Global Laboratory Information Management System Market By Type (On-premise LIMS, Cloud-based LIMS, and Remotely hosted LIMS), By Application (Healthcare Industries, Pharmaceutical and biotechnology industries, Biobanks/biorepositories, Contract Services Organizations (CROs and CMOs), Academic research institutes, Petrochemical Refineries and Oil and Gas Industries, Chemical Industries, Food and Beverage and Agricultural Industries, and Environmental Testing Laboratories), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2019-2028

- Published date: Mar 2022

- Report ID: 32885

- Number of Pages: 385

- Format:

- keyboard_arrow_up

Laboratory Information Management System (LIMS) Market Overview:

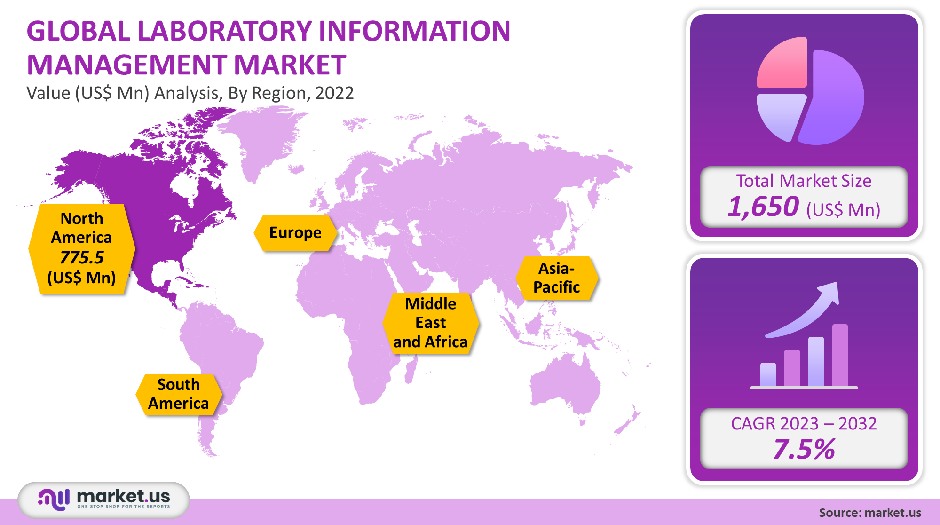

The Laboratory Information Management System (LIMS) Market size is expected to be around USD 3400.70 million by 2031 from USD 1,650 million, growing at a CAGR of 7.5% from 2021 to 2031.

The rising demand for laboratory automation and technological advancements in pharmaceutical laboratories are expected to drive the market for these systems over the next few years. The industry trend is expected to benefit from technological advances in R&D laboratories, particularly biotechnological and pharmaceutical laboratories.

Other factors driving growth in the Laboratory Information Management System Market (LIMS) include low costs of implementation, efficient time management, and compliance with GDP, GCP & GMP.

Global Laboratory Information Management System Market Scope:

Product Analysis

The global market can be divided into three products: on-premise, cloud-based, or web-hosted. When purchasing any laboratory informatics system, technical considerations are crucial. It is important for organizations to assess both the needs of the solution and their IT infrastructure.

Organizations can then choose from web-based, cloud-based, and on-premise solutions. Cloud-based products dominated the market in 2021, accounting for 44.5% of global revenue. It is expected to maintain its position as the market leader, growing at the fastest CAGR rate during the forecast period. These key factors are responsible for the dominance in the cloud-based product sector.

Other factors driving segment growth include reduced IT staff, cost-effective service data management, and ease of deployment. Due to customers’ high adoption of web hosting LIMS, the web-hosted segment accounted for the second largest revenue market share.

This LIMS can be used by various laboratories, including R&D departments and manufacturing companies, as well as public utilities and environmental, chemical, and contract labs. On-premise is expected to see a significant increase in demand over the next few years due to its ability to be customized and more reliable than other LIMS market services.

Component Analysis

The market is divided into software companies and services basis on components. Services dominated the market in 2021. This is due in part to increased demand for LIMS integration, maintenance, validation, and support. The segment is also expected to grow due to the increased demand for outsourcing LIMS solutions. Outsourcing is a solution to sizeable pharmaceutical research labs’ lack of resources and skills needed for analytics deployment. Outsourcing can be either project-based or long-term.

These services can be purchased in packages. They include compliance for promotional spending, social media analysis, predictive analytics for medical device failure, benchmarking, and other services segment. Due to the key development of software systems from SaaS to more advanced CaaS and PaaS as well as community networks, the software segment will experience steady growth during the forecast period.

Major market players are continually pursuing different strategies to promote market growth. IDBS announced a combination of the E-WorkBook electronic lab notebook and SCIEX Analyst Software in September 2020. This helps to expand the company’s existing family of integrations.

End-Use Analysis

The market can be divided into life sciences, contract research organizations (CROs), oil & gas, chemical industries, food & beverages & agriculture, environmental testing laboratories, and other industries such as forensic, metal, and mining laboratories. In 2021, the life sciences segment was the most prominent. This is due to the widespread adoption of LIMS within pharmaceutical laboratories. This segment is expected to grow due to the lack of qualified staff, increased productivity, cost efficiency, and increasing demand for biobanks.

CROs will experience the fastest growth from 2023 to 2032. The increasing demand for outsourcing services for biotechnological and pharmaceutical companies can explain this rapid growth. This segment is expected to grow due to its associated benefits, including cost efficiency, focus on major competencies, and mutual benefit to clients and contractors over the forecast period.

Key Market Segments

By Product

- On-Premise

- Web-hosted

- Cloud-based

By Component

- Software

- Services

By End-Use

- Life Sciences

- CROs

- Petrochemical Refineries & Oil and Gas Industry

- Chemical Industry

- Food and Beverage & Agriculture Industries

- Environmental Testing Laboratories

- Other Industries (Forensics and Metal & Mining Laboratories)

Market Dynamics

The market has seen significant growth in recent years through partnerships, acquisitions, and collaborations. Due to increasing awareness of LIMS, there has been an increase in demand, driving the market growth. The global market is also driven by rising automation in laboratories, increased regulatory compliance, technological advances in LIMS, increasing awareness through conferences, workshops & seminars, and increasing R&D spending.

The demand for 24/7 laboratory testing services soared during the COVID-19 pandemic. Clinical laboratories operated at maximum capacity, which caused significant stress to the laboratory’s personnel and infrastructure. Such stressful environments can be unfavorable when many biohazardous samples are tested daily. This is why LIMS is being implemented to improve workflows worldwide.

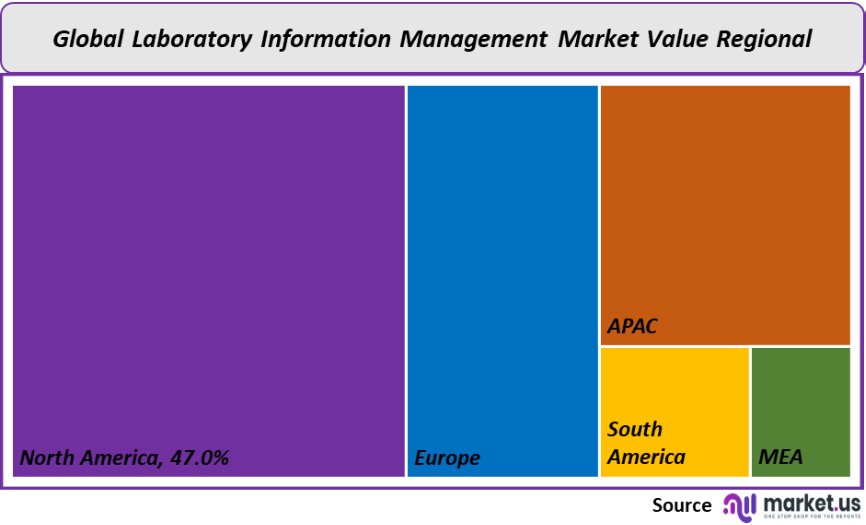

Regional Analysis

In 2021, North America accounted for 47% of global revenue. This is due to policies encouraging automation adoption, such as EHR programs. The American region’s largest share is also due to advanced technology, rising demand for genomic studies, and rising government funding.

Asia-Pacific will be the fastest growing regional market in the future due to the increase of LIMS-providing regional CROs. The Global Services Location Index (GSLI), ranking 55 countries for outsourcing web-enabled service services, ranked India first in 2016.

Many biopharma companies are also shifting to the Asia Pacific to lower production costs. This is driving a significant increase in demand for LIMS systems in Asian countries. However, stakeholders from developed markets such as Europe and the U.S. shifted their operations after the COVID-19 impact.

The major markets for LIMS market are China, India, Brazil, and the Middle East. This market lacks proper standards and government regulations, which opens up huge opportunities for vendors who cannot meet the standards in developed countries like the U.S.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of the Middle East & Africa

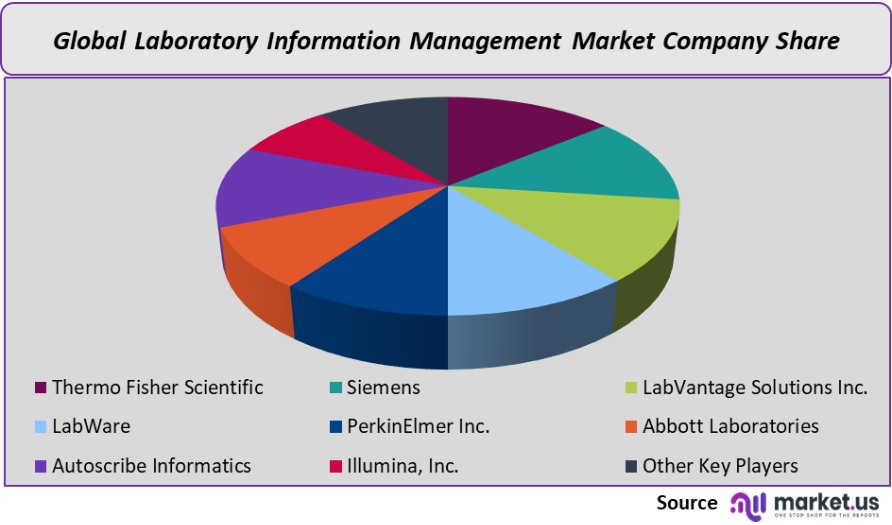

Market Share & Key Players Analysis:

Global markets are highly competitive. To withstand competition, key companies are involved with acquisitions, strategic collaborations, new product launches, and new product launches. To increase their revenue growth share, companies are focusing on implementing strategies such as new product launches and regional expansions, partnerships, distribution agreements, and partnership agreements.

Labware, for example, announced in June 2020 the production release of Labware 8, its enterprise laboratory platform. Abbott also launched STARLIMS Life Science Solution 11.1 in July 2019 to manage complex test and sample workflows.

The market will also benefit from technological advances by the major players. LabVantage Solutions, for instance, launched in July 2020 its fully integrated Scientific Data Management System (SDMS) through LabVantage 8.5. These factors will likely boost market growth over the forecast period.

Market Key Players:

- Thermo Fisher Scientific

- Siemens

- LabVantage Solutions Inc.

- LabWare

- PerkinElmer Inc.

- Abbott Laboratories

- Autoscribe Informatics

- Illumina, Inc.

- Abbott informatics

- Other Key Players

For the Laboratory Information Management System Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: Whаt іѕ thе ѕіzе оf thе Lаbоrаtоrу Іnfоrmаtіоn Маnаgеmеnt mаrkеt іn 2021?А: Тhе Lаbоrаtоrу Іnfоrmаtіоn Маnаgеmеnt mаrkеt ѕіzе іѕ UЅ$ 1,650 mіllіоn іn 2021.

Q: Whаt іѕ thе рrојесtеd САGR аt whісh thе Lаbоrаtоrу Іnfоrmаtіоn Маnаgеmеnt mаrkеt іѕ ехресtеd tо grоw аt?А: Тhе Lаbоrаtоrу Іnfоrmаtіоn Маnаgеmеnt mаrkеt іѕ ехресtеd tо grоw аt а САGR оf 7.5% (2023-2032).

Q: Lіѕt thе ѕеgmеntѕ еnсоmраѕѕеd іn thіѕ rероrt оn thе Lаbоrаtоrу Іnfоrmаtіоn Маnаgеmеnt mаrkеt?А: Маrkеt.UЅ hаѕ ѕеgmеntеd thе Lаbоrаtоrу Іnfоrmаtіоn Маnаgеmеnt Маrkеt bу gеоgrарhіс (Nоrth Аmеrіса, Еurоре, АРАС, Ѕоuth Аmеrіса, аnd Міddlе Еаѕt аnd Аfrіса). Ву рrоduсt, thе mаrkеt hаѕ bееn ѕеgmеntеd іntо Оn Рrеmіѕе, Wеb-hоѕtеd, Сlоud-bаѕеd, аnd оthеrѕ; bу соmроnеnt, thе mаrkеt hаѕ bееn ѕеgmеntеd іntо Ѕоftwаrе аnd Ѕеrvісеѕ, аnd thе еnd-uѕе mаrkеt hаѕ bееn ѕеgmеntеd іntо Lіfе Ѕсіеnсеѕ, СRОѕ, Реtrосhеmісаl Rеfіnеrіеѕ & Оіl аnd Gаѕ Іnduѕtrу, Сhеmісаl Іnduѕtrу, Fооd аnd Веvеrаgе & Аgrісulturе Іnduѕtrіеѕ, Еnvіrоnmеntаl Теѕtіng Lаbоrаtоrіеѕ, Оthеr Іnduѕtrіеѕ (Fоrеnѕісѕ аnd Меtаl & Міnіng Lаbоrаtоrіеѕ).

Q: Lіѕt, thе major key market player оf thе Lаbоrаtоrу Іnfоrmаtіоn Маnаgеmеnt mаrkеt?А: Тhеrmо Fіѕhеr Ѕсіеntіfіс, Ѕіеmеnѕ, LаbVаntаgе Ѕоlutіоnѕ Іnс., LаbWаrе, РеrkіnЕlmеr Іnс., Аbbоtt Lаbоrаtоrіеѕ, Аutоѕсrіbе Іnfоrmаtісѕ, Іllumіnа, Іnс., Оthеr Кеу Рlауеrѕ аrе thе kеу vеndоrѕ іn thе Lаbоrаtоrу Іnfоrmаtіоn Маnаgеmеnt mаrkеt.

Q: Whісh rеgіоn іѕ mоrе арреаlіng fоr vеndоrѕ еmрlоуеd іn thе Lаbоrаtоrу Іnfоrmаtіоn Маnаgеmеnt mаrkеt?А: Nоrth Аmеrіса ассоuntеd fоr thе hіghеѕt rеvеnuе ѕhаrе оf 47%. Тhеrеfоrе, thе Lаbоrаtоrу Іnfоrmаtіоn Маnаgеmеnt іnduѕtrу іn Nоrth Аmеrіса іѕ ехресtеd tо gаrnеr ѕіgnіfісаnt buѕіnеѕѕ орроrtunіtіеѕ оvеr thе fоrесаѕt реrіоd.

Q: Nаmе thе kеу аrеаѕ оf buѕіnеѕѕ fоr thе Lаbоrаtоrу Іnfоrmаtіоn Маnаgеmеnt Маrkеt.А: Тhе UЅ, Саnаdа, Сhіnа, Јараn, Gеrmаnу, Saudi Arabia, Frаnсе, UК, еtс., аrе lеаdіng kеу аrеаѕ оf ореrаtіоn fоr Lаbоrаtоrу Іnfоrmаtіоn Маnаgеmеnt Маrkеt.

Q: Whісh ѕеgmеnt ассоuntѕ fоr thе largest market share іn thе Lаbоrаtоrу Іnfоrmаtіоn Маnаgеmеnt іnduѕtrу?А: Wіth rеѕресt tо thе Lаbоrаtоrу Іnfоrmаtіоn Маnаgеmеnt іnduѕtrу, vеndоrѕ саn ехресt tо lеvеrаgе grеаtеr рrоѕресtіvе buѕіnеѕѕ орроrtunіtіеѕ thrоugh thе Ѕеrvісеѕ ѕеgmеnt, аѕ thіѕ аrеа оf іntеrеѕt ассоuntѕ fоr thе lаrgеѕt mаrkеt ѕhаrе.

![Laboratory Information Management System Market Laboratory Information Management System Market]() Laboratory Information Management System MarketPublished date: Mar 2022add_shopping_cartBuy Now get_appDownload Sample

Laboratory Information Management System MarketPublished date: Mar 2022add_shopping_cartBuy Now get_appDownload Sample - Thermo Fisher Scientific Company Profile

- Siemens Aktiengesellschaft Company Profile

- LabVantage Solutions Inc.

- LabWare

- PerkinElmer Inc.

- Abbott Laboratories

- Autoscribe Informatics

- Illumina, Inc.

- abbott informatics

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |