Global Oil & Gas Drill Bits Market By Product Type (Roller-cone and Fixed Cutter), By Application (Onshore and Offshore), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Apr 2022

- Report ID: 28996

- Number of Pages: 342

- Format:

- keyboard_arrow_up

oil and gas drill bits Market Overview:

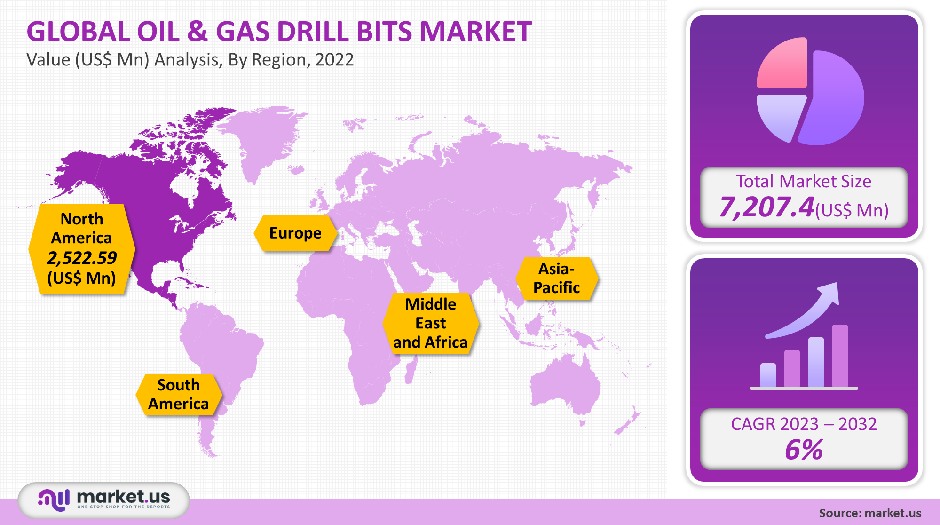

In 2021, the global market for drill bits for oil & gas was USD 7,207.4 million market growth has been driven by the rapid increase in fossil fuel extraction to meet rising global energy demands.

The significant demand for drill bits has resulted from large-scale drilling, E&P, and offshore oilfields in the Middle East and the U.S. over the past five years.

E&P companies have been forced to find hydrocarbons in unconventional resources, such as CBM, shale, and tight blocks, due to the depletion of conventional oil & gas wells. These unconventional reserves require special techniques and equipment to extract hydrocarbons.

Global Oil & Gas Drill Bits Market Scope:

Product Type Analysis:

The largest oil & gas drilling bit segment was the roller cone drill bits. It accounted for 70.4% market share in 2021.

It is projected to have a net worth exceeding US$ 1,060.0 million by 2022. Because of their low cost and ability to drill in soft and traditional formations, roller cone segments are expected to dominate the market. It is expected to lose market share to fixed cutters due to increased explorations into unconventional plays and the encounter of hard rocks at deeper depths.

The tricorne and roller cone bits can also be classified as milled tooth or tungsten carbide inserts. These products can be used in soft formations with greater efficiency than other downhole tools. The development of sealed bearings has seen recent innovations that prevent bearing corrosion and reduce the risk of failure.

Tungsten carbide inserts provide gauge and hard-facing protection to prevent downhole equipment failure from abrasion. Milled-tooth cuttings can be used to scrape in soft formations. However, tungsten carbide inserts increase the overall durability of downhole equipment against extremely hard formations.

PDC fixed cone bits, and natural/synthetic cutters are niche market segments that are likely to see high growth in the future. Due to their superior durability and effectiveness, natural/synthetic cutters offer the greatest potential for industrial investors for future investments.

The high penetration rate (ROP) of shale and other sandstone formations and their suitability for many rock formations is a major reason for the increase in PDC demand. Geology and topography play an important role in selecting the right bit type for particular operations, viz., exploration and extraction. PDC’s durability allows for more use in Canada and the U.S. oil & gas, E&P.

Application Analysis

The global oil and natural gas drill bit market can be divided based on its Application. Due to the rapid growth in offshore exploration and production activities, the onshore segment will see significant revenue growth during the forecast period.

This segment is expected to see significant revenue growth due to the increased shale gas exploration in North America to reduce carbon emissions and meet the increasing demand for clean fuel. Onshore E&P activities will be boosted by a paradigm shift to natural gas, shale, and renewable energy resources, which in turn will drive revenue growth.

Маrkеt Ѕеgmеntѕ:

By Product Type

- Roller-cone

- Fixed Cutter

By Application

- Onshore

- Offshore

Market Dynamics:

North America’s drill bits’ demand reached 1,023.400 units in 2021. It is expected to grow at a CAGR of 6.2% between 2023 and 2032.

Drill bits are essential equipment for oil and gas extraction. These bits are made from high-performance metal composites such as tungsten carbide and high-speed steel. They can also be made with synthetic or natural diamonds and polycrystalline diamonds. These bits are coated with special metallic coatings made of cobalt or titanium to increase durability and wear resistance.

A typical E&P project requires a lot of drilling. This is because the effective design and drill bits that are sensitive to case conditions play an important role in the drilling process.

Highly optimized operations can be achieved by analyzing complex parameters like drilling medium, rock strength, drilling system, and bottom hole environment. A well-designed bit and thorough material testing can help to reduce costs and increase profitability.

The OEM manufacturers have had to improve their bit designs in response to increasing drilling performance requirements and the rising concern from E&P companies about reducing operating costs due to recent low crude oil prices. Smith Bits has developed a rolling polycrystalline diamond cutter that increases performance and durability under extreme operating conditions.

Future development will be possible due to technological advancements and changing customer preferences for cost-effective equipment. Companies are constantly working to improve the expected life span of drill bits and design hybrid extraction equipment.

Regional Analysis

The North American drill bit market was dominant in the global market, accounting for more than 38.6% of the total market volume share. It is expected to see moderate growth over this forecast period. The increased drilling of shale gas in the region is responsible for the dominance of this market.

In 2021, the government of Italy lifted the ban on offshore drilling and exploration activities. This is expected to have a positive effect on the market growth in the drill bit. After the discovery of significant petroleum reserves in Egypt’s Nile Delta, Italy, the government of Italy renewed an agreement with Egypt. This agreement was to invest funds in the development of the crude-oil industry.

This agreement will increase Egypt’s domestic crude oil production and fuel the demand for drill bits.

Exploration projects for both onshore and offshore reserves are expected to be driven by rising crude oil and natural gas consumption and large proven reserves in Canada and the Gulf of Mexico.Exploration activities in unconventional formations like shale or CBM will drive demand for durable, efficient drilling equipment and downhole instruments. Over the forecast period, oilfield directional drilling will drive the demand for PDC bits.

The new exploration and development of reserves are expected to be driven by declining production in traditional oil fields. This region’s high market growth can be attributed to India and China’s increasing demand for oil products.

China has made investments in new oil refineries in partnership with companies from the Middle East and Africa. These projects are expected to have a positive impact on the oil product trade balance by being commissioned in the Asia Pacific region and the Middle East.

Кеу Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share & Key Players Analysis:

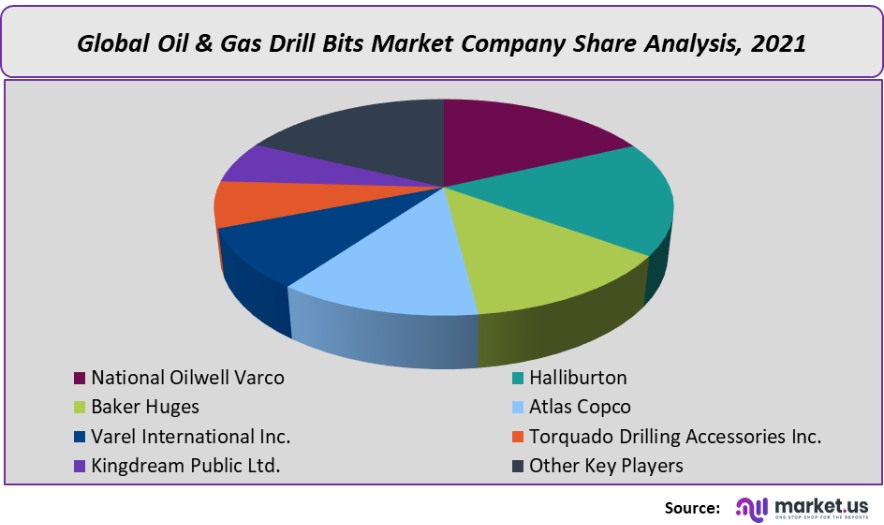

The global drill bit market for the oil and gas industry is highly consolidated, with the top five players accounting for over 70% of the market share for 2021. These companies compete on the basis of product differentiation and innovative solutions.

As part of their strategy to increase market share and sustain existing competition, some of the largest companies have formed strategic partnerships and acquired small and regional players.

The OEM manufacturers have had to improve their bit designs in response to increasing drilling performance requirements and the rising concern from E&P companies about reducing operating costs due to recent low crude oil prices. Smith Bits has developed a rolling polycrystalline diamond cutter that increases performance and durability under extreme operating conditions.

There are also other companies in this market: National Oilwell Varco, Halliburton, Baker Huges, Atlas Copco, Varel International, Inc., Torquado Drilling Accessories Inc., and Kingdream Public Limited Company.

Маrkеt Кеу Рlауеrѕ:

- National Oilwell Varco

- Halliburton

- Baker Huges

- Atlas Copco

- Varel International Inc.

- Torquado Drilling Accessories Inc.

- Kingdream Public Ltd.

- Other Key Players

For the oil and gas drill bit Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the Oil & Gas Drill Bits Market size in 2021?A: The Oil & Gas Drill Bits Market size is US$ 7,207.4 million in 2021.

Q: What is the CAGR for the Oil & Gas Drill Bits Market?A: The Oil & Gas Drill Bits Market is expected to grow at a CAGR of 6 % from 2023 to 2032.

Q: What are the segments covered in the Oil & Gas Drill Bits Market report?A: Market.US has segmented the Global Oil & Gas Drill Bits Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, the market has been segmented into Roller-cone and Fixed Cutter. By Application, the market has been further divided into Onshore and Offshore.

Q: Who are the key players in the Oil & Gas Drill Bits Market?A: National Oilwell Varco, Halliburton, Baker Huges, Atlas Copco, Varel International Inc., Torquado Drilling Accessories Inc., Kingdream Public Ltd. and Other Key Players are the key vendors in the Oil & Gas Drill Bits market

Q: Which region is more attractive for vendors in the Oil & Gas Drill Bits Market?A: North America accounted for the highest revenue share of 38.6% among the other regions. Therefore, the Oil & Gas Drill Bits Market in North America is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for endpoint security?A: Key markets for Oil & Gas Drill Bits are the U.S., Germany, U.K., China, India, and Japan.

Q: Which segment has the largest share in the Oil & Gas Drill Bits Market?A: In the Oil & Gas Drill Bits Market, vendors should focus on grabbing business opportunities from the roller cone Drill Bits segment as it accounted for the largest market share in the base year.

A: The Leather Chemicals market is expected to grow at a CAGR of 6.9% during 2023-2032.A: Market.US has segmented the Leather Chemicals market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type, market has been segmented into Biocides, Surfactants, Chromium Sulfate, Polyurethane Resins, Sodium Bicarbonate, Other Product Types,. By End User, market has been further divided into Footwear, Upholstery, Leather Goods, Garments.

![oil and gas drill bits Market oil and gas drill bits Market]() oil and gas drill bits MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample

oil and gas drill bits MarketPublished date: Apr 2022add_shopping_cartBuy Now get_appDownload Sample - National Oilwell Varco

- Halliburton

- Baker Huges

- Atlas Copco AB. Company Profile

- Varel International Inc.

- Torquado Drilling Accessories Inc.

- Kingdream Public Ltd.

- Other Key Players

- settingsSettings

Our Clients

|

Single User

$5,999

$2,999

USD / per unit

save 50% |

Multi User

$7,999

$3,499

USD / per unit

save 55% |

Corporate User

$12,999

$4,499

USD / per unit

save 65% | |

|---|---|---|---|

| e-Access | |||

| Data Set (Excel) | |||

| Company Profile Library Access | |||

| Interactive Dashboard | |||

| Free Custumization | No | up to 10 hrs work | up to 30 hrs work |

| Accessibility | 1 User | 2-5 User | Unlimited |

| Analyst Support | up to 20 hrs | up to 40 hrs | up to 50 hrs |

| Benefit | Up to 20% off on next purchase | Up to 25% off on next purchase | Up to 30% off on next purchase |

| Buy Now ($ 2,999) | Buy Now ($ 3,499) | Buy Now ($ 4,499) |