Global Mining Equipment Market By Type (Mineral Processing Equipment, Surface Mining Equipment, Underground Mining Equipment, Mining Drills & Breakers, Crushing, Pulverizing, & Screening Equipment, And Others), By Application (Metal Mining, Mineral Mining, And Coal Mining), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2019-2028

- Published date: Mar 2022

- Report ID: 19825

- Number of Pages: 289

- Format:

- keyboard_arrow_up

Mining Equipment Market Overview

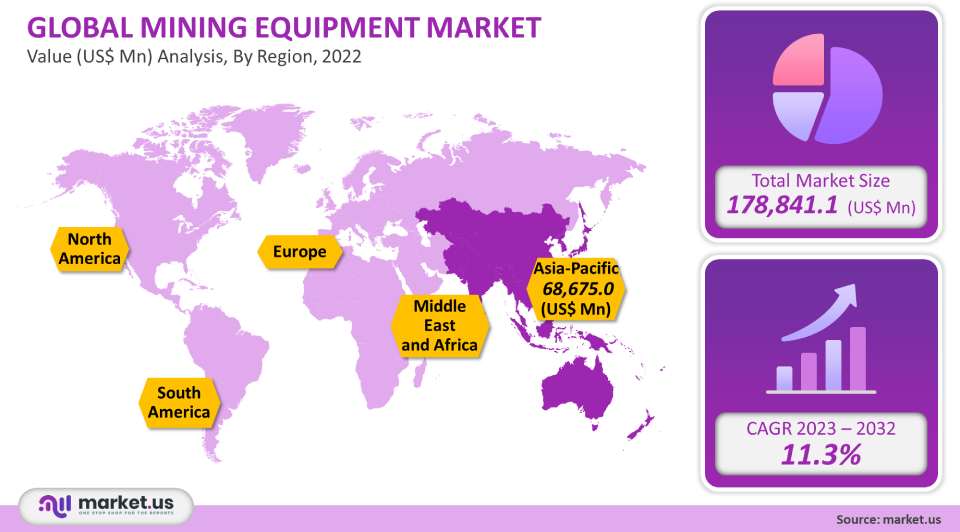

The market value of the global mining equipment market size was estimated to be at US$ 178.84 billion in 2021 and is projected to increase at a CAGR of 11.3% from 2023 to 2032. Over the next few years, it is anticipated that ongoing digital mine innovation will revolutionize the essential elements of mining. The demand for mining equipment is anticipated to be augmented by increased investments and government support for digital mine innovation. Older mines have been able to operate longer owing to advancements and developments in extraction methods and machinery that have improved ore grades.

Global Mining Equipment Market Scope:

Equipment analysis

In 2021, ‘Surface Mining Equipment’ accounted for the highest percentage of total revenue, and this segment is anticipated to continue to retain its respective industry standing throughout the projected timeline. Over the next few years, it is anticipated that a surging demand for coal, chromium, iron ore and diamonds in emerging nations would open up new growth opportunities for players engaged in the surface mining equipment industry. As this equipment becomes more widely used, selective mining operations are being conducted by sourcing high-quality resources and building embankments with stable surfaces.

Furthermore, a major portion of the expansion of the surface mining equipment market trend is anticipated to come from the increasing demand for excavators in the oil & gas and construction industries. Due to the development of compact excavators, the demand for this equipment has also increased. These excavators offer a viable remedy for carrying out excavation work in small areas. To satisfy the current demand for metal exploration, businesses are upgrading excavators and electric shovels even more. For instance, in September 2019, Komatsu Ltd. unveiled the PC2000-11, a hydraulic excavator that has KomVision, a machine monitoring system. This can be used to remove overburden, load coal, and load shot rock when loading haul trucks.

In 2021, the ‘Underground Mining Equipment’ segment had a substantial impact on sales growth. The need for subterranean high-capacity trucks was facilitated as a result of the need to maximize a truck haulage’s efficiency and preserve its competitiveness with shaft haulage. Additionally, open-pit mining resources are not found to be economically viable by miners. Due to this, underground mining companies have grown in order to prolong the life of a mine, which has led to an increase in the demand for underground mining electric machinery.

Application Analysis

Owing to an increase in the hauling of metal deposits and surging demand for precious metals, the metal mining application sector was an industry frontrunner for the global mining equipment market growth in 2021. The industry growth of mining-related end-use industries, favorable government regulations, and changes in commodity prices are all anticipated to have a substantial impact on the demand for mining equipment for metal mining applications.

Additional equipment deliveries are being ordered by iron and copper mines in South America and Australia, which is anticipated to boost the expansion of this application area. Progress in iron and copper exploration led to this acquisition. In 2021, the non-metal mining application segment indexed significant growth. An increase in the demand for the extraction of rocks, sand, stone, and other similar materials for the construction of roads, monuments, buildings, and landscaping has led to an increase in the need for non-metal mining products. The expansion of the non-metal mining category is also being aided by an increase in the number of investment plans being offered in this industry by various governments. For instance, the Australian government raised fresh funds in 2019 for its sector of rare earth minerals and essential minerals. Through the Export Finance Australia (EFA) and Northern Australia Infrastructure Facility (NAIF), extraction projects in the fields of defense and vital minerals will have access to dual funding.

Key Market Segments:

By Equipment

Crushing, Pulverizing, & Screening

Others

By Application

Non-metal

Metal

Coal

Market Dynamics:

Given the ongoing importance of digitalization and automation, technology is increasingly becoming a key differentiator for manufacturing and mining firms. The key players are concentrating on lowering the extraction and equipment maintenance costs. Additionally, this industry has seen a significant uptake of various technology clusters like robots & automation, smart sensors, and 3D printing to improve operational efficiency. For instance, in order to reduce downtime in mining during material handling, ABB Ltd. released the Ability Smart Sensor in January 2019. It evaluates the state of mounted bearings. The demand for environmentally friendly equipment to support a sustainable future is increasing.

The constant transition to renewable energy has raised the demand for a number of minerals. Due to this, businesses have been able to grow and now provide equipment that is both more productive and less harmful to the environment. For instance, the Autonomous Haulage System (AHS) of Komatsu Ltd. uses cutting-edge control technology to reduce fuel consumption, tire wear, and pollutants.

Over the next few years, it is anticipated that the demand for mining equipment would increase as subterranean mining gives way to creative and cost-effective open pit mining operations. Energy-intensive procedures like refining and concentration are used in the mining sector to extract and safeguard resources. The average copper ore grade has decreased, which has increased energy use and material production, driving up the price of high-performance machinery.

The creation of high-performance machinery has allowed for the economical extraction of ores with decreasing grades. In order to secure their supplies of coking coal and iron ore at a reasonable price, various steel manufacturing corporations are pushing to enter the mineral exploration business.

However, it is expected that changes in the price of raw materials and stringent government restrictions and tariffs will impede upon the expansion of the global industry. Additionally, it is anticipated that the growing demand for technologically advanced mining equipment will create profitable prospects for the expansion of the global mining equipment market.

In the mining industry, telematics has changed the game. The fleet management receives feedback from sensors connected using the Internet of Things (IoT), decreasing unplanned downtime, and assisting with maintenance scheduling. The demand for automation in the mining sector has increased as a result of businesses’ ongoing drive for process optimization in an increasingly competitive market across all industries. Monitoring and investigation are being done with drones. Drones track post-blast scents, ensure that areas are clear before explosions, and improve overall site safety. Actions that are typically referred to as extraction, or the physical removal of solid ores, minerals, and substances from geological formations, characterize the mining industry. Building materials, rock, stone, rare earth, coal, uranium, diamonds, various compounds, and industrially significant solids are all supplied by mining. In contrast to techniques that use wells and thermal energy, chemicals, gases, or fluids to generate petroleum and bring it to the surface, surface excavation and soil removal are generally referred to as mining when recovering petroleum deposits in sands, shale, or bitumen.

The mining industry uses various equipment, heavy industry manufactured vehicles and machinery to develop mines to access deposits, explore geological deposits of economically significant and valuable ore, mineral, and chemical substance deposits, ore and material processing, as well as mine away deposits for stacking and storage.

A few examples of products that fall under the category of mining equipment include bulldozers, trams, mining trucks, elevators or lifts, drills, excavators, hoppers, control & support systems for explosives, filtering screens (trommels), hydro cyclones, centrifuges, mechanized shovels, sluices, lighting equipment, cranes, sensors, power equipment (generators), as well as life support and emergency supplies. Processing plants can be found on or near mines and contain mechanical – crushers, roasters, mills, or chemical equipment to extract desired materials, minerals, and compounds from ore. Processing plants are recognized as a distinct stage in the mining chain.

COVID-19 Impact Analysis

The COVID-19 pandemic has had a significantly negative influence on a number of industries, including the mining equipment sector. Due to supply chain discrepancies, there was a considerable decline in the demand for these machines. Even the producers of mining equipment noticed a shortage of raw materials as a result of travel and import restrictions, which forced the cancellation or delay of mining projects. Additionally, mining equipment manufacturers have seen major adjustments in their business operations as a result of this severe COVID-19 crisis. To counteract the effects of fluctuations in foreign exchange rates and market demand, for instance, Komatsu Ltd., a major player in the industry, prioritized worldwide cross-sourcing and the acquisition of finished vehicles and parts. Due to the virus’ quick spread, some businesses placed their production operation on hold at their manufacturing facilities. In addition, numerous manufacturers experienced some financial turbulence. Large portions of their workforce were laid-off as a result of the slump, which restrained market expansion prospects throughout the course of this pandemic.

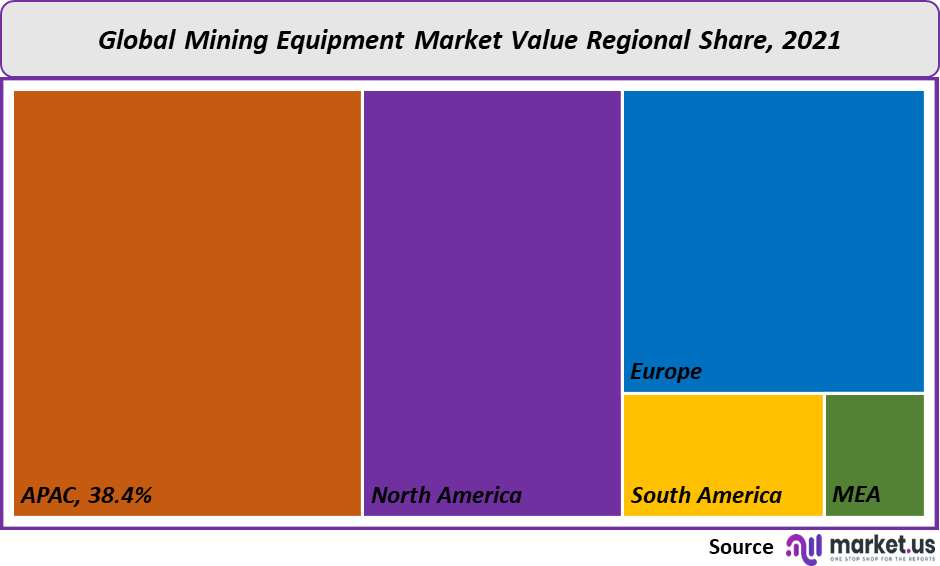

Regional Analysis

The Asia Pacific accounted for the largest market share of 38.4% in 2021. Owing to ongoing rounds of investments and expanding infrastructure projects, India and Australia took the lead in terms of overall revenues generated. Because there is plenty of room for bauxite, iron ore, and coal exploration in India, there are many prospects for mining businesses. Additionally, the nation’s burgeoning real estate market is anticipated to increase the demand for metal mining equipment, while supporting regional prosperity in the process.

Additionally, the government’s ongoing backing of mining and exploration has created numerous opportunities for equipment makers to offer improved products. For the discovery of metal and nonmetal ores, for instance, the Indian government has approved 100% FDI. Additionally, the Ministry of Steel wants to more than double the producing steel capacities by 2030–2031, to 300 million tonnes. These activities and support are anticipated to push mining equipment makers to set up bases in the nation, enhancing the mining equipment industry’s annual growth rate over the coming few years. Due to increasing mineral exploration operations brought about by substantial expenditures in this industry, the region of Latin America has grown in prominence. Numerous copper and gold mines can be found in Chile and Peru, and they have a big impact on the world’s metal exploration operations. Additionally, this region is growing thanks to advantageous mining legislation for foreign investors, particularly in Chile, Peru, and Colombia. Large amounts of gold, copper, and iron are also present in the area, which opens up exploration possibilities and raises the need for surface mining equipment.

Key Regions and Countries Covered in this Report:

North America

US

Canada

Mexico

Europe

Germany

UK

France

Italy

Russia

Spain

Rest of Europe

APAC

China

Japan

South Korea

India

Rest of Asia-Pacific

South America

Brazil

Argentina

Rest of South America

MEA

GCC

South Africa

Israel

Rest of MEA

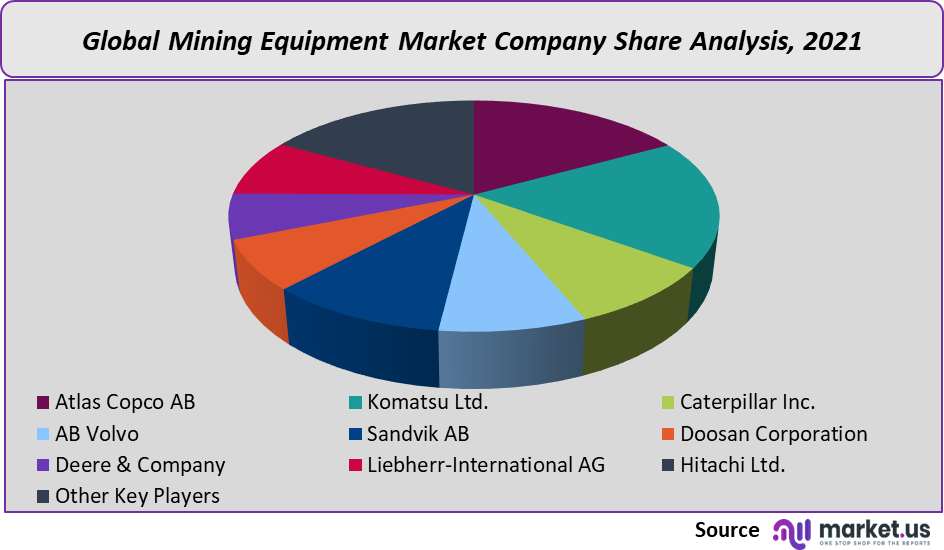

Market Share & Key Players Analysis:

To lend customers value-added services, businesses place a strong emphasis on improving their service and post-service initiatives. Caterpillar Inc., for example, develops strategies to provide a superior customer experience that emphasizes value-added products to alter conventional product support. A more robust aftermarket presence for the corporation resulted from this strategy’s increase in product sales. One of the key factors of market growth is a rise in industrialization and urbanization.

To save on manufacturing costs and offer competitive distinctiveness, major OEMs have begun working with some competitors on joint ventures and research initiatives for components and bought-finished materials. One of the primary techniques used by businesses to secure long-term client loyalty is the expansion of products by creating the correct differentiated product. For example, Caterpillar Inc.’s latest 20-ton size class excavators have helped clients achieve cost and productivity targets by lowering fuel consumption, increasing operating efficiency, and reducing maintenance costs.

Key Market Players:

A few of the leading companies in the mining equipment market are:

Caterpillar Inc.

AB Volvo

Sandvik AB

Doosan Corporation

Deere & Company

Liebherr-International AG

Hitachi Ltd.

Other Key Players

For the Mining Equipment Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Market Size in 2022

178.84 Billion

Growth Rate

11.3%

Forecast Value in 2032

580.64 Billion

Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the mining equipment market in 2021?The mining equipment market share value was US$ 178.84 billion in 2021.

What is the projected CAGR at which the mining equipment market is expected to grow at?The mining equipment market is expected to grow at a CAGR of 11.3% (2023-2032).

List the segments encompassed in this report on the mining equipment market?Market.US has segmented the mining equipment market by region (North America, Europe, APAC, South America, and the Middle East and Africa). By equipment, this market has been segmented into underground mining, surface mining, crushing, pulverizing, & screening, mining drills & breakers, and others. By application, this market has been further divided into metal, non-metal, and coal.

List the key industry players in the mining equipment market?Atlas Copco AB, Komatsu Ltd., Caterpillar Inc., AB Volvo, Sandvik AB, Doosan Corporation, Deere & Company, Liebherr-International AG, Hitachi Ltd., and Other Key Players.

Which region is more appealing for vendors employed in the mining equipment market?APAC accounted for the highest revenue share of 38.4%. Therefore, the mining equipment industry in this region is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for mining equipment?The U.S., Canada, Germany, the U.K., Spain, France, Finland, Sweden, etc. are key areas of operation for the mining equipment market.

Which segment accounts for the highest market share in the mining equipment industry?With respect to the mining equipment industry, vendors can expect to leverage greater prospective business opportunities through the surface mining equipment segment, as this area of interest accounts for the greatest market share.

![Mining Equipment Market Mining Equipment Market]()

- Atlas Copco AB. Company Profile

- Komatsu Ltd.

- Caterpillar Inc.

- AB Volvo

- Sandvik AB

- Doosan Corporation

- Deere & Company

- Liebherr-International AG

- Hitachi Ltd. Company Profile

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |