Global Industrial Water Treatment Chemicals Market By Type (Соаgulаntѕ & Flоссulаntѕ, Віосіdеѕ & Dіѕіnfесtаntѕ, and Others), By Application (Water Desalination, Raw Water Treatment, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2021

- Report ID: 64387

- Number of Pages: 267

- Format:

- keyboard_arrow_up

Industrial Water Treatment Chemicals Market Overview:

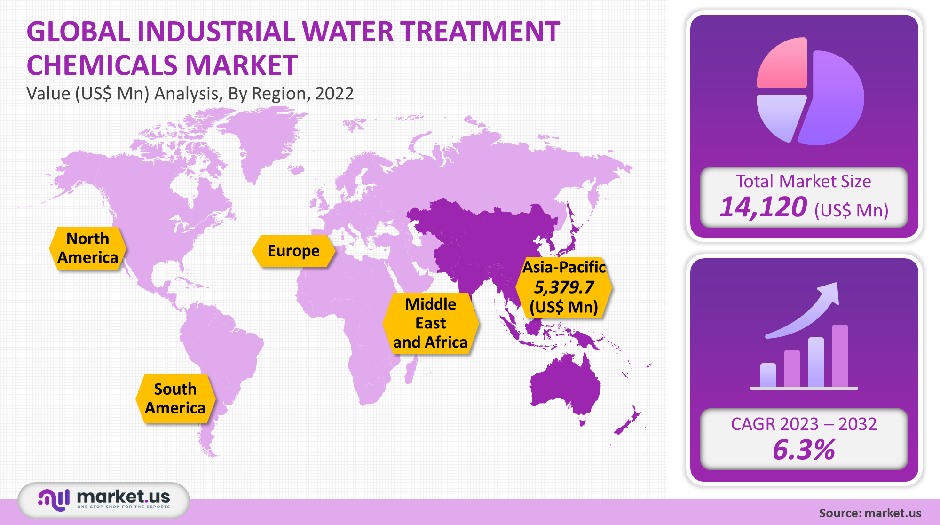

The market for industrial water treatment chemicals in 2021 was valued at USD 14,120 million, at a CAGR of 6.3%.

Global Industrial Water Treatment Chemicals Market

Product Analysis

With a revenue share of over 35%, coagulants/flocculants emerged as the largest product segment in 2021. This is due to the fact that most treatment plants incorporate sedimentation. Coagulation is used most often in the tank for chemical products of oil- and gas plants.

The coagulation process speeds up the sedimentation process. Coagulation can be in the form of both organic and inorganic compounds like aluminum hydroxide chloride or aluminum sulfate. The goal of adding coagulants in wastewater treatment is to eliminate 90% of suspended solid particles.

The second-largest product segment was biocides and disinfectants. These products ensure safety and operational efficiency. Manufacturing and industrial processes are dependent on the safe control of microbiological activities.

For feed, wastewater, and reusable water treatment, disinfectants and biocides are used. They are used in sugar, ethanol, and other industries to make sure wastewater meets the correct standards. Biocides can also control bacteria in the ethanol fermentation process.

Application Analysis

Cooling and boilers treatment was the most popular application segment in the market for industrial water treatment chemicals. They accounted for 56.7% of the total revenue share in 2021. However, the CAGR for raw water treatment chemicals is 4.3%. This will continue to be the fastest-growing segment.

Due to heavy metals and suspended parts, the demand for pretreated industrial waters is expected to rise, particularly in key countries like Brazil and U.K. This will allow for future product consumption.

Effluent treatment is the process of treating industrial wastewater and safely disposing of or reusing it.This is where industrial wastewater is separated from the wastewater in an effluent plant. It uses several chemicals like deoiling polyelectrolytes (also known as DOPE), organic coagulants flocculants, filtration aids, and dewatering aids.

As a result, the demand for effluent treatments is expected to grow significantly. The process reduces procurement expenditure and protects the environment. It also contributes to sustainable growth.

Key Market Segments

Туре

- Соаgulаntѕ & Flоссulаntѕ

- Віосіdеѕ & Dіѕіnfесtаntѕ

- Ѕсаlе Іnhіbіtоrѕ

- Соrrоѕіоn Іnhіbіtоrѕ

- Сhеlаtіng Аgеntѕ

- РН Аdјuѕtеrѕ & Ѕtаbіlіzеrѕ

- Аntі-fоаmіng Аgеntѕ

Application

- Water Desalination

- Raw Water Treatment

- Effluent Water Treatment

- Cooling & Boilers

- Others

Market Dynamics

The need to treat wastewater is expected to rise due to decreasing availability of fresh and potable drinking water in the Middle East and Africa, as well as the Asia Pacific.

Most commonly used chemicals include sodium bicarbonate (algicide), muriatic, muriatic, chlorine dioxide, and aluminum. The majority of treatment methods include flocculants, clarifiers, and coagulants. To make the resource safe for human use, treatment chemicals such as the aforementioned are used in polluted waterways, wastewater effluents, and seawater.

As a result, water consumption is increasing due to rapid urbanization and rising economic development. To meet this growing demand, a variety of products are available to ensure safety and satisfaction. There are four main processes: purification, boiler treatment, and treatment of wastewater effluent.

Due to the changing climate, energy generation, land use, and growing population, freshwater demand is expected to rise in the U.S. Most freshwater used in the country is for municipal and industrial purposes, as well as for irrigation and cooling electric power plants. It also serves as a source of water for aquaculture and livestock.

Because of the inconsistent rainfall and rain in these areas, Asia Pacific, South America, and Africa are not able to provide fresh water per capita. These are emerging markets for biocides for industrial wastewater management to preserve hygienic conditions and provide potable resources for residents.

The market has many policies and regulations that regulate the industrial treatment of chemicals. Clean Water Act, Safe Drinking Water Act, and Safe Drinking Water Act (SDWA), are EPA regulations. These programs include setting up standards for wastewater quality to protect U.S. drinking water. In Europe, the Water Framework Directive, Drinking Water Directive and Urban Wastewater Treatment Directive regulate water treatment chemicals.

The high cost of the process, including energy and maintenance, can lead to significant operating costs that could be a hindrance to market growth. There are many other factors that affect operating costs, including the plant’s size, number of employees, and geographical location.

However, the transformation from UN Sustainable Development Goals to Millennium Development Goals will likely change the nature of solutions and technologies used in the industry. The market is expected to grow by implementing efficient solutions and increasing industrial production in the power sector.

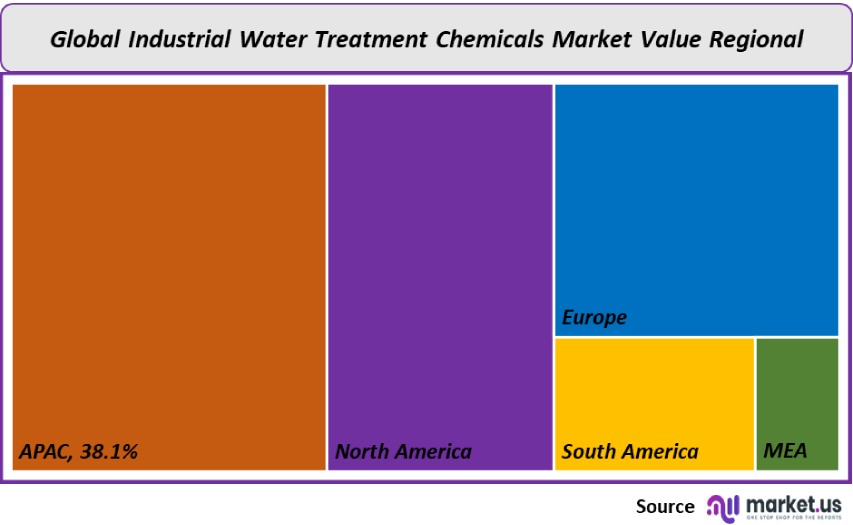

Regional Analysis

The Asia Pacific, which includes China, had the largest share of revenue and volume in 2021. It accounted for 38.1% of the global revenue share. Thailand, Vietnam, the Philippines, and Indonesia have led water PPP development due to regulatory support by policymakers for private sector participation and wastewater management in these nations. These factors will increase regional markets over the forecast period.

Taiwan is one country that suffers from severe droughts, receiving only 21% of the annual intense rains. This reduces air quality, compromises people’s wellbeing, and also affects strategic manufacturing businesses. Taiwan’s resource planners focus on diversifying their resource supply in the future, driven by a steady increase in the country’s industrial demands, which have risen from 15.4 million to 16.4 million M3/year.

In the United States and Canada, the strong presence of manufacturing plants in the chemical, pharmaceutical, food, beverage, and automotive sectors is expected to play a key role in the growing demand for treatment services over the coming years.

In the near future, management services will be reduced due to the declining growth of the U.S. mine sector and the limited operating funds available for mineral processors. However, increasing automotive production in the United States is expected to increase the demand for treatment services in utilities of plants over the forecast period.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

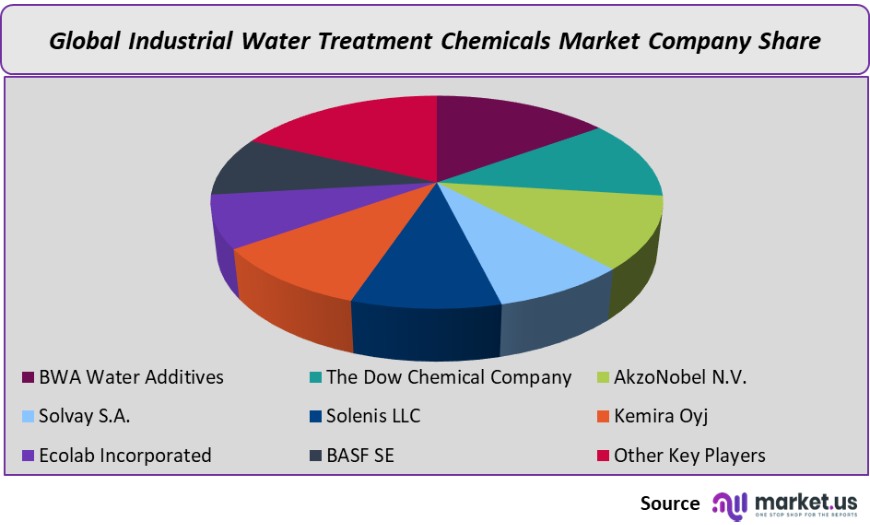

Market share Analysis

The global market is extremely competitive and highly consolidated. High industry competition is expected over the forecast period, due to the possibility of mergers and acquisitions as well as the threat from backward and forward integration by manufacturers to distribute their products and increase market share. Over the next few years, the industry is expected to see more competition from new players.

The industry is expected to be constrained by stringent government guidelines and policies regarding the manufacture of chemicals and other equipment. Brand image plays an important role in the market, as regulatory agencies are concerned with the brand and the quality of the product. The market is expected to experience a medium threat over the forecast.

Key Market Players

- BWA Water Additives

- The Dow Chemical Company

- AkzoNobel N.V.

- Solvay S.A.

- Solenis LLC

- Kemira Oyj

- Ecolab Incorporated

- BASF SE

- Other Key Players

For the Industrial Water Treatment Chemicals Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Industrial Water Treatment Chemicals market in 2021?A: The Industrial Water Treatment Chemicals market size is estimated to be US$ 14,120 million in 2021.

Q: What is the projected CAGR at which the Industrial Water Treatment Chemicals market is expected to grow at?A: The Industrial Water Treatment Chemicals market is expected to grow at a CAGR of 6.3% (2023-2032).

Q: List the segments encompassed in this report on the Industrial Water Treatment Chemicals market?A: Market.US has segmented the Industrial Water Treatment Chemicals market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, market has been segmented into Соаgulаntѕ & Flоссulаntѕ, Віосіdеѕ & Dіѕіnfесtаntѕ, Ѕсаlе Іnhіbіtоrѕ, Соrrоѕіоn Іnhіbіtоrѕ, Сhеlаtіng Аgеntѕ, РН Аdјuѕtеrѕ & Ѕtаbіlіzеrѕ, and Аntі-fоаmіng Аgеntѕ. By Application, the market has been further divided into Water Desalination, Raw Water Treatment, Effluent Water Treatment, Cooling & Boilers, and Others.

Q: List the key industry players of the Industrial Water Treatment Chemicals market?A: BWA Water Additives, The Dow Chemical Company, AkzoNobel N.V., Solvay S.A., Solenis LLC, Kemira Oyj, Ecolab Incorporated, BASF SE, and Other Key Players engaged in the Industrial Water Treatment Chemicals market.

Q: Which region is more appealing for vendors employed in the Industrial Water Treatment Chemicals market?A: Asia Pacific accounted for the highest revenue share of 38.1%. Therefore, the Industrial Water Treatment Chemicals Technology industry in Asia Pacific is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Industrial Water Treatment Chemicals?A: India, Japan, South Korea, Singapore, Indonesia, Thailand, ad Vietnam, are key areas of operation for Industrial Water Treatment Chemicals Market.

Q: Which segment accounts for the greatest market share in the Industrial Water Treatment Chemicals industry?A: With respect to the Industrial Water Treatment Chemicals industry, vendors can expect to leverage greater prospective business opportunities through the coagulants/flocculants segment, as this area of interest accounts for the largest market share.

![Industrial Water Treatment Chemicals Market Industrial Water Treatment Chemicals Market]() Industrial Water Treatment Chemicals MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample

Industrial Water Treatment Chemicals MarketPublished date: Dec 2021add_shopping_cartBuy Now get_appDownload Sample - BWA Water Additives

- The Dow Chemical Company

- AkzoNobel N.V.

- Solvay S.A.

- Solenis LLC

- Kemira Oyj

- Ecolab Incorporated

- BASF SE Company Profile

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |