most prominent players in global industrial dust collector markets:

Маrkеt Кеу Рlауеrѕ:

- FLSmidth

- Hamon

- Camfil AB

- Thermax Ltd.

- Kelin Environmental Protection Technology Co. Ltd.

- KC Cottrell

- Nederman Holding AB

- Sumitomo Heavy Industries, Ltd.

- Donaldson Company, Inc.

- Babcock & Wilcox Enterprises, Inc.

- Other Key Players

For the Industrial Dust Collectors Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the industrial dust collector Market in 2021?The industrial dust collector Market size is US$ 8,240.4 million in 2021.

What is the projected CAGR at which the industrial dust collector Market is expected to grow at?The industrial dust collector Market is expected to grow at a CAGR of 5.1% (2023-2032).

List the segments encompassed in this report on the industrial dust collector Market?Market.US has segmented the industrial dust collector Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, the market has been further divided into Cartridge Dust Collector, Inertial Separators, and Baghouse Dust Collector. By End-Use, the market has been further divided into Food & Beverage, Energy & Power, Steel, Cement, and Other End-Uses. By Mechanism, the market has been further divided into Wet and Dry. By Mobility, the market has been further divided into Portable and Fixed.

List the key industry players of the industrial dust collector Market?FLSmidth, Hamon, Camfil AB, Thermax Ltd., Kelin Environmental Protection Technology Co. Ltd., KC Cottrell, Nederman Holding AB, Sumitomo Heavy Industries, Ltd., Donaldson Company, Inc., Babcock & Wilcox Enterprises, Inc., and Other Key Players engaged in the Industrial Dust Collector Market.

Which region is more appealing for vendors employed in the industrial dust collector Market?APAC is expected to account for the highest revenue share of 36.4%. Therefore, the industrial dust collector industry in APAC is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for industrial dust collector?China, India, The US, Canada, UK, Japan, & Germany are key areas of operation for the industrial dust collector Market.

Which segment accounts for the greatest market share in the industrial dust collector industry?With respect to the industrial dust collector industry, vendors can expect to leverage greater prospective business opportunities through the dry mechanism segment, as this area of interest accounts for the largest market share.

![Industrial Dust Collectors Market Industrial Dust Collectors Market]() Industrial Dust Collectors MarketPublished date: May 2022add_shopping_cartBuy Now get_appDownload Sample

Industrial Dust Collectors MarketPublished date: May 2022add_shopping_cartBuy Now get_appDownload Sample - FLSmidth

- Hamon

- Camfil AB

- Thermax Ltd.

- Kelin Environmental Protection Technology Co. Ltd.

- KC Cottrell

- Nederman Holding AB

- Sumitomo Heavy Industries, Ltd.

- Donaldson Company, Inc.

- Babcock & Wilcox Enterprises, Inc.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |