Global Lactic Acid Market By Type (Glazed Ceramic Tile, Unglazed Ceramic Tile, and Porcelain Tile), By Application (Household Usage, and Commercial Usage), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2019-2028

- Published date: Mar 2022

- Report ID: 34505

- Number of Pages: 245

- Format:

- keyboard_arrow_up

Lactic Acid Market Overview

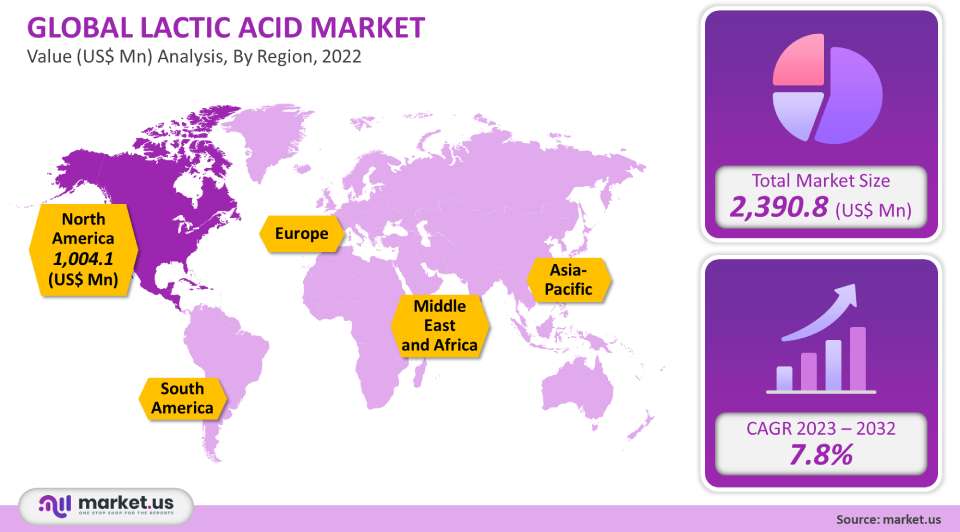

The market for lactic acid was worth US$ 2.39 Billion in 2021. It is projected to grow at a CAGR of 7.8% between 2023 and 2032. This product will be used in many end-use industries including pharmaceuticals, food & beverages. The majority of these countries are emerging economies like India, China & Indonesia. PLA is a biodegradable plastic and a compostable thermoplastic. It is made from renewable resources such as lactic acids, which are produced by fermentation processes. The majority of PLA is made using lactic acid. The chemical is Generally Recognized as Safe (GRAS) and is highly marketable in the food & beverage industry. It is being acknowledged as safe by the United States Food and Drug Administration.

Global Lactic Acid Market Scope:

Raw Material Analysis

In 2021, the sugarcane raw materials segment was responsible for 43% of the total revenue. This can be attributed to the abundance of biomass materials. The main feedstock for the production of lactic acid is raw sugar from sugar beets or sugarcane. Sugarcane is a key ingredient in the development and growth of bioplastics as well as the biochemical and food industries.

Over the forecast period, the corn segment will see a 7.9% CAGR. Because of its low cost and sustainability, it has become a popular raw material. Over the forecast period, rising environmental concerns, sustainable processing techniques, and limited supplies of petroleum feedstock will increase the demand for corn-based lac acid products. One of the most common ingredients used in the production of lactic acid is yeast extract. The high production costs associated with this process led to Corn Steep Liquor (CSL), which is a corn-based by-product of corn steeping. In the next few years, the market for corn-based lactose will grow as it is used in the food & beverage industry as a pH regulator, microbial activator enhancer, and acidulant. Starchy and cellulosic raw materials are also used the produce lactic acid. These include potato, sweet sorghum as well as wheat, rye barley, and rice.

End-Use Analysis

The market for polylactic acid was dominated by the end-user segment and represented the largest revenue share at 32% in 2021. Its durability, mechanical strength, transparency, and cost-effectiveness are all reasons for this. This end-user segment is driven by the increasing demand for bio-degradable materials, the steady growth of the automotive sector, and the growing demand from end-use industries.

Many components used in vehicle interiors, such as trim and under-the-hood components, are made from lightweight materials. These lightweight components improve vehicle performance and reduce vehicle weight. PLA will see a significant increase in demand for bioplastic materials that can be recycled to improve fuel efficiency and durability.

Food and beverages were the second most popular application sector in 2021. The ability of lactic acid to control the growth of pathogenic microorganisms and enhance the flavor of foods and beverages can make them more shelf-worthy. This product’s unique properties will lead to a rise in demand. PLA is made from lactic acid, which is a key feedstock. It can also be used to make biodegradable plastic. These biodegradable plastics can be used in many industries such as chemical and packaging. Natural solvent lactic acid can be used in both mechanical and metal cleaning applications.

This market has seen significant growth in the pharmaceutical industry over the last few years due to the increased use of lactic acid in drug production and intravenous solutions that supplement the body’s required fluids. The growth of the pharmaceutical sector is expected to be boosted by lactic acid’s properties, such as pH regulator, metal sequestration, effectiveness as a natural body component, and chiral intermediate. This is due to the increasing use of skin care products in personal care applications.

Key Market Segments:

By Raw Material

Corn

Cassava

Sugarcane

Other Raw Materials

By End-Use

Industrial

Pharmaceuticals

Food & Beverages

Polylactic Acid (PLA)

Personal Care

Other Applications

Market Dynamics:

Polylactic acid (PLA), which was widely used during the global COVID-19 pandemic to create microwaveable containers such as food containers or disposable cutlery, was extensively used. PLA is being used more widely in food packaging. Plastic is becoming more popular than older packaging options. Food and beverage packaging was in high demand during the pandemic. People bought packaged food products because of sanitation and well-being concerns. These reasons have led to an increase in demand for lactic acid.

One of the most well-known organic acids, lactic acid has many industrial applications. This product is used in the cosmetics, chemical, pharmaceutical, and food industries. The product is a lactobacillus, which is a group of beneficial bacteria with probiotic properties. This acid is also important in the preparation and fermentation of dairy products and pickling vegetables.

Not only is lactic acid a key ingredient in fermented foods such as yogurt, butter, and canned vegetables, but it is also used in pickled vegetables and olives as a preservative or acidulant. This organic acid, which is naturally occurring, can be used in many applications including food, beverages, pharmaceuticals cosmetics chemicals, and industries. This organic acid is produced on a large scale. Most commonly, carbohydrates are obtained from various sources such as corn starch and sugarcane. Organic acids like formic acid or lactic acid are not as easily dissociated in water, unlike mineral acids.

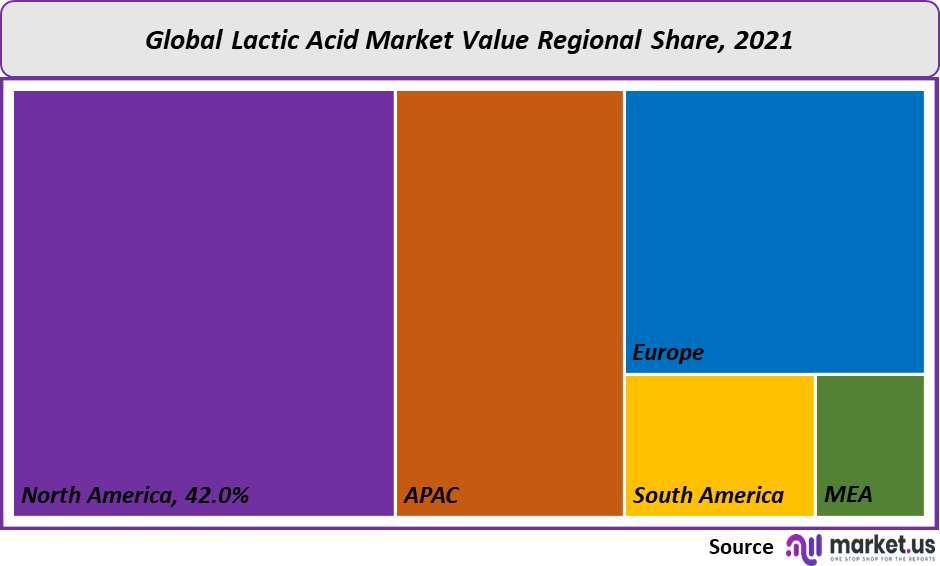

Regional Analysis

North America was the dominant market for lactic acids and had the highest revenue share, of 42% in 2021. This can be attributed to the expanding personal care, pharmaceutical, food, and beverage industries. Market growth is expected to be positive due to the expansion of the U.S. pharmaceutical industry as a result of increased expenditures on medicine. The North American market for Lactic Acid is expected to grow due to the presence of several personal cares and cosmetic companies such as Procter and Gamble and Colgate-Palmolive Company.

The strong manufacturing base of global cosmetic companies, including Johnson and Johnson Private Limited and Procter and Gamble in the U.S., is expected to increase the demand for personal care products. The U.S. government’s efforts to reduce carbon footprint and high demand for packaging applications will drive market growth for PLA over the forecast period.

Key Regions and Countries covered in the report:

North America

US

Canada

Mexico

Europe

Germany

UK

France

Italy

Russia

Spain

Rest of Europe

APAC

China

Japan

South Korea

India

Rest of Asia-Pacific

South America

Brazil

Argentina

Rest of South America

MEA

GCC

South Africa

Israel

Rest of MEA

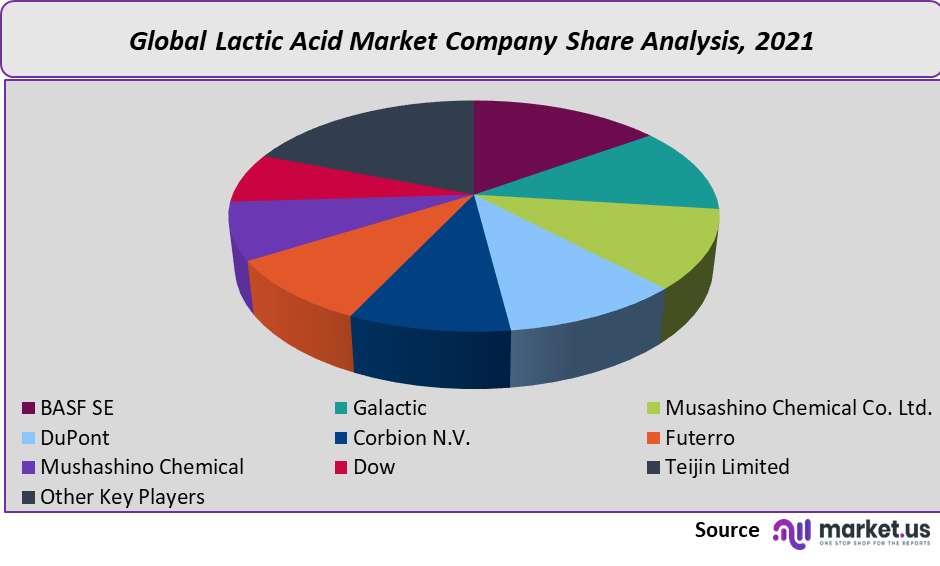

Market Share & Key Players Analysis:

Mergers and acquisitions are a common strategy for companies to increase their manufacturing capacity, diversify their product lines, and provide a more competitive product range. According to the November 2020 article, Sulzer Chemtech helped partnered with B&F PLA to develop China’s first fully integrated sugar to polylactic acid (Bengbu) plant. Sulzer’s technology for polymerization, distillation, and crystallization is used to produce 35,000 tons annually.

Market Key Players:

Galactic

Musashino Chemical Co. Ltd.

DuPont

Corbion N.V.

Futerro

Musashino Chemical

Dow

Teijin Limited

Other Key Players

For the Lactic Acid Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

2.39 Billion

Growth Rate

7.8%

Forecast Value in 2032

5.46 Billion

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Lactic Acid market in 2021?The Lactic Acid market size is US$ 2,390.8 million in 2021.

What is the projected CAGR at which the Lactic Acid market is expected to grow at?The Lactic Acid market is expected to grow at a CAGR of 7.8% (2023-2032).

List the segments encompassed in this report on the Lactic Acid market?Market.US has segmented the Lactic Acid Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By raw material, the market has been segmented into Corn, Sugarcane, Cassava, & Other Raw Materials; by end-use, the market has been segmented into Industrial, Food & Beverages, Pharmaceuticals, Personal Care, Polylactic Acid (PLA), & Other Applications.

List the key industry players of the Lactic Acid market?BASF SE, Galactic, Musashino Chemical Co. Ltd., DuPont, Corbion N.V., Futerro, Mushashino Chemical, Dow, Teijin Limited, Other Key Players, are engaged in the Lactic Acid market.

Which region is more appealing for vendors employed in the Lactic Acid market?North America accounted for the highest revenue share of 42%. Therefore, the Lactic Acid industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for the Lactic Acid Market.The US, Canada, Mexico, U.K., Germany, Italy, France, Netherlands, China, Japan, India, Indonesia, Malaysia, Philippines, Brazil, etc., are leading key areas of operation for Lactic Acid Market.

Which segment accounts for the greatest market share in the Lactic Acid industry?With respect to the Lactic Acid industry, vendors can expect to leverage greater prospective business opportunities through the sugarcane segment, as this area of interest accounts for the largest market share.

![Lactic Acid Market Lactic Acid Market]()

- BASF SE Company Profile

- Galactic

- Musashino Chemical Co. Ltd.

- DuPont

- Corbion N.V.

- Futerro

- Musashino Chemical

- Dow

- Teijin Limited

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |