Global Non-Alcoholic Beverages Market By Product (Carbonated Soft Drinks, Bottled Water, Tea & Coffee, Juices, and Others), By Distribution Channel (Food Service, and Retail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Apr 2022

- Report ID: 26499

- Number of Pages: 209

- Format:

- keyboard_arrow_up

Non-alcoholic Beverages Market Overview:

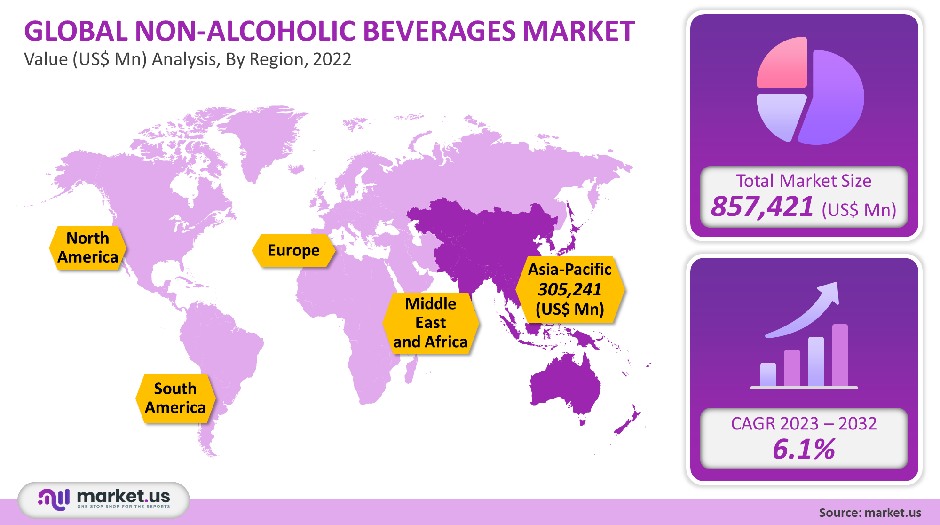

The market for non-alcoholic beverages in the world was worth USD 857,421 million in 2021. It is projected to grow at a CAGR of 6.1% between 2023 and 2032.

This happened because consumers are switching to healthier drinks for their daily and occasional needs due to rising health concerns from the virus. Bacardi Cocktail trends report with The Future Laboratory found that 58.8% of global consumers are now switching to non-alcoholic drinks.

Global Non-Alcoholic Beverages Market Scope:

Product Analysis

The largest market share was held by the bottled water segment in 2021. It accounts largest revenue share of 56%. It is expected to continue its dominance over the forecast period. Segment growth will be driven by rising consumer awareness regarding the health benefits of bottled water consumption during the forecast period.

Products sales are driven by the growing preference for bottled water over regular water, particularly among younger customers. Many restaurants offer different types of bottled waters to meet customer demand, as a result. Water seems to be finding a sweet spot among health-conscious customers. It is predicted that the U.S. will see a substantial increase in restaurants over the next few years, which will lead to a rise in demand for bottled waters.

Juices will experience the second-fastest growth from 2023 to 2032. The demand for juices will rise as people realize the importance of a healthy lifestyle. New product launches by major manufacturers such as Tropicana, The Coca-Cola Company, and Tropicana are expected to boost the market. PepsiCo’s Tropicana juice brand launched a new product line in September 2020.

Tropicana Lean was added in three flavors: Citrus Fruit and Mixed Berries. Each contains 40% less sugar than the original and 40% fewer calories. Additionally, increasing concerns about various health issues such as obesity, nutritional deficiencies, and other ailments are expected to increase demand for these products, which will support segment growth.

Distribution Channel Analysis

In 2021, the world’s largest retail channel was responsible for a more significant global market share. This retail channel comprises hypermarkets & supermarkets, as well as other channels. Because of the wide variety of brands available under one roof, hypermarkets and supermarkets hold the highest share. Whole Foods, Target, Walmart, and Aldi, have expanded their alcohol-free products.

Woolworths increased the availability of alcohol-free beer, wine, and spirits to meet consumer demand in July 2021. The retailer added more products to its range, including 30 with low alcohol content. The segment growth is likely to be accelerated by such initiatives.

Online distribution channels are expected to grow at a faster CAGR than the retail channel. Because of the low entry barriers, many new players are entering the market through e-Commerce platforms, such as Amazon and Walmart.

Figlia is a modern, non-alcoholic Aperitivo business that launched its product line through DrinkFiglia.com. Online platforms are becoming increasingly popular for premium brands and new entrants. SOLE launched expensive bottled waters on Amazon in January 2022 through an exclusive partnership with Beverage Universe.

Key Market Segments:

By Product

- Carbonated Soft Drinks

- Bottled Water

- Tea & Coffee

- Juices

- Other Products

By Application

- Food Service

- Retail

- Hypermarkets & Supermarkets

- Online

- Others

Market Dynamics:

The market is accepting the low-alcohol and non-alcohol categories, and manufacturers are adapting their product offerings to accommodate these new trends. This will likely lead to future growth. In the market, recent trends emerged due to COVID-19’s pandemic restrictions. Due to increasing health concerns, consumers are choosing healthy beverages for everyday use and special occasions.

Large brands offer mass quantities in categories like bottled waters, low-carb beverages, craft, and flavored cocktails. These factors are likely to help the market grow. The positive effect of consumers choosing non-alcohol drinks has boosted the development of new complex-tasting soft, premium beverages targeting adults.

In October 2021, Waitrose Food and Drink Report revealed that alcohol-free drinks searches continue to grow by 22% per year. Brands continue to innovate by creating new product lines or expanding existing ones. Good Earth, an American tea brand, increased its product offerings in the U.K., for example, in May 2020. It offers a range of teas, including green and black, herbal and fruit, and original and flavored kombucha. Adding to this, these drinks are made from natural ingredients.

In addition, consumers are increasingly turning to non-alcoholic and healthier beverages because of growing concern over the COVID-19 pandemic. Consumers are choosing drinks without alcohol to improve their physical and mental health. Consumers in countries like the U.S. prefer zero-proof spirits, non-alcoholic cocktails, low calories, or low-carb drinks, according to the Beverage Trends Report of 2021 from Goliath Consulting Group. This trend has opened up new opportunities for beverage manufacturers.

Ritual Zero proof announced that its new liquor replacement was launched in October 2021. The brand’s Gin, Whiskey, & Tequila Spirit Alternatives were available at Whole Foods Markets across the U.S. and on Amazon.

Major retailers selling alcoholic and other alcoholic beverages are seeing a spike in demand for new palettes and premium ingredients. Instacart (American retailer/grocery company), trends expert, and Well+Good Wellness Advisors said that non-alcoholic drinks, such as carbonated drinks and alcohol complimentary cocktails, are expected to increase 37% by 2021 over 2020. Whole Foods saw an increase in such demand in 2020. Supermarkets will likely increase the number of these beverages in their stores, expanding their brand portfolio.

Aldi’s May 2020 venture into alcohol-free spirits is a great example. They are vegan-friendly and sugar-free. Many key players are looking to expand their brand portfolio by acquiring non-alcoholic brands and developing their product range. Diageo bought a minority stake in Ritual Zero Proof, a brand that makes non-alcoholic spirits, in January 2020. The company would be able to launch new products and expand its brand portfolio with the acquisition. This growth trend is likely to be positive for future market expansion.

Regional Analysis

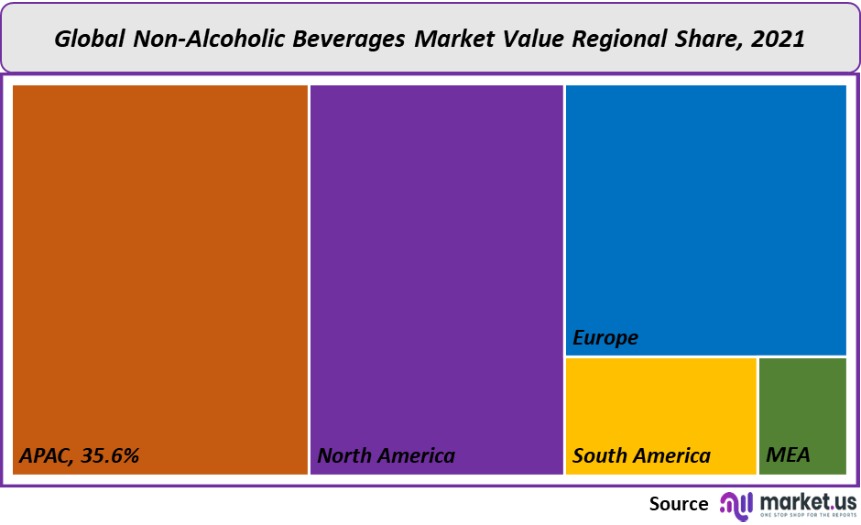

The Asia Pacific had the highest rate of market growth as a result of its vast untapped market potential and the great number of its living people, as well as its high disposable income. The Asia Pacific region accounts for 35.6% of the global market.

It largely takes advantage of its inexpensive labor, and also many inexpensive resources, such as wood and cotton. Rising consumer demand for better alcohol substitutes will drive this market. The Make in India Initiative, 100 FDI on food, and the One Belt, One Road Initiative, are attracting new entrants looking to establish production and distribution plants in the Asia-Pacific market.

Budweiser, introduced by AB InBev India (AB InBev), was the first non-alcoholic beverage in a 250ml can to be made available in North America. It was because of the growth of major economies and the development of soda brands. PepsiCo and Coca-Cola Company are two of the most dominant franchises in this industry.

The government of Mexico is imposing higher taxes on products that contain sugar because of the increase in obesity in Mexico. The taxes also increase the demand for low-calorie sweeteners that do not have a nutritional component.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

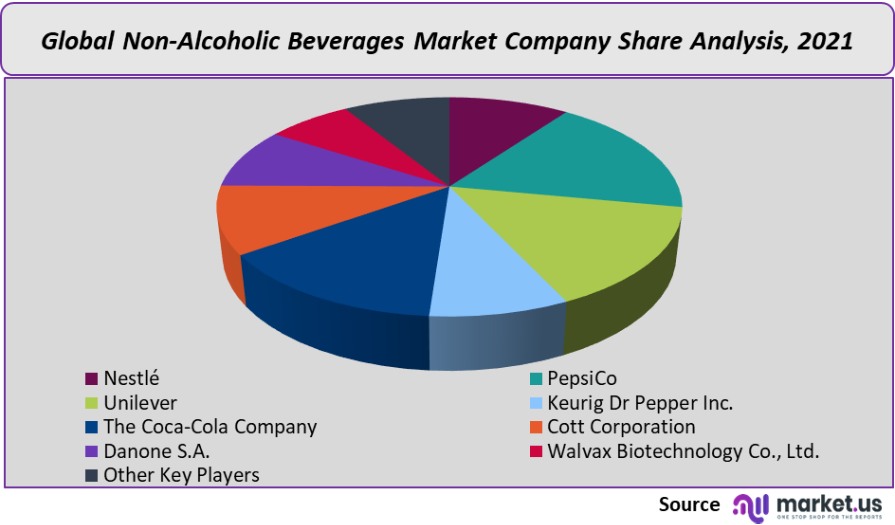

This industry is competitive due to both small and large players. The industry’s key factor is product differentiation, which drives research and development activities. The rapid pace of technology change and the demands of customers creates an environment that encourages product enhancement and new product development.

Companies spend heavily on research to develop new products that meet the requirements of local regulations and standards. This industry’s success depends on the ability to extend and stretch product lines.

Switching costs for consumers are low in consumer goods. This means that companies must offer their customers value and work to create a customer-centric culture. Promoting your brand is as important as a quality product. In this market, companies are spending heavily on promotion to build a unique brand image that gives them an advantage over their competitors.

Katy Perry and Morgan McLachlan, her business partner, launched De Soi, a non-alcoholic beverage brand. 3 sparkling non-alcoholic aperitifs were available in the product line: Champignon Dreams, Golden Hour, and Purple Lune.

The Coca-Cola Company, in partnership with Corona U.S. Manufacturers, announced the launch of Fresca canned cocktails on January 20, 2022.

DrinksDeli launched an online platform for zero-alcohol beverages in India in October 2021. The company will sell packaged coffee and cocktail mixers.

The following are key players in the non-alcoholic beverage market worldwide:

- Nestlé

- PepsiCo

- Unilever

- Keurig Dr. Pepper Inc.

- The Coca-Cola Company

- Cott Corporation

- Danone S.A.

- Suntory Beverage & Food Limited

- Asahi Group Holdings, Ltd.

- Red Bull

- Other Key Players

For the Global Non-alcoholic Beverages Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the non-alcoholic beverages market in 2021?A: The non-alcoholic beverages market size is US$ 857,421 million in 2021.

Q: What is the projected CAGR at which the non-alcoholic beverages market is expected to grow at?A: The non-alcoholic beverages market is expected to grow at a CAGR of 6.1% (2023-2032).

Q: List the segments encompassed in this report on the non-alcoholic beverages market?A: Market.US has segmented the non-alcoholic beverages Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By product, the market has been segmented into carbonated soft drinks, bottled water, tea & coffee, juices, and others; by distribution, the channel market has been segmented into food service and retail.

Q: List the key industry players in the non-alcoholic beverages market?A: Nestlé, PepsiCo, Unilever, Keurig Dr Pepper Inc., The Coca-Cola Company, Cott Corporation, Danone S.A., Walvax Biotechnology Co., Ltd., and Other Key Players are engaged in the Meningococcal Vaccines market.

Q: Which region is more appealing for vendors employed in the non-alcoholic beverages market?A: APAC accounted for the highest revenue share of 35.6%. Therefore, the Non-alcoholic Beverages industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key business areas for the non-alcoholic beverages Market.A: China, Japan, Germany, France, The US, Canada, Mexico, UK, etc., are leading key areas of operation for the Non-alcoholic Beverages Market.

Q: Which segment accounts for the greatest market share in the non-alcoholic beverages industry?A: With respect to the non-alcoholic beverages industry, vendors can expect to leverage greater prospective business opportunities through the bottled water segment, as this area of interest accounts for the largest market share.

![Non-alcoholic Beverages Market Non-alcoholic Beverages Market]() Non-alcoholic Beverages MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample

Non-alcoholic Beverages MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample - Nestlé S.A Company Profile

- PepsiCo

- Unilever Plc Company Profile

- Keurig Dr. Pepper Inc.

- The Coca-Cola Company

- Cott Corporation

- Danone S.A.

- Suntory Beverage & Food Limited

- Asahi Group Holdings, Ltd.

- Red Bull

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |