Global Masterbatch Market By Type (Black, White, Additive, Color, and Filler), By Carrier Polymer (Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Polyvinyl Chloride (PVC), and Biodegradable Plastics), By End-use (Consumer Goods, Packaging, Agriculture, Building & Construction, and Automotive & Transportation), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Nov 2021

- Report ID: 20354

- Number of Pages: 207

- Format:

- keyboard_arrow_up

Masterbatch Market Overview:

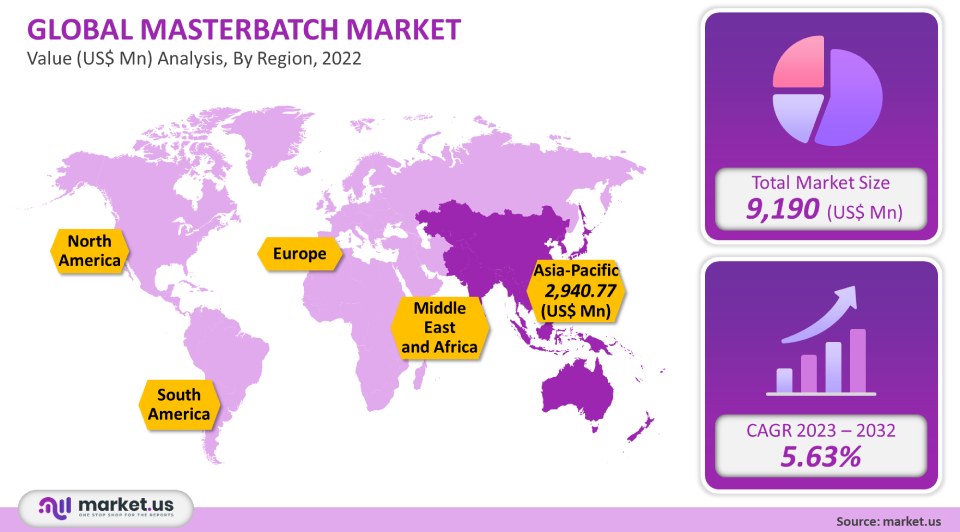

The global masterbatch market was valued at USD 9,190 million in 2021. It is expected to grow at a 5.63% CAGR, from 2023 to 2032.

Global market growth is expected to be driven by the replacement of metal with plastics in end-use industries such as automotive, transportation, building and construction, and consumer goods and packaging. It is available in liquid and solid forms. It is used to impart color and enhance useful properties of polymers like antistatic, antifog and antilocking, ultraviolet stabilizing, flame retardation, and UV stabilizing. For extrusion and injection molding, the product can be used with a variety of carrier polymers, including polypropylene and polyethylene.

Global Masterbatch Market Scope:

Type Analysis

Black masterbatch accounted for more than 26% of the total revenue in 2021. Black masterbatch’s demand has increased due to the high demand for tires and PVC containers. These products are used in agriculture, transportation, building, construction, and agriculture. Market growth is expected to be boosted by the growing demand for agricultural products like drip irrigation tubing, tape, greenhouse films, shade cloth, as well as geo-membranes. Color masterbatches are important because they can be used to distinguish products on the market. This is why the forecast period will see a significant increase in demand for color masterbatches. Color masterbatches allow for customization to produce products that have attractive visual appearances.

Carrier Polymer analysis

The largest revenue share, with more than 27% in 2021, was held by polypropylene masterbatch. Due to its exceptional mechanical strength and flexibility, polypropylene is expected to be in high demand as a carrier plastic. The quality of surfaces is also improved by polypropylene. Because it is lightweight, polypropylene can be used to replace metal parts in the automotive industry. These factors will drive the segment’s growth over the forecast period. In 2021, the European polyethylene market was worth more than US$ 231 million. Germany is a major manufacturing center and is increasing its production capabilities, which will increase polyethylene demand. A key driver of the European market is the presence of many plastic component manufacturing businesses in Europe. This implies that plastics are easily and economically available.

The widespread use of polypropylene in consumer goods has contributed to the increase in product demand. It is useful for manufacturing products that are related to building and construction. Due to environmental concerns, polypropylene producers are shifting their focus to biobased products. This will drive the market for the next few years.

End-use analysis

Packaging masterbatch accounted for the highest revenue share, with more than 26% in 2021. The packaging industry encompasses retail, industrial, and consumer packaging. It also includes rigid and flexible options. The increased demand for packaging is due to an increase in city dwellers who need packaged goods. Packaging that is easy to trace, durable, flexible, protects, and offers protection is essential for consumers. Plastic packaging fulfills all of these requirements, and its demand is projected to rise, which will, in turn, lead to a growing demand for the product. The packaging industry has huge growth potential in emerging countries like India and China.

These countries have seen an increase in infrastructure activities, which has led to a growing demand for the building and construction industry. This may help boost product demand. Over the forecast period, the product demand will rise due to the development of government schemes like Make in India or Smart City plans.

Кеу Маrkеt Ѕеgmеntѕ:

By Type

- Black

- White

- Additive

- Color

- Filler

By Carrier Polymer

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Biodegradable Plastics

- Other Carrier Polymers

By End-Use

- Consumer Goods

- Packaging

- Agriculture

- Building & Construction

- Automotive & Transportation

- Other End-uses

Market Dynamics:

In 2021, the U.S. market was worth US$ 881.1 million. Market growth is expected to be boosted by the rising demand from American packaging industries. The U.S. packaging market has seen significant growth due to the eCommerce business. To increase sales of their products, the consumer goods manufacturers offer attractive packaging. To create attractive packaging, masterbatch can be combined with polymers. This will increase product demand in the future. Plastic is increasingly being used in automotive to reduce vehicle weight and improve fuel economy. This has driven the demand for plastics that have functional properties. Automobile production has increased in emerging Asian economies like Japan, India, China, and China. The region’s demand for plastic components is expected to rise over the next few years. The market faces challenges due to stringent environmental regulations regarding the non-biodegradability and adoption of plastics. This has implications for the demand.

Regional Analysis:

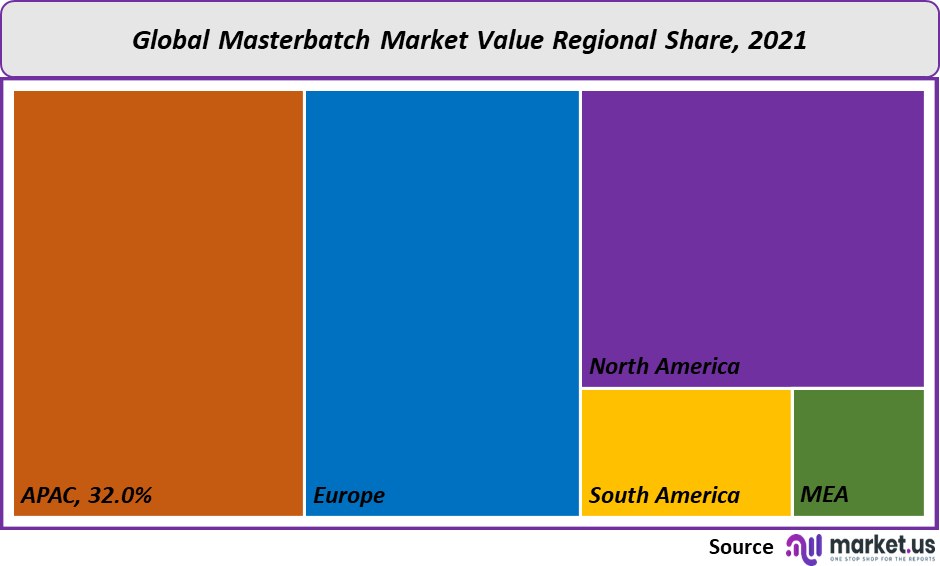

The Asia Pacific accounted for the highest revenue share, with more than 32% in 2021. A number of end-use industries, including transportation, packaging, construction, and building, have contributed to an increase in demand. These industries are expected to grow in the coming eight years, which will fuel the demand. Europe was the second largest regional market in terms of revenue in 2021. This trend is expected to continue during the forecast period. Projections show that the market will be driven by the rapid growth in the packaging, automotive, and consumer goods industries. This is combined with the expanding building, construction, and agriculture sectors of Asia Pacific, which are some of the most important end-use sectors for the product.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

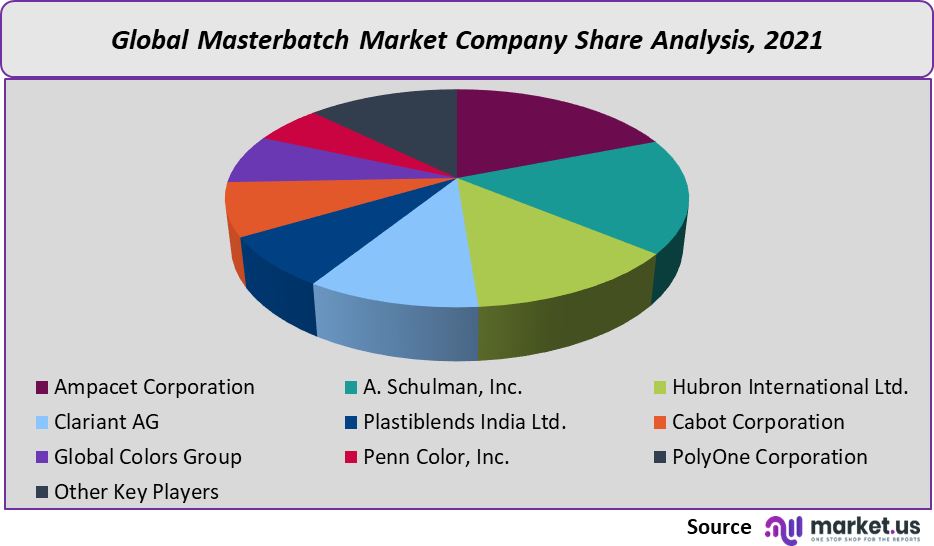

With the presence of many global and regional players, the market is fragmented. The market’s key players adhere to the regulations and engage in research and development activities to create innovative products. The majority of industry leaders are integrated throughout the value chain, which creates barriers to entry for new market players.

Маrkеt Кеу Рlауеrѕ:

- Ampacet Corporation

- Schulman, Inc.

- Hubron International Ltd.

- Clariant AG

- Plastiblends India Ltd.

- Cabot Corporation

- Global Colors Group

- Penn Color, Inc.

- PolyOne Corporation

- Other Key Players

For the Masterbatch Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Masterbatch market in 2021?The Masterbatch market size is US$ 9,190 million in 2021.

What is the projected CAGR at which the Masterbatch market is expected to grow at?The Masterbatch market is expected to grow at a CAGR of 5.63% (2023-2032).

List the segments encompassed in this report on the Masterbatch market?Market.US has segmented the Masterbatch market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type, market has been segmented into Black, White, Additive, Color, and Filler. By Carrier Polymer, market has been segmented into Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Polyvinyl Chloride (PVC), and Biodegradable Plastics. By End-use, the market has been further divided into Consumer Goods, Packaging, Agriculture, Building & Construction, and Automotive & Transportation.

List the key industry players of the Masterbatch market?Ampacet Corporation, A. Schulman, Inc., Hubron International Ltd., Clariant AG, Plastiblends India Ltd., Cabot Corporation, Global Colors Group, Penn Color, Inc., PolyOne Corporation, and Other Key Players engaged in the Masterbatch market.

Which region is more appealing for vendors employed in the Masterbatch market?APAC accounted for the highest revenue share of 32%. Therefore, the Masterbatch industry in APAC is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Masterbatch?China, India, Japan, Germany, U.K., France, & The US, are key areas of operation for Masterbatch Market.

Which segment accounts for the greatest market share in the Masterbatch industry?With respect to the Masterbatch industry, vendors can expect to leverage greater prospective business opportunities through the black masterbatch segment, as this area of interest accounts for the largest market share.

![Masterbatch Market Masterbatch Market]()

- Ampacet Corporation

- Schulman, Inc.

- Hubron International Ltd.

- Clariant AG Company Profile

- Plastiblends India Ltd.

- Cabot Corporation

- Global Colors Group

- Penn Color, Inc.

- PolyOne Corporation

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |