Global Islamic Financing Market By Type (Banking Assets, Sukuk Outstanding, Islamic Funds' Assets, and Takaful Contributions), By Application (Individual, Commercial, Government, and International), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2031

- Published date: Dec 2021

- Report ID: 65009

- Number of Pages: 206

- Format:

- keyboard_arrow_up

Islamic Financing Market Introduction

Islamic finance refers to financial activities that must comply with Sharia (Islamic Law). The concept may also refer to investments that are permissible under Sharia law. The common practices of Islamic finance and banking came into existence with the foundation of Islam. However, the establishment of formal Islamic finance only occurred in the 20th century. Nowadays, the Islamic finance sector grows at 15%-25% per year, while Islamic financial institutions oversee over $2 trillion. The primary difference between conventional finance and Islamic finance is that some of the practices and principles that are used in conventional finance are strictly prohibited under Sharia law.

Islamic banking is commonly seen to have two advantages over conventional banking. The first is a perception that Islamic banks are bound to a higher moral standard. They will not take on irresponsible amounts of risk or pay inflated bonuses to their top bankers. The second is that earnings come from identifiable assets, not opaque combinations of derivatives and securities. As Islamic banks cannot make money through interest, they rely on ties to tangible assets, such as real estate and equity, charging ‘rent’ instead of interest.

Principles of Islamic Finance:

- Paying or charging an interest

- Not investing in businesses involved in prohibited activities

- Speculation (maisir)

- Uncertainty and risk (gharar)

- Material finality of the transaction

- Profit/loss sharing

Types of Financing Arrangements

- Profit-and-loss sharing partnership (mudarabah)

- Profit-and-loss sharing joint venture (musharakah)

- Leasing (Ijarah)

Detailed Segmentation–

The global Islamic finance market is segmented on the basis of Financial Sectors, and regions. Represented below is a detailed segmental description:

Based on Financial Sectors:

- Islamic Banking

- Islamic Insurance: Takaful

- Islamic Bonds ‘Sukuk’

- Other Islamic Financial Institutions (OIFIs)

- Islamic Funds

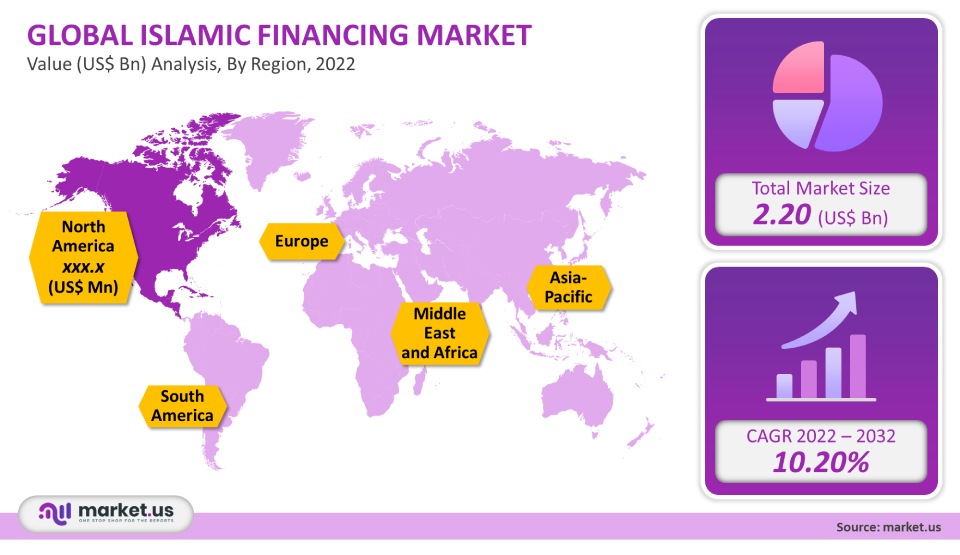

Based on Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Market Dynamics–

The global Islamic finance market is growing at a rapid pace, on account of strong investments in Halal Sectors, infrastructure, and Sukuk bonds, especially through electronic modes concerning products and services. The factors driving the economic growth of the Islamic finance market are directing investments toward ample growth opportunities in promising Islamic sectors.

With the rapidly growing popularity of mobile banking, particularly among younger individuals, according to PwC’s 2018 Digital Banking Consumer Survey, a growing number of digital-only, or disruptor banks with no physical branches, have emerged. Islamic banks are also catching up on this trend, with the launch of digital-only subsidiaries, such as Gulf International Bank’s Meem in Bahrain and Saudi Arabia, and Albaraka Trks Insha in Germany and other European countries with substantial Muslim communities.

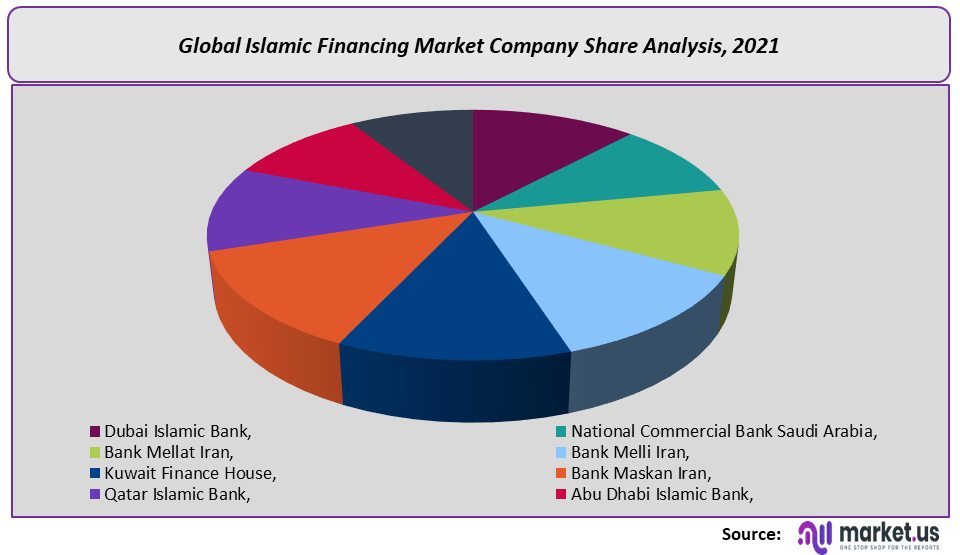

Competitive Landscape –

The global Islamic finance market is relatively competitive, with the presence of a moderate number of local and global players such as

- Dubai Islamic Bank

- National Commercial Bank Saudi Arabia

- Bank Mellat Iran

- Bank Melli Iran

- Kuwait Finance House

- Bank Maskan Iran

- Qatar Islamic Bank

- Abu Dhabi Islamic Bank

- May Bank Islamic

- the CIMB Islamic Bank.

Key developments –

Two Shariah-compliant challenger banks were launched in the UK early in 2020 – Rizq and the mobile-only Niyah. Four more digital banks are currently in the pipeline, based in the UK, Malaysia, and Kenya. Halal Robo-advisory Wahed Invest and the newly launched gold trading platform Minted established Shariah-compliant digital banks in Q1 of 2021.

Dubai Islamic bank successfully closed a US$1 billion Sukuk issuance in June 2020 that had originally been intended as a US$750 million issue during Q1 but was postponed due to unfavorable market conditions caused by the pandemic.

For the Islamic Financing Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

![Islamic Financing Market Islamic Financing Market]()

- Dubai Islamic Bank,

- National Commercial Bank Saudi Arabia,

- Bank Mellat Iran,

- Bank Melli Iran,

- Kuwait Finance House,

- Bank Maskan Iran,

- Qatar Islamic Bank,

- Abu Dhabi Islamic Bank,

- May Bank Islamic,

- the CIMB Islamic Bank.

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |