Global Milling Machine Market By Type (Vertical Milling Machines and Horizontal Milling Machines), By End-Use (Automotive, Power and Energy, Construction Equipment, Industrial, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Apr 2022

- Report ID: 28903

- Number of Pages: 227

- Format:

- keyboard_arrow_up

Milling Machine Market Overview:

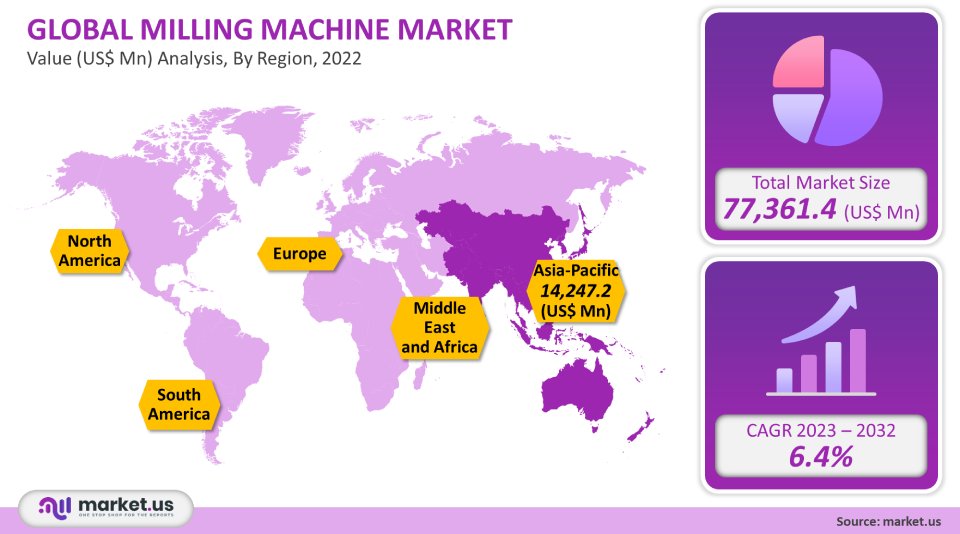

The global milling machine market was valued at USD 77,361.4 million in 2021 and is expected to experience a CAGR of 6.4%.

Milling machines are a key component of many metal cutting applications. In recent years, the demand has increased due to the growing global metalworking industry as well as a significant increase in the number of metalworking facilities around the world.

Global Milling Machine Market Analysis:

Type Analysis

Because of their popularity and increasing preference, horizontal milling machines dominated the market in 2021. Horizontal mills provide better chip evacuation which results in a smoother surface and longer tool life. They can also handle more complex parts with fewer operations. A horizontal mill has the spindle pointing horizontally. This allows for greater spindle life and longer spindle life. Horizontal milling machines can also perform the work of several vertical mills, making them a favorite choice.

The market share for vertical milling machines was substantial in that year. Its features include high affordability, visibility, ease of use, and high accuracy. These mills are used for drilling and cutting and can be found in a variety of specifications.

End-Use Analysis

Due to the extensive use of horizontal-milling machines for results-driven operations, the industrial segment made a significant contribution in 2021. The growth of the industrial segment will also be driven by the increasing demand for mass production.

Due to the increasing preference of OEMs for precision-cut metal parts, the automotive segment is expected the highest CAGR. In 2021, a large share of the market was also held by power & energies. Oil & Gas exploration companies all over the world are launching new drilling projects. This means that drilling rigs demand is on the rise. Power companies continue to invest heavily in renewable energy technologies, such as wind power. High-precision machine tools are used to machine the components that will be required in these rapidly expanding areas. This is expected to increase the demand for milling machines in the power sector.

Key Market Segments:

By Type

- Vertical Milling Machines

- Horizontal Milling Machines

By End-Use

- Automotive

- Power and Energy

- Construction Equipment

- Industrial

- Other End-Uses

Market Dynamics:

Milling machines have a wide range of capabilities. They can do a multitude of tasks, such as fillet making and turn, chamfering and drilling, facing, cutting gears, and slotting. Multi-cutting can also be done on these machines by using multiple cutters. These benefits make milling machines perfect for manufacturing metal parts in industries like aerospace, defense, and automotive.

Milling machines are used extensively to drill holes, through gears, and create slots. Numerous milling machine makers are using CNC technology to improve the quality and productivity of their work. This is done by using the same tools as a program to produce multiple parts. The most important trends in the market are automation and multi-axis. Companies are also using software programs to control the spindle speeds, axis, and tool changes of milling machines. This helps reduce the need to manually intervene.

The integration of CAM and CAD software into CNC machinery offers additional benefits like a shorter machining time and a more efficient workflow. Compact machine tools, which take up minimal floor space, are particularly popular in the industrial manufacturing sector.

The market is also seeing a rise in five-sided machining, which is aimed at reducing setup time. Numerous companies are investing in R&D and implementing automated diagnostics to overcome these problems.Regional Analysis:

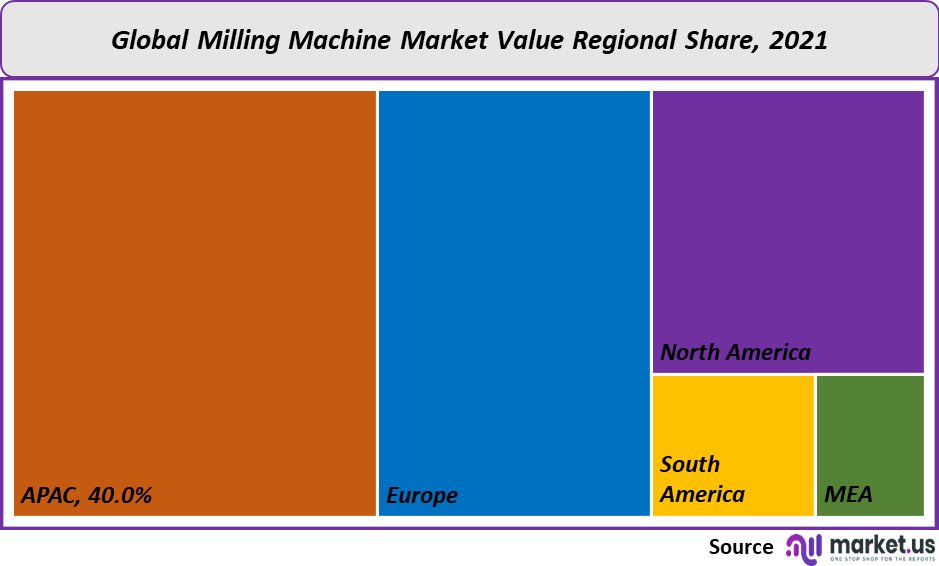

The rising popularity of metal cutting in the Asia Pacific was a major reason why the Asia Pacific dominated 2021’s market, accounting for 40% of revenue share. The Asia Pacific, which is home to many of the major market companies in the milling machines industry, is expected to continue its dominance over the forecast period. The demand for machine tools in the Asia Pacific will also be driven by government initiatives.

A large proportion of the 2021 market share was in Europe, thanks to the rapid adoption of milling machinery by local automotive manufacturers. Many European automobile manufacturers are located in Europe. However, multi-tasking machine companies operating in the rail sector in certain European countries such as France, Germany, and the U.K. are also adopting multi-tasking devices. The increasing energy sector and the subsequent rise in demand for parts such as turbines or motors that need to be machined with high-precision tools can also explain the growth of this regional market.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

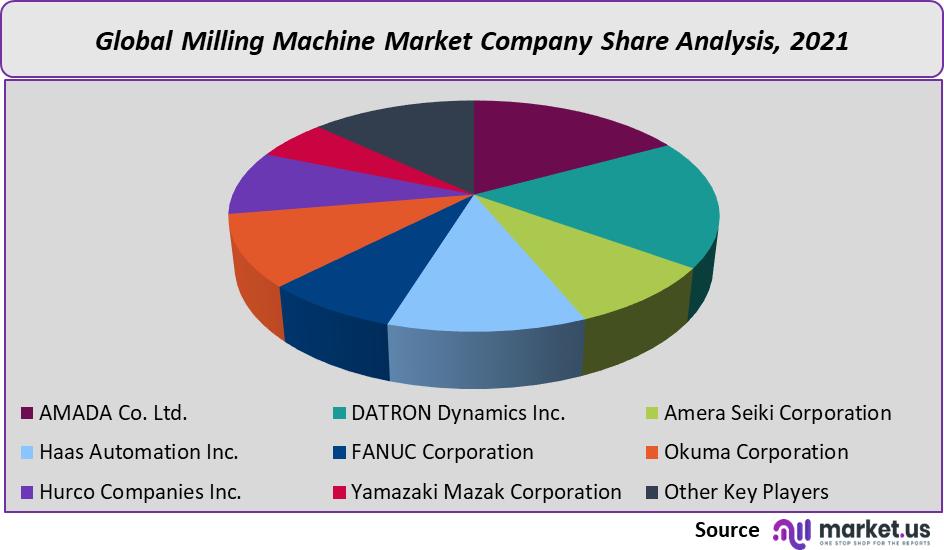

This industry is trying to get a competitive advantage over its competitors by launching new products. Okuma Corporation of Japan has introduced the MU8000V LASEREX multitasking machine center. This new multitasking machine center uses laser metal deposit technology to provide unique cutting capabilities in many different sizes and shapes. Market leaders are also adopting new strategies like mergers and acquisitions, partnerships, and collaborations in order to grow their product portfolios. To integrate cutting-edge technologies into products, the top players are keen to work with companies that provide advanced systems and components.

Маrkеt Кеу Рlауеrѕ:

- AMADA Co. Ltd.

- DATRON Dynamics Inc.

- Amera Seiki Corporation

- Haas Automation Inc.

- FANUC Corporation

- Okuma Corporation

- Hurco Companies Inc.

- Yamazaki Mazak Corporation

- Other Key Players

For the Milling Machine Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Milling Machine market in 2021?The Milling Machine market size is US$ 77,361.4 million in 2021.

Q: What is the projected CAGR at which the Milling Machine market is expected to grow at?The Milling Machine market is expected to grow at a CAGR of 6.4% (2023-2032).

Q: List the segments encompassed in this report on the Milling Machine market?Market.US has segmented the Milling Machine market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type, the market has been segmented into Vertical Milling Machines and Horizontal Milling Machines. By End-Use, the market has been further divided into Automotive, Power and Energy, Construction Equipment, Industrial, and Other End-Uses.

Q: List the key industry players of the Milling Machine market?AMADA Co. Ltd., DATRON Dynamics Inc., Amera Seiki Corporation, Haas Automation Inc., FANUC Corporation, Okuma Corporation, Hurco Companies Inc., Yamazaki Mazak Corporation, and Other Key Players are engaged in the Milling Machine market

Q: Which region is more appealing for vendors employed in the Milling Machine market?APAC is expected to account for the highest revenue share of 40%. Therefore, the Milling Machine industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Milling Machine?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Milling Machine Market.

Q: Which segment accounts for the greatest market share in the Milling Machine industry?With respect to the Milling Machine industry, vendors can expect to leverage greater prospective business opportunities through the horizontal milling machines segment, as this area of interest accounts for the largest market share.

![Milling Machine Market Milling Machine Market]()

- AMADA Co. Ltd.

- DATRON Dynamics Inc.

- Amera Seiki Corporation

- Haas Automation Inc.

- FANUC Corporation Company Profile

- Okuma Corporation

- Hurco Companies Inc.

- Yamazaki Mazak Corporation

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |