Global Isopropyl Alcohol Market By Application (Antiseptic & Astringent, Cleaning Agent, Solvent, and Other Applications), By End-Use (Cosmetics and Personal Care, Pharmaceutical, Food and Beverages, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jul 2022

- Report ID: 57761

- Number of Pages: 371

- Format:

- keyboard_arrow_up

Isopropyl Alcohol Market Overview :

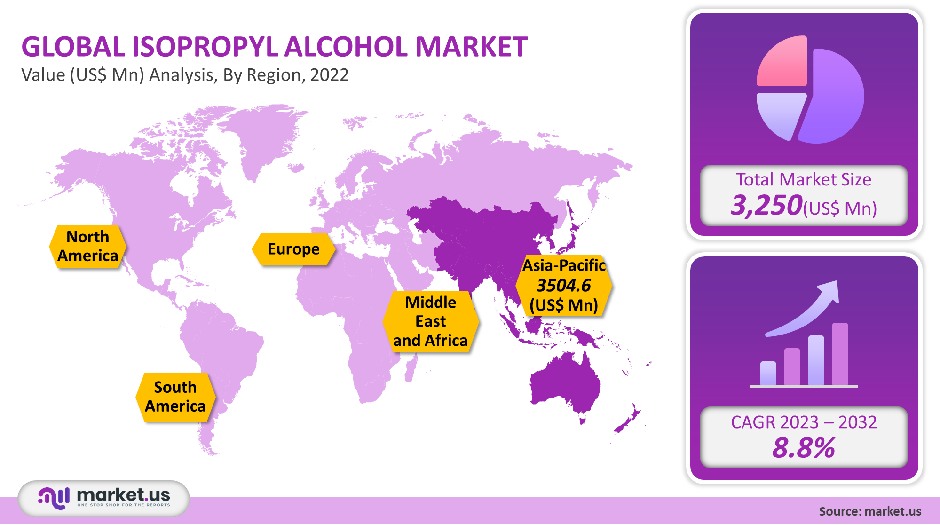

The global isopropyl alcohol market was worth USD 3,250 million in 2021. It is projected to grow at an 8.8% compound annual growth rate (CAGR) between 2023 and 2032.

The excellent solvency properties of isopropyl alcohol (IPA) make it a key solvent in many end-use industries. Because of its disinfectant properties, the substance is a crucial component in many medical facilities, pharmaceutical products, and medical devices.

Global Isopropyl Alcohol Market Scope:

Application Analysis

Based on 2021 revenue, the largest share was held by antiseptic and astringent at 42.4%. Due to the recent pandemic of 2020, there has been a rapid increase in demand for antiseptic and astringent products. Regular use of antiseptics and personal care products will be necessary to prevent the spread of the virus. This will reflect a high demand for personal and pharmaceutical care product formulation.

Because of its excellent disinfectant properties, antiseptics are one of the most important uses of the compound. Hand sanitizers are made from IPA at a concentration of ideally 70%. It is also used in the production of cleaning agents, where it is used as a household solvent, surface disinfectant, and electronic component cleaner. Isopropyl alcohol can also be used as an astringent to reduce skin pores and make skin smoother.

Its main uses include its ability to act as a solvent. It is used in the formulation of pesticides and herbicides, as well as on surfaces and coatings. Because of its lower density, low boiling points, and toxicity, the substance can also be used to dilute essential oils. These properties will continue to drive the high demand for the product by solvent manufacturers in the future.

End-Use Analysis

The demand for chemicals is increasing rapidly in the pharmaceutical, personal care, cosmetics, food, beverage, and the paints and coatings and chemicals industries. Based on 2021 revenue, the pharmaceutical segment held 35.1% of the total market share. Its high ethanol content makes it a versatile product used in many industries. After the virus outbreak in the first quarter of 2020, the personal care market will expand rapidly.

The cosmetics and personal-care segment accounted for the second-largest market share in 2021 and will see the most growth during the forecast period. Isopropyl alcohol, also known as rubbing alcohol, is used extensively in designing skincare products, shampoo products, hair care products, and aftershave lotions. It is widely used in personal hygiene products such as hand washes, hand scrubs, hand washes, antiseptic skin preparations for patients, and sanitizers. It can also be used to make makeup and eye care products.

It is used as an inert solvent in wood furnishing and coatings industries and is also found in thinners and paints. It helps in safe storage and transportation by reducing the coating’s flammability. Isopropyl alcohol is also used as a preservative, food flavoring agent, and sweetener in the food industry.

Маrkеt Ѕеgmеntѕ:

By Application

- Antiseptic & Astringent

- Cleaning Agent

- Solvent

- Other Applications

By End-Use

- Cosmetics and Personal Care

- Pharmaceutical

- Food and Beverages

- Other End-Uses

Market Dynamics:

Isopropyl alcohol, also known as isopropanol, is a flammable, colorless liquid that has a strong odor. It is used in many industries to make industrial and household chemicals. It is also a key ingredient of many chemical formulations such as antiseptics, disinfectants, detergents, and disinfectants. There are three types of production methods: direct hydration (indirect hydration) and hydrogenation.

Due to the growing demand for solvent and pharmaceutical applications, U.S. demand is expected to rise. The market is being supported by large pharma companies like Merck, Abbott, and Johnson & Johnson. The existing downstream specialty chemicals market will also drive future product demand.

However, the chemical has many antimicrobial properties. Mixing 60% to 90% of it with 10% to 40% water can quickly fight several bacteria and viruses. The disinfecting properties of the chemical will decrease if it is less than 50%. Additionally, alcohol can form a protective layer by rapidly coagulating proteins. This protects the skin from any future protein coagulation.

Multinational companies that produce isopropyl alcohol or other disinfectants began optimizing their production capacity to meet rapidly rising demand during times of crisis. ExxonMobil Corporation in Europe experienced a fire hazard at an IPA production facility in early 2020.

However, the company quickly recovered and resumed production at its optimal capacity. INEOS Corporation’s two IPA production facilities in Germany are fully functional. However, the rising demand has caused a shortage of supplies, and travel restrictions have added to the difficulties for local formulators.

Regional Analysis

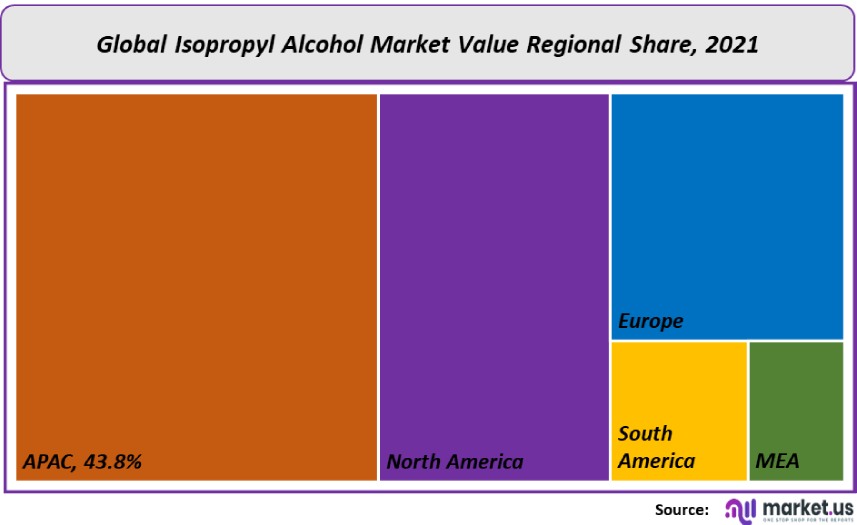

The recent industry trends and economic recovery of countries post-coronavirus will likely determine the regional movement of isopropyl alcohol. The Asia Pacific accounted for 43.8% of the market share in 2021 and is expected to experience the most rapid growth.

The U.S. was the largest consumer of the product in 2021, followed by Western Europe, China, and India. With the current global situation, Europe is the largest consumer of personal hygiene and sanitizers, just behind the U.S. To contain the 2020 virus outbreak, major capacity increases were made in Europe, particularly in Germany.

Safety and hygiene products are in high demand across Europe, including Germany, Italy, the U.S.A., and Asia, like Japan, India, and China. Due to the multiple companies that require IPA solvent to produce personal care products and pharmaceutical applications, the demand for IPA will likely be high in these regions.

A majority of solvents are used in paints and coatings due to the increasing number of healthcare facilities in Europe, North America, and the Asia Pacific. Emerging economies in the Asia Pacific like India, Thailand & Japan, and other regions, are more dependent on preservatives to maximize shelf life. These countries will continue to see steady growth in IPA demand over the forecast period, as IPA is a common food coloring agent and preservative.

Кеу Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

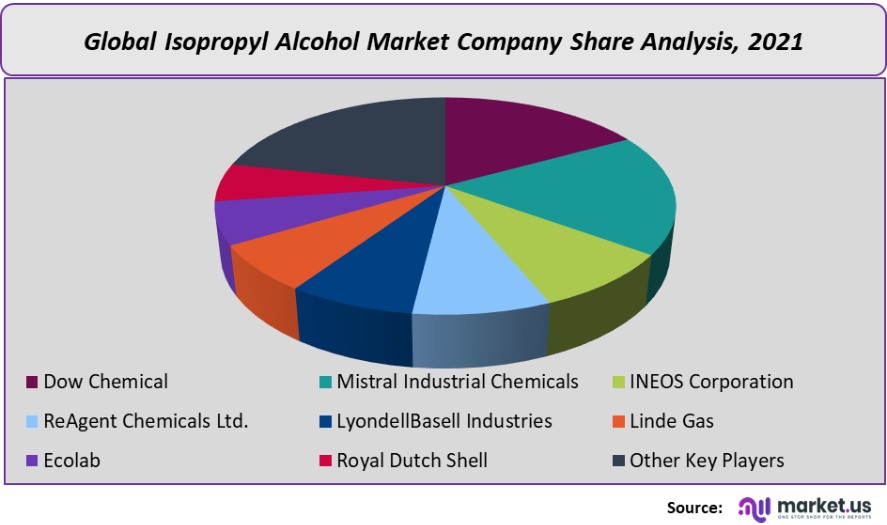

Market leaders with international reach and a large product portfolio have been prominent. This is due to significant investments in research and development.

INEOS Corporation stated that it will use its full capacity in Germany for sanitizer production at its two facilities during the first quarter of 2020. This large amount of IPA is essential for the continued operation of these facilities.

To meet the increasing demand for personal care products and sanitizers in their respective markets, American companies have increased their production capacities. Market participants have adopted major strategies such as joint ventures and product development that focus on new applications. The market leader in isopropyl alcohol includes:

Маrkеt Kеу Рlауеrѕ:

- Dow Chemical

- Mistral Industrial Chemicals

- INEOS Corporation

- ReAgent Chemicals Ltd.

- LyondellBasell Industries

- Linde Gas

- Ecolab

- Royal Dutch Shell

- Other Key Players

For the Isopropyl Alcohol Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Isopropyl Alcohol Market size in 2021?A: The Isopropyl Alcohol Market size is US$ 3,250 million in 2021.

Q: What is the CAGR for the Isopropyl Alcohol Market?A: The Isopropyl Alcohol Market is expected to grow at a CAGR of 8.8% during 2023-2032.

Q: What are the segments covered in the Isopropyl Alcohol Market report?A: Market.US has segmented the Global Isopropyl Alcohol Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type, market has been segmented into Antiseptic & Astringent, Cleaning Agent, Solvent and other applications. By End-Uses, market has been further divided into Cosmetics and Personal Care, Pharmaceutical, Food and Beverages, and Other Key players.

Q: Who are the key players in the Isopropyl Alcohol Market?A: Dow Chemical, Mistral Industrial Chemicals, INEOS Corporation, ReAgent Chemicals Ltd., LyondellBasell Industries, Linde Gas, Ecolab, Royal Dutch Shell, Other Key Players are the key vendors in the Isopropyl Alcohol market

Q: Which region is more attractive for vendors in the Isopropyl Alcohol Market?A: APAC is accounted for the highest revenue share of 43.8% among the other regions. Therefore, the Isopropyl Alcohol Market in APAC is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for advanced ceramics?A: Key markets for Isopropyl alcohol are The U.S., Germany, U.K., China, India, Brazil.

Q: Which segment has the largest share in the Isopropyl Alcohol Market?A: In the Isopropyl Alcohol Market, vendors should focus on grabbing business opportunities from the antiseptic and astringent segment as it accounted for the largest market share in the base year.

![Isopropyl Alcohol Market Isopropyl Alcohol Market]()

- Dow Chemical

- Mistral Industrial Chemicals

- INEOS Corporation

- ReAgent Chemicals Ltd.

- LyondellBasell Industries

- Linde Gas

- Ecolab

- Royal Dutch Shell

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |