Global Natural Oil Polyols Market By Product (Palm Oil Polyols, Soy Oil Polyols, Canola Oil Polyols, and Others), By End-Use (Automotive, Furniture & Interiors, Packaging, Construction, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Aug 2022

- Report ID: 41143

- Number of Pages: 327

- Format:

- keyboard_arrow_up

Natural Oil Polyols Market Overview:

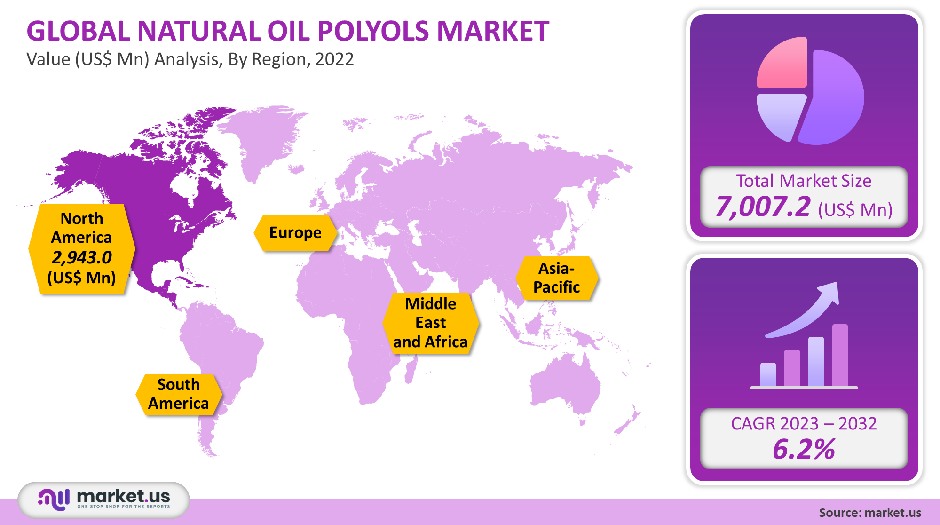

The global market for natural oil polyols was valued at USD 7,007.2 million in 2021. This market is expected to expand at a 6.2% CAGR, between 2023-2032.

These natural oil polyols can also be called bio polyols. They are made from vegetable oils. These polyols can be made from the transesterification of natural oils, such as soy oil.

Additionally, castor oil, a natural polyol that is commercially available, is made directly from vegetable or plant oils. Due to its bio-based, non-polluting raw material, this product boasts an impressive eco-friendly factor. Natural oil polyols are used for a wide range of purposes, such as cushioning, metallic coatings, and feedstock.

Global Natural Oil Polyols Market Analysis

Product Information

With a revenue share exceeding 40% in 2021, the segment of soy oil polyols dominated this market. This market is expected to grow due to its high demand for soybean oil polyols in food and animal feed. Castor oil can be found in many commercially available products that are made from oilseeds.

It is used in manufacturing a wide range of polyurethane products, that includes coatings and foams. This oil is being used more frequently to manufacture polyurethane-based foams. Castor oil has been created due to the growing demand for high-quality natural oil at low prices and the improvements in extraction technologies.

Palm oil is one of the most economical oil crops on the planet. It is an easily accessible, renewable, and important bio-based, polyol-based raw material, which can be used for semi-rigid, rigid, or flexible polyurethane foams, adhesives and coatings, and composites. Also, it can be used in various industrial applications. It is anticipated that the segment of palm oil polyol will grow with an increase in R&D to develop alternative vegetable polyols and palm oil extraction for industry purposes.

End Use Analysis

Construction dominated the market in 2021 with a high revenue share. This is due to the increased use of polyurethanes when building roofs and walls. With the U.S. construction market growing faster than China’s, the global construction industry will experience rapid growth. The rise in construction activity worldwide is expected to lead to a higher demand for rigid polyurethane rubber foams made of natural oil polyols.

The furniture and interiors sector held the second-largest revenue share in 2021. For the manufacture of polyurethane, natural oil polyols are used most. Flexible polyurethane foam is a common material for carpet underlays and bedding. For furniture, flexible polyurethane foams from natural oils polyols can be used to make it durable, comfortable, and long-lasting. They can be used as cushions in upholstered furniture.

The automotive industry uses polyurethanes to make many parts, such as bumpers and spoilers. They also use them for interior ceiling sections, doors, windows, and vehicle body panels. Because of their lightweight and structural benefits, as well as their crash performance and overall strength, there is a growing demand for lightweight but high-strength materials.

Non-foam urethanes, also called potting compounds, are commonly used in electronics and the electrical industry to seal, encapsulate, insulate, and insulate microelectronic components, fragile devices, pressure-sensitive systems, and underwater systems. There will be an increase in the use of non-foam polyurethane for electrical and other appliances, which will drive up the demand for natural oils and polyols.

Key Market Segments

By Product

- Palm Oil Polyols

- Soy Oil Polyols

- Canola Oil Polyols

- Castor Oil Polyols

- Sunflower Oil Polyols

By End-Use

- Automotive

- Furniture & Interiors

- Packaging

- Construction

- Other End-Uses

Market Dynamics

The increasing demand for light and durable products in various industries such as electronics, automotive, and construction is responsible for the market’s growth. This includes emerging economies like China and India. The growing use of bio-based Polyurethane Foam in automotive and construction, and other sectors will drive market growth. The automotive OEMs have adopted polyurethane foams derived from natural oils to reduce vehicle weight and improve fuel efficiency.

The growing demand for environmentally-friendly plastic products, added to a volatile price range of vital raw materials that are used for manufacturing conventional polyols, is expected to remain a key driving factor for the market. Major petrochemical-based producers like BASF and Cargill Incorporated have moved their attention to eco-friendly products to decrease reliance on conventional Polyols. This reduces the risk associated with price volatility.

Bio-based polyurethane is being adopted worldwide due to increasing environmental concerns and volatile prices of conventional Polyurethane. Bio-based polyurethane’s market growth will be influenced by favorable regulations on manufacturing bio-based products, as well as strict environmental sanctions on petrochemicals and synthetic polymers.

Personal care product sales have increased over the last few decades due to the increasing number of specialty retail shops and salons, spas, and online sales platforms. The forecast period will see a rise in demand for bio-based products due to growing preferences for skin care products in France and India.

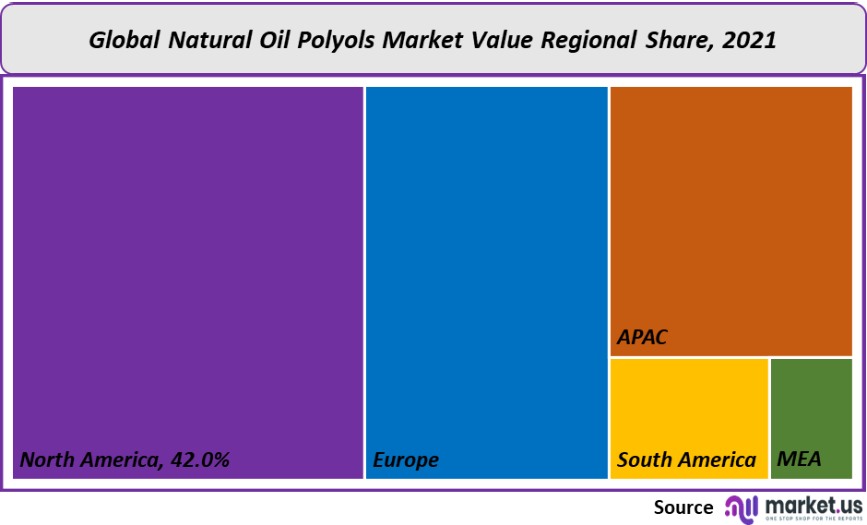

Regional Analysis

North America held the largest market share, with 42% in 2021. This can be attributed to rising energy costs and volatile petrochemical prices, which have increased biofuel demand. This market growth will also be supported by the increasing demand from the region’s end-use sectors, such as construction, electronic and electrical appliances, furniture, and interiors.

Germany is one of Europe’s most important automotive markets. This country is the most prominent European producer of passenger vehicles, accounting for over 30% of all member countries of the EU. These factors will be key to the market’s continued growth during the forecast period.

Low manufacturing costs and a growing manufacturing sector will be key factors in natural oils polyol production. A number of major international companies have expanded their regional production capacity due to the above-mentioned factors. This is expected to strengthen the production landscape for the regional market.

Strong growth potential is being created by the growing use of soy, palm-based, and other oilseeds-based polyurethanes for appliances and developments in electronics. Saudi Arabia is one of the fastest-growing construction and real estate markets in the Gulf. The forecast period will increase demand for natural oil oils due to the expanding construction industry.

Key Regions and Countries covered in thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

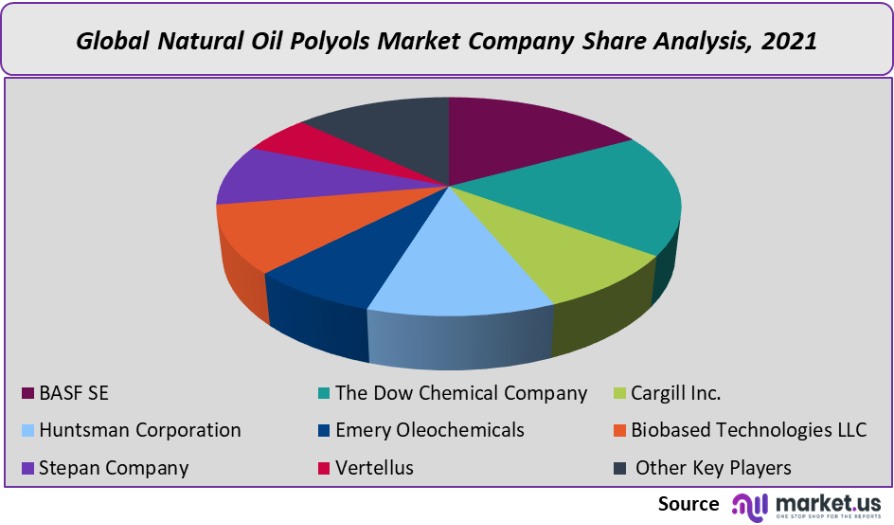

Because of the number of multinationals actively involved in research & development, this market is highly competitive. Global companies focus on capacity expansions and signing partnership agreements for advanced biotechnology companies to gain an advantage in this competitive market.

Cargill, Incorporated, for example, purchased Agrol, a product collection of natural oil polyols from BioBased Technology LLC. These strategies will reflect increased competition in the years ahead.

Маrkеt Кеу Рlауеrѕ:

- BASF SE

- The Dow Chemical Company

- Cargill Inc.

- Huntsman Corporation

- Emery Oleochemicals

- Biobased Technologies LLC

- Stepan Company

- Vertellus

- Other Key Players

For the Natural Oil Polyols Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

What is the size of the Natural Oil Polyols Market in 2021?The Natural Oil Polyols Market size is US$ 7,007.2 million in 2021.

What is the projected CAGR at which the Natural Oil Polyols Market is expected to grow at?The Natural Oil Polyols Market is expected to grow at a CAGR of 6.2% (2023-2032).

List the segments encompassed in this report on the Natural Oil Polyols Market?Market.US has segmented the Natural Oil Polyols Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, the market has been further divided into Palm Oil Polyols, Soy Oil Polyols, Canola Oil Polyols, Castor Oil Polyols, and Sunflower Oil Polyols. By End-Use, the market has been further divided into Automotive, Furniture & Interiors, Packaging, Construction, and Other End-Uses.

List the key industry players of the Natural Oil Polyols Market?BASF SE, The Dow Chemical Company, Cargill Inc., Huntsman Corporation, Emery Oleo chemicals, Bio-based Technologies LLC, Stepan Company. Vertellus, and Other Key Players are engaged in the Natural Oil Polyols market.

Which region is more appealing for vendors employed in the Natural Oil Polyols Market?North America is expected to account for the highest revenue share of 42%. Therefore, the Natural Oil Polyols industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Natural Oil Polyols?The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Natural Oil Polyols Market.

Which segment accounts for the greatest market share in the Natural Oil Polyols industry?With respect to the Natural Oil Polyols industry, vendors can expect to leverage greater prospective business opportunities through the soy oil polyols segment, as this area of interest accounts for the largest market share.

![Natural Oil Polyols Market Natural Oil Polyols Market]()

- BASF SE Company Profile

- The Dow Chemical Company

- Cargill Inc.

- Huntsman Corporation

- Emery Oleochemicals

- Biobased Technologies LLC

- Stepan Company

- Vertellus

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |