Global Laundry Care Market By Product Type (Laundry Detergents, Laundry Aides, and Fabric Softeners & Conditioners), By Distribution Channel (Online and Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2021

- Report ID: 65572

- Number of Pages: 279

- Format:

- keyboard_arrow_up

Laundry Care Market Overview:

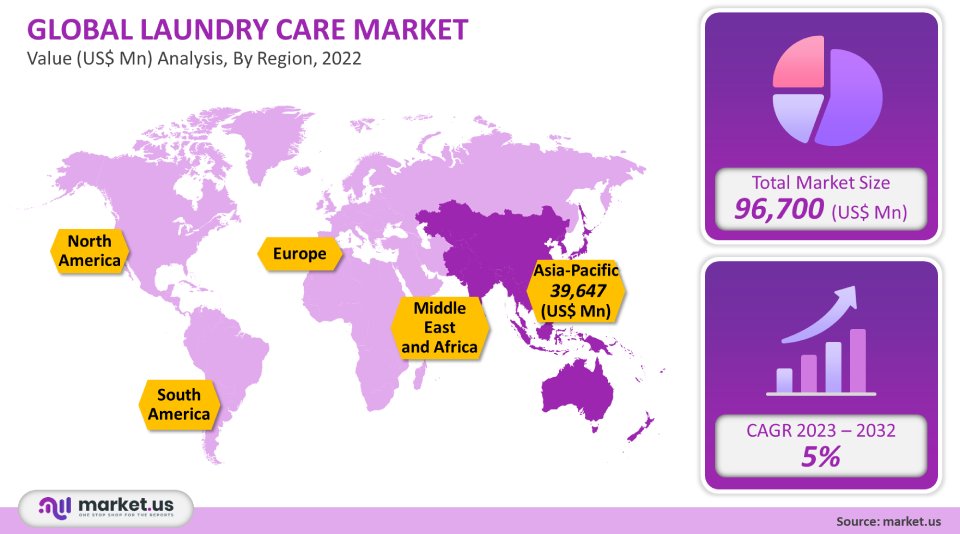

The global laundry care market was worth USD 96,700 million in 2021. It is expected to grow at a CAGR of 5% between 2022 to 2032.

Due to the growing population in developing countries, the growth of the global laundry care market is driven mainly by the rising demand for products. Consumers are more likely to spend on laundry care and cleaning products because there are so many wash & care products. The demand for laundry products is increasing due to rising awareness of hygiene and health. The market will continue to grow due to the increasing demand for laundry products and rising consumer preference for eco-friendly products.

Global Laundry Care Market Scope:

Product type analysis

Due to growing demand, the laundry detergents product category contributed around 66% to the global market revenue for 2021. Laundry detergents are used to clean clothes of dirt and stains. Its quick and effective results have made detergents very popular with consumers. Market players have increased their marketing efforts to increase consumer awareness about laundry detergent products, including gels, pods, and liquids.

Consumers are increasingly looking for simple-to-clean clothes. This has led to the growth of both liquid and pod laundry detergents. When used in a washer, liquid laundry detergents disperse quickly in cold water. These factors will likely drive the segment’s growth over the forecast period.

The fastest-growing segment is fabric softeners and conditioners. This product category is expected to grow significantly over the forecast period. This is due to the growing demand for premium clothing and a 5.1% increase in the segment’s growth from 2023 to 2032. In the next few years, the growing preference of young people for premium products will positively impact the growth of conditioners.

As customers demand high-end clothing, they will be looking for fabric conditioners and softeners to help preserve their softness. Rising concerns about chemicals like quaternary ammonium compounds, that can cause skin problems, are driving the demand for biodegradable products. Manufacturers will be compelled to invest in research and development, as well as the creation of new products.

Distribution Channel analysis

In 2021, the largest share of global market revenue was held by the offline distribution channel segment. It accounted for approximately 81%. This includes specialty shops, hypermarkets, and supermarkets as well as independent retail stores. In the next few years, laundry product demand will rise due to the expansion of the organized retail sector in emerging economies like India, Malaysia, and China.

In the next few years, the offline distribution channel will see a rise in popularity due to increased product availability in supermarkets and other offline channels. These factors will all be a factor in the segment’s growth over the next few years.Due to the growing use of online shopping, the segment with the greatest growth is likely to be the largest. A rise in laundry care product sales mainly via company websites and eCommerce companies like Amazon, Walmart, etc. In the next few years, the online distribution channel segment is expected to grow. Key players in the global market will continue to showcase new product launches via e-commerce websites and online portals. This is expected to increase their reach and create new revenue streams. The market will grow positively due to increasing internet penetration and the growth of the eCommerce industry.

Кеу Маrkеt Ѕеgmеntѕ:

By Product Type

- Laundry Detergents

- Laundry Aides

- Fabric Softeners & Conditioners

- Other Product Types

By Distribution Channel

- Online

- Offline

Market Dynamics:

The global laundry market saw a rise in demand for and acceptance of laundry products during the COVID-19 pandemic. Due to COVID-19, the global demand for laundry products increased due to the increasing awareness of consumers about the importance of disinfecting and cleaning their homes and clothes to protect themselves and family members from the new coronavirus. Infrastructural improvements and increasing disposable income have led to significant growth in laundry care product demand in the coming years.

This industry will see more opportunities due to the growing demand for eco-friendly and sustainable laundry care products. This will drive the laundry care market’s growth in the next few years. The rising importance of healthier living and increased consumer concern about hygiene and sanitation will drive the growth of the global laundry care market in the near future.

A constant increase in household cleaning supplies has resulted from rising concerns about hygiene and living sanely, especially laundry detergents. The role of fragrance in household cleaning products has increased over the past few years. Consumers prefer products that have a pleasant odor to make their products stand out. Market players are expected to invest more to create new eco-friendly and organic products over the forecast period.

Additionally, rising household spending and increased real estate investment as a result of rising residential unit counts have helped to increase laundry detergent product demand around the world. Vendors are making the most of online platforms to sell their products through their websites and place them on well-known e-tailing sites to increase their product reachability.

Increased demand for organic and eco-friendly laundry care products is influencing the industry. This trend gives key players the opportunity to sell organic products that are also environmentally friendly. This will increase organic laundry care’s growth, creating new opportunities for market players. Vendors are continually introducing new products that contain biodegradable chemicals such as mineral-based surfactants, coconut oil, natural washing soap, and plant-based enzymes.

Many companies are recalling these products from the market due to strict regulations concerning the harmful effects on the health of the use of these products. This could limit market growth in the forecast period. The industry is seeing increased demand due to the COVID-19 epidemic. The pandemic has led to an increase in awareness and growth of the market.

Regional Analysis:

The Asia Pacific is the dominant region, capturing more than 41% of the industry share. This is due to the majority of laundry product usage being done in the Asia Pacific. This market is also being driven by rising disposable income and an increasing population. The market will be driven by growing economies like India and China during the forecast period. There will also be an increase in laundry product and cleaning products spending. China will likely remain a major shareholder in the Asia Pacific due to its large population that is looking for fast dry-cleaning products and laundry care products to maintain their personal hygiene.

North America will see a 5.3% CAGR between 2023 to 2032. This could be explained by the growing demand for laundry products. This market is also seeing an increase in sales of eco-friendly and sustainable laundry care products. Market growth is expected to be fueled by a high concentration of workers and higher disposable incomes in the U.S. and Canada.

The laundry industry in North America has seen significant growth over the past few years due to the increased awareness of hygiene and a healthier lifestyle. Household cleaner sales are boosted by the well-established reality industry, household spending, and an increase in housing units.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

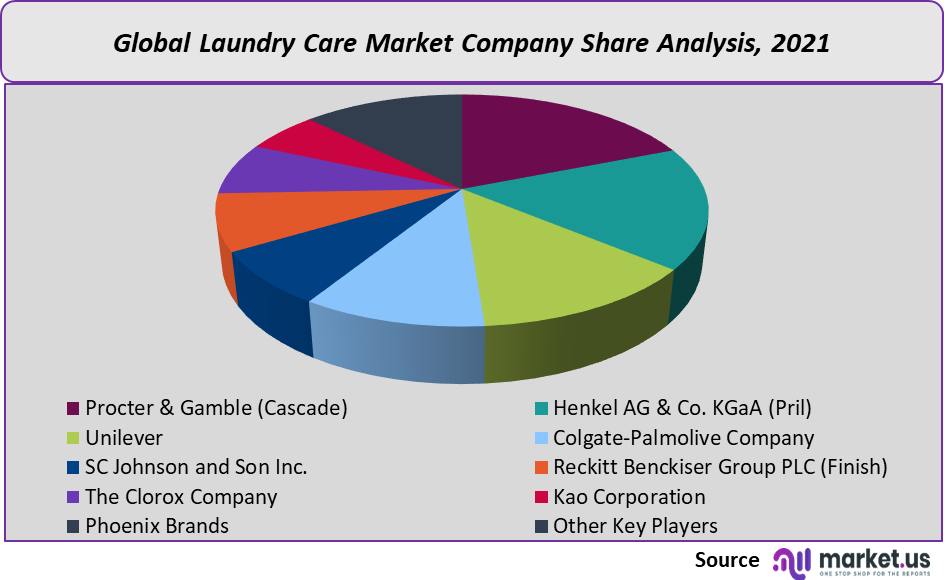

To meet growing demand, key players are focusing their R&D efforts and also creating sustainable and environmentally-friendly products. To expand the market and increase production, key players invest in new manufacturing plants.

Маrkеt Кеу Рlауеrѕ:

- Procter & Gamble (Cascade)

- Henkel AG & Co. KGaA (Pril)

- Unilever

- Colgate-Palmolive Company

- SC Johnson and Son Inc.

- Reckitt Benckiser Group PLC (Finish)

- The Clorox Company

- Kao Corporation

- Phoenix Brands

- Other Key Players

For the Laundry Care Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Laundry Care market in 2021?The Laundry Care market size is US$ 96,700 million in 2021.

Q: What is the projected CAGR at which the Laundry Care market is expected to grow at?The Laundry Care market is expected to grow at a CAGR of 5% (2023-2032).

Q: List the segments encompassed in this report on the Laundry Care market?Market.US has segmented the Laundry Care market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, market has been segmented into Laundry Detergents, Laundry Aides, and Fabric Softeners & Conditioner. By Distribution Channel, the market has been further divided into Online and Offline.

Q: List the key industry players of the Laundry Care market?Procter & Gamble (Cascade), Henkel AG & Co. KGaA (Pril), Unilever, Colgate-Palmolive Company, SC Johnson and Son Inc., Reckitt Benckiser Group PLC (Finish), The Clorox Company, Kao Corporation, Phoenix Brands, and Other Key Players engaged in the Laundry Care market.

Q: Which region is more appealing for vendors employed in the Laundry Care market?APAC accounted for the highest revenue share of 41%. Therefore, the Laundry Care industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Laundry Care?China, India, The US, Germany, U.K., France, Brazil, are key areas of operation for Laundry Care Market.

Q: Which segment accounts for the greatest market share in the Laundry Care industry?With respect to the Laundry Care industry, vendors can expect to leverage greater prospective business opportunities through the laundry detergents segment, as this area of interest accounts for the largest market share.

![Laundry Care Market Laundry Care Market]()

- Procter & Gamble (Cascade)

- Henkel AG & Co. KGaA (Pril)

- Unilever Plc Company Profile

- Colgate-Palmolive Company

- SC Johnson and Son Inc.

- Reckitt Benckiser Group PLC (Finish)

- The Clorox Company

- Kao Corporation Company Profile

- Phoenix Brands

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |