Global Offshore Lubricants Market By Application (Engine Oil, Gear Oil, Grease, Hydraulic Oil, and Others), By End-use (Offshore Rigs, OSVs, and FPSOs), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Mar 2022

- Report ID: 31921

- Number of Pages: 231

- Format:

- keyboard_arrow_up

Offshore Lubricants Market Overview:

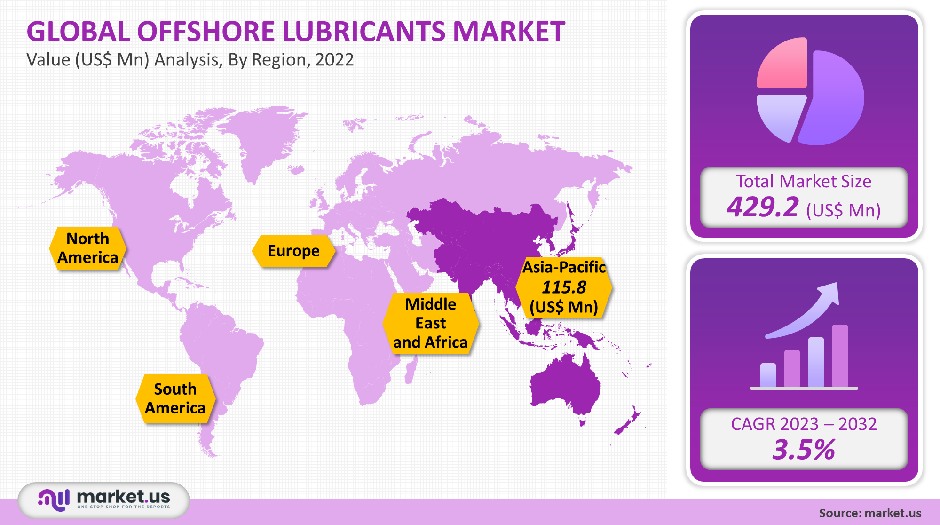

In 2021, the global offshore lubricants industry was worth USD 429.2 million and is expected to grow at a CAGR of 3.5% from 2022 to 2032.

Lubricants are used in a variety of offshore applications like turbines, vessel engines, hydraulic equipment, and gearboxes. They help reduce wear and tear on machinery, improve operational efficiency, and make it easier to do business.

Global Offshore Lubricants Market

Application Analysis

The global industry is divided by application into hydraulic oil, engine oil, and grease, along with other applications like cylinder oil or turbine oil.

Engine oil accounted for 74% of all market volume and was the most popular application segment. The main driver is expected to be increasing maritime traffic as a result of increased international trade. Engine oil is expected to drop in market share to 73.1% by 2032. This will be primarily because of the growing demand for grease- and gear oil.

Engine oils are used in boat engines and vessel engines. Engine oil is essential in optimizing engines’ output. These oils are specially formulated to improve the speed and efficiency of engine strokes. They protect engines against rusting and wear and tear. Over the forecast period, engine oil demand will rise due to increasing maritime traffic.

Grease will see the most volume growth in the forecast period, due to its growing use in offshore machinery, vessels, oil & gas equipment, and grease. To reduce downtime and operational costs, manufacturers value efficiency in their equipment. This factor will likely influence high demand during the forecast period.

End-Use Analysis

The global offshore oil lubricants industry is segmented based on end-use.

OSVs accounted for 57.0% of the global offshore lubricants industry volume in 2021. OSVs are often used to support offshore drilling and production. The AHTS (Anchor Handling Tug Supply Vessel), as well as PSV (Platform Supply Vessel), are two of the major offshore supply vessels. AHTS acts as an anchor for semisubmersible rigs, and accommodation bars.

AHTS serves as an anchor for semisubmersible rigs (FPSOs), accommodation barges, and other types of rigs. OSVs with higher utilization rates are directly linked to an increase in maintenance. This is expected to drive offshore lubricants supply.

OSVs will become more popular due to increased deepwater resources exploration and production. This will lead to higher maintenance and a greater need for lubricants like engine oils, compressor oils, and hydraulic fluids.

Key Market Segments

Application

- Engine Oil

- Gear Oil

- Grease

- Hydraulic Oil

- Others

End-Use

- Offshore Rigs

- OSVs (Offshore Support Vessels)

- FPSOs (Floating, Production, Storage & Offloading Vessels)

Market Dynamics

The global industry is expected to grow in the coming years due to increased offshore oil & gas exploration and production activities, especially in the Gulf of Mexico. Industry development can be influenced by regulations. Regulatory agencies such as the U.S. EPA (REACH) and ECHA are always evolving, forming, and establishing policies related to their usage.

BEACH (Beaches Environmental Assessment and Coastal Health), for example, amended acts like the Clean Water Act to regulate and manage petrochemicals in water bodies such as oceans & seas.

Offshore lubricants can be found in FPSOs, OSVs, and offshore rig units. For machinery maintenance and improved operational efficiency, heavy-duty equipment is dependent on lubricants. The industry will benefit from the increased offshore drilling activity in the Gulf of Mexico as well as in the South China Sea and Arabian Seas.

The U.S. EPA issued guidelines regarding vessel general permits (VGP) for vessels operating within the U.S. waters. These VGP requirements provide guidelines to reduce aquatic environment impacts by prescribing an approved list of environmentally friendly lubricants (EAL).

Volatility in raw material prices combined with strict environmental regulations to manufacture conventional lubricants makes the global market volatile. Manufacturers have been working together with biotechnology companies to create bio-based solutions to these problems. This collaboration is further supported by tax incentives and governmental favors to encourage the use of clean technologies.

Due to their eco-friendly properties, biobased lubricants continue to gain popularity. The development of bio-based lubricants is also being driven by the increasing concern for aquatic pollution caused by the unregulated disposal of conventional oils.

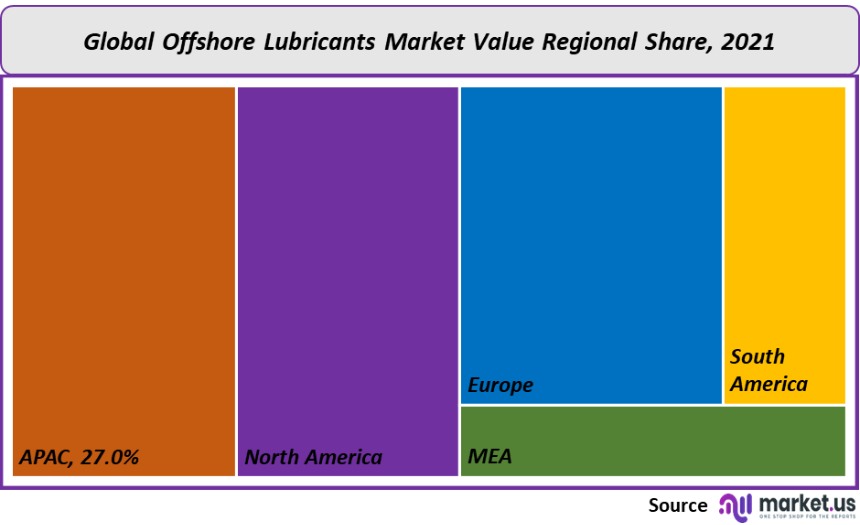

Regional Analysis

The report examines the regional markets of North America, Europe, Asia Pacific, and the Middle East. The Asia Pacific was the largest buyer and accounted for more than 27% of total market volume in 2021. The region’s growth is expected to be driven by the expansion of offshore projects in India (Indonesia), Malaysia (Malaysia), and China over the forecast period.

Economic growth has also facilitated greater maritime trade. This has led to a substantial increase in sea traffic in recent times. This is expected to increase offshore lubricants’ demand across the Asia Pacific.

The Asia Pacific was closely followed by North America. This country accounted for an 18.2% overall market share in 2021. North America is characterized by strict regulations from the U.S. EPA concerning marine lubricants. This will be driven by the growth of the region’s offshore activities in the Gulf of Mexico. North America is expected to account for 17.2% by 2032.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share Analysis

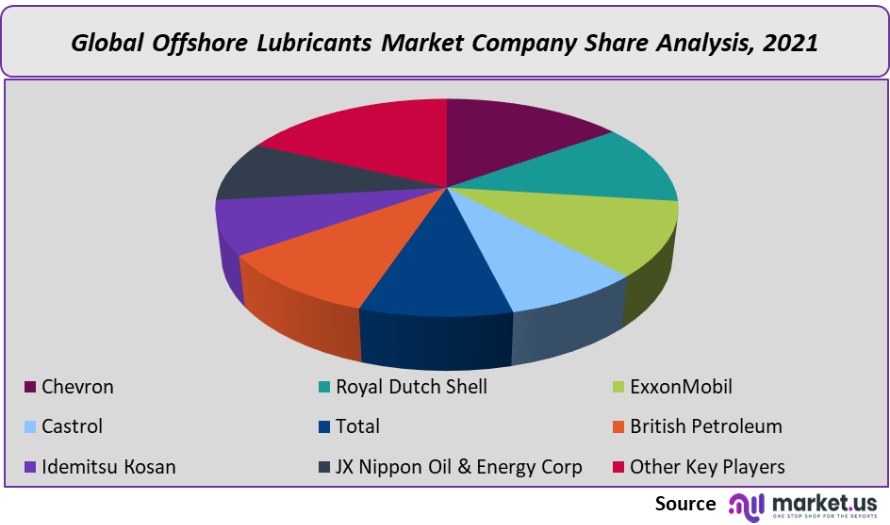

The four largest companies in the global offshore lubricants industry share, Chevron ExxonMobil, and Royal Dutch Shell, accounted for 46%. Many independent producers account for 1/3 rd the market share. Total S.A. has a strong global presence as well as Sinopec, British Petroleum, and Sinopec.

Distribution companies have the advantage of earning profit margins that can’t be attributed to distributors. This direct marketing is typically done via factory sales outlets or centers. Major suppliers and distributors of oil include Lynx Marine (Bruke Lubricants), Tropic Oil (Crown Oil), and Lynx Marine (Lynx Marine).

For industry players to remain competitive, technology innovation, product development, and production optimization are essential. Integrated players, which are involved in the production of raw materials and base oils as well as lubricants, are also abundant.

Key Market Players:

- Сhеvrоn

- Rоуаl Dutсh Ѕhеll

- ЕххоnМоbіl

- Саѕtrоl

- Тоtаl

- Вrіtіѕh Реtrоlеum

- Іdеmіtѕu Коѕаn

- ЈХ Nірроn Оіl & Еnеrgу Соr

For the Offshore Lubricants Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Offshore Lubricants market size in 2021?A: The Offshore Lubricants market size is $ 429.2 million for 2021.

Q: What is the CAGR for the Offshore Lubricants market?A: The Offshore Lubricants market is expected to grow at a CAGR of 3.5% during 2022-2032.

Q: What are the segments covered in the Offshore Lubricants market report?A: Market.US has segmented the Global Offshore Lubricants Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Application, market has been segmented into Engine Oil, Hydraulic Oil, Gear Oil, Grease, and Others. By End-Use, market has been further divided into Offshore Rigs, FPSOs (Floating, Production, Storage & Offloading Vessels), OSVs (Offshore Support Vessels).

Q: Who are the key players in the Offshore Lubricants market?A: Сhеvrоn, Rоуаl Dutсh Ѕhеll, ЕххоnМоbіl, Саѕtrоl, Тоtаl, Вrіtіѕh Реtrоlеum, Іdеmіtѕu Коѕаn, ЈХ Nірроn Оіl & Еnеrgу Соrр, Lukоіl, and Other Key Players are the key vendors in the Offshore Lubricants market.

Q: Which region is more attractive for vendors in the Offshore Lubricants market?A: Asia Pacific is accounted fo the highest growth rate of 27%. Therefore, the Offshore Lubricants market in Asia Pacific is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for Offshore Lubricants?A: India, Indonesia, Malaysia and China are key areas of operation for Pigment Dispersion Market.

Q: Which segment has the largest share in the Offshore Lubricants market?A: In the Offshore Lubricants market, vendors should focus on grabbing business opportunities from the engine oil segment as it accounted for the largest market share in the base year.

![Offshore Lubricants Market Offshore Lubricants Market]()

- Сhеvrоn

- Rоуаl Dutсh Ѕhеll

- ЕххоnМоbіl

- Саѕtrоl

- Тоtаl

- Вrіtіѕh Реtrоlеum

- Іdеmіtѕu Коѕаn

- ЈХ Nірроn Оіl & Еnеrgу Соr

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |