Global Insurance Agency Software Market By Deployment Type (Cloud-based, On-Premise), By Application (Claims Management, Commission Management, Contact Management, Document Management, Insurance Rating, Policy Management, Quote Management), By End-Users (Small Business, Medium-sized Business, Large Business), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2031

- Published date: Apr 2022

- Report ID: 17786

- Number of Pages: 372

- Format:

- keyboard_arrow_up

Global Insurance Agency Software Market is expected to be driven by the increasing penetration of insurance companies.

Market.US announces the publication of its most recently generated research report titled, “Global Insurance Agency Software Market by Deployment Type (Cloud-based, On-Premise), By Application (Claims Management, Commission Management, Contact Management, Document Management, Insurance Rating, Policy Management, Quote Management), End-Users (Small Business, Medium-sized Business, Large Business ), and by Region – Global Forecast to 2031”, which offers a holistic view of the Global Insurance Agency Software Market through systematic segmentation that covers every aspect of the target market.

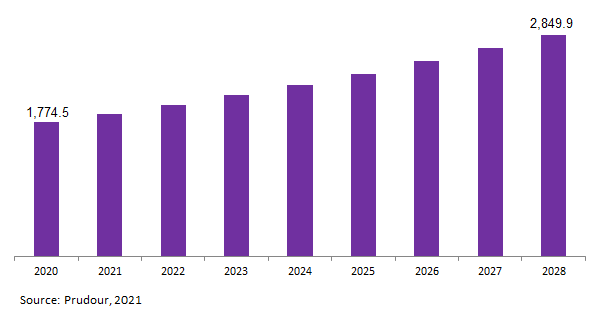

The global insurance agency software market was valued at $1,774.5 Мn in 2020 and is projected to register а САGR of 6.0% by 2028.

An insurance agency software streamlines and automates various procedures for insurance agents, brokers, and insurers. This software allows agents to keep track of their reports in a centralized archive, and to deliver operations through a single network, removing eliminating the need for them to use multiple accounting systems, while efficiently handling their given customer bases and necessary paperwork with minimal errors.

trending_up Total Revenue in 2018$ 1,774.5 Mn

trending_up Market CAGR of the Next Ten Years6.0%

no_encryption Market Value (US$ Mn), Share (%) and Growth Rate (%) Comparison 2012-2028Purchase this report or a membership to unlock the market value (US$ Mn), share (%) and growth rate (%) comparison for this industry.- By Type

- By Region

- By Application

no_encryption Leading Companies Financial HighlightsPurchase this report or a membership to unlock the leading companies financial highlights for this industry.trending_up Market Revenue of the Next Ten Years$ 2849.9 Mn

Insurance agency software has a large capacity, meaning it allows multiple users to work at the same time, and it gives online help to both head office and remote branch employees, which is made possible by cloud-based CRM systems. Another distinguishing aspect of insurance agency software is that it allows agents and corporations to retain and access enormous amounts of customer data for extended periods of time, which would otherwise be lost if they used several platforms.

Global Insurance Agency Software Market Revenue (US$ Mn), 2020–2028

The increasing penetration of insurance companies in developing countries such as India, China, Brazil, etc., is expected to boost the revenue growth prospects for the insurance agency software market as a whole. Insurance services have already reached their respective saturation stage points in developed countries such as the US, Germany, France, etc.

Increased awareness levels regarding the importance of insurance among the populations of these countries are expected to result in an adoption surge in the adoption of insurance services.

Additionally, the rapid digitalization of the customer service segment across of various industries is also expected to increase the demand for customer-facing software customer-facing software, as there is a low preference for conventional methods of software platforms is low, particularly among younger people individuals.

However, cyber threats and attacks are one of the many major concerns faced by or insurance companies. Sensitive customer data, particularly personal, financial, or transactional information is usually the primary target for cyber hackers. In addition, leakage of confidential customer data can lead to the loss of a customer’s loyalty, while the companies bearing sustains major financial and reputational damage in the process major financial and reputational damage.

Nonetheless, the increasing adoption of the Internet of Things (IoT), machine learning, robotics, and Artificial Intelligence (AI) iares expected to provide massive significant business opportunities for key industry players in the global insurance agency software market. Artificial intelligence technology can reduce the need for underwriters, customer service staff, as well as sales staff.

In addition, these technologies provide allow for features such as the automatic filling of forms, and chatbots on websites that can are capable of resolving claims and answering clients’ questions and queries, thereby simplifying the work of insurance agencies and improving operational efficiency as wellies. Factors such as these are anticipated to augment the financial development of this given market over the forecast period.

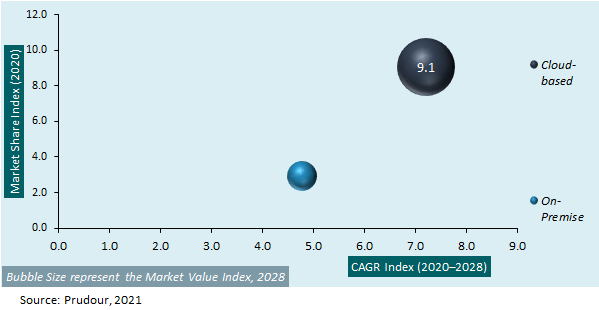

Global Insurance Agency Software Market Attractiveness Analysis by Product Type, 2020–2028

The research report on the global insurance agency software market includes profiles of some of the major companies such as

- Insurance Systems Inc.

- InsuredHQ Limited.

- Buckhill Ltd.

- Agencybloc Inc.

- Agency Matrix

- Allclients LLC

- Jenesis Software

- Vertafore Inc.

- Applied Systems Inc.

- Insurance Technologies Corporation

- EZLynx

- Agency Computer Systems Inc.

- Others

Global Insurance Agency Software Market Segmentation Based on Deployment Type, Application, End-Users and Region

Based on Deployment Type

- Cloud-based

- On-Premise

Based on Application

- Claims Management

- Commission Management

- Contact Management

- Document Management

- Insurance Rating

- Policy Management

- Quote Management

Based on End-Users

- Small Business

- Medium-sized Business

- Large Business

Based on Region

- North America

- Europe

- APAC

- South America

- MEA

For the Insurance Agency Software Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

![Insurance Agency Software Market Insurance Agency Software Market]() Insurance Agency Software MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample

Insurance Agency Software MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample - Insurance Systems Inc.

- InsuredHQ Limited.

- Buckhill Ltd.

- Agencybloc Inc.

- Agency Matrix

- Allclients LLC

- Jenesis Software

- Vertafore Inc.

- Applied Systems Inc.

- Insurance Technologies Corporation

- EZLynx

- Agency Computer Systems Inc.

- Others

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |