Global Liquor Confectionery Market By Product (Candies & Gums, and Chocolates), By Application (Specialty Stores, Supermarkets/Hypermarkets, and Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Oct 2021

- Report ID: 15488

- Number of Pages: 231

- Format:

- keyboard_arrow_up

Liquor Confectionery Market Overview:

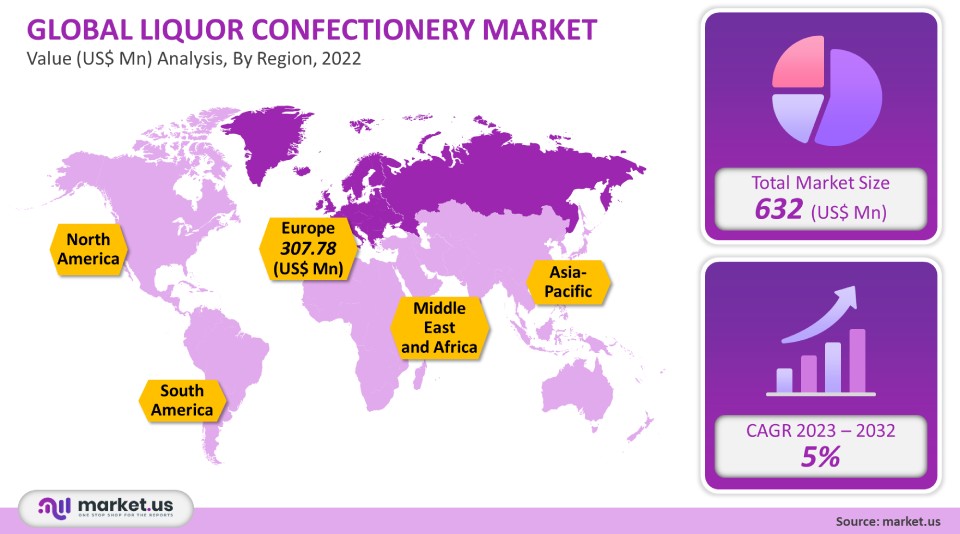

In 2021, the global liquor confectionery market was valued at USD 632 million. It is projected to grow by 5% between 2022-2032.

There is a rising demand for liquor confectionery due to changing palates of consumers, especially millennials. The U.K., Belgium, and Germany are among the countries with high levels of liquor consumption. In these countries, chocolates with alcohol are popular. This encourages consumers to experiment with new methods of alcohol consumption. This situation has helped to increase the demand for global markets.

Global Liquor Confectionery Market Analysis:

Product Analysis

2021 saw chocolates lead the global liquor confectionery industry with revenue exceeding US$ 380.1 million. The consumer is attracted to these confectioneries because of their innovative labeling and the different manufacturing methods. Anthon Berg makes fine dark chocolates with cocktails, orange liquor, and high-quality cocoa in miniature bottles.

The forecast period sees gums and candy grow at a rate of 4.2%. Innovative gums and candies from major vendors are expected to be a driving force in this market. To take one example, chocolate is not dissolved in the candies before being placed on top of hard candies containing alcoholic beverages.

Distribution Channel Analysis

Supermarkets/hypermarkets held a significant market share in 2021, which gives the opportunity to pick from many flavored confectioneries. This is possible due to their visibility of various products, easy accessibility, and various discounts. Supermarkets or hypermarkets offer attractive discounts and other offers, such as “buy one get one” to increase liquor chocolate sales.

From 2023 to 2032, the online channel will grow at a rate of 5.1%. The most popular online retailers of liquor confectioneries are Alibaba, Amazon, and Candy Warehouse. For convenience, consumers can access the different varieties online rather than buying them in stores. Solidarno Liqueurs & Vodka prefers online sales of liquor confectionery. They are limited in quantity and distributed mainly in the country where they were made.

Key Market Segments:

By Product

- Candies & Gums

- Chocolates

By Distribution Channel

- Specialty Stores

- Supermarkets/Hypermarkets

- Online

Market Dynamics:

Global market growth is being driven by the high demand for handmade confectioneries with liquor as the main ingredient. Global market growth is due to a rise in liquor confectionery consumption. New product developments and new flavors are expected to increase market growth over the next few years. Abtey, for example, launched four new coulis options that were made from refined alcohol and ganache center with four different varieties of coulis: ganache & rum jelly, ganache & strawberry jelly, mousse & kirsch jelly, ganache, and Cointreau jelly.

Liquor is in high demand in countries like the U.K. and Germany. They are also the major producers of premium chocolates like the Belgian and Swiss chocolates. This in turn increases the market for liquor confectioneries in these European countries. The presence of European chocolate manufacturers means that there is a constant stream of product innovations.

Regional Analysis:

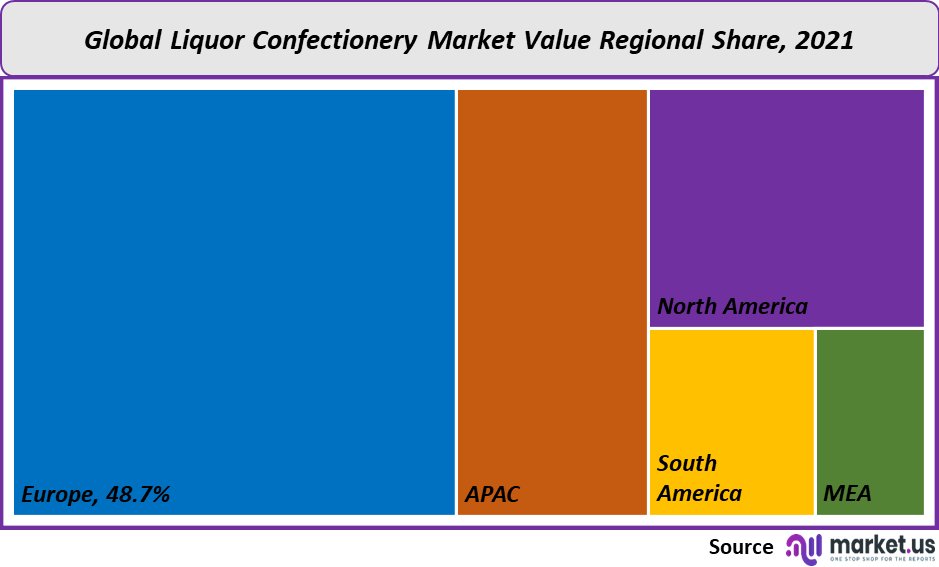

Europe held a 48.7% market share in 2021. This was due to the increase in demand for liquor confectionery from countries like Switzerland and Germany. These products are gaining popularity due to their taste, availability in a variety of flavors, and the practice of eating them on different occasions. European culture has this custom of enjoying these homemade liquor confectioneries at big events, vacations, and celebrations.

Asia Pacific has emerged as the fastest-growing region and is expected to grow at a 5.2% CAGR over the forecast period. This growth can be attributed to increased awareness and changing preferences for alcoholic beverages in confectionery. Because these products can be used for special occasions rather than a heavy alcohol intake, consumers (primarily millennials) are willing to spend more money to try new confectioneries.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

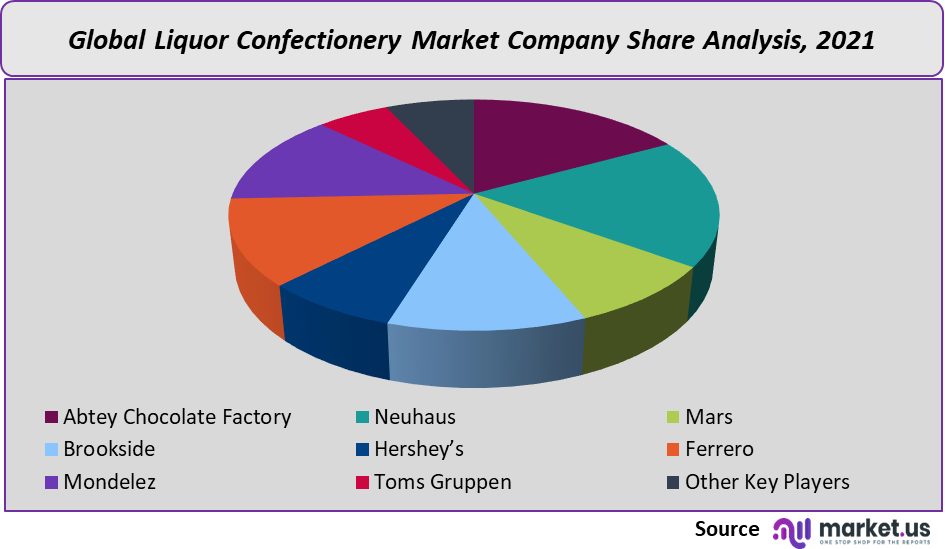

Market Share & Key Players Analysis:

Few companies are considering mergers or acquisitions to improve their capabilities and product ranges. Ferrero bought Nestle’s U.S. manufacturing business to make liquor confectioneries. The purchase cost US$ 2.8 million. Barry Callebaut purchased American Almond Products Co. in order to further expand its product line.

Маrkеt Кеу Рlауеrѕ:

- Abtey Chocolate Factory

- Neuhaus

- Mars

- Brookside

- Hershey’s

- Ferrero

- Mondelez

- Toms Gruppen

- Other Key Players

For the Liquor Confectionery Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Liquor Confectionery market?The Liquor Confectionery market size is expected to be US$ 632 million in 2021.

Q: What is the projected CAGR at which the Liquor Confectionery market is expected to grow at?The Liquor Confectionery market is expected to grow at a CAGR of 5% (2023-2032).

Q: List the segments encompassed in this report on the Liquor Confectionery market?Market.US has segmented the Liquor Confectionery market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Candies & Gums, and Chocolates. By Distribution Channel, the market has been further divided into Specialty Stores, Supermarkets/Hypermarkets, and Online.

Q: List the key industry players of the Liquor Confectionery market?Abtey Chocolate Factory, Neuhaus, Mars, Brookside, Hershey’s, Ferrero, Mondelez, Toms Gruppen, and Other Key Players are engaged in the Liquor Confectionery market.

Q: Which region is more appealing for vendors employed in the Liquor Confectionery market?Europe is accounted for the highest revenue share of 48.7%. Therefore, the Liquor Confectionery Technology industry in Europe is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Liquor Confectionery?The US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc. are key areas of operation for Liquor Confectionery Market.

Q: Which segment accounts for the greatest market share in the Liquor Confectionery industry?With respect to the Liquor Confectionery industry, vendors can expect to leverage greater prospective business opportunities through the chocolates liquor confectionery segment, as this area of interest accounts for the largest market share.

![Liquor Confectionery Market Liquor Confectionery Market]()

- Abtey Chocolate Factory

- Neuhaus

- DATAMARS SA Company Profile

- Brookside

- Hershey’s

- Ferrero

- Mondelez

- Toms Gruppen

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |