Global Network Probe Market By Component, By Deployment Mode, By Enterprise Size, By End-Use, By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2021–2031

- Published date: Sep 2021

- Report ID: 73121

- Number of Pages: 365

- Format:

- keyboard_arrow_up

Network Probe Market Overview –

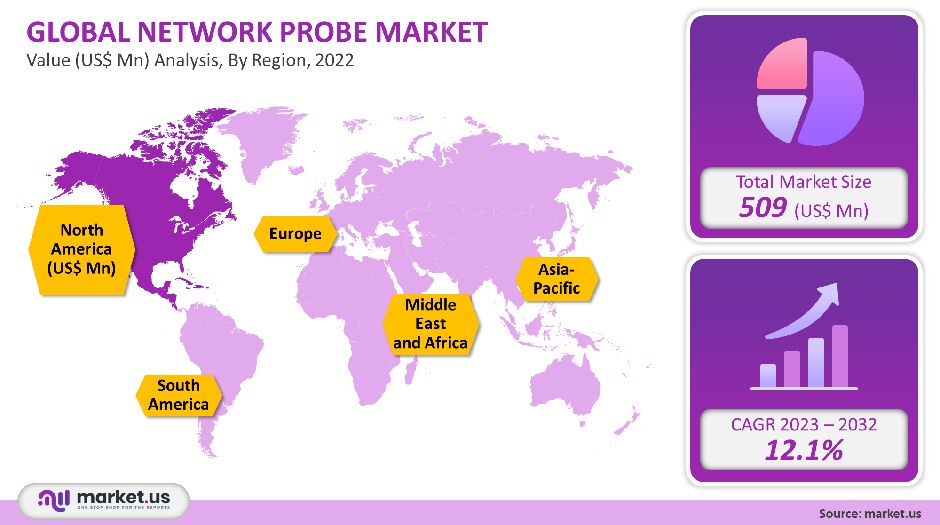

The Global Network Probe Market size was estimated at USD 453.6 Million. The market growth rate is expected at 11.1% between the Forecast period of 2023 and 2031.

Introduction –

A network probe is a probe that attempts to access a computer and its files through known or possible weak entry points where complete visibility is seen in a computer system. Network probes are not a direct threat to networks, however, they do indicate that someone is encapsulating possible attacks on network security concerns through entry points on your system. It is a network monitor that can analyze protocols by protocol analyzer and the organization’s network traffic monitoring (in real-time).

The definition of network probe technologies may vary depending on the network management solutions that a given operator uses. There are two types of network probes: the first one is software plug-ins built into a network monitoring tool. These are basic text files for a poll device. The second type of probe is installed separately on the equipment an operator wants to monitor. The main job of these two types of probes is to communicate to given network devices and retrieve answers in turn.

Once a probe has tested the device, it will receive any offline data analytics solution provided by the device supplier. The probe brings this data back to the market demand for network monitoring application issues in real-time. If any of the preset performance thresholds are exceeded, the probe will take actions specified by the operator, such as triggering an alarm or an automatic activity.

Several network infrastructure monitoring tools come with numerous common probes. Some even allow the creation of their own detectors to monitor more devices. The probe uses internet protocols such as Simple Network Management Protocol (SNMP), Transmission Control Protocol (TCP), Hypertext Transfer Protocol (HTTP), or a command line to retrieve data analytics by polling a device. After receiving this data, the probe will feed the same to a display in a continuous network probe monitoring software solution.

Detailed Segmentation –

Global Network Probe Market outlook is segmented on the Basis of Market by Component, Financial position, Deployment Mode, Enterprise Networks Organization Size, End-use Insights, and region with the fastest-growing regional market with the major factors and, major share revenue with shareholding terms.

In this comparative analysis of the market for Network probe deployment, larger market size estimation processes organizations prefer to buy network probe solutions.

Represented Below is a Detailed Analysis and Premise Segment Description:

Based on Component:

- Solutions

- Services

Based on Deployment Mode:

- On-premise

- Cloud

Based on Enterprise Size:

- Large Enterprises

- Small & Medium Enterprises

Based on End-Use:

- Government & Defense

- IT & Telecom

- BFSI

- Other End-Uses

Based on Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Market Dynamics:

As increasingly advanced DNS technology is adopted, device interconnection and virtualization technologies have rapid annual growth rate strategies, revenue forecast periods, and revenue growth factors. This has led to an increase in the number of network attacks, security technologies, security vulnerabilities, and security visibility, leading to the need for appropriate network performance and security testing mechanisms.

Hence, key players have begun to implement network probing to provide in-depth network visibility in a network’s infrastructure. Demand for network probe vendors provides a solution for security issues for both wired, and wireless networks, and overall network security service, which in turn, helps to reduce network attack risks.

Tools Among SMEs where Small & Medium Enterprises (SMEs) are moving towards new modern technologies such as cloud probes, artificial intelligence, Software-Defined Networking (SDN), and the Internet of Things (IoT), and the Adoption of cloud-based network monitoring solutions to effectively improve overall business units operations and productivity with efficiencies and productivity. They also use the benefits of network probe solutions to effectively manage and operate a network.

A wide range of Cybersecurity attacks increased employee productivity, and cost reduction is a key factor for the adoption of network probe tools. Therefore, SMEs will create new opportunities and key driving factors for the various suppliers in this market consulting segment growth.

Network probes tools cannot provide extreme visibility and control. There are blind spots in the network that cannot be reached by network detection tools. Any active network difficulties such as network downtime issues will result in wasted energy and reduced profits.

In-depth extreme value performance comprehensive analysis, at the granular level, allows organizations to discover irregularities, and to communicate with high risks in real-time, which may further hamper the trajectory of the adoption of the network probe industry insights in the foreseeable future.

Competitive Landscape –

Key Major Players in this market are –

- SolarWinds Corporation

- International Business Machines Corporation

- NetScout Systems Inc. (InfiniStreamNG platform)

- Cubro Network Visibility

- Broadcom, Inc.

- IBM Corporation

- Cisco Systems Inc.

- Nokia Corporation (NetAct Network Management System)

- NEC Corporation

- Micro Focus International PLC

- AppNeta

- Catchpoint Systems Inc.

- Cisco Systems, Inc.

- Flowmon Networks A.S. (advanced application layer visibility)

- Paessler AG

- Cubro Kentik

These key largest network probe market players prominent market players have been focusing on mergers, partnerships, primary sources, internal factors, acquisitions, product portfolios, product launches, and development of technology, advanced technologies, collaboration strategies, enhanced network technology, and in order to sustain their competitive edge.

Key developments –

2021:

- June 2021: Micro Focus established a partnership with RAH Infotech, a technology distributor in India. The partnership aims to help Indian companies embark on their digital transformation journey and develop more agile, cybersecurity, and analytics-driven companies. In this collaboration, RAH Infotech will use its pan-India distribution network to implement Micro Focus’s entire portfolio of technology cloud-based solutions, deployment of solutions covering security, IT hybrid environment (cloud), enterprise DevOps, and predictive analytics.

- May 2021: Catchpoint collaborates with Google Cloud Infrastructure, and this collaboration aims to enable IT, teams, to be user-centric and to understand availability, performance, and the health of applications as well as the infrastructure that is running on the Google Cloud Platform. Combining Catchpoint’s unique global digital experience, enterprise-size insights generated by the world’s largest market share with a global surveillance network with universal visibility provided by Google Cloud’s partner ecosystem has eliminated the visibility gap that has plagued the company profile’s market share for a long time.

- April 2021: SolarWinds established a partnership with DNS Filter, which is the industry’s leading provider of DNS threat protection and content filtering. This partnership aims to help MSPs use improved DNS technology to protect users from online security risks. Under this partnership, DNSFilter combines its cloud-based security solutions with N-central to provide risk protection and content filtering for MSPs.

- April 2021: Broadcom and Google Cloud reached a partnership. This collaboration aims to promote the advancement of Broadcom’s key software franchise rights and to strengthen the capability of cloud services integration. In this cooperation, Broadcom will provide its security and enterprise operation software portfolio on Google Cloud Segment, allowing the company to implement the security, DevOps, etc. of Broadcom’s solutions on Google Cloud’s trusted global infrastructure.

- April 2021: NEC and Cisco signed the Global System Integrator Agreement (GSIA). The agreement aims to promote the global implementation of innovative 5G IP transmission network solutions. In this agreement, the two companies will jointly promote the latest in 5G business improvements, business intelligence, business overviews, business process, business productivity, business requirement, business strategies, business operations, and business efficiency. In addition, NEC group companies will work closely with Cisco to support NEC’s ecosystem through optimized IP metro/access transmission and edge cloud computing solutions. In addition, Cisco will support NEC user participation by providing market classification products, proposals, and implementation support.

![Network Probe Market Network Probe Market]()

- SolarWinds Corporation

- International Business Machines Corporation Company Profile

- NetScout Systems Inc. (InfiniStreamNG platform)

- Cubro Network Visibility

- Broadcom, Inc.

- IBM Corporation

- Cisco Systems Inc.

- Nokia Corporation (NetAct Network Management System)

- NEC Corporation

- Micro Focus International PLC

- AppNeta

- Catchpoint Systems Inc.

- Cisco Systems, Inc.

- Flowmon Networks A.S. (advanced application layer visibility)

- Paessler AG

- Cubro Kentik

- Nestlé S.A Company Profile

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |