Global Liquid Smoke Market By Application (Meat Products, Sauces, Dairy Products, and Other Applications), By Distribution Channel (Hypermarkets & Supermarkets, E-Commerce, and Other Distribution Channel), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Mar 2022

- Report ID: 33501

- Number of Pages: 246

- Format:

- keyboard_arrow_up

Liquid Smoke Market Overview:

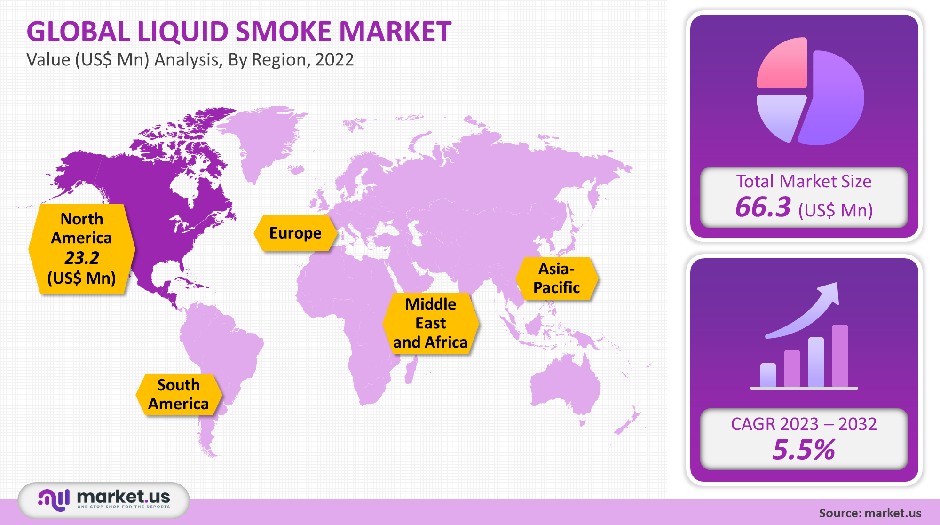

In 2021, the global liquid smoke market was worth USD 66.3 million and will register a CAGR of 5.5% for the forecasted years.

The positive factor that liquid smoke products can improve the life of food products without roasting or grilling, and enhance their flavor, is expected to continue to be a driving force. The rising purchasing power of the working class in developing countries like China, Brazil, and India is encouraging consumers to spend more on liquid smoke products.

Global Liquid Smoke Market Scope:

Application Analysis

With a market share of more than 30%, meat products dominated 2021. They are popular because they mimic onsite-generated wood smoke and can be mixed into liquid smoke products. This segment is driven by the booming meat-processing sector, new processes, and increasing use of liquid smoke solutions. Similar trends can also be seen in the preparation of sauces. These products can be added to sauces to improve flavors, such as barbeque or dry seasoning.

Additionally, liquid smoke can be used to add a natural smokey flavor to dairy goods like cheese. Currently, these liquids are included in pet food. Giving their pets the best care is the owners’ top priority. The aqueous smoke solution has acquired popularity because of its intricate usage in food processing, including oil extraction, food plating, and the addition of yeast, malt flour, and salt.

Additionally, these compounds can be used to reduce microbial development, improve plant structure, and promote seed germination. Other claims refer to advantages for cattle such as better nutrient absorption and feed preservation from microorganisms.

Additionally, these liquids provide advantages for agriculture, such as better soil quality, healthier leaves, and improved seeds. These items provide health advantages for symptoms like digestion issues, skin conditions, tooth infections, skin diseases, heart diseases, and eye, and liver issues, as well as health benefits like better hearing, eyesight, and overall wellbeing. These goods have a variety of uses, which is what is driving the market demand.

Distribution Channel

Based on distribution channels, the hypermarkets/supermarkets segment in the liquid smoke market was the highest contributor to the market, with the majority of the share in 2021, and is estimated to grow at a CAGR of 5.8% during the forecast period. The fastest expected growth rate is in the e-commerce sector throughout the forecast period.

Кеу Маrkеt Ѕеgmеntѕ

Application

- Meat Products

- Sauces

- Dairy Products

- Pet Food

- Other Applications

Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- E-Commerce

- Other Distribution Channel

Market Dynamics:

In recent years, food processing companies have increased their spending on liquid smoke. This is because they believe that liquid smoke can be used as a functional ingredient in meats, poultry products, and seafood. These products are perceived by many consumers as food additives that enhance the taste of foods. They can also be eaten without side effects.

One of the most important uses of liquid smoke products is to replace smoking food with on-site smoke from wood. This has led to a significant increase in demand worldwide for liquid smoke products. To give food products the desired functional and desirable smoke effect, liquid smoke is often applied topically.

These products are very popular in developed countries like Germany and the U.K. because of their ability to add smoky flavor and aroma to many recipes. Consumers are increasingly inclined to buy premium smoked foods products, such as smoked salmon or sausages. The traditional method of smoking meat products will continue to be difficult.

Regional Analysis

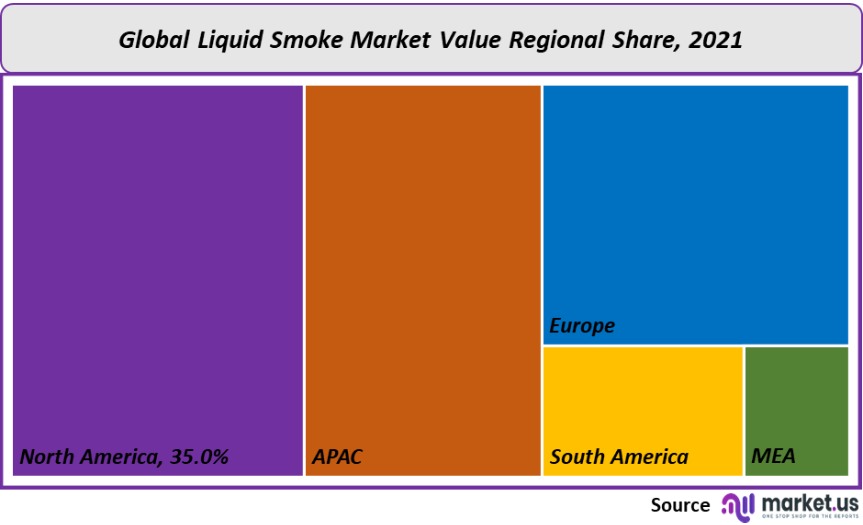

North America accounted for 35%, making it the dominant market. There has been a significant increase in demand for smoky-flavored meats, sauces, pet food products, and other products. This has helped to propel the industry forward.

Red Arrow International LLC, Colgin, and other top-producing liquid smokers in the region are all listed. More than 35 processed meat plants in North America use liquid smoking in large quantities. It is the largest consumer and producer of liquid smoke in the world.

This industry is very important in Europe. Between 2023 and 2032, it is expected to increase by 7%. France, Germany, and the U.K. are important markets in this region. Manufacturers are compelled to invest in R&D because of the industry’s increasing revenue. This will increase the liquid smoke market growth. High spending power drives this market. These products are popular because they mimic the smokey flavor of real wood smoking. They can also be used in many other foods.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

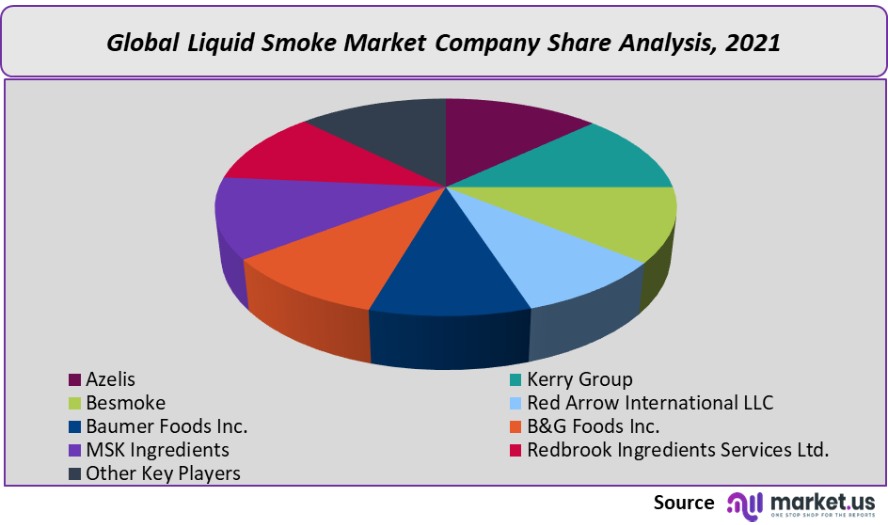

The liquid smoke market is also being driven by the presence of companies such as Azelis, Kerry Group, Besmoke, Red Arrow International LLC, Baumer Foods Inc., and B&G Foods Inc. are key players in this market. Red Arrow International LLC and Baumer Foods Inc. are the top manufacturers in the global industry.

Маrkеt Кеу Рlауеrѕ:

- Azelis

- Kerry Group

- Besmoke

- Red Arrow International LLC

- Baumer Foods Inc.

- B&G Foods Inc.

- MSK Ingredients

- Redbrook Ingredients Services Ltd.

- Other Key Players

For the Liquid Smoke Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Liquid Smoke market in 2021?A: The Liquid Smoke market size is US$ 66.3 million in 2021.

Q: What is the projected CAGR at which the Liquid Smoke market is expected to grow at?A: The Liquid Smoke market is expected to grow at a CAGR of 5.5% (2023-2032).

Q: List the segments encompassed in this report on the Liquid Smoke market?A: Market.US has segmented the Liquid Smoke market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Application the market is further divided into Meat Products, Sauces, Dairy Products, Pet Food, and Other Applications, By Distribution Channel the market is further segmented into Hypermarkets & Supermarkets, Convenience Stores, E-Commerce, and Other Distribution Channel.

Q: List the key industry players of the Liquid Smoke market?A: Azelis, Kerry Group, Besmoke, Red Arrow International LLC, Baumer Foods Inc., B&G Foods Inc., MSK Ingredients, Redbrook Ingredients Services Ltd., Other Key Players are the key vendors in the Liquid Smoke market.

Q: Which region is more appealing for vendors employed in the Liquid Smoke market?A: North America is expected to account for the highest revenue share of 35%. Therefore, the Liquid Smoke industry in North America is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Liquid Smoke?A: The US, France, Germany, The UK, and Spain are key areas of operation for the Liquid Smoke Market.

Q: Which segment accounts for the greatest market share in the Liquid Smoke industry?A: With respect to the Liquid Smoke industry, vendors can expect to leverage greater prospective business opportunities through the meat products segment, as this area of interest accounts for the largest market share.

![Liquid Smoke Market Liquid Smoke Market]()

- Azelis

- Kerry Group

- Besmoke

- Red Arrow International LLC

- Baumer Foods Inc.

- B&G Foods Inc.

- MSK Ingredients

- Redbrook Ingredients Services Ltd.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |