Global Limestone Market By Product Type (High-calcium limestone and Magnesian limestone), By End-Use (Building & Construction, Iron & Steel, Agricultural, and Chemical), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Nov 2021

- Report ID: 17168

- Number of Pages: 297

- Format:

- keyboard_arrow_up

Limestone Market Overview

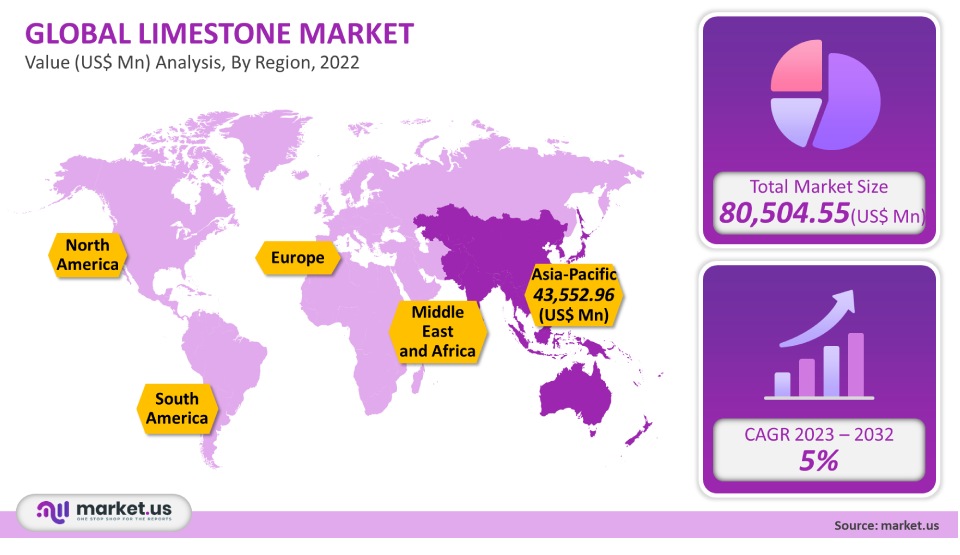

The global limestone market was worth USD 80,504.55 million in 2021. It is projected to grow at a CAGR of 5% between 2022 to 2032.

The future will see an increase in demand for limestone due to the development of infrastructure around the globe. The demand for limestone was anticipated to grow at a rapid rate across all end-use industries until 2020’s introduction of COVID-19, which disrupted the global economy.

Global economies are working to restart manufacturing operations and other activities at a slower pace while adhering to strict safety protocols. This will positively impact the limestone demand in the near future. The country’s high consumption is due to its widespread use of limestone in construction and iron and steel manufacturing.

Global Limestone Market Scope:

End-Use Analysis

Construction was the largest segment by volume, with over 81% of the total in 2021. It is expected to continue its lead in the future due to rising infrastructure development around the world. Because limestone adds beauty and strength to a project’s architecture, architects and builders have been using it extensively for many years. It’s used in concrete, cement, and road base. The material can be produced in a variety of colors, including black, brown, pink, cream, and gold. However, pure limestone is almost white.

Construction activities are undoubtedly affected by the current pandemic situation around the world. Companies are slowly returning to business after stabilizing the global economy. They adhere to safety protocols and emphasize employee safety. This modular walk-through station is designed to combat the spread of bacteria, coronavirus, and other viruses. These initiatives will likely increase construction activity and boost limestone demand in the near future.

The material can be used in construction to build walls and floors. It is also useful in furnaces that allow refining and production of steel. In the production of crude steel in a basic oxygen furnace, limestone is approximately 28% and 10% respectively. The World Steel Association reports that 72.3% of crude steel was made in a basic oxygen furnace by 2021.

Coronavirus has had a devastating impact on steel production around the globe. Global crude steel production fell by 7% between 2021 and 2022, with a significant drop in Europe. The production activities are now resuming slowly, despite the ease of many governments’ restrictions.

Product analysis

The two main product categories of limestone that are categorized based on their place of origin are high-calcium and magnesian. While the high-calcium grade limestone is found in calcium carbonate rocks, the magnesian grade is created by extracting dolomite. The high-calcium grade can be used to treat agricultural goods, paints, and paper because of its high calcium concentration. Magnesian limestone is excellent for use in the construction of architectural structures because it has a comparatively softer character.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- High-calcium limestone

- Magnesian limestone

By End-use

- Building & Construction

- Iron & Steel

- Agricultural

- Chemical

- Other End-uses

Market Dynamics:

The U.S. is well-known for its large number of limestone quarries. This makes the country self-sufficient and less dependent on imports. The U.S. has seen a revival in construction, which is boosting the demand for limestone. In Durham, North Carolina, construction began in July 2020 for a luxury residential community. It is expected that the residential community will open in the second half of 2021. There will be 404 units spread across seven 4-story buildings.

The United States is also one the largest steel producers in the globe, ranking 4th for the past five years. The covid-19 pandemic also affected this sector, but the country was able to produce a certain amount.

Iron and steel are a major end-use for limestone. In many countries, its manufacturing is considered an essential service. While the pace of production of iron or steel has slowed in the first half of 2021, it will soon pick up and propel limestone demand. Due to the current coronavirus outbreak, both the production and the demand for limestone were severely affected. Both mining operations and manufacturing operations were halted. However, in many countries, the restrictions began to ease in May-June 2021. This is expected to increase limestone demand, particularly in the construction sector.

Regional Analysis

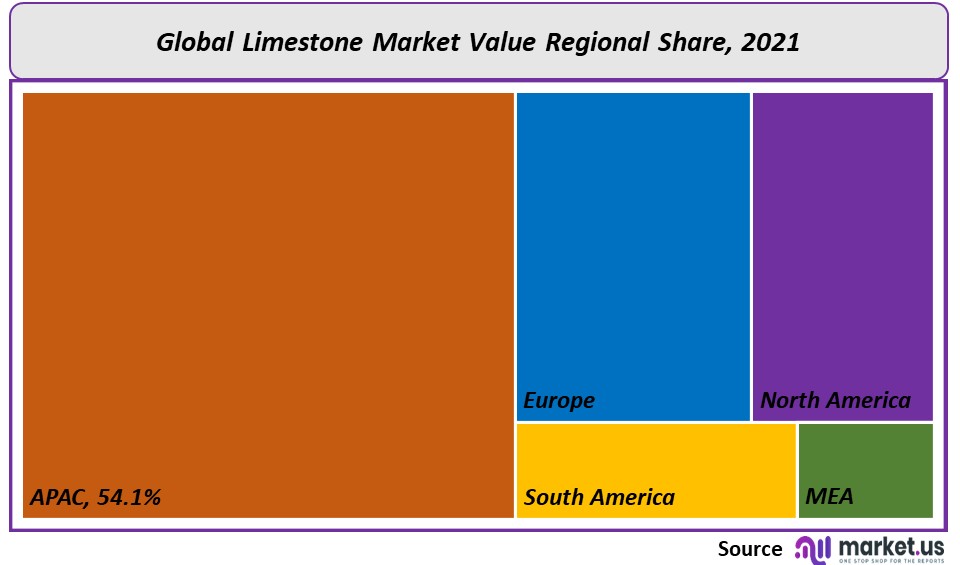

With a revenue share exceeding 54.1%, the Asia Pacific region was the largest regional market. This trend will likely continue in the future. This market is dominated by the Asia Pacific as the largest producer of steel in the world. It also benefits from the rapid growth of construction in developing countries.

Although the covid-19 pandemic had a negative impact on the economic stability in the region, manufacturing and other activities in China are returning to normal at a faster rate than in other countries. This is good news for market growth.

North America’s market is expected to grow at 4% in terms of revenue over the forecast period. This growth rate can be attributed to the region’s steel production and the acceleration of construction activities. It is also a major producer of animal feed worldwide, which is an important application of limestone. Mexico and the United States are the seven top-producing countries for animal feed in the world.

The covid-19 pandemic caused the entire world to suspend all manufacturing and construction activities. The activities have slowly begun to resume operations in the second half of 2020. In July 2020 plans were revealed for the construction of 322-unit housing development in New York, USA. This project is part of the state’s US$ 1.4 million initiatives. It is being constructed as a joint venture by Monadnock Development and CB Emmanuel Realty.

Europe is a major market region and the second-largest producer of steel in the world, after Asia. According to the World Steel Association, Europe’s crude steel production was 299 million tons in 2021. According to EUROFER, the steel industry has a significant impact on the European economy.

The covid-19 epidemic had a devastating impact on the steel industry in the region. In the first quarter of 2021, the supply of steel was down 11%. The region has seen a slump in manufacturing activity, which has had a significant impact on steel demand and production. This is expected to have an impact on limestone demand over the next few years.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

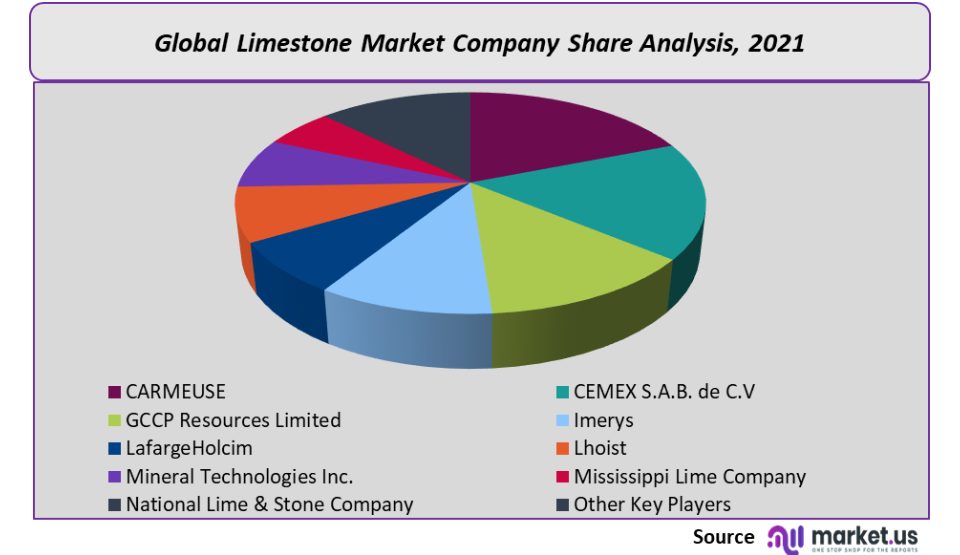

Due to the presence of many established companies with well-known brands, the market is highly competitive. To gain more market share, market players compete on many factors including aggressive pricing strategies and the development and marketing of new products and technologies.

Маrkеt Кеу Рlауеrѕ:

- CARMEUSE

- CEMEX S.A.B. de C.V

- GCCP Resources Limited

- Imerys

- LafargeHolcim

- Lhoist

- Mineral Technologies Inc.

- Mississippi Lime Company

- National Lime & Stone Company

- Other Key Players

For the Limestone Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Limestone market in 2021?The Limestone market size is US$ 80,504.55 million in 2021.

Q: What is the projected CAGR at which the Limestone market is expected to grow at?The Limestone market is expected to grow at a CAGR of 5% (2023-2032).

Q: List the segments encompassed in this report on the Limestone market?Market.US has segmented the Limestone market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, market has been segmented into High-calcium limestone and Magnesian limestone. By End User, the market has been further divided into Building & Construction, Iron & Steel, Agricultural, and Chemical.

Q: List the key industry players of the Limestone market?CARMEUSE, CEMEX S.A.B. de C.V, GCCP Resources Limited, Imerys, LafargeHolcim, Lhoist, Mineral Technologies Inc., Mississippi Lime Company, National Lime & Stone Company, and Other Key Players engaged in the Limestone market.

Q: Which region is more appealing for vendors employed in the Limestone market?APAC accounted for the highest revenue share of 54.1%. Therefore, the Limestone industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Limestone?China, Japan, India, South Korea, Indonesia, Bangladesh, Brazil, Germany, France, The U.K., The U.S., Canada, Mexico, are key areas of operation for Limestone Market.

Q: Which segment accounts for the greatest market share in the Limestone industry?With respect to the Limestone industry, vendors can expect to leverage greater prospective business opportunities through the construction segment, as this area of interest accounts for the largest market share.

![Limestone Market Limestone Market]()

- CARMEUSE

- CEMEX S.A.B. de C.V

- GCCP Resources Limited

- Imerys

- LafargeHolcim

- Lhoist

- Mineral Technologies Inc.

- Mississippi Lime Company

- National Lime & Stone Company

- Other Key Players

- Nestlé S.A Company Profile

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |