Global Medical Device Packaging Market By Material (Plastic, Paper & Paperboard, Metal and Other Materials), By Product (Pouches & Bags, Trays, and Other Products), By Application (Equipment & Tools, Devices, IVD, and Implants) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov 2021

- Report ID: 21553

- Number of Pages: 213

- Format:

- keyboard_arrow_up

Medical Device Packaging Market Overview:

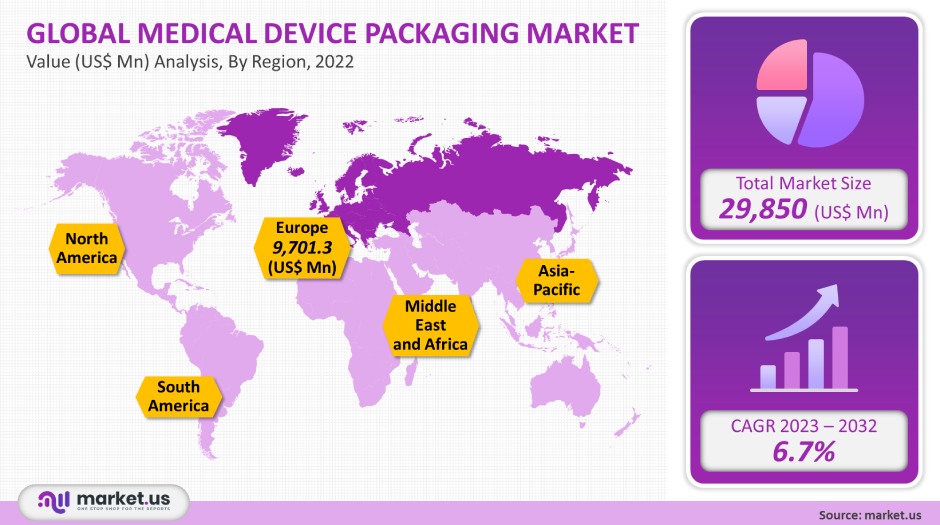

The global medical device packaging market value was USD 29,850 million in 2021. It is projected to increase at a compound annual gain rate (CAGR), of 6.7% between 2022-2032.

Medical device packaging products are in demand due to the increasing demand for surgical implants and other medical equipment.

People living unhealthy lifestyles have led to a high incidence of chronic diseases like stroke, heart disease, and diabetes in recent years. This is especially true in advanced economies. These diseases require medical equipment for diagnosis and treatment. They have contributed to the rapid growth of the medical devices market in the past five years.

Global Medical Device Packaging Market Scope:

Material analysis

Plastic held the highest share, at 60.0%, in 2021. This position is expected to hold for the foreseeable future. Plastic was the most commonly used material on the market in 2021. Low-density plastic ethylene (LDPE), linear high-density polyester (LLDPE), Polypropylene, and Polyethylene Terephthalate (PET) are all types of plastic.

Plastic materials have a wide range of aesthetics, including the ability to appear opaquely or clear. This makes them more appealing to the market. Plastics are versatile, safe, hygienic, and long-lasting. Plastics are cost-friendly and lightweight, making them ideal for packaging medical devices.

Aluminum is the most popular metal used for packaging medical devices. It is resistant to oxygen, light, and moisture so it is commonly used in medical device packaging. This is why medical devices containing biologics and pharmaceuticals are seeing an increase in aluminum demand. These factors are expected to drive metal growth at 7.2% CAGR during the forecast period.

Product analysis

The largest segment, pouches/bags, accounted for over 35.0% of all 2021 sales. They pack small, large, and mid-sized medical devices. The small size of the pouches and high product-to-package ratio makes it easy for medical devices to be stored and handled. Bags and pouches, made of appropriate materials such as LLDPE and PET can protect devices from light, water, and gases.

There are several options available for trays: plastic medical trays (plastic shipping trays), and medical inspection trays (plastic inspection trays). Trays are stronger for packaging and shipping medical parts and machine parts. While most trays are made of various plastics, some applications call for trays made from vinyl. Vinyl is more rigid than other types.

Special requirements must be met when packaging medical devices or related components. The safe packaging and transportation of medical devices can be safely handled in cardboard boxes. These boxes can be used in packaging small- or large-sized devices.

Application analysis

Equipment and tools had the largest share at over 30.0% in 2021. They require flexible packaging and high sterilization. Flexible packaging materials include plastic pouches and bags, plastic trays, bags, and clamshells for the majority of the tools.

Additionally, the equipment section offers packaging solutions for medical devices like CT scanners. X-ray machines. MRI machines. Ultrasound scanners. These large-sized devices need to be packaged in a structured way as they can be bought by hospitals and other healthcare facilities.

The segment of in-vitro diagnosis (IVD), is expected to grow at a 7.3% CAGR over the forecast period. This is due in part to the increasing use of IVDs to diagnose COVID patients. Due to the growing threat of coronavirus in developing regions, there is a high demand for these test kits. Over the next few years, this will likely lead to an increase in the packaging of these products.

Implantable devices represent a new area in medical science. The key component to these life-saving tools is secure packaging. The aesthetic implants market suffered greatly from the pandemic. These factors led to a decline in demand for implant packaging in 2021. The healthcare sector is on track to increase the market’s growth, but the market is still expected to grow.

Кеу Маrkеt Ѕеgmеntѕ

By Material

- Plastic

- Paper & Paperboard

- Metal

- Other Materials

By Product

- Pouches & Bags

- Trays

- Boxes

- Clamshells

- Other Products

By Application

- Equipment & Tools

- Devices

- IVD

- Implants

Market Dynamics:

The product manufacturers offer a variety of technologies such as seal/peal and counterfeit technology. These technologies are meant to make it easier and safer for customers. Products can be protected against counterfeiting by using solutions such as 2-D barcodes and serializations, UV identification codes, and holograms.

The strong healthcare sector and the presence of many companies that deal with medical devices have made the U.S. the largest market. It has a strong competitive advantage in terms of software, instrumentation, and technology development.

The USA has the highest per capita healthcare expenditures in the world with USD 10,966 in 2019. In 2021, the national health expenditure was 18%. The country’s demographics are changing with an increasingly aging population. A rising number of older people means that healthcare services are more urgently needed to treat chronic illnesses such as arthritis, diabetes, and hypertension.

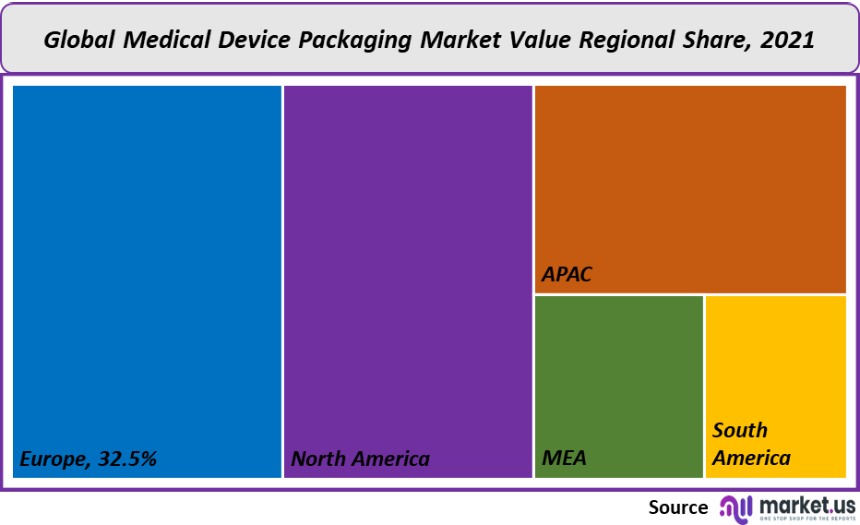

Regional Analysis

Europe held 32.5% of the world’s total market share in 2021. After Germany, the U.K. emerged as a key market for 20

21. There are several established manufacturing companies, both in the domestic market and overseas. This country is well-known for its device manufacturing industry. The U.K., which is the world’s largest exporter and innovator of medical technology, is well-known. The projected increase in medical packaging demand is due to these factors.

North America took the second-largest portion of 2021’s total due to the strong healthcare sector and the presence of many entities dedicated to it. The U.S. enjoys a competitive advantage when it comes to instrumentation, technology, and software development. These factors also result in high production volumes. Around 40% of all global medical devices are produced in the U.S.

The Asia Pacific is expected to see the fastest growth rate over the forecast period. China is Asia Pacific’s fastest-growing region and one of the largest global markets for medical products. Many investments are now being made in the healthcare industry because of China’s economic development. China’s healthcare industry will continue to grow over the next several years.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

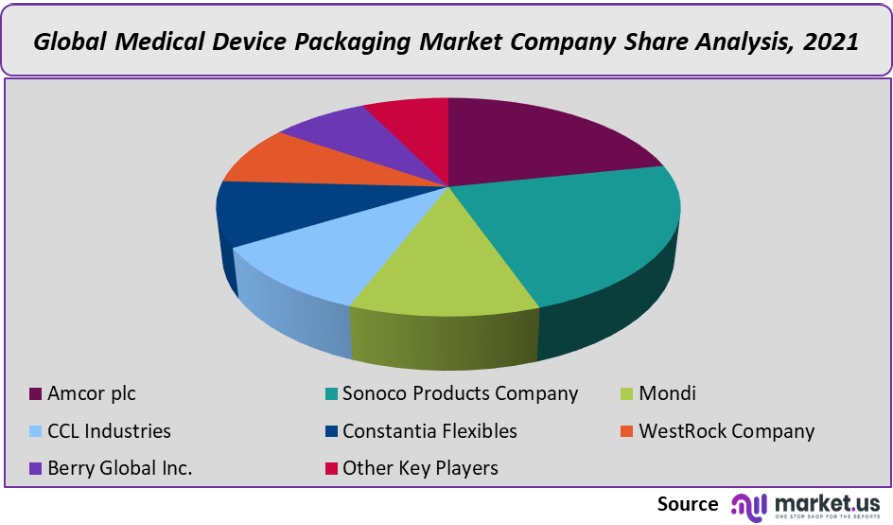

Major corporations are often involved in acquisitions of other companies to expand product lines and increase manufacturing capacity. Because of the inability to compete with smaller, privately-held players in the international market in terms both of revenue generation, regional/global presence, as well the establishment and maintenance of distribution channels, there is likely to be an increase in mergers & Acquisitions. There are several prominent players in this global market for medical device packaging.

Маrkеt Kеу Рlауеrѕ:

- Amcor plc

- Sonoco Products Company

- Mondi

- CCL Industries

- Constantia Flexibles

- WestRock Company

- Berry Global Inc.

- Glenroy Inc.

- SteriPack Group

- Riverside Medical Packaging Company Ltd.

- Other Key Players

For the Medical Device Packaging Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Medical Device Packaging market in 2021?A: The Medical Device Packaging market size is estimated to be US$ 29,850 million in 2021.

Q: What is the projected CAGR at which the Medical Device Packaging market is expected to grow at?A: The Medical Device Packaging market is expected to grow at a CAGR of 6.7% (2023-2032).

Q: List the segments encompassed in this report on the Medical Device Packaging market?A: Market.US has segmented the Medical Device Packaging market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Material, market has been segmented into Plastic, Paper & Paperboard, Metal and Other Materials. By Product, the market has been further divided into Pouches & Bags, Trays, Boxes, Clamshells and Other Products and by Application, further segmented into Equipment & Tools, Devices, IVD and Implants.

Q: List the key industry players of the Medical Device Packaging market?A: Amcor plc, Sonoco Products Company, Mondi, CCL Industries, Constantia Flexibles, WestRock Company, Berry Global Inc., Other Key Players are the key vendors in the Medical Device Packaging market

Q: Which region is more appealing for vendors employed in the Medical Device Packaging market?A: Europe is expected to account for the highest revenue share of 32.5% Therefore, the Medical Device Packaging Technology industry in Europe is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Medical Device Packaging?A: The US, China, Japan, India, Brazil, Germany, UK, France, Italy, Spain, etc., are key areas of operation for Medical Device Packaging Market.

Q: Which segment accounts for the greatest market share in the Medical Device Packaging industry?A: With respect to the Medical Device Packaging industry, vendors can expect to leverage greater prospective business opportunities through the passive Medical Device Packaging segment, as Equipment and tools accounts for the largest market share.

![Medical Device Packaging Market Medical Device Packaging Market]() Medical Device Packaging MarketPublished date: Nov 2021add_shopping_cartBuy Now get_appDownload Sample

Medical Device Packaging MarketPublished date: Nov 2021add_shopping_cartBuy Now get_appDownload Sample - Amcor plc

- Sonoco Products Company

- Mondi

- CCL Industries

- Constantia Flexibles

- WestRock Company

- Berry Global Inc.

- Glenroy Inc.

- SteriPack Group

- Riverside Medical Packaging Company Ltd.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |