Global Industrial Engines Market By Product Type (Diesel Engines and Gasoline Engines), By Engine Size (Small and Large), By End-Use Industry (Construction, Energy & Power, Oil & Gas, Agriculture, and Other End-Use Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: May 2022

- Report ID: 13286

- Number of Pages: 257

- Format:

- keyboard_arrow_up

Industrial Engines Market Overview:

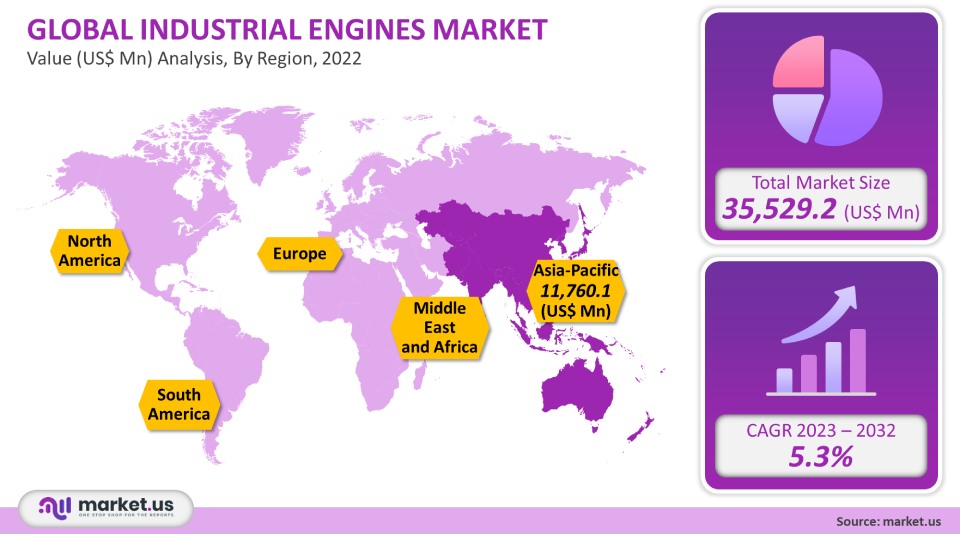

The global Industrial Engines market was valued at USD 35,529.2 million by 2021. It will grow at a CAGR, of 5.2%, from 2023-2032.

The global industrial engine market is projected to reach US$ 58,615.7 Mn in 2032, owing to increasing demand for construction machinery as well as the manufacturers are shifting to more technologically advanced industrial engines that can save energy and cut running costs.

An engine, often known as a motor, is a machine that converts one or more forms of energy into mechanical energy. Heat engines, such as internal combustion engines and external combustion engines use fuel to produce heat, which is subsequently converted into force. Electric motors use electricity to generate mechanical motion, pneumatic motors use compressed air, and clockwork motors such as wind-up toys use elastic energy.

Global Industrial Engines Market Analysis:

Product Type Analysis

On the basis of product type, this market is further categorized into diesel engines and gasoline engines. Among all mentioned product type segments, the diesel engine sub-segment is expected to register the highest CAGR of over 5.7%. Diesel engines for ships and trains, as well as stationary diesel engines used for electricity generation, will contribute to industrial growth. Diesel engines are often used as power generators, mechanical engines, and mobile drives. They are widely used in automobiles and other industrial applications.

Various government agencies have done a lot to limit the dangerous emissions of diesel engines, and practically every country will have new emission regulations. Manufacturers will continue to integrate new clean technology into their engines, resulting in higher production costs that are generally borne by customers.

Engine Size Analysis

The engine size market segmentation of the global industrial engines market is further bifurcated into small & large. The large size segment accounted for a significant revenue share in 2021. The large diesel engines can power ships, liners, and other vessels on the high seas. These enormous engines can produce power outputs as high as 90,000 kW and turn at 60 to 100 rpm. They are also 15 meters tall.

End-Use Industry Analysis

Based on the end-use industry segmentation aspect of this industry, the global industrial engine market is classified into construction, energy & power, oil & gas, agriculture, and other end-use industries sub-segments. The construction sub-segment is projected to register a high rate of revenue growth over the forecast period. The rapid urbanization, combined with the growth in infrastructure activities in both residential and commercial sectors, has fueled the demand for construction machinery.

Additionally, in order to increase farm automation, especially in developing countries, such initiatives have increased the demand for agricultural machineries like heavy-duty tractors and power tillers. This has led to a rise in demand for engines in off-road vehicles, which are used in construction and agriculture.

Key Market Segments:

By Product Type

- Diesel Engines

- Gasoline Engines

By Engine Size

- Small

- Large

By End-Use Industry

- Construction

- Energy & Power

- Oil & Gas

- Agriculture

- Other End-Use Industries

Market Dynamics:

The demand for agriculture and construction machinery engines is determined by the rate of growth in the agriculture and construction industries. The construction and agricultural machinery markets are being driven by a growing trend of mechanization in agriculture, particularly in various emerging nations, as well as an increase in residential and commercial construction projects around the world.

Construction, marine, mining, hospitals, forestry, telecommunication, underground, and agricultural applications are all attractive markets for manufacturers of industrial diesel engines. This is a major factor that is anticipated to fuel the revenue growth trajectory of this given market in the foreseeable future.

The global expansion of construction and agricultural machinery is to blame for the increased use of diesel-powered engines. The demand for construction machinery has been spurred by rapid urbanization and a surge in infrastructure activities, both in residential and non-residential sectors.

Regional Analysis:

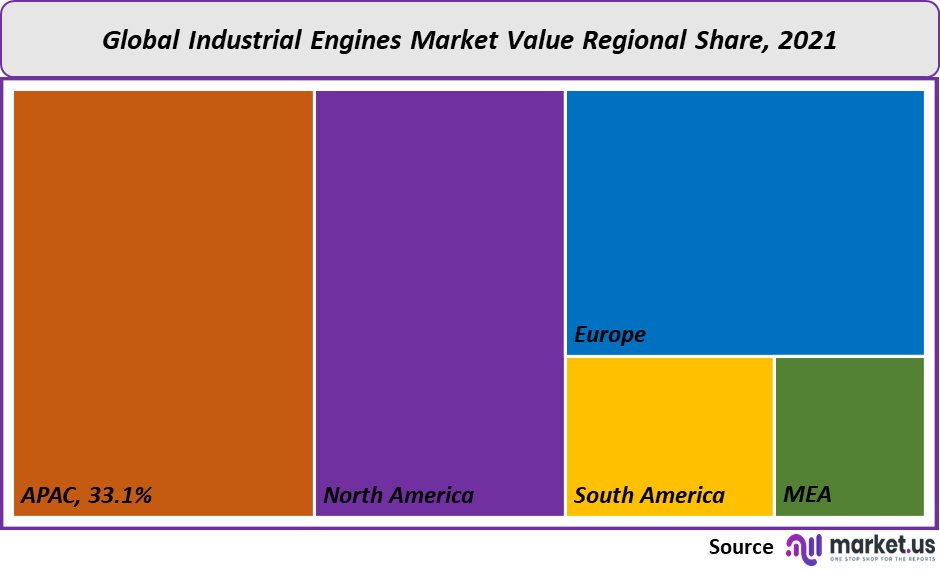

The APAC market is expected to account for 33.1% highest revenue share of the global industrial engines market, followed by the markets in North America. Japan is expected to experience a rapid CAGR during the forecast period. In the current state of affairs, every effort is made to provide advanced models for civil and defense applications. Suppliers are involved in partnerships and have acquired manufacturing licenses from American and European companies.

In the last few decades, the market has seen a lot of development in marine engines as well as the evolution of heavy-duty diesel engines. Germany’s suppliers specialize in the supply of heavy-duty engine components, including crankshafts, connecting rods, cylinder heads, crankcases, and camshafts.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

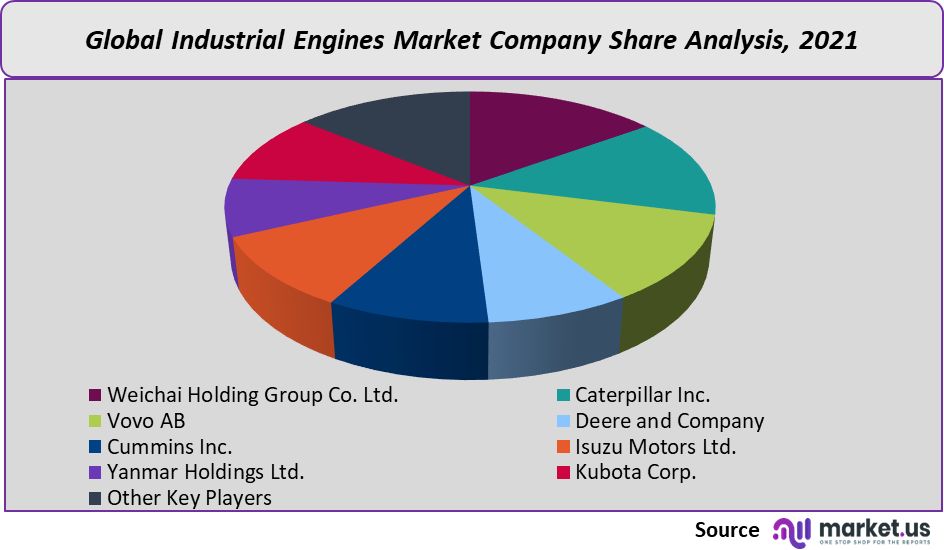

The global industrial engine market is competitive. Top players hold nearly 70% of it. This space is seeing key developments such as new product launches, expansions of production facilities, and other innovations. Some of the prominent key players are Vovo AB, Deere, and Company, Isuzu Motors lTD, etc. For instance, Yanmar Group of Japan opened India’s first diesel engine production facility in India in February 2021. The plant was located in an industrial area that was created as a JV between Sumitomo Corporation of Japan and Mahindra Sub-Sidia.

Маrkеt Кеу Рlауеrѕ:

- Weichai Holding Group Co. Ltd.

- Caterpillar Inc.

- Vovo AB

- Deere and Company

- Cummins Inc.

- Isuzu Motors Ltd.

- Yanmar Holdings Ltd.

- Kubota Corp.

- Other Key Players

For the Industrial Engines Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Industrial Engines market in 2021?The Industrial Engines market size is US$ 35,529.2 million in 2021.

Q: What is the projected CAGR at which the Industrial Engines market is expected to grow at?The Industrial Engines market is expected to grow at a CAGR of 5.2% (2023-2032).

Q: List the segments encompassed in this report on the Industrial Engines market?Market.US has segmented the Industrial Engines market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, the market has been segmented into Diesel Engines and Gasoline Engines. By Engine Size, the market has been further divided into Small and Large. By End-Use Industry, the market has been further divided into Construction, Energy & Power, Oil & Gas, Agriculture, and Other End-Use Industries.

Q: List the key industry players of the Industrial Engines market?Weichai Holding Group Co. Ltd., Caterpillar Inc., Vovo AB, Deere and Company, Cummins Inc., Isuzu Motors Ltd., Yanmar Holdings Ltd., Kubota Corp., and Other Key Players are engaged in the Industrial Engines market

Q: Which region is more appealing for vendors employed in the Industrial Engines market?APAC is expected to account for the highest revenue share of 33.1%. Therefore, the Industrial Engines industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Industrial Engines?The US, Canada, UK, Japan, Mexico, India, China & Germany are key areas of operation for the Industrial Engines Market.

Q: Which segment accounts for the greatest market share in the Industrial Engines industry?With respect to the Industrial Engines industry, vendors can expect to leverage greater prospective business opportunities through the diesel engine segment, as this area of interest accounts for the largest market share.

![Industrial Engines Market Industrial Engines Market]()

- Weichai Holding Group Co. Ltd.

- Caterpillar Inc.

- Vovo AB

- Deere and Company

- Cummins Inc.

- Isuzu Motors Ltd. Company Profile

- Yanmar Holdings Ltd.

- Kubota Corp.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |