Global Joint Replacement Market By Product Type (Knees, Hips, and Extremities), By Fixation Type (Hybrid, Reverse Hybrid, Cemented, and Cement less), By Procedure (Total Replacement, Partial Replacement, and Other Procedures) By End-use (Hospitals, Orthopaedic Clinics, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Aug 2022

- Report ID: 35264

- Number of Pages: 311

- Format:

- keyboard_arrow_up

Joint Replacement Market Overview:

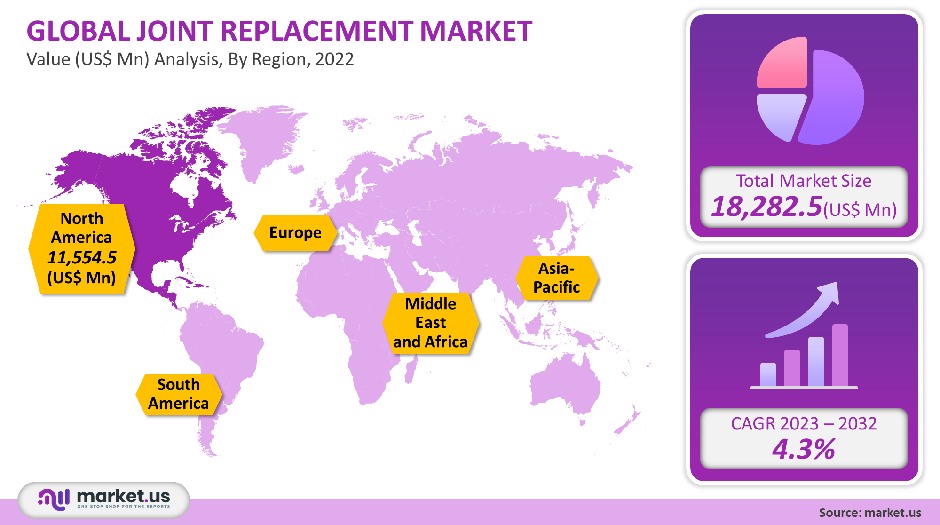

The global joint replacement market was valued at USD 18,282.5 million in 2021. It is expected to grow at a CAGR of 4.3% between 2023 and 2032.

Market forces driving joint replacement include the rise in osteoporosis, osteoporosis (OA), and lower extremity disorders. Another form of arthritis that affects the joints and causes muscle pain is called Rheumatoid. These chronic diseases are increasing in number, leading to high demand for surgical intervention, which is thereby limiting the growth of the joint replacement market.

Global Joint Replacement Market Scope:

Product Type Analysis

In 2021, the largest revenue share was held by the knee segment which dominated the joint replacement market. It accounted for more than 44.2% of the total market. This segment is mainly driven by the increasing number of elderly people, which in turn leads to an increase in old-age diseases such as arthritis and osteoporosis. The segment will also benefit from technological advances such as minimally invasive surgery and improved implant materials.

Over the forecast period, the extremities market is expected to expand rapidly. There have been many technological advances in the field of extremity surgery. These include mobile-bearing ankles and reverse shoulder implants. New and safer materials are also being developed. Industry players like Exactas and Lima are launching new products for shoulder replacement.

Fixation Type Analysis

Cemented was the dominant segment in the market for joint replacement, with a revenue share of more than 48.7% in 2021. Cement-less fixation, while better suited for younger patients, was found to be more suitable for older patients than cement.

Cemented fixation is more popular because it has a high rate of survivorship and low revision rates compared to other types. Cemented THA’s cost-effectiveness is also driving its growth. To provide greater comfort for the patient, vendors offer a variety of cemented implant designs. Zimmer’s Legacy LPS-Flex Fixed Bearing Total Knee offers greater flexion and posterior stability to the patient.

Procedure Analysis

In 2021, the total replacement segment was the dominant market for joint replacement. It held the largest revenue share at 63.1%. The Arthritis Foundation report projects that the U.S. will see 640,000 total hip replacements per year by 2020. THINK Surgical, Inc. was granted FDA approval in 2019 for the T-Solution One Total Knee Application to be used in total knee arthroplasty.

Resurfacing and revision are the other segments. While total replacement surgery is the most efficient, it can fail to perform for multiple reasons. Resurfacing replacement can be done. Revision replacements are similar in that they aim to relieve pain and restore the function of the organ.

End-Use Analysis

Hospitals dominated the joint replacement market and had the highest revenue share at over 51.4% in 2021. This was due to advanced treatment options and increased patient footfall. Hospitals are easy to find as they can be found in almost all locations. This is why most patients choose hospitals over other settings.

The segment growth is further encouraged by the favorable reimbursement policies offered through Medicare and Blue Cross Blue Shield. Due to the increase in sports injuries, trauma accidents, and other chronic diseases, the orthopedic clinic’s segment will experience the greatest growth.

These clinics are in high demand due to their shorter wait times, personalized care, and shorter stays. Because of their low-cost structure, orthopedic clinics are able to provide affordable services and procedures. These factors will continue to drive this market in the future. There has been a substantial increase in the number and quality of clinics that provide orthopedic care, as patients are more inclined to choose them.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Hips

- Knees

- Extremities

By Fixation Type

- Hybrid

- Reverse Hybrid

- Cemented

- Cement less

By Procedure

- Partial Replacement

- Total Replacement

- Other Procedures

By End-Use

- Hospitals

- Orthopedic Clinics

- Other End-Uses

Market Dynamics:

Many countries decided to stop performing non-emergency surgery in order to make it easier for COVID-19 patients. The orthopedic companies suffered huge revenue losses due to widespread surgical restrictions and cancellations. However, the market for joint repair began to recover and was able to work quickly despite a large backlog of delayed surgeries. It is expected that the market for joint substitutes will rebound quickly after the full resumption of surgical procedures.

In 2021, the industry players reported a decrease in sales. Stryker saw its net revenue drop by 8.3% compared to last year, while Zimmer Biomet saw its revenue decline by 10.6% in 2021. Due to knee replacement’s more urgent nature than hip replacement, the pandemic had a major impact on sales. Due to its faster underlying growth, the extremities segment saw steady growth.

The revenue is also being boosted by technological advances in the fields of hips, knees, and extremities. In 2020 Stryker Corporation introduced Mako Total Hip 4.0, a smart robotic system. This system allows doctors and surgeons to plan the implant position of the patient while also taking into account the pelvic tilt changes in patients’ sitting, standing, and supine positions. Smith+Nephew purchased Integra Lifesciences’ extremity orthopedic business in 2020 to expand its reach in this market.

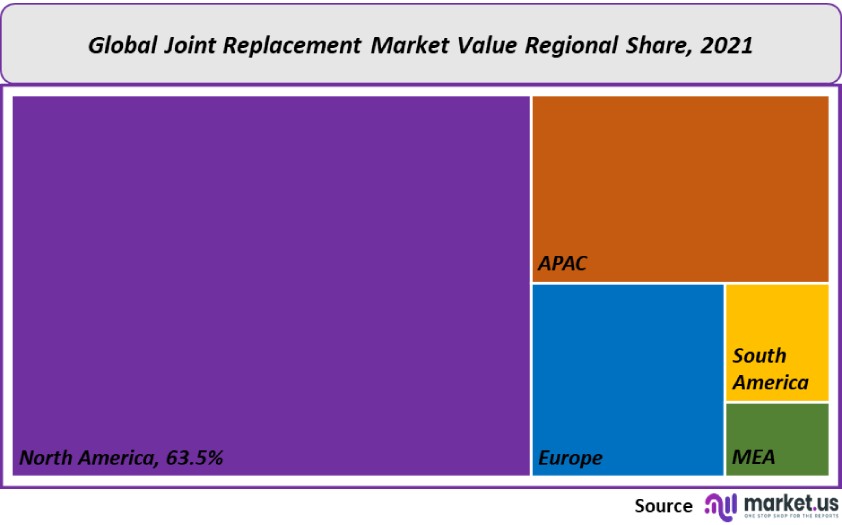

Regional Analysis

North America was the dominant market for joint replacement in 2021, accounting for more than 63.5% of the total revenue. The North American market for joint replacements is expected to grow due to a variety of factors such as osteoarthritis prevalence, geriatric population, insurance coverage availability, and the number of accident and trauma cases. This supports the market growth for joint replacement. Market growth for joint replacement is expected to be fueled by the increasing prevalence of orthopedic diseases and the rapid adoption of innovative products.

The Asia Pacific market for joint replacement will show the highest growth rate over the forecast period due to increasing healthcare spending, rapidly evolving healthcare infrastructure, and growing medical tourists. The market for joint replacement will be influenced by other factors such as increasing elderly populations, rising healthcare spending in Asian economies, and an increasing prevalence of osteoarthritis and osteoporosis.

Key Regions and Countries covered іn thе rероrt:- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

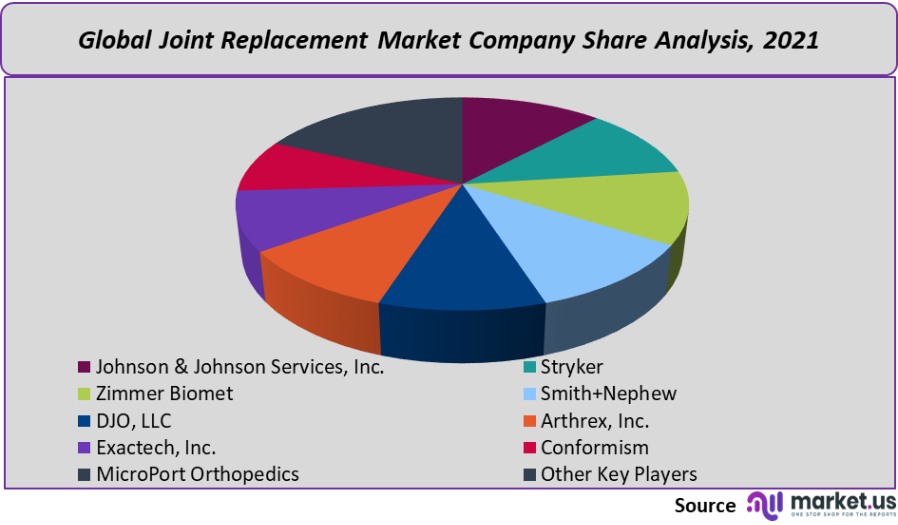

Market Share & Key Players Analysis:

There are many small and large industry players in the market for joint replacement. To gain market share, key players are implementing business strategies that include regional expansion, partnerships, and product launches, as well as diversifying product offerings. Stryker purchased OrthoSensor, Inc. in 2021, a leader in digital technology for total joint replacement. This acquisition has strengthened Stryker’s position in the market. The market for joint replacement is dominated by the following players:

Маrkеt Кеу Рlауеrѕ:

- Johnson & Johnson Services, Inc.

- Stryker

- Zimmer Biomet

- Smith+Nephew

- DJO, LLC

- Arthrex, Inc.

- Exactech, Inc.

- Conformism

- MicroPort Orthopedics

- Corin Group

- Other Key Players

For the Joint Replacement Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the joint replacement market in 2021?The Joint replacement market size is US$ 18,282.5 million in 2021.

What is the projected CAGR at which the Joint replacement market is expected to grow at?The Joint replacement market is expected to grow at a CAGR of 4.3% (2023-2032).

List the segments encompassed in this report on the Joint replacement market?Market.US has segmented the Joint replacement market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, the market has been segmented into Knees Hips, and Extremities. By Fixation Type, the market has been further divided into Hybrid, Reverse Hybrid, Cemented, and Cement less. By Procedure, the market has been further divided into Total Replacement, Partial Replacement, and Other Procedures. By End-use, the market has been further divided into Hospitals, Orthopedic Clinics, and Other End-Uses.

List the key industry players of the Joint replacement market?Johnson & Johnson Services, Inc., Stryker, Zimmer Biomet, Smith+Nephew, DJO, LLC, Arthrex, Inc., Exactech, Inc., Conformism, MicroPort Orthopaedic, Corin Group, and Other Key Players engaged in the Joint Replacement Market.

Which region is more appealing for vendors employed in the Joint replacement market?North America is expected to account for the highest revenue share of 63.5%. Therefore, the Joint replacement industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for joint replacement?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Joint Replacement Market.

Which segment accounts for the greatest market share in the joint replacement industry?With respect to the Joint replacement industry, vendors can expect to leverage greater prospective business opportunities through the knee segment, as this area of interest accounts for the largest market share.

![Joint Replacement Market Joint Replacement Market]()

- Johnson & Johnson Services, Inc.

- Stryker Corporation Company Profile

- Zimmer Biomet

- Smith+Nephew

- DJO, LLC

- Arthrex, Inc.

- Exactech, Inc.

- Conformism

- MicroPort Orthopedics

- Corin Group

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |